You’re staring at the clock. It’s April. Maybe you’re missing a 1099, or perhaps your life just got messy and the thought of calculating capital gains makes you want to crawl under a rock. Whatever the reason, you’ve decided to punt your tax deadline to October. You’ve downloaded the PDF. You’ve filled out the basic info. Now comes the part that weirdly trips everyone up: finding the right mail form 4868 address.

It’s not just one place.

If you send your extension to the wrong IRS service center, you aren't necessarily doomed, but you are inviting a headache. The IRS processes millions of these. They rely on regional hubs. Sending a California return to a Kansas City address is a great way to ensure your paperwork sits in a mailroom limbo while the IRS computer systems start churning out "failure to file" notices. Nobody wants that.

Why the IRS Changes the Mail Form 4868 Address Every Few Years

IRS logistics are a beast. They shift workload based on which centers have the high-speed scanners and the staff to handle the seasonal crush. Honestly, it’s kinda annoying for taxpayers because the address you used three years ago might not be the one you need today.

Most people don't realize that the IRS divides these addresses based on two things: where you live and whether or not you are enclosing a payment. This is the "Fork in the Road" moment for your extension. If you're just filing the paper to get the extra six months, you send it to one spot. If you're including a check or money order because you know you owe money, it often goes to a completely different P.O. Box. This is because the IRS wants to get those checks to the bank immediately, while the "no payment" forms can wait a beat for data entry.

Finding Your Specific Destination

Let’s look at the actual geography. If you are living in a state like Florida, Louisiana, Mississippi, or Texas, and you are not sending a payment, your form goes to the Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0045. But wait. If you are sending a payment from those same states, the address shifts to P.O. Box 12192, Covington, KY 41012-0192.

✨ Don't miss: Who Owns Planters Peanuts: The Real Story Behind the $3.3 Billion Deal

See the trap?

If you live in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Nevada, New Mexico, Oregon, Utah, Washington, or Wyoming, your "no payment" address is in Fresno, CA 93888-0045. This is a high-volume center. They handle the bulk of the West Coast. However, the second you add a check to that envelope, you have to mail it to San Francisco, specifically P.O. Box 7122, San Francisco, CA 94120-7122.

It feels like a scavenger hunt where the prize is just not being audited.

The Payment Paradox

Here is something a lot of people get wrong: Form 4868 is an extension to file, not an extension to pay.

If you owe the IRS $5,000 and you mail in Form 4868 without a check, you have successfully avoided the "failure to file" penalty, which is a whopping 5% per month. But you are still racking up the "failure to pay" penalty and interest. It’s a smaller bite—usually 0.5% per month—but it adds up.

I’ve seen folks get smug because they "filed an extension" only to be blindsided by a bill in October that includes six months of interest. If you can't pay the whole amount, pay something. Even $50 sent to the correct mail form 4868 address shows "good faith." The IRS is a giant machine, but it’s a machine that likes getting paid more than it likes chasing you.

What if you live abroad?

Expats have it a bit different. If you’re a U.S. citizen living in a foreign country, or if you have an APO/FPO address, your filing destination is usually the International Internal Revenue Service center in Austin, Texas. Specifically, for those not sending a payment, it’s Austin, TX 73301-0215. If you are sending a payment, it goes to P.O. Box 1302, Charlotte, NC 28201-1302.

✨ Don't miss: The Signal Vault Shark Tank Deal: What Really Happened to the RFID Protector

It’s a bit of a trek for a piece of paper. This is why many expats prefer the electronic route, but if you’re a "paper and ink" person, you’ve got to be precise.

The Physical Mailing Trap

Use Certified Mail. Seriously.

If you are going to the trouble of finding the exact mail form 4868 address, spend the extra few bucks for a tracking number and a return receipt. The IRS loses things. Mail trucks get in accidents. Clerks misplace envelopes. If the IRS claims you never filed an extension and tries to hit you with that 5% monthly penalty, your only defense is that little piece of paper from the Post Office.

In the tax world, if you can’t prove you sent it, you didn't send it.

Also, verify the "Private Delivery Service" (PDS) rules. If you’re using FedEx or UPS because you waited until 8:00 PM on April 15th, you can’t send it to a P.O. Box. The IRS has specific street addresses for PDS deliveries. For example, the Austin center's street address for private couriers is 3651 S. Interregional Hwy 35, Austin, TX 78741. If you try to send a FedEx overnight to a P.O. Box, it will be rejected or delayed, and you’ll miss your deadline.

Common Mistakes to Avoid

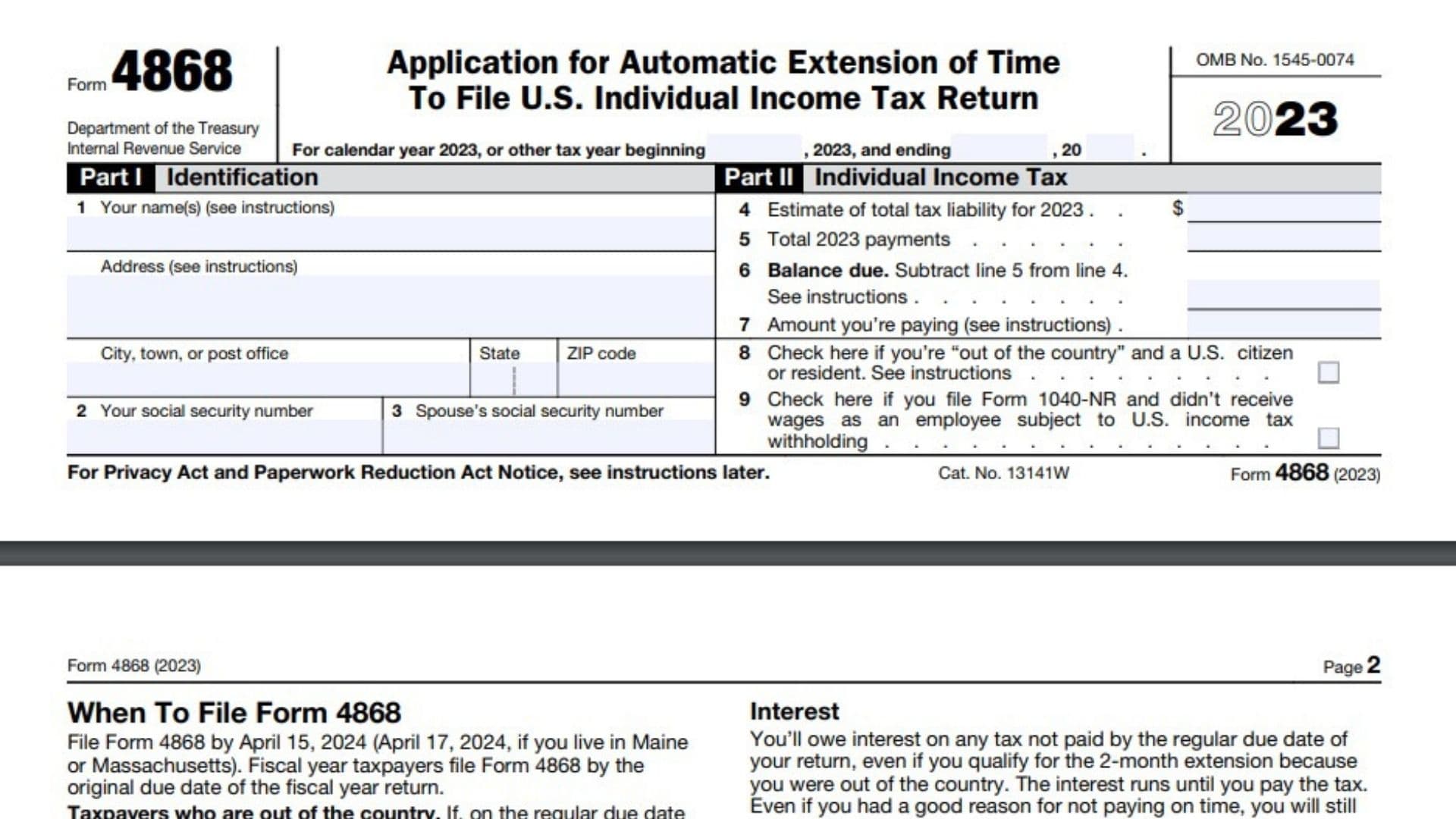

- Wrong Year: Believe it or not, people print out the 4868 from the previous year. The IRS updates the form annually. Make sure the top right corner says 2025 (or the current tax year).

- Missing SSN: If you're filing jointly, include both Social Security numbers. If the names don't match the numbers in the IRS database, the form gets tossed.

- Estimating Zero: Some people think if they put "0" for tax liability, it’s okay as long as they file. If the IRS later determines you knew you owed money and intentionally put zero to get an extension, they can void the extension entirely. Be honest with your estimate. It doesn't have to be perfect, but it has to be a "reasonable" attempt.

The Shift Toward Digital

Look, I know you’re looking for a physical address. You might have your reasons—maybe you don't trust the "cloud," or you have a complex attachment you want to include. But the IRS really, really wants you to use Free File.

Even if you make a million dollars, you can use the Free File Fillable Forms to submit an extension electronically. You get a confirmation number in minutes. No stamps. No wondering if the envelope is sitting in a rain-soaked bin in Kentucky.

But if you are sticking to your guns and using the mail, double-check the state-by-state list. The IRS updates these instructions in "Publication 4868." It’s a dry read, but it’s the bible for this specific task.

A Quick Cheat Sheet for 2026 Locations

If you're in the Northeast (MA, NH, NY, VT, CT, RI), and you're not paying, you’re looking at Kansas City, MO 64999-0045.

If you're in the Midwest (IL, IN, IA, KS, MI, MN, MO, NE, ND, SD, WI), and you're not paying, you’re also heading to Kansas City.

👉 See also: Finding a Letter of Recommendation Sample for Job Applications That Actually Works

The South and Mid-Atlantic (PA, DE, NJ, MD, VA, NC, SC, GA) generally route through Charlotte or Kansas City depending on the payment status.

It’s a patchwork quilt of bureaucracy.

Final Steps for a Stress-Free Extension

Don't wait until the last minute. The post office lines on April 15th are a special kind of hell. If you’re mailing, do it on the 10th.

Verify your math. Even though it’s just an extension, the IRS uses the numbers on Form 4868 to track what they expect to receive later. If your estimate is wildly off, it can trigger flags.

Sign the check. If you are mailing a payment to the mail form 4868 address, make the check out to "United States Treasury." Not "IRS." Write your SSN and "2025 Form 4868" in the memo line. This ensures that even if the check gets separated from the form, the agency knows where to apply the money.

Keep a copy. Take a photo of the completed form and the signed check. Put it in a folder. Forget about it until August when you finally sit down to do your actual taxes.

The extension gives you breathing room. Use it wisely. By getting the address right the first time, you’re cutting out the most common point of failure in the entire process.

Next Steps for Taxpayers:

- Download the current version of Form 4868 from IRS.gov to ensure you have the correct year.

- Determine your "Payment Status"—if you are including a check, your mailing address will likely change.

- Locate your state in the official IRS instruction table to find your specific regional service center.

- Head to the post office and request "Certified Mail, Return Receipt Requested" to get a physical paper trail of your filing.