Imagine opening your paycheck and seeing that 94% of your top earnings belong to the government. It sounds like a dystopian novel or a bad fever dream, right? But for some of the wealthiest Americans during the 1940s, this was reality. Most people assume taxes have always hovered around the 30% or 40% mark, yet history tells a much wilder story. If you’ve ever wondered which president had the highest tax rate, you’re looking straight at Franklin D. Roosevelt.

Under FDR, the top marginal tax rate hit its absolute peak. In 1944 and 1945, that number reached a staggering 94%. Yes, 94.

The 94% Reality Under Franklin D. Roosevelt

It was the height of World War II. The government was hemorrhaging money to fund the global fight against the Axis powers, and Roosevelt needed cash. Fast. Before the war, the top rate was already high by modern standards—about 79% in 1936—but the Revenue Act of 1944 pushed it over the edge.

📖 Related: Dollar Tree store closures today: Why your local shop might be gone

Wait. Before you feel too bad for the millionaires of the 1940s, we have to talk about how marginal rates actually work. You didn’t pay 94% on your entire income. That’s a common myth. The 94% rate only kicked in for income earned over $200,000. In today’s money, that is roughly $3.5 million.

So, if you were a tycoon making $300,000 back then, your first $200k was taxed at various lower (but still high) brackets. Only that last $100,000 got the 94% "haircut." Still, it’s a massive chunk of change.

Why did FDR go so high?

- War Costs: Tanks, planes, and ships aren't cheap. The federal budget exploded during WWII.

- Social Equity: FDR famously believed that in a time of national sacrifice, no one should be getting "fabulously rich" while soldiers were dying abroad. He even once proposed a 100% tax on all income over $25,000 (about $450k today). Congress thought that was a bit much and settled for 94%.

- Inflation Control: By pulling money out of the economy through taxes, the government helped prevent prices from spiraling out of control while supply was low.

Eisenhower and the Myth of the "Low Tax" 1950s

There is this weird nostalgia for the 1950s. People talk about it as a golden era of American prosperity and "small government."

✨ Don't miss: Noble Americas South Bend Ethanol: What Really Happened to This Biofuel Giant

Honestly? The taxes were brutal.

When Dwight D. Eisenhower took over in 1953, he didn't slash the rates. He was a fiscal conservative, sure, but he also had to deal with the debt from the Korean War and the beginning of the Cold War. Throughout almost his entire presidency, the top marginal tax rate sat at 91%.

People often ask how the economy boomed while the rich were being taxed at 91%. The answer is nuanced. Very few people actually paid that rate. The tax code was riddled with loopholes, deductions, and ways to shift "ordinary income" into "capital gains," which were taxed much lower (around 25% at the time).

The Effective Rate vs. The Statutory Rate

There is a big difference between what the law says (statutory) and what people actually pay (effective). Research from the Tax Foundation and experts like Mark Luscombe shows that while the top rate was 91%, the effective tax rate for the top 1% was closer to 42%. Still higher than today’s 37%, but not exactly the 90% "confiscation" it looks like on paper.

The Great Slide: Kennedy to Reagan

The high-tax era didn't last forever. It started to crumble in the early 60s. John F. Kennedy—a Democrat—was actually the one who pushed to lower the top rate from 91% down to 70%. He argued that high rates were actually discouraging investment.

Then came the 1980s. Ronald Reagan basically took a sledgehammer to the old system.

- 1981: The top rate dropped from 70% to 50%.

- 1986: The Tax Reform Act slashed it further to 28%.

That 28% rate was the lowest the top bracket had been since the early 1930s. It was a total paradigm shift. Since Reagan, the top rate has "bounced" between 31% and 39.6%, depending on who is in the White House.

What Most People Get Wrong About High Taxes

We tend to look at these historical numbers and think, "How did anyone survive?" But the context matters. Back in the 40s and 50s, the "base" of people who paid any income tax at all was much smaller. FDR actually expanded the tax base so that middle-class workers started paying, whereas before, the income tax was almost exclusively for the ultra-wealthy.

👉 See also: What’s Actually Happening at 500 N Orange Ave Orlando FL 32801

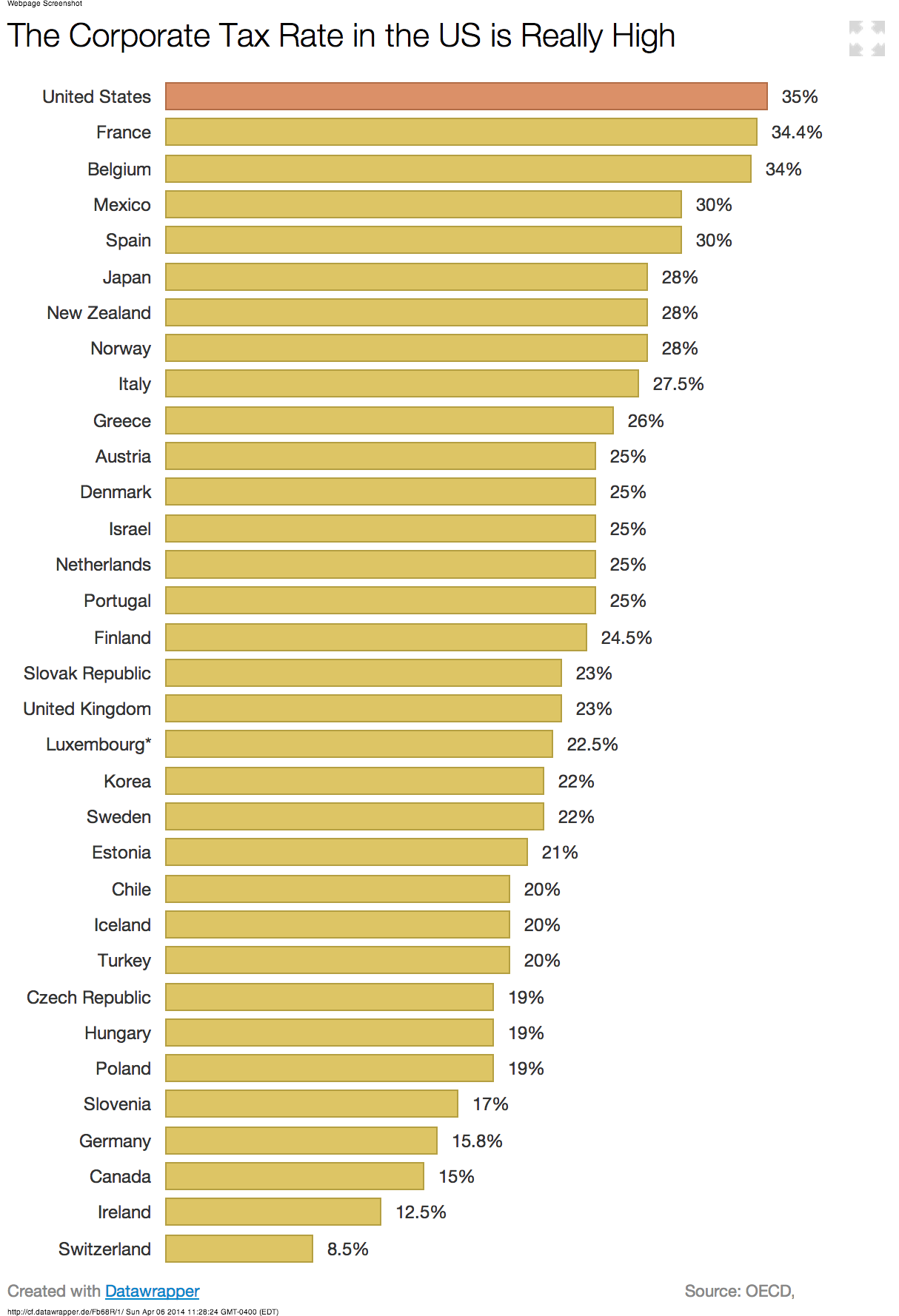

Also, corporate taxes were much higher. In the 1950s, corporations often paid over 50% in taxes. This arguably encouraged them to reinvest profits back into the company—higher wages, better equipment, R&D—rather than just handing it out as dividends or stock buybacks, which would have been taxed heavily anyway.

Actionable Insights: How to Use This Knowledge

Understanding which president had the highest tax rate isn't just a trivia fact. It helps you see where the economy might be headed and how to protect your own assets.

- Look at Effective Rates, Not Just Brackets: If you’re an investor or business owner, don't just panic when you hear "tax hikes." Look for the deductions and credits that actually determine your final bill.

- Capital Gains is the Real Game: Throughout history, the wealthiest Americans stayed wealthy because they earned money through assets (stocks, real estate) rather than salaries. Capital gains rates have almost always been significantly lower than income tax rates.

- Diversify Your Tax Buckets: We are currently in a relatively "low tax" era by historical standards. If you think rates will eventually return to the 50% or 70% range to pay off national debt, it might make sense to look into Roth IRA conversions or other "tax-now" vehicles to lock in current rates.

History shows us that tax rates are never permanent. They are tools of war, social engineering, and economic theory. While we’re nowhere near the 94% peak of the FDR years, the pendulum always swings. Keeping an eye on the long-term historical trend is the only way to avoid being caught off guard when it swings back.

Check your current tax strategy against these historical shifts. If your wealth is concentrated in a single "taxable" bucket, you're at the mercy of whoever sits in the Oval Office next. Diversifying how your income is classified—ordinary, capital gains, or tax-free—is the best defense against the next big shift in the revenue code.