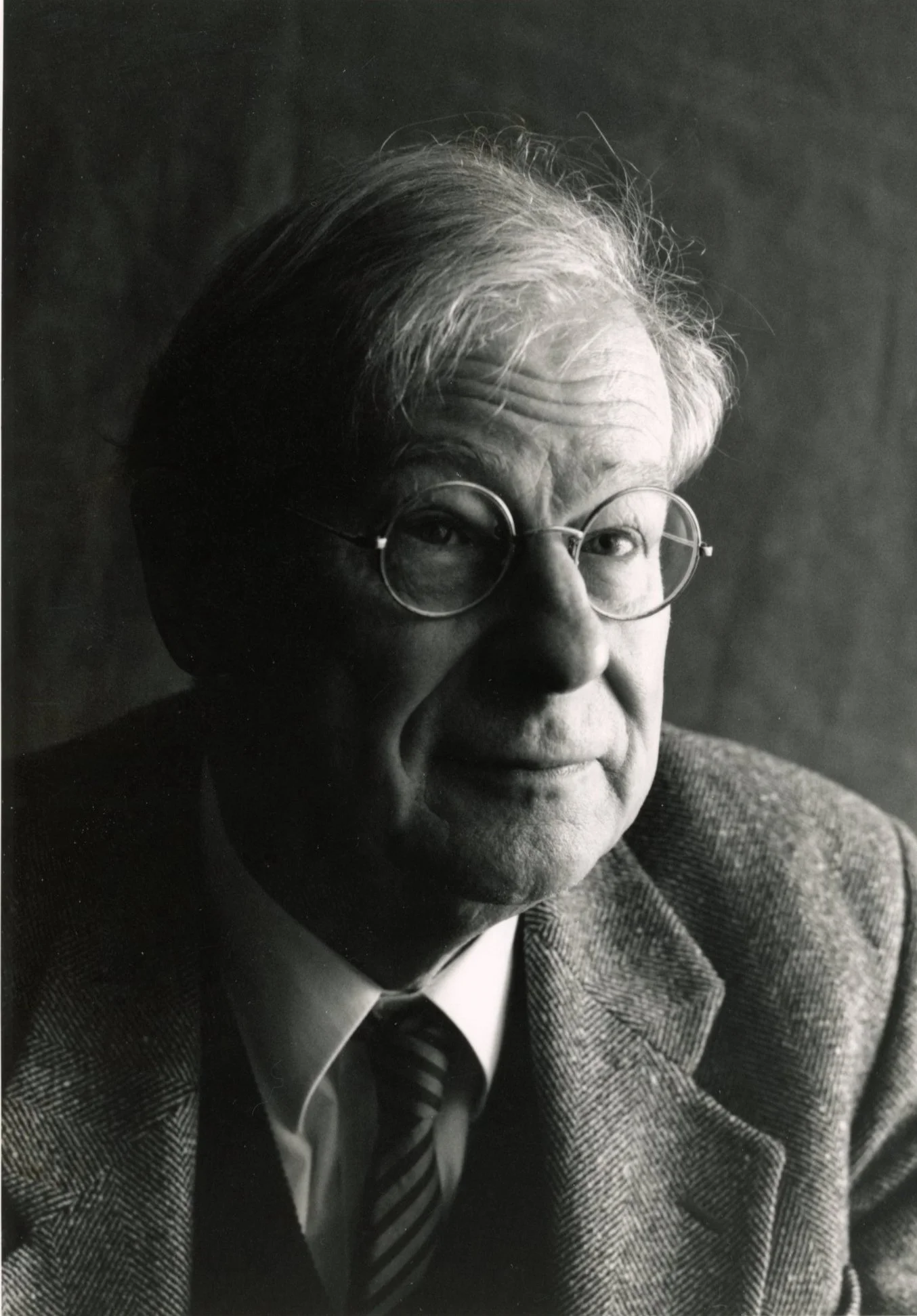

Robert Maxwell was a man who didn't just walk into a room; he essentially invaded it. Standing over six feet tall and weighing nearly 300 pounds at his peak, he was a physical force of nature with a booming bass voice that could make powerful men tremble. Most people today probably recognize the name because of his daughter, Ghislaine Maxwell, but for decades, Robert was the one making the world’s front pages. He was a war hero, a billionaire, a member of the British Parliament, and eventually, the architect of one of the most audacious financial frauds in history.

Honestly, his life plays out like a movie script that a studio would reject for being too unrealistic.

He was born Ján Ludvík Hyman Binyamin Hoch in 1923, growing up in a tiny, dirt-poor village called Slatinské Doly in what was then Czechoslovakia. His family was Yiddish-speaking and deeply Orthodox. When the Nazis swept through, Maxwell escaped, but most of his family didn't. His parents and several siblings were murdered in Auschwitz. That kind of trauma doesn't just go away. It seemingly fueled a lifelong, desperate need for validation, power, and—perhaps most of all—a new identity. By the time he reached British soil, he had cycled through several aliases before settling on Ian Robert Maxwell.

The Rise of a Media Titan

After the war, where he won a Military Cross for charging a German machine-gun nest, Maxwell didn't just look for a job. He looked for an empire. He started with Pergamon Press, a scientific publishing house. He realized early on that academic journals were a gold mine because libraries had to buy them, regardless of the price. It was a brilliant, cutthroat business model.

But scientific papers weren't enough. He wanted the prestige of Fleet Street.

By 1984, he finally got his hands on the Mirror Group Newspapers, which included the Daily Mirror. This put him in direct competition with his arch-nemesis, Rupert Murdoch. The two men loathed each other. While Murdoch was seen as a calculating strategist, Maxwell was the "Bouncing Czech," a bombastic showman who loved putting his own face on the front page of his newspapers.

👉 See also: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

He was everywhere. He bought football clubs like Oxford United. He flew around in a private helicopter. He lived in a palatial estate called Headington Hill Hall. To the outside world, Robert Maxwell was the personification of the self-made billionaire. But behind the scenes, the math wasn't adding up.

What Really Happened with the Money?

Success is expensive. To keep up with Murdoch and expand into the U.S. market—where he bought Macmillan Publishers and the New York Daily News—Maxwell borrowed money like a man possessed. By the late 1980s, his debts were astronomical. We’re talking billions.

When the banks started sniffing around, Maxwell did the unthinkable.

He didn't just "fudge" the books. He reached into the Mirror Group pension funds and started siphoning off hundreds of millions of pounds. He used the retirement savings of his own employees—the printers, the journalists, the delivery drivers—to prop up his failing private companies and keep his lenders at bay. It was a massive shell game. He moved money between accounts so fast that even seasoned auditors couldn't keep track of it.

The Final Act at Sea

Everything came to a head in November 1991.

✨ Don't miss: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

Maxwell was on his luxury yacht, the Lady Ghislaine, cruising off the Canary Islands. He was 68 years old, and the walls were closing in. A scheduled meeting with the Bank of England was looming—a meeting where he would have to explain where the money had gone. He never made that meeting.

On the morning of November 5, Maxwell was reported missing from the boat. His naked body was later found floating in the Atlantic.

The conspiracy theories started immediately. Was it suicide? Did he jump because he couldn't face the ignominy of prison? Was it a heart attack? Or, as some darker theories suggest, was he pushed? Some even whispered about the Mossad or the KGB, given his long-rumored ties to various intelligence agencies. The official Spanish autopsy ruled it as death by drowning and a heart attack, but the "how" remains a mystery.

The Aftermath of the Fraud

The true horror of who Robert Maxwell was didn't emerge until after he was buried on the Mount of Olives in Jerusalem. Within weeks, the £460 million hole in the pension funds was discovered.

- Thousands of pensioners saw their life savings vanish overnight.

- The business empire collapsed into a heap of bankruptcy filings.

- His sons, Ian and Kevin, were put on trial for fraud (though they were eventually acquitted).

It was a betrayal on a Shakespearean scale. He had styled himself as a "man of the people" and a champion of the Labour Party, yet he had robbed the very workers who looked up to him.

🔗 Read more: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

Why the Maxwell Legacy Still Matters

You can't talk about modern media or corporate governance without mentioning Maxwell. He is the ultimate cautionary tale. He showed how a charismatic leader could bypass boardrooms, ignore regulators, and bully the press into silence using draconian libel laws.

If you're looking for actionable insights from the wreckage of the Maxwell empire, here is what history teaches us:

- Beware the Cult of Personality: When a company revolves entirely around the ego of one man, the checks and balances usually fail.

- Scrutinize the "Shells": Maxwell’s fraud worked because he had a dizzying array of private companies that were shielded from public view. Transparency is the only antidote to that kind of "creative" accounting.

- The Importance of Pension Protection: The Maxwell scandal was the primary catalyst for the 1995 Pensions Act in the UK, which created much stricter rules for how employee funds are managed.

Robert Maxwell was a man of immense talent and even greater flaws. He rose from nothing to own the world, only to realize that he had built his palace on a foundation of stolen dreams. He wasn't just a businessman; he was a warning.

If you want to understand the current headlines regarding the Maxwell family, you have to start with the father. His shadow is long, and the ripples of his 1991 plunge into the Atlantic are still being felt today. You might want to look into the "Maxwellisation" legal process or the specific ways UK pension law changed after 1991 to see his lasting impact on the law.