Tax season is honestly a bit of a nightmare for most of us. You’re sitting there, staring at a mountain of digital receipts, wondering if that one coffee meeting counts as a business expense or if the IRS is going to come knocking on your door. But before you even get to the deductions, there's the one question that keeps everyone up at night: when is tax due?

The answer isn't as simple as a single date on a calendar. If you're a standard W-2 employee, you've got one deadline. If you're a freelancer or a small business owner, you've got four. And if you live in a state hit by a natural disaster, the government might give you a grace period that changes everything.

The Big One: April 15th and the Exceptions

For most Americans, the deadline to file individual income tax returns is April 15. That is the date burned into our collective brains. In 2026, April 15 falls on a Wednesday, so there are no weekend delays or weird Emancipation Day conflicts pushing it back this time. You’ve got until midnight.

But wait.

If you live in Maine or Massachusetts, you usually get an extra day or two because of Patriots' Day. It’s a small win, but a win nonetheless. Then there’s the whole "extension" thing. People think filing an extension gives you more time to pay. It doesn’t. You're basically telling the IRS, "Hey, I need more time to do the paperwork, but here is the money I think I owe you." If you don't pay by April 15, the interest starts ticking. It’s relentless.

What Happens If You Just... Don't?

The IRS has two main penalties: failure to file and failure to pay. The failure to file penalty is actually way worse. It’s usually 5% of the unpaid taxes for each month or part of a month that a tax return is late. The failure to pay penalty is only 0.5% per month.

Basically? Even if you can't pay a dime, file the paperwork. It sounds counterintuitive to tell the government you owe them money you don't have, but it saves you a massive headache and a lot of cash in the long run.

When Is Tax Due for the Side Hustle Crew?

If you’re part of the "gig economy"—Uber drivers, Etsy sellers, freelance consultants—you don’t just have one deadline. You have four. These are the Estimated Tax Payments.

The IRS wants their cut as you earn it. They don't want to wait until next April to see the profits from that viral TikTok shop you started. For 2026, the quarterly deadlines are:

💡 You might also like: Writing a Sample Reference Letter for Employee From Manager That Actually Lands the Job

- April 15 (For income earned Jan 1 – March 31)

- June 15 (For income earned April 1 – May 31)

- September 15 (For income earned June 1 – Aug 31)

- January 15, 2027 (For income earned Sept 1 – Dec 31)

Notice how the "quarters" aren't actually three months long? The second "quarter" is only two months. It’s weird. It’s confusing. It’s the IRS. If you miss these, you might get hit with an underpayment penalty. Most tax pros, like those at H&R Block or specialized CPAs, suggest aiming to pay at least 90% of your current year's tax or 100% of last year's tax to avoid the sting.

Extensions: The October 15 Safety Net

If life gets in the way—and it usually does—you can file Form 4868. This pushes your filing deadline to October 15, 2026.

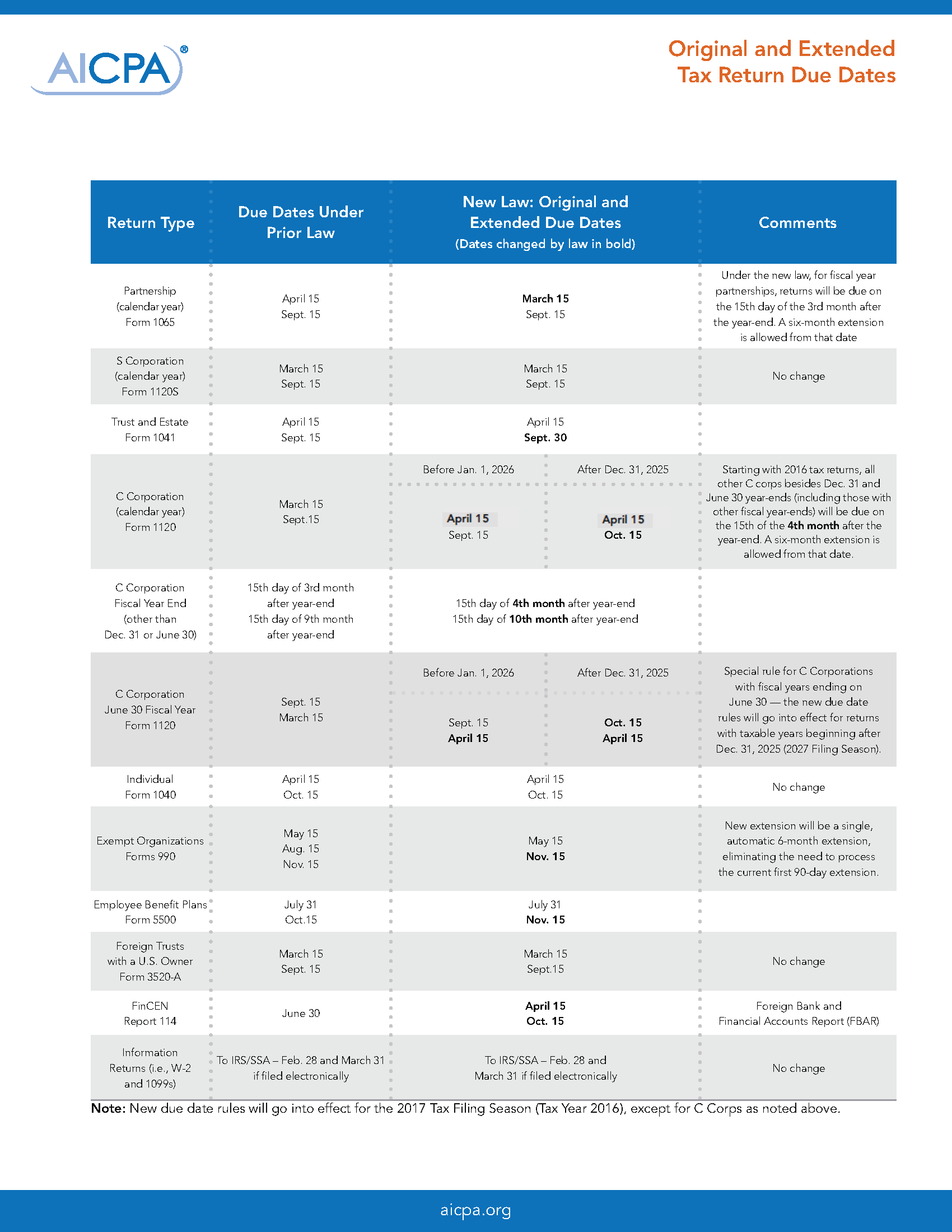

I’ve seen people use this as a procrastination tool, which is dangerous. If you owe $5,000 and you wait until October to pay it, you're going to owe that $5,000 plus months of interest. However, if you're waiting on a K-1 from a partnership or some complex investment documents, the extension is a literal lifesaver. It gives you the breathing room to be accurate. Accuracy prevents audits.

The Disaster Zone Factor

Sometimes, the IRS plays the "good guy." If your area is declared a federal disaster area due to hurricanes, wildfires, or floods, they often move the when is tax due date back significantly. For example, in previous years, taxpayers in parts of California or Florida were given months of extra time without even having to ask for it. It’s automatic based on your address of record. Always check the IRS "Tax Relief in Disaster Situations" page if your area has been hit by something major.

Special Cases: Expats and Military

If you’re a U.S. citizen living abroad, you get an automatic two-year extension to June 15 to file and pay. You still owe interest from April 15 if you haven't paid, but the late-payment penalties don't start until June.

For military members serving in combat zones, the rules are even more generous. You typically get at least 180 days after leaving the combat zone to file your returns and pay any taxes due. It’s one of the few areas where the tax code feels genuinely empathetic to human circumstances.

The "Safe Harbor" Rule

Ever heard of it? It’s the secret to not panicking. If you pay in 100% of what you owed last year (or 110% if your income is over $150,000), the IRS generally won't penalize you for underpayment, even if you end up owing a lot more when you finally file. It’s a way to cap your risk.

Actionable Steps to Take Right Now

Stop waiting for April. Taxes are a year-round sport.

- Check your withholding: If you got a massive refund last year, you’re giving the government an interest-free loan. Adjust your W-4. If you owed a ton, do the same so you aren't hit with a surprise bill.

- Organize your digital paper trail: Use an app like Expensify or even just a dedicated folder in your email. Searching for "invoice" on April 14 at 11:00 PM is a recipe for a breakdown.

- Set up a separate "Tax Savings" account: If you’re self-employed, take 25% of every check and move it immediately. Don't look at it. Don't touch it. It belongs to Uncle Sam.

- Mark the June and September dates: Everyone remembers April. Almost everyone forgets June and September. Put them in your phone with a loud, annoying alert.

- Verify your state deadlines: Most states follow the federal calendar, but not all. Places like New Hampshire or Delaware can sometimes have their own quirks regarding business or interest taxes.

The worst thing you can do is go silent. If you can't pay, file anyway and set up an installment agreement. The IRS is surprisingly easy to work with when you're proactive, but they're a nightmare if they have to come find you.