Tax season hits like a freight train every January. One minute you're ringing in the New Year, and the next, you're staring at a pile of 1099s and wondering why on earth we still do this on paper. Honestly, the biggest hurdle isn't even the math—it's just figuring out where to get tax forms without losing your mind or driving across three counties.

It’s weird. We live in a world where you can order a taco from your watch, yet every year, thousands of people are left wandering into half-lit post offices asking if they still carry the "long form." Spoiler: they might not. The IRS has been aggressively pushing digital for a decade, and while that's great for the environment, it’s a massive headache if your printer is out of ink or you just prefer the tactile feel of a 1040.

You've got options. Some are easy. Some are surprisingly annoying. Let’s break down the reality of finding these documents in 2026.

The IRS Digital Vault (And Why It’s Your Best Bet)

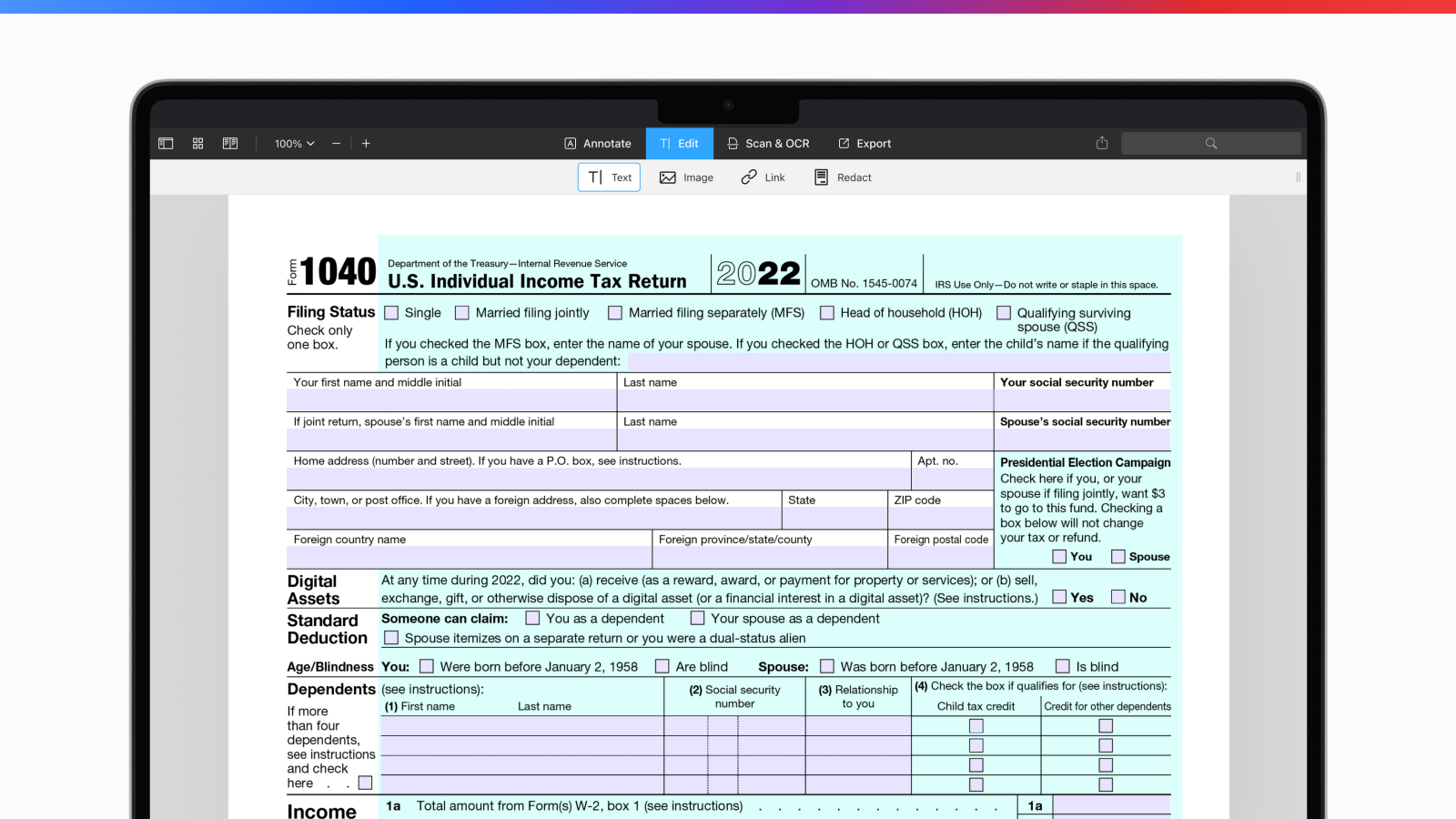

The most direct way to find what you need is the official IRS website. It’s not flashy. It looks like it was designed in 2005, but it works. If you go to IRS.gov, there’s a "Forms and Instructions" tab right on the homepage. You can search for the 1040, the 1040-SR for seniors, or any of those niche schedules that most people never have to touch.

Most people don't realize that the IRS actually maintains a massive archive. You can find forms dating back decades. Why would you need a 1998 1040? Probably for some very specific, painful audit or an estate issue, but it's there.

Downloading vs. Ordering

You can download a PDF and print it. Easy. But if you don't have a printer, the IRS still offers a mail-order service. You can call 800-829-3676 or use the "Order Forms and Publications" tool online.

Keep in mind: it takes time. Usually 7 to 15 business days. If it’s April 10th and you’re just now looking for where to get tax forms via mail, you’re basically playing chicken with the deadline. Don't do that to yourself.

Libraries and Post Offices: The Dying Tradition

Used to be, you could walk into any local post office and grab a stack of booklets. Not anymore. The IRS significantly scaled back the "Tax Forms Outlet Program" years ago to save money.

Now, most post offices only carry the basic 1040 and maybe the instructions. If you need something specific—like Schedule C for your side hustle—you’re likely out of luck at the post office.

Libraries are a better bet. Many local branches still participate in the program and often have a dedicated "Tax Corner." Even if they don't have the pre-printed booklets, most librarians are absolute pros at helping you find the right PDF on their computers and printing it for a few cents a page. They see this every year. They know the stress.

Software is Taking Over (For Better or Worse)

Let’s be real. Most people aren't filling these out by hand anymore.

Services like TurboTax, H&R Block, and FreeTaxUSA are where the majority of Americans go. When you use these, the "where" is built-in. The software generates the forms as you answer questions.

But here is the catch.

Sometimes you just need the blank form to do a "pro forma" run—basically a practice round to see how much you’re going to owe. Or maybe you're filing an amendment (Form 1040-X) and your software wants to charge you an extra $50 just to print it. In those cases, going back to the IRS website is the move.

The IRS Direct File Revolution

By now, you've probably heard about the IRS Direct File system. It started as a pilot and has expanded. It's essentially the government's own version of tax prep software. It’s free. It’s direct. And it eliminates the need to hunt down physical forms entirely for many taxpayers.

Check if your state is participating. If it is, and your tax situation is relatively simple (W-2 income, standard deduction), this is probably the fastest way to bypass the "where to get tax forms" hunt altogether.

Where to Get Tax Forms for State Taxes

This is where people get tripped up. The IRS handles federal. They do not handle your state.

If you live in a state with income tax—looking at you, California and New York—you have to go to your state's Department of Revenue or Franchise Tax Board website. They have their own versions of the 1040.

Often, these state websites are actually better than the IRS site. They’re usually more localized and offer specific instructions for state-only credits, like renters' credits or local energy-saving incentives.

- Pro-tip: Many states still mail out booklets to residents who filed paper returns the previous year. If you didn't get one, check the local "State Office" building in your county seat. They almost always have them in the lobby.

The "Secret" Sources You Might Forget

Sometimes the best place to find a form is right under your nose.

If you work for a company, your HR portal probably has links to necessary forms, or at least the ones related to your employment (like the W-4).

👉 See also: Why Short Rounded Gel Nails Are Actually The Smartest Choice You Can Make

Tax professionals are another source. If you have an accountant, don't waste time looking for where to get tax forms. Just call them. They have professional software that can spit out any form in seconds. Most will email you a PDF for free if you're a regular client.

Banks used to be a reliable spot, but like post offices, they've largely stepped away from this. It's rare to find a Chase or Bank of America with a stack of tax forms these days. It’s a liability and a space-waster for them.

Real Examples of the "Form Hunt"

Take my friend Sarah. Last year, she needed a Form 8606 for her non-deductible IRA. She went to three different post offices. Nothing. She tried the library, but their printer was jammed.

She ended up at a local Staples. They have a service where you can email a file to their "print-to-me" address and pick it up at a kiosk. She downloaded the 8606 onto her phone from IRS.gov, sent it to the store, and had it in five minutes.

It cost her about $0.20.

Then there’s the case of the 1040-SR. This is the version for seniors (65 and older). It has larger print and a different layout. If you're helping a parent or grandparent, don't let them squint at a standard 1040. Go to the IRS site and specifically search for the "SR" version. It’s a game-changer for readability.

Don't Forget the Instructions

The form is one thing. The instructions are another.

The 1040 instruction booklet is often over 100 pages long. Do not print this. It is a waste of paper and ink. Use the PDF and use the "Find" function (Ctrl+F) to search for keywords like "Child Tax Credit" or "Student Loan Interest."

If you absolutely need a physical copy of the instructions, that’s when you use the mail-order service from the IRS. It's free, and it saves you from destroying your home printer.

Essential Next Steps for Tax Season

Finding where to get tax forms is only step one. Here is how to actually execute.

First, identify exactly which forms you need. Don't just grab a 1040. Check if you need Schedule A (itemized deductions), Schedule C (business profit/loss), or Schedule D (capital gains).

Second, decide on your format. If you're going digital, set up a folder on your desktop now. If you're going paper, clear a spot on your kitchen table.

Third, verify the year. It sounds stupid, but every year, people accidentally fill out the previous year's form. Make sure the top right corner says the correct tax year.

Finally, gather your documentation before you start writing. There is nothing worse than being halfway through a 1040 and realizing you don't have your 1098-T from your college or your mortgage interest statement.

Get your forms. Get your receipts. And honestly? Get started earlier than you think you need to. April 15th has a way of sneaking up on you like a deadline you thought was a month away but is actually tomorrow morning.