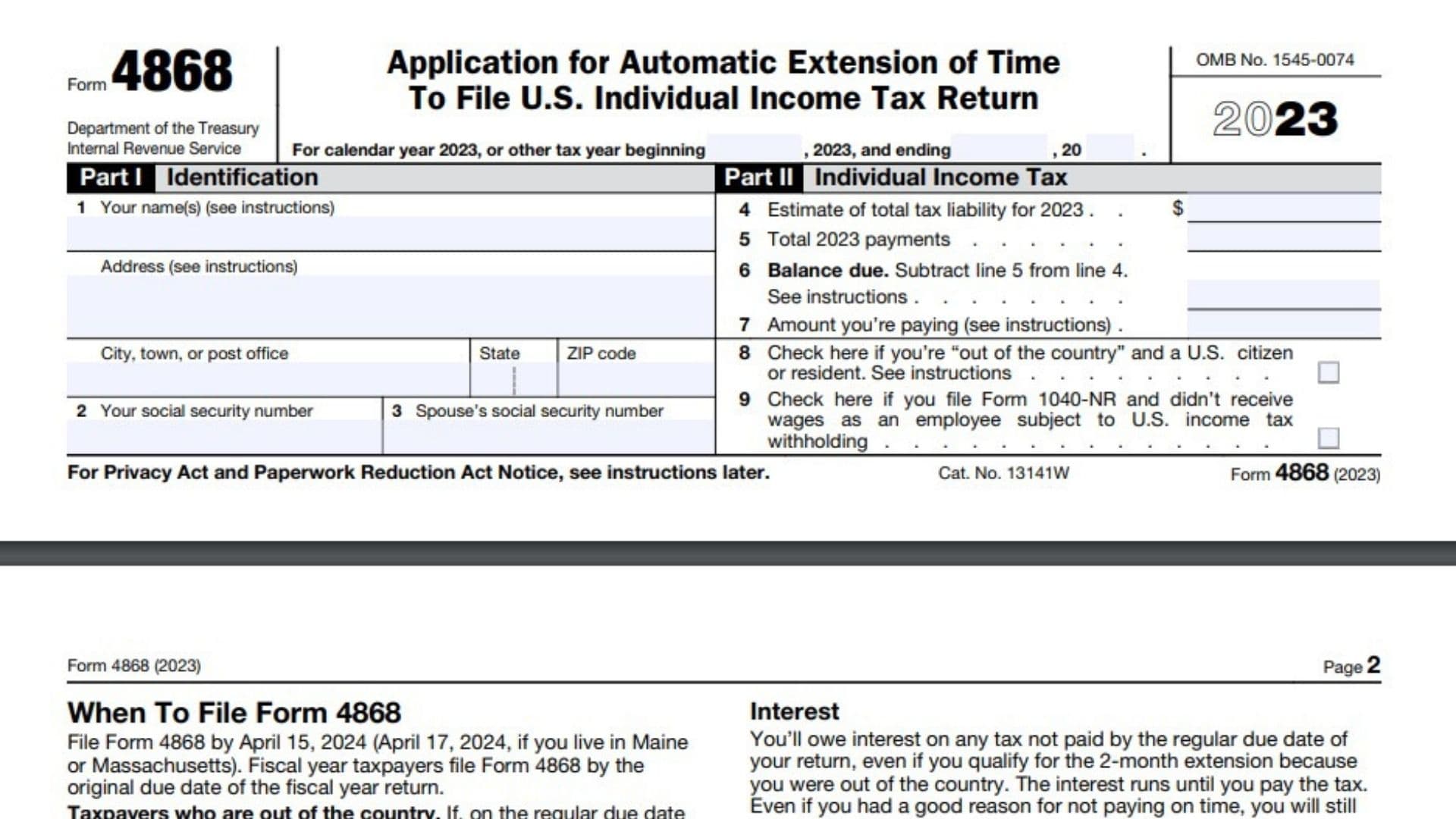

Tax season is basically the Olympics of paperwork. You're racing against a clock that doesn't care if your life is messy right now. If you've realized that April 15 is breathing down your neck and your records are a disaster, you need an extension. That's where Form 4868 comes in. But here is the thing: the IRS doesn't just have one giant mailbox in D.C. where everything goes. If you're asking where do i mail form 4868, the answer depends entirely on where you live and whether you’re sending a check along with it.

Mistakes happen. People send forms to the wrong processing center all the time. Honestly, it’s a miracle more mail doesn't just vanish into the ether. But when it comes to the IRS, a "wrong address" error can lead to late filing penalties if they don't receive your request by the deadline.

The Regional Map of IRS Addresses

The IRS divides the United States into specific regions for processing. It’s not about where you want the mail to go; it's about where the IRS has decided your specific state’s data should be handled. This changes occasionally, so checking the current year's instructions is vital.

If you live in a state like Florida, Louisiana, Mississippi, or Texas, and you are not including a payment, you’ll likely be sending your form to Austin, Texas. Specifically, Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0045. But wait. If you are including a payment—maybe a check or money order because you know you owe—the address flips. In that case, you'd send it to P.O. Box 1214, Charlotte, NC 28201-1214.

See the pattern? The IRS separates the "just paperwork" from the "money included" mail.

For those up in the Northeast—think Maine, Massachusetts, New Hampshire, New York, Vermont—the "no payment" address is in Kansas City, MO 64121-0045. If you’ve got a check in the envelope, you're looking at a P.O. Box in Louisville, KY. It feels counterintuitive to mail something from Boston to Missouri, but that's the system.

Why Mailing With a Payment Changes Everything

Money changes the destination. Why? Because the IRS uses "lockbox" addresses for payments. These are specialized financial processing centers designed to get your check deposited as fast as humanly possible. They want that cash in the government's account.

If you send your payment to the center that only handles paper forms, it might take days or even weeks for it to be rerouted to the right department. During that lag time, the IRS might think you haven't paid. Then the notices start arriving. Nobody wants those letters. They're stressful.

The Specifics for Western States

If you're out west in California, Alaska, Arizona, Hawaii, or Nevada, your "no payment" destination is Ogden, UT 84201-0045.

Payment included? You're mailing it to Los Angeles, CA 90084-8272.

Middle America and the South

States like Alabama, Arkansas, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, and Virginia have their own pipeline.

No payment: Kansas City, MO 64491-0045.

With payment: Charlotte, NC 28201-1214.

It’s a bit of a jigsaw puzzle. Honestly, it’s easier to just e-file, but some people really prefer the paper trail. I get it. There's something final about licking an envelope.

International Filers and Special Cases

If you’re living abroad or have an APO/FPO address, you're in a different boat entirely. You aren't part of the domestic regional grid.

For those outside the 50 states or D.C., you generally mail Form 4868 to:

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

This applies whether you're in American Samoa, Puerto Rico, or teaching English in Prague. If you're a "dual-status alien," the rules get even stickier. You’ll usually follow the instructions for the state where you lived at the end of the tax year, but when in doubt, the International office in Austin or the Louisville payment center are the hubs.

👉 See also: Tax Calculator Based on Income: Why Your Take-Home Pay Never Matches Your Math

Common Blunders When Mailing Form 4868

Don't just drop it in a blue USPS box and hope for the best.

One: Certified Mail. This is non-negotiable. If the IRS claims they never got your extension and tries to hit you with a failure-to-file penalty (which is way harsher than the failure-to-pay penalty), your only shield is that stamped receipt from the post office. It is your "get out of jail free" card. Sorta.

Two: The Deadline. April 15. If that falls on a weekend or a holiday (like Emancipation Day in D.C.), you get until the next business day. But don't push it. If you're mailing it on the 15th, you better make sure the post office actually postmarks it that day. A postmark on the 16th is a rejection.

Three: The Check. If you are sending money, make it payable to "United States Treasury." Not "IRS." Also, write your Social Security number and "2025 Form 4868" on the memo line. This ensures that if the check gets separated from the form—which happens more than the IRS likes to admit—they know whose account to credit.

What Happens After You Mail It?

Nothing.

✨ Don't miss: Net Worth Donald Trump: What Most People Get Wrong

That’s the weird part. The IRS doesn't send you a "Hey, we got it!" postcard. If you don't hear anything, you’re good. They only contact you if the extension is denied, which almost never happens unless you provided a fake SSN or messed up your basic identification.

It’s essentially an automatic approval. You’ve just bought yourself until October 15.

But remember—and this is the part people get wrong every single year—an extension to file is not an extension to pay. If you owe the IRS $5,000 and you mail in Form 4868 without a check, interest starts accruing on April 16. The extension just stops the "late filing" penalty. That penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The "late payment" penalty is only 0.5% per month.

By mailing that form, you are saving yourself from that 5% hit. It's massive.

Digital Alternatives to the Mailbox

Honestly, mailing a paper form in 2026 feels a bit like using a typewriter. You can go to the IRS website and use "Direct Pay." When you make a payment and select "Extension" as the reason, the IRS automatically grants you the extension. No Form 4868 required. No stamps. No wondering where do i mail form 4868.

If you really want to stick to paper, though, just double-check the address list on the official IRS.gov site one last time before you seal the envelope. Addresses can shift if a processing center closes or if the IRS redistributes the workload to a different state.

Actionable Steps for a Stress-Free Extension

To make sure this actually works, follow this quick sequence:

- Confirm your region: Look at the "Where to File" section in the Form 4868 instructions specifically for the current tax year.

- Decide on payment: If you can pay even $50, do it. It shows "good faith" and reduces your interest.

- Print clearly: If the IRS computer can't read your handwriting, your extension might as well be a grocery list.

- Use the right envelope: Don't fold the form into a tiny origami shape. Use a standard business envelope.

- Get the postmark: Walk into the post office. Stand in line. Get that certified mail receipt. Keep that receipt with your tax records for at least three years.

You've got this. Take a breath, get the envelope ready, and give yourself that six-month window to breathe.