We’re obsessed with batteries. Honestly, look around—your phone, that electric truck your neighbor just bought, the massive storage units backing up the grid. It’s all lithium. But for a long time, the United States was basically a spectator in the lithium game. We’ve had the maps, sure, but we weren't doing much with them. Now? Everything is shifting. The lithium deposits USA map is no longer just a geological curiosity; it’s a high-stakes blueprint for the next century of American industry.

It’s not just a single dot on a map. People think "lithium" and imagine a giant hole in the ground, but the reality is way messier and more interesting. We’re talking about ancient lake beds in Nevada, deep brine pockets under the Salton Sea, and even jagged rocks in North Carolina that look like something out of a construction site.

The Hotspots: Where the Maps Get Crowded

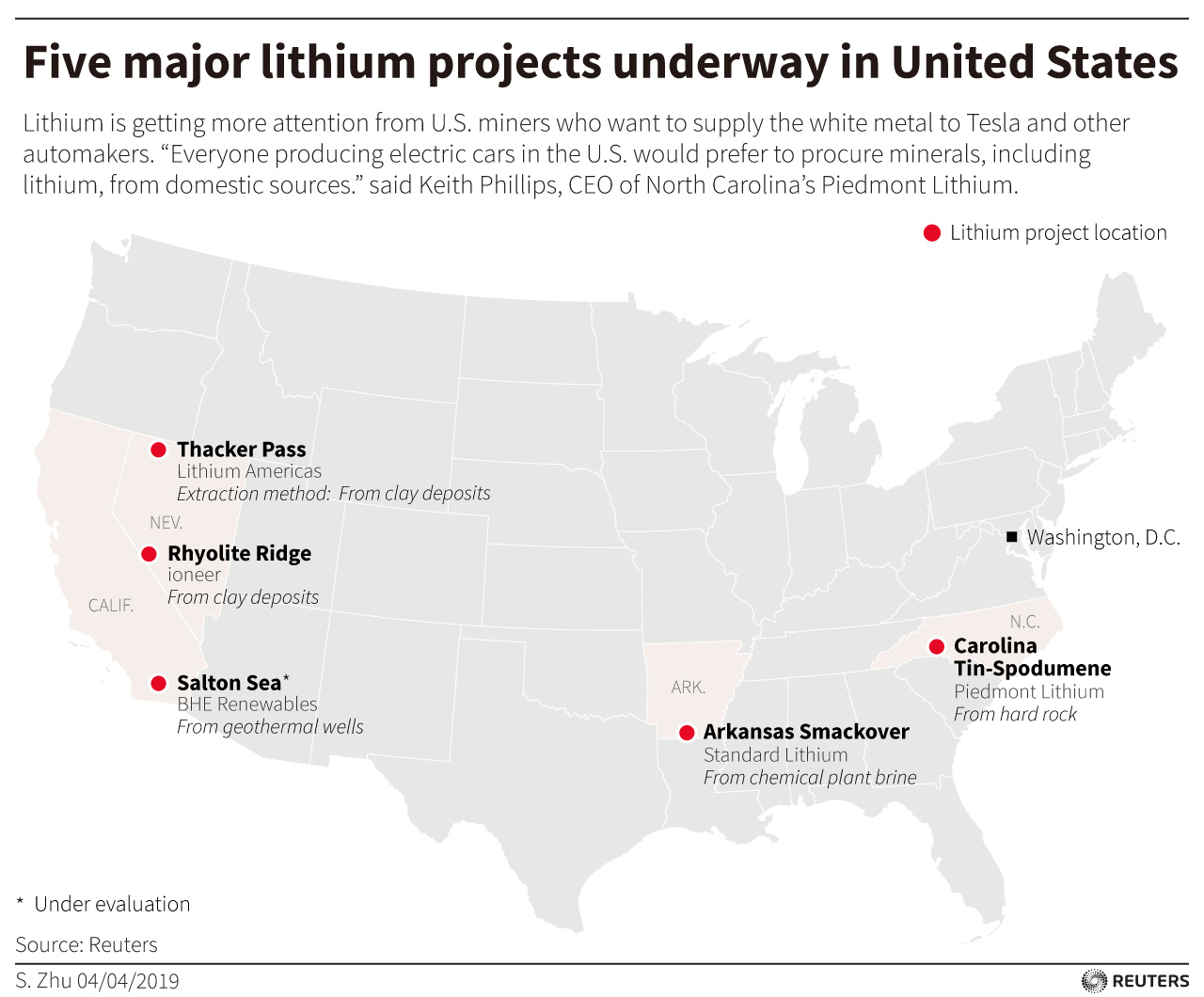

If you zoom into a lithium deposits USA map, your eyes will immediately dart to the West. Nevada is the undisputed heavyweight right now. It’s home to Silver Peak, which, until very recently, was the only game in town for actual production. But the real buzz—and the real controversy—is centered on Thacker Pass.

Lithium Americas is working that site, and it’s massive. Geologists estimate it contains one of the largest lithium deposits in the world. It’s an extinct supervolcano caldera. Think about that for a second. Millions of years ago, a volcano erupted, collapsed, and left behind a lithium-rich clay that we’re now trying to turn into smartphone batteries.

But Nevada isn't the whole story. You’ve got to look at the Salton Sea in California. They call it "Lithium Valley." It’s a weird, eerie place, but underneath that salty water is a geothermal goldmine. Companies like Berkshire Hathaway Energy and Controlled Thermal Resources are trying to pull lithium out of the hot brine that’s already being pumped up for electricity. It’s a "two birds, one stone" situation.

- Kings Mountain, North Carolina: This is old-school hard rock mining. Albemarle Corp owns a site here that used to be a major producer decades ago. They're looking to bring it back online.

- The Smackover Formation: This stretches across Arkansas. It’s an underground trend where companies like ExxonMobil are buying up land. They aren't looking for oil this time; they want the lithium-rich brine trapped in the limestone.

- Clayton Valley, Nevada: Right next to Silver Peak, this remains a focal point for junior mining companies trying to prove they have the tech to extract lithium efficiently.

The Tech Is Changing the Map

You can’t just look at a map and see "lithium." You have to see how it's getting out. In the past, we mostly used massive evaporation ponds. You pump salty water into a field, wait for the sun to do its thing, and scoop up the leftovers. It’s slow. It takes up a lot of space.

Direct Lithium Extraction (DLE) is the new kid on the block. DLE is basically like a Brita filter for the earth. You run the brine through a chemical process, grab the lithium, and shove the water back underground. It’s faster. If DLE works at scale—and that’s a big "if"—it changes the lithium deposits USA map entirely because it makes smaller or "dirtier" deposits suddenly profitable.

Standard Lithium and SLB (formerly Schlumberger) are betting big on this in places like Arkansas. If they nail it, the map expands. If they don't, we're stuck with the old ways.

Why Does This Map Matter Now?

Energy security. That’s the buzzword, but let’s be real: it’s about not being reliant on a handful of other countries for the stuff that runs our lives. The Biden administration and subsequent energy policies have poured billions into the "Battery Belt"—a corridor of factories popping up in the Southeast and Midwest. But a factory is just a building if you don't have the raw materials.

The U.S. Geological Survey (USGS) keeps updating these maps because the stakes are climbing. They recently identified huge potential in the McDermitt Caldera (which spans the Nevada-Oregon border). We’re talking about enough lithium to power millions of EVs for decades.

The Friction Points Nobody Likes to Talk About

It sounds great on paper. Find lithium, dig it up, save the world.

🔗 Read more: EV Mandates and Consumer Choice: What Most People Get Wrong

Hardly.

Every single dot on that lithium deposits USA map represents a fight. At Thacker Pass, it’s a clash between green energy goals and the rights of Indigenous peoples and local ranchers. There are concerns about water usage in the desert. Lithium mining is thirsty work. In North Carolina, it's about "not in my backyard" (NIMBY) sentiment. People want EVs, but they don't necessarily want a massive open-pit mine three miles from their house.

Then there’s the "paper lithium" problem.

Just because a map says there is lithium in the ground doesn't mean it’s "reserve" grade. There’s a massive difference between a resource (we know it’s there) and a reserve (we can actually get it out and make money). A lot of the hype you see in penny stocks is based on resources that might never be economically viable.

Practical Insights for Navigating the Lithium Boom

If you’re looking at this from a business or even a curious citizen's perspective, don’t just look at the size of the deposit. Look at the infrastructure. A massive deposit in the middle of nowhere with no road access, no water, and no power grid is basically worthless.

- Check the Permitting Status: This is the biggest bottleneck in the U.S. A company can have the best deposit in the world, but if they’re stuck in litigation for ten years, the map doesn't move.

- Follow the Brine: Hard rock mining (spodumene) is proven but expensive and environmentally heavy. Brine and DLE are the "wild cards" that could make the U.S. a global leader if the chemistry holds up at scale.

- The "Battery Belt" Connection: Look at where the battery plants are being built. It makes zero sense to ship raw lithium across the ocean to be processed and then shipped back. The closer the mine is to the cathode plant, the better the margins.

The lithium deposits USA map is essentially a map of our future economy. It's shifting from the "Oil Patch" of the Gulf Coast to the "Lithium Loop" of the West and the Southeast. We aren't just looking for rocks anymore; we're looking for the foundation of a completely different kind of grid.

Keep an eye on the USGS Mineral Resources Program updates. They’re the ones doing the actual dirt-under-the-fingernails work to see where the next big find might be. And watch the Salton Sea projects over the next 24 months. If they can prove that "green lithium" is real, the map gets a lot more crowded, very quickly.

The next step is tracking the midstream. Extraction is step one, but the U.S. still lacks the massive refining capacity needed to turn that raw ore into battery-grade lithium carbonate or hydroxide. Watch for announcements regarding "integrated" sites—where the mine and the refinery are in the same zip code. That’s where the real money and the real stability will be found.