If you look at an oil map united states today, you’re basically looking at a giant jigsaw puzzle that keeps changing shapes every few years. It’s not just some static drawing of where the "black gold" sits. Honestly, most people think of Texas and maybe Alaska, but the reality is way messier and a lot more interesting than that. You have massive subterranean formations like the Permian Basin that span across state lines, and then you have these tiny, almost forgotten pockets in places like Michigan or Illinois that still pump out barrels every single day.

Geography matters, but technology is what actually draws the lines on the map.

A decade ago, half the stuff we see on a modern oil map united states wasn't even considered "active." Then fracking happened. Suddenly, North Dakota was the talk of the town. Now, as we move through 2026, the map is shifting again because of how we manage "old" wells and where the new infrastructure for carbon capture is being built. It's a living document.

The Big Three: Where the Real Volume Lives

When you zoom in on an oil map united states, three names dominate the conversation: the Permian, the Bakken, and the Eagle Ford.

The Permian Basin is the undisputed heavyweight champion. It sits right in West Texas and Southeastern New Mexico. If the Permian were its own country, it would be one of the largest oil producers on the entire planet. It’s huge. It’s deep. It’s got multiple layers—think of it like a lasagna of oil-rich rock. Companies like Chevron and ExxonMobil have spent billions here because the geology is just that forgiving. You can drill one well and hit several different productive zones.

Then you’ve got the Bakken. This is up in North Dakota and stretches into Montana and Canada. It’s a different beast entirely. The weather is brutal, and the oil is trapped in tight shale. Back in the mid-2000s, this area was a ghost town. By 2012, it was a gold rush. Today, it’s a more mature play, but it still defines the northern border of the U.S. energy footprint.

👉 See also: The Truth About Seeking a Student Credit Card American Express Option

Down in South Texas, the Eagle Ford shale provides a massive chunk of production. It’s conveniently located near the Gulf Coast, which makes it easy to get that oil to refineries or onto ships for export. That proximity to the coast is a massive economic advantage that the Bakken just doesn't have.

The Offshore Frontier

Don't forget the water. A huge part of the oil map united states isn't even on land. The Gulf of Mexico is home to some of the most complex engineering projects humanity has ever attempted. We are talking about platforms sitting in thousands of feet of water, drilling miles into the earth's crust.

- Thunder Horse: A massive BP-operated field.

- Appomattox: Shell's giant project in the Norphlet formation.

- Atlantis: Another deepwater titan.

These aren't just holes in the ground; they are floating cities.

Why Some States Disappeared from the Map

You’ve probably heard of the Pennsylvania oil rush. It’s where the American industry started in 1859 with the Drake Well. But if you look at a modern oil map united states, Pennsylvania is mostly a "gas state" now. The Marcellus Shale is world-class for natural gas, but the oil? That’s mostly gone or just too expensive to get compared to the massive flows in Texas.

California is another weird one.

Historically, California was an oil powerhouse. Think of the Huntington Beach rigs or the Kern River field. But politics and aging fields have shrunk California’s footprint on the map. It still produces, sure, but the regulatory environment is so tight that most major players are looking elsewhere. It’s a lesson in how the "oil map" isn't just about where the oil is—it's about where you're allowed to go get it.

The Surprise Players

You might see dots in places you don't expect.

- Colorado: The Wattenberg Field in the Denver-Julesburg Basin is a massive producer, despite the state's growing focus on green energy.

- Oklahoma: The SCOOP and STACK plays keep the Sooner State firmly in the top tier of the oil map united states.

- New Mexico: This is the "quiet" part of the Permian, but it has seen explosive growth. The Delaware Basin side of the Permian is actually where some of the best rock is currently being drilled.

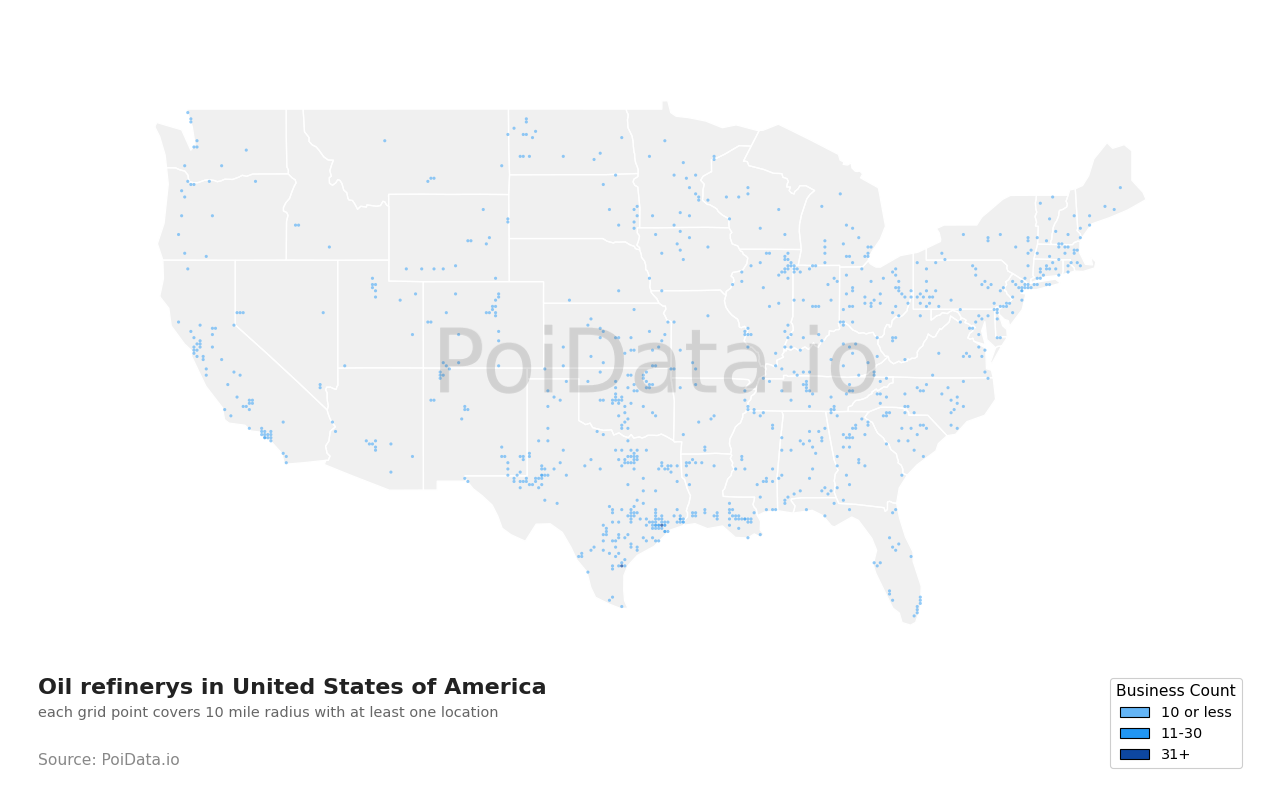

The Infrastructure Web: Pipelines and Refineries

An oil map united states is useless if you don't look at the veins and arteries. Crude oil is useless if it stays in the ground in Midland, Texas. It has to get to the Gulf Coast or the Midwest.

The Cushing, Oklahoma hub is the "Pipeline Crossroads of the World." Every major map of U.S. oil has a giant circle around Cushing. This is where the price of West Texas Intermediate (WTI) is physically settled. If the tanks in Cushing are full, prices drop. If they’re empty, prices spike. It’s the heartbeat of the whole system.

💡 You might also like: Trump Meme Coin Value: What Most People Get Wrong About PolitiFi

Then you have the massive pipeline projects. Some, like the Dakota Access Pipeline (DAPL), became household names because of the legal and environmental battles surrounding them. Others, like the Enbridge Mainline or the Colonial Pipeline, just quietly move millions of barrels every day. Without these lines, the oil map would just be a bunch of isolated islands.

Looking at the "Invisible" Oil Map

What's really fascinating in 2026 is the rise of the "re-drilled" map.

Kinda cool, actually. We are seeing companies go back to wells that were drilled 40 years ago. With new sensor technology and better fracking fluids, they are finding oil that the old-timers missed. This means the oil map united states is getting denser, not just bigger. We aren't necessarily finding "new" fields in Florida or Vermont; we are finding more oil in the places we already knew about.

There’s also the environmental layer.

The Bureau of Land Management (BLM) keeps a very specific map of where you can and cannot drill on federal land. This is a massive point of contention. If a new administration shrinks the "permitted" area, the oil map united states effectively shrinks overnight, even if the oil is still in the rock.

Real Data and Economic Impact

According to the Energy Information Administration (EIA), the U.S. remains the top crude oil producer in the world. That’s a wild fact when you think about where we were 20 years ago.

- Texas: Produces over 5 million barrels per day.

- New Mexico: Closing in on 2 million barrels per day.

- North Dakota: Hovering around 1.2 million.

The economics are staggering. These states rely on "severance taxes"—basically a tax on the oil taken out of the ground—to fund schools, roads, and emergency services. When the oil map united states shows a decline in a certain region, it's not just a business problem. It’s a "we can’t pay the teachers" problem for local counties.

💡 You might also like: The Cracker Barrel Name Change Controversy: What Really Happened

Misconceptions About the Map

People think the map is just a big pool of oil underground. It's not.

It’s actually "tight" rock. It’s more like a sponge that you have to squeeze really hard to get a drop out of. When you see a shaded area on an oil map united states, you're looking at a geological formation, not an underground lake. You need high-pressure water, sand, and chemicals to crack that rock. If the price of oil falls below $50 or $60 a barrel, a lot of those shaded areas on the map effectively "disappear" because nobody can afford to squeeze the sponge.

How to Use This Information

If you’re looking at an oil map united states for investment or just to understand the economy, you have to look past the surface.

First, check the rig count. Baker Hughes puts out a report every week. If the map shows oil in Ohio, but the rig count is zero, that field is "dead" for the moment. Second, look at midstream capacity. If there aren't enough pipelines in a region—like we've seen in the Permian at times—producers have to sell their oil at a massive discount just to get someone to take it away.

Actionable Insights for 2026

If you want to stay ahead of the curve on U.S. energy geography, follow these steps:

- Monitor the EIA Short-Term Energy Outlook: They update this monthly. It’s the gold standard for seeing which regions are growing and which are stalling.

- Watch the Permian "DUCs": DUC stands for "Drilled but Uncompleted" wells. If companies are drilling holes but not finishing them, it means they are waiting for higher prices. This is a huge "hidden" inventory on the oil map united states.

- Track the "Basin Differentials": This is the price difference between oil in North Dakota and oil in Texas. If the gap gets too wide, it tells you there's a bottleneck in the pipeline map.

- Keep an eye on New Mexico's regulatory shifts: Since so much of their oil is on federal land, any change in D.C. policy hits the New Mexico map harder than it hits the Texas map (which is mostly private land).

The oil map united states is basically a story of American engineering and stubbornness. It’s a map that says as much about our technology and our politics as it does about our geology. Whether we are talking about the deep waters of the Gulf or the dusty plains of the Perming, the lines are always being redrawn.

Stay focused on the Permian for the volume, the Gulf for the long-term projects, and the pipeline hubs for the real economic truth. That’s how you actually read the map.