If you’ve walked into an Albertsons recently to grab a gallon of milk or some ribeyes, you probably didn't think much about the boardroom drama happening behind the scenes. You see the logo, the familiar aisles, and maybe a "Now Hiring" sign. But the answer to who owns Albertsons Market is actually a lot messier than a simple name on a deed. It’s a story of private equity giants, a failed multi-billion dollar marriage, and a public stock market that currently can't decide what the company is actually worth.

Honestly, the biggest misconception right now is that Kroger owns them. They don't.

For a couple of years, everyone—from Wall Street analysts to the people stocking the produce—assumed the "mega-merger" was a done deal. Kroger was set to swallow Albertsons Companies Inc. for roughly $24.6 billion. But then the regulators stepped in. The Federal Trade Commission (FTC) and several state attorneys general basically said, "Not so fast." After a grueling legal battle throughout 2024, judges in Washington and a federal court blocked the deal. By December 2024, the two companies officially called it quits.

So, where does that leave us today in early 2026?

The Power Players Behind the Banner

Albertsons Companies Inc. (NYSE: ACI) is a publicly traded company. That means thousands of people and institutions own little pieces of it. However, "public" is a bit of a loaded term here because a few massive players still hold the steering wheel.

Cerberus Capital Management is the name you really need to know. This private equity firm has been the backbone of Albertsons since 2006. They were the ones who rescued the brand from the brink when it was struggling under previous management. Even though the company went public in 2020, Cerberus still holds a massive stake—roughly 27% to 30% of the total shares as of current 2026 filings.

🔗 Read more: US Stock Futures Now: Why the Market is Ignoring the Noise

When you ask who owns Albertsons Market, you're mostly talking about:

- Cerberus Capital Management: The dominant private equity force.

- Institutional Investors: Heavyweights like Vanguard, BlackRock, and State Street own a combined majority (over 60%) of the public shares.

- Apollo Global Management: They jumped in with a $1.75 billion investment back in 2020, keeping a significant slice of the pie.

- Individual Insiders: The executives running the show, including CEO Susan Morris, own smaller but still influential amounts of stock.

It's a weird hybrid. It's a public company that still behaves a lot like a private equity-backed venture.

Albertsons Market vs. Albertsons Companies

Here is where it gets slightly confusing for folks in the Southwest. There is a distinction between the "Albertsons" name you see in Boise or Seattle and the Albertsons Market stores you find in West Texas and New Mexico.

The "Market" branded stores are part of The United Family, which is a subsidiary. Back in 2013, Albertsons LLC bought United Supermarkets. They kept the local management intact in Lubbock, Texas, which was a smart move. They didn't want to mess with a brand people actually liked. So, while "Albertsons Market" has its own distinct culture and local feel, it is ultimately owned by the parent company, Albertsons Companies Inc.

Think of it like a Russian nesting doll. You have the local store, inside the United Family division, inside the Albertsons corporate umbrella, which is then owned by the shareholders and Cerberus.

💡 You might also like: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Why the Failed Merger Still Matters

The ghost of the Kroger merger still haunts the grocery aisles. When the deal collapsed in late 2024, it wasn't just a "never mind" moment. It left Albertsons in a bit of an identity crisis.

For two years, they hadn't been investing in the same way their competitors were because they thought they were being sold. Now, under the leadership of CEO Susan Morris—who took over the top spot after the merger fell through—the company is trying to prove it can survive on its own. They're leaning hard into AI shopping assistants and "Project Unity" to streamline their supply chain.

Wait, why does a grocery store need an AI assistant?

Basically, they’re trying to catch up to Walmart and Amazon. They want to know that you like 2% milk and Honeycrisp apples before you even open their app. If they can't be the biggest (since they didn't merge with Kroger), they want to be the smartest.

The Financial Tug-of-War

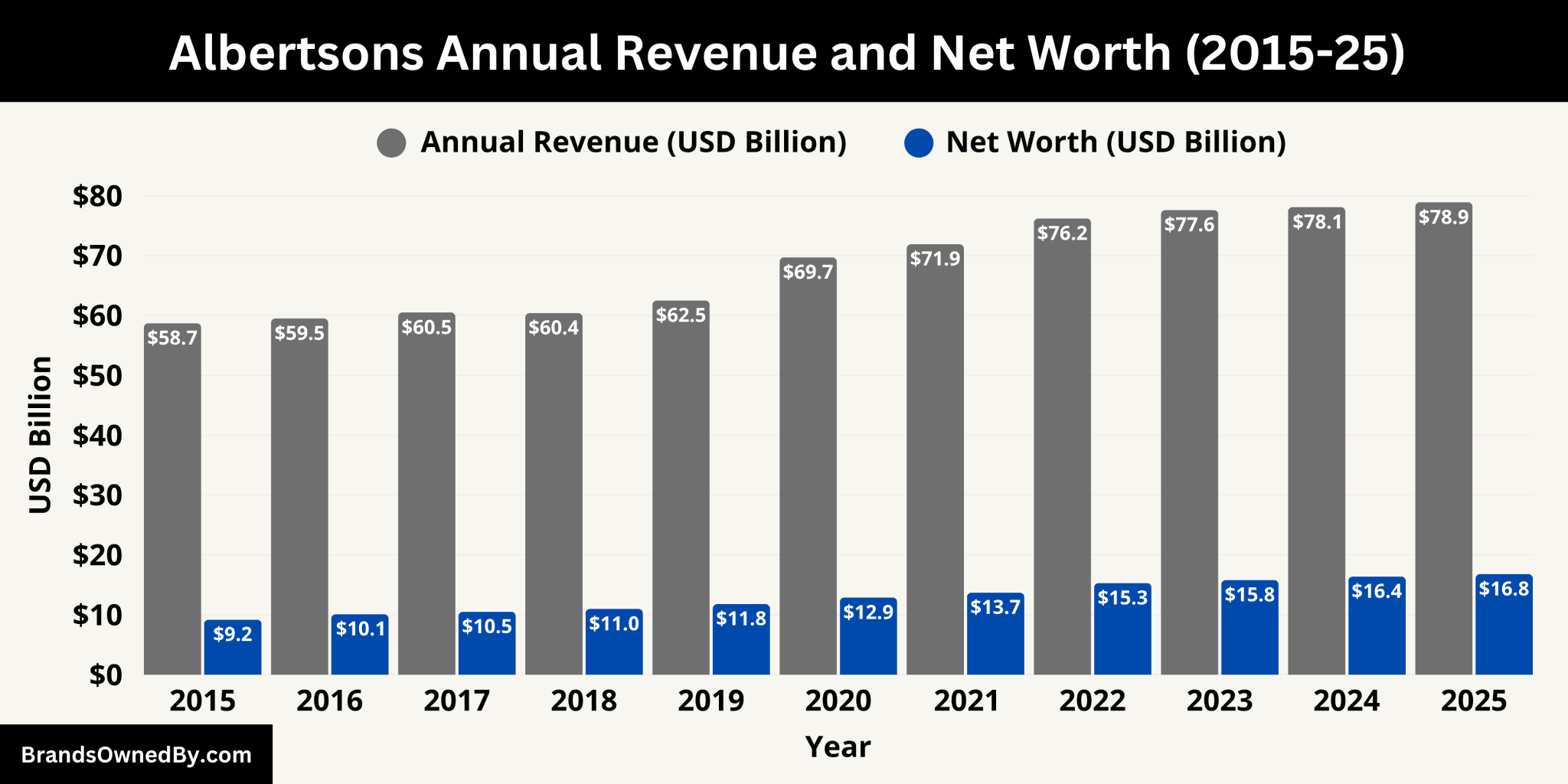

Current stock market data from early 2026 shows that investors are still a bit skeptical. The share price has been sitting around $17 to $18, which is actually lower than where it was when the merger was first announced.

📖 Related: Starting Pay for Target: What Most People Get Wrong

Some experts, like those at Barclays and Bernstein, have pointed out that the company is "undervalued." But the market is worried about a few things:

- The Debt: Private equity ownership often comes with a lot of debt. Albertsons has been chipping away at it, but it's still a heavy load.

- Competition: Walmart is a beast. Aldi is expanding like crazy. Even dollar stores are selling more groceries now.

- The Cerberus Exit: Eventually, Cerberus will want to sell its remaining 27% stake. When a huge owner dumps that many shares, it can make the price volatile.

What This Means for Your Weekly Grocery Run

Does it matter to you that a firm in New York owns the store where you buy your cereal? Maybe not directly. But ownership structure dictates everything from the price of eggs to whether or not the store gets a renovation.

Because Albertsons is now forced to stand on its own two feet after the failed merger, they are actually being more aggressive with their loyalty programs. They need you to stay. They can't rely on the scale of a Kroger-sized empire.

Actionable Insights for the Savvy Shopper:

- Double down on the "for U" app. Since the company is fighting for market share in 2026, their digital coupons are currently some of the most aggressive in the industry.

- Watch the "Banners." Albertsons owns Safeway, Vons, Jewel-Osco, and Shaw's. Often, the store brands (like Signature Select) are identical across all these stores. If you see a deal at one, it’s likely coming to the others.

- Check the "United" difference. If you live in an area with Albertsons Market (The United Family), take advantage of their decentralized local sourcing. They often have better local produce than the standard Albertsons stores because they have more autonomy from the corporate office in Boise.

The ownership of Albertsons isn't just a corporate factoid. It's a reflection of how the American grocery landscape is being squeezed between big tech, private equity, and government regulators. For now, the "who" is a mix of Wall Street giants, but the "what" is a company trying desperately to prove it doesn't need a partner to win.

If you’re tracking the business side of things, keep a close eye on the SEC Form 4 filings for Cerberus. The moment they start selling that last 27% is the moment we’ll see the next big chapter for this grocery icon. For now, the Boise-based giant remains independent, public, and a little bit under the thumb of the private equity guys who saved it twenty years ago.