The world of high finance is usually pretty dry, but lately, the gossip around 20th and Constitution Avenue feels more like a political thriller than a central bank update. If you’ve been watching the markets, you know everyone is asking the same thing: when is Jay Powell's term up, and is he actually going to make it to the finish line?

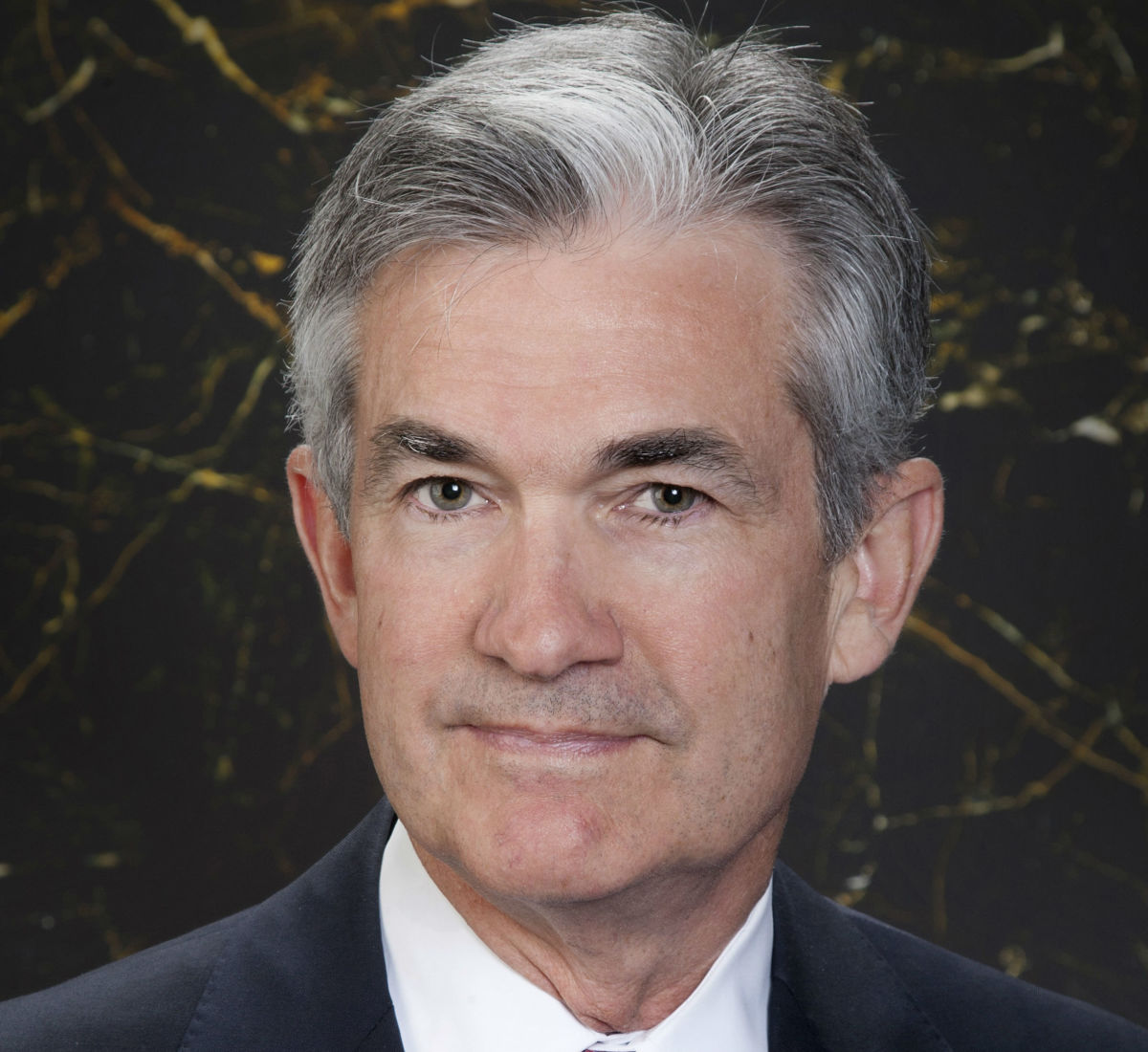

Jerome "Jay" Powell has been the face of the U.S. Federal Reserve through a pandemic, a massive spike in inflation, and a series of aggressive rate hikes that made borrowing money a whole lot more expensive for the rest of us. Now, with 2026 officially here, the clock is ticking loudly.

📖 Related: 1 Dollar to Guatemalan Quetzal: What Most People Get Wrong About the Exchange

The Short Answer: May 15, 2026

If you just want the hard date, there it is. Jay Powell’s term as Chair of the Federal Reserve officially expires on May 15, 2026.

But honestly, it’s not that simple. People often confuse his role as "The Chair" with his role as a member of the Board of Governors. They are two different things. While his leadership of the Fed is ending soon, he technically has the legal right to stay in the building much longer. His term as a Governor doesn’t expire until January 31, 2028.

Most Chairs quit entirely once a new leader is picked. It’s a tradition of courtesy. But given the current friction between the Fed and the White House, there’s been plenty of speculation that Powell might stick around as a regular Governor just to keep an eye on things. That would be an incredibly awkward "office dynamic," to say the least.

Why the White House is Already Shopping

President Trump has made no secret of the fact that he isn't exactly Powell's biggest fan. Even though Trump was the one who originally appointed him back in 2018, the relationship soured over interest rate policies. Now, the administration is moving fast.

We’re seeing names like Kevin Hassett and Kevin Warsh being tossed around constantly. In fact, by early January 2026, the buzz in D.C. suggested a nominee might be announced any day now. The goal for the administration is to have a "Shadow Chair" ready to go the moment May 16 hits.

💡 You might also like: US House Forecast 2024: What Most People Get Wrong

There was even a brief, wild moment where people wondered if Powell would be fired early. A Department of Justice investigation into the Fed’s headquarters renovation costs added fuel to that fire. But as of mid-January, Trump has stated he has "no plan" to fire Powell. He’s basically letting the clock run out.

The Two-Hat Problem

To understand the timing, you have to look at the math of the Federal Reserve Act:

- The Chair Hat: A 4-year term. Powell's second 4-year stint ends this May.

- The Governor Hat: A 14-year term. These are staggered so one expires every two years.

Because Powell was first appointed as a Governor by Obama in 2012 to fill an unexpired term, and then reappointed to a full 14-year term in 2014, he’s got "Governor seniority" that lasts another two years.

What Happens if he Leaves Early?

If Powell decided he’d had enough of the heat and walked away tomorrow, the Vice Chair, Philip Jefferson, would likely take the reins in an acting capacity. But Powell is a "institutionalist." Most experts, like those at the Atlantic Council, believe he views it as his duty to stay until the bitter end to protect the Fed's independence.

The markets hate uncertainty. If Powell leaves and is replaced by someone seen as "too political," we could see a massive reaction in bond yields. Investors pay Powell to be the adult in the room. When that adult leaves, the room gets a lot noisier.

What This Means for Your Wallet

You might think, "Why do I care about a 72-year-old lawyer's contract expiration?"

💡 You might also like: The Price of Gold During the Depression: What Really Happened to Your Great-Grandfather’s Money

Well, because whoever replaces him will decide if your mortgage rate stays at 6% or drops to 4%. They’ll decide if the "inflation monster" is actually dead or if we need more medicine.

Next Steps for the Savvy Observer:

- Watch the "Kevins": Keep an eye on news involving Kevin Hassett (National Economic Council Director) and Kevin Warsh. They are the frontrunners. Warsh is known for being a bit more "hawkish," meaning he might be slower to cut rates than some people hope.

- Monitor the Senate Banking Committee: Any nominee has to go through them. If Senate Republicans like Thom Tillis continue to express concerns about Fed independence, the confirmation process for Powell’s successor could be a total mess.

- Check the May FOMC Meeting: This will be Powell's "swan song." Expect a lot of legacy-talk and perhaps some very specific guidance on where he thinks the economy is headed before he hands over the keys.

The transition is happening, whether the markets are ready or not. Between now and May 15, every word Jay Powell speaks will be dissected for clues about the future. Just remember: the date is fixed, but the drama is just getting started.