You’ve checked your bank account again. Nothing. It’s that familiar, low-grade annoyance that hits every spring when you know the government owes you money but the "pending" status feels eternal. If you are asking where is my colorado state tax refund, you aren't alone. Thousands of Coloradans are hitting refresh on the Department of Revenue’s portal right now, hoping for a different color bar or a new status update. Honestly, it’s a bit of a waiting game, but there are actual reasons why your neighbor got theirs in eight days while you’re sitting on week four.

The Colorado Department of Revenue (DOR) isn't just sitting on your cash for fun. They’ve got a massive, increasingly complex fraud detection system that sifts through millions of returns. Since the rise of identity theft and sophisticated tax scams, the state has gotten way more aggressive about "verifying" before "sending." This means your refund might be perfectly accurate, but if it triggered a random security flag, it’s going to sit in a digital queue until a human or a secondary algorithm clears it. It sucks. But that’s the reality of modern tax filing.

The Revenue Online Portal: Your Best Friend (And Greatest Enemy)

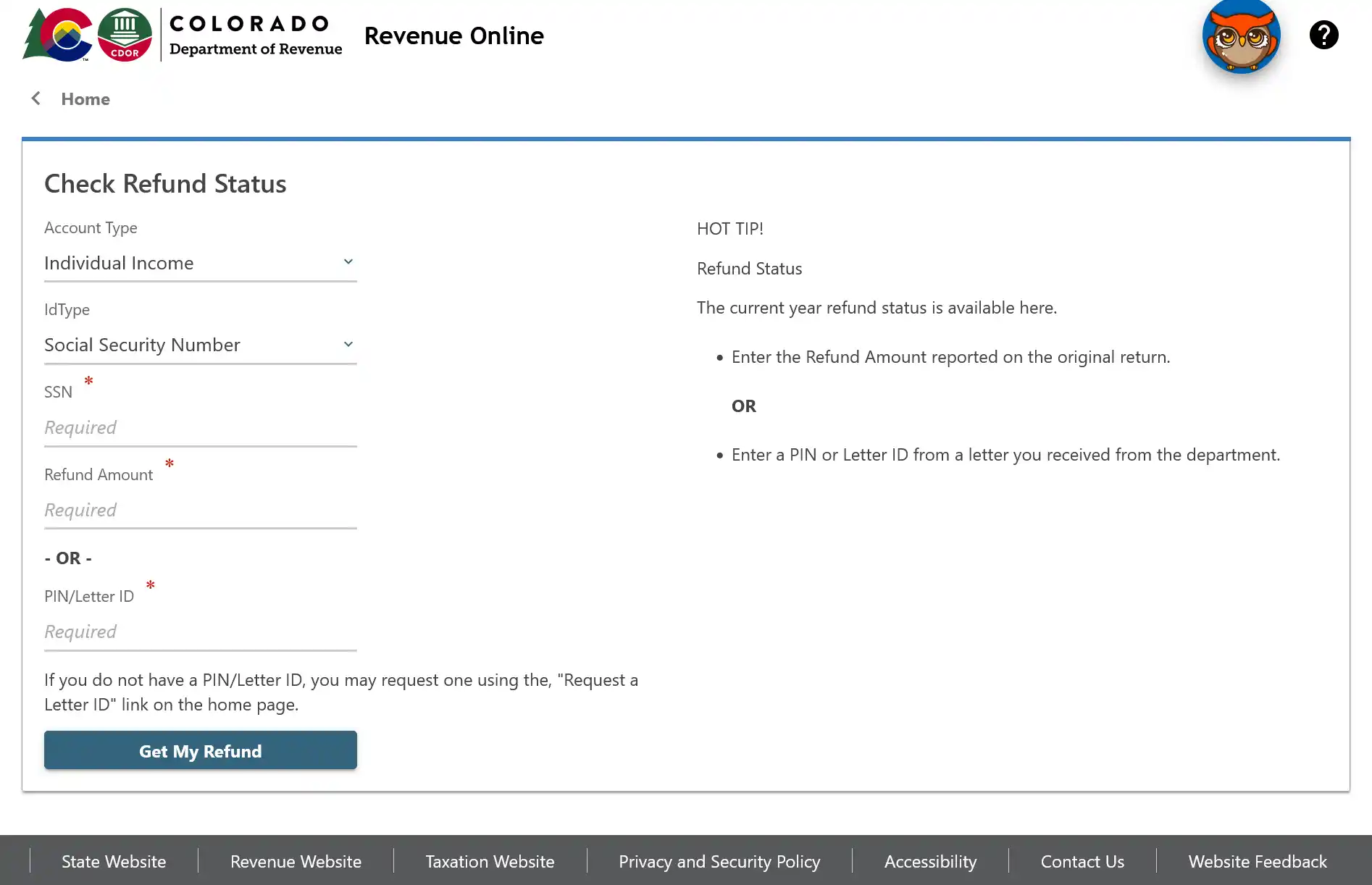

Most people start their search at the Colorado Revenue Online portal. It’s the official source of truth. You don’t need an account to check your status, which is a relief. You just need your Social Security Number (SSN) or ITIN and the exact refund amount you're expecting. If you’re off by even a dollar because of a rounding error on your 104 form, the system will tell you it can't find your record. It’s finicky like that.

When you finally get through, you’ll likely see a status like "Sent," "In Review," or "Requested." If it says "Sent," give it up to 10 business days for the bank to catch up. If it’s "In Review," don't panic. That doesn't mean you’re being audited in the scary, IRS-man-at-your-door sense. It usually just means the state is doing its due diligence. Sometimes, they just need to verify that you are actually you.

🔗 Read more: USD to UZS Rate Today: What Most People Get Wrong

Why Some Refunds Take Forever

Why the delay? Well, did you file on paper? If you did, I have bad news. Paper returns are processed manually and can take up to 12 weeks. In the digital age, filing on paper is basically like sending a letter via carrier pigeon and expecting an instant reply. E-filing is the gold standard. Most e-filed returns are processed within 21 days, but even then, things happen.

The biggest bottleneck right now is the "Verification Letter." This is a specific Colorado quirk. If the state suspects anything—or even if you’re just the "lucky" winner of a random spot check—they will mail you a physical letter (Form DR 0012) with a unique code. You have to take that code, go back to the Revenue Online site, and enter it to prove you exist. Until you do that, your refund is essentially frozen in carbonite. They won't email you this code. They won't call you. They use the U.S. Postal Service, which adds another week of waiting. Keep an eye on your mailbox; it’s easy to mistake this for junk mail.

Tabor Credits and the Complexity of 2026

Colorado is unique because of the Taxpayer’s Bill of Rights (TABOR). When the state collects more revenue than it’s legally allowed to keep, it has to give it back to us. This often comes in the form of a flat-rate refund or a temporary tax rate reduction. In 2026, these calculations can get messy. If you forgot to claim your TABOR credit or if the amount you claimed doesn't match the state's records, your return gets kicked over to a manual reviewer.

💡 You might also like: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

Think of the DOR staff as a group of people trying to drain a swimming pool with a garden hose. They can only go so fast. During peak season—late March through mid-April—the volume of returns is staggering. If you filed early in January, you probably saw your money in two weeks. If you filed on April 14th, you’re in for a wait.

Common Roadblocks You Didn't See Coming

- Offset Programs: Did you know the state can take your refund before you ever see it? It’s called an "offset." If you owe back taxes, unpaid child support, or even certain court fines or restitution, the state will intercept that money. They’ll send you a notice explaining where the money went, but by then, the "Where is my refund?" tool will simply show that the process is complete.

- Banking Errors: Double-check your routing number. A single digit off means the bank rejects the deposit, sends it back to the state, and then the state has to cut a physical check and mail it to the address on file. This can add three to five weeks to the timeline.

- Identity Verification: As mentioned, the DR 0012 letter is the primary tool here. But sometimes, they might ask for copies of your W-2s or a photo ID. If you moved recently and didn't update your address with the DOR, that letter is currently sitting in a dead-letter office or at your old apartment.

What to Do If It’s Been More Than a Month

If it has been over 30 days since you e-filed and the online tool isn't giving you any useful info, it might be time to call. But honestly? Calling the Colorado Department of Revenue is an exercise in patience. Expect long hold times. The best time to call is usually early in the morning, right when they open.

However, before you call, check your email spam folder. If you used software like TurboTax or H&R Block, they will often send you an alert if the state has rejected your return for a simple error (like a transposed digit in your Social Security number). If the state rejected the return, it was never actually "filed," so there won't be a refund to track until you fix it and resubmit.

📖 Related: Getting a Mortgage on a 300k Home Without Overpaying

The Direct Deposit vs. Check Debate

Direct deposit is almost always faster. But some people still prefer a physical check because they don't trust the digital systems or they've changed banks recently. If you requested a check, understand that the "Sent" status on the website means it was put in the mail, not that it’s in your hands. Give it time to traverse the postal system. Colorado's mail centers are efficient, but things happen.

Specific Steps to Take Right Now

- Locate your copy of your state return. You need the exact refund amount. Not the federal amount, the state amount.

- Go to the Revenue Online portal. Don't use third-party tracking sites; they just scrape data from the official site anyway and might be phishing for your info.

- Check for the 'Letter ID'. If the status says "Identity Verification Required," look for that letter in your mail.

- Verify your address. If you've moved, ensure your mail forwarding is active.

- Look for 'Offsets'. Check if you have any outstanding debts with the state that could have eaten the refund.

The Colorado state tax refund process is generally reliable, but it isn't instantaneous. It’s a bureaucracy, after all. Most of the "delays" people experience are actually just the system working its security protocols. If your return is clean, your math is right, and you haven't moved recently, you'll likely see that money hit your account within three weeks of filing. If not, the portal is your first stop, and the mailbox is your second.

Stop refreshing the page every hour. The system usually updates once a day, typically overnight. Checking it at 10 AM and then again at 2 PM is just going to stress you out for no reason. Grab a coffee, wait for the mail, and keep an eye on that "Review" status. It’ll move eventually.

Practical Next Steps

- Gather your DR 0104 form and navigate to the Colorado Revenue Online "Check My Refund" tool to verify your current status.

- Sign up for a Revenue Online account if you haven't already; it provides more detailed information than the quick-search tool and allows you to respond to notices electronically.

- Check your physical mail daily for Form DR 0012, as failing to respond to an identity verification request is the number one cause of multi-month refund delays in Colorado.

- Review your filed return for any small errors in the "Refund Amount" line to ensure you are entering the correct search criteria into the state’s tracking system.