You're staring at the "Sent" status on your tax software. It’s a weird mix of relief and immediate greed. You want that money. Most people start checking the "Where’s My Refund?" portal approximately twelve seconds after hitting submit. But let’s be real: when do you get the tax return? It isn't a single, fixed date on a calendar like Christmas or the Super Bowl. It’s a bureaucratic dance. Usually, the IRS says it takes about 21 days for an e-filed return. That sounds fast. In reality, that three-week window is more of a "best-case scenario" than a pinky-promise.

Wait.

Did you paper file? If you actually put a physical stamp on an envelope and dropped your 1040 in a blue mailbox, you're looking at months. Six months. Maybe more. The IRS is still digging out from paper backlogs that feel prehistoric. Modern life runs on fiber optics, but the IRS still runs, in large part, on paper and ancient COBOL programming.

The 21-Day Myth and Why It Breaks

The IRS isn't a monolith. It’s a series of checkpoints. When you ask when do you get the tax return, you have to realize that "21 days" only applies if your return is perfect. No typos. No "Wait, did I claim my kid or did my ex?" drama. If there is a single mismatch between what you report and what the IRS has in their system—like a missing 1099-NEC from that side gig you did in July—the automated system kicks your file to a human. Humans are slow.

The PATH Act is the biggest speed bump for early birds. If you're claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), the law literally forbids the IRS from sending your money before mid-February. It doesn't matter if you filed on opening day in January. Your money sits in a digital purgatory. Why? Fraud prevention. The IRS needs time to verify that you actually have the kids you’re claiming and that you aren't an identity thief using a stolen Social Security number.

Typically, PATH Act filers see their cash land in bank accounts by the first week of March. That’s assuming direct deposit. If you requested a paper check, add another week or two for the USPS to do its thing.

✨ Don't miss: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Factors That Actually Speed Up the Clock

Direct deposit is king. Honestly, if you're still waiting for a paper check in the mail, you're choosing to be frustrated. The IRS reports that 8 out of 10 taxpayers use direct deposit. It’s the only way to get the money within that 21-day window.

- Electronic Filing: This is non-negotiable. E-filing catches basic math errors before the IRS even sees them.

- Accuracy: Double-check your routing number. One wrong digit and your refund bounces back to the IRS, adding weeks of manual processing to the timeline.

- The "Clean" Return: If you have standard W-2 income and the standard deduction, you're the "easy" file. You're the one who gets the 10-day turnaround that everyone else brags about on Reddit.

Some people think calling the IRS helps. It doesn't. Unless it’s been more than 21 days since you e-filed (or six months since you mailed a paper return), the phone reps literally have the same information you see on the website. They can't "push" a button to release your funds. They are just reading a screen.

Why Your Friend Got Theirs First

It feels personal. You filed on Tuesday, your friend filed on Thursday, and they got paid before you. Life isn't fair, and neither is the IRS processing queue. Different regional processing centers have different workloads. Some returns go through "Systemic Verification," which is just a fancy way of saying a computer randomly picked your return to double-check a specific data point.

There’s also the "Refund Offset" issue. If you owe back taxes, child support, or federally funded student loan debt, the Treasury Offset Program might snag your refund. You won't know until the money doesn't show up, or shows up much smaller than expected. You eventually get a letter in the mail, but usually, the missing money is the first clue.

The Dark Side: Identity Theft and Scams

If you check the status and it says your return has already been filed, but you haven't filed yet? Panic. That's identity theft. Someone used your SSN to snag a fraudulent refund. This is the ultimate "when do you get the tax return" nightmare because resolving identity theft takes, on average, 120 to 180 days. You'll be waiting until summer or fall to see that money.

🔗 Read more: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

Scammers also love this time of year. They’ll text you saying there’s a "problem with your refund" and send a link. The IRS never, ever texts you. They don't DM you on Instagram. They send old-fashioned, scary-looking letters in the mail. If you get a text about your refund, delete it. It’s a trap to get your bank info.

What to Do While You Wait

Check the "Where's My Refund?" tool once a day. It only updates once every 24 hours, usually overnight. Checking it 50 times a day won't change the status, it'll just make you twitchy.

If the status moves to "Refund Approved," it’ll give you an actual date. That date is when the IRS sends the money to your bank. Depending on your bank, it might take another 1-5 business days to clear. Some "neo-banks" like Chime or Varo might give you the funds a few days early, but traditional big banks like Chase or Wells Fargo usually stick to the date the IRS provides.

Actionable Steps for a Faster Turnaround

Don't just sit there. Take control of the variables you can actually influence.

1. Go Digital Everywhere. Use tax software to e-file and select direct deposit. If you make under $79,000, use the IRS Free File program. It's literally free software from big names like TaxSlayer or TurboTax, provided through an IRS partnership.

💡 You might also like: How Much Do Chick fil A Operators Make: What Most People Get Wrong

2. Audit Your Own Info. Before you hit send, verify your Social Security number and bank account details. If you moved, make sure the IRS has your new address via Form 8822, just in case they need to mail you a clarification letter.

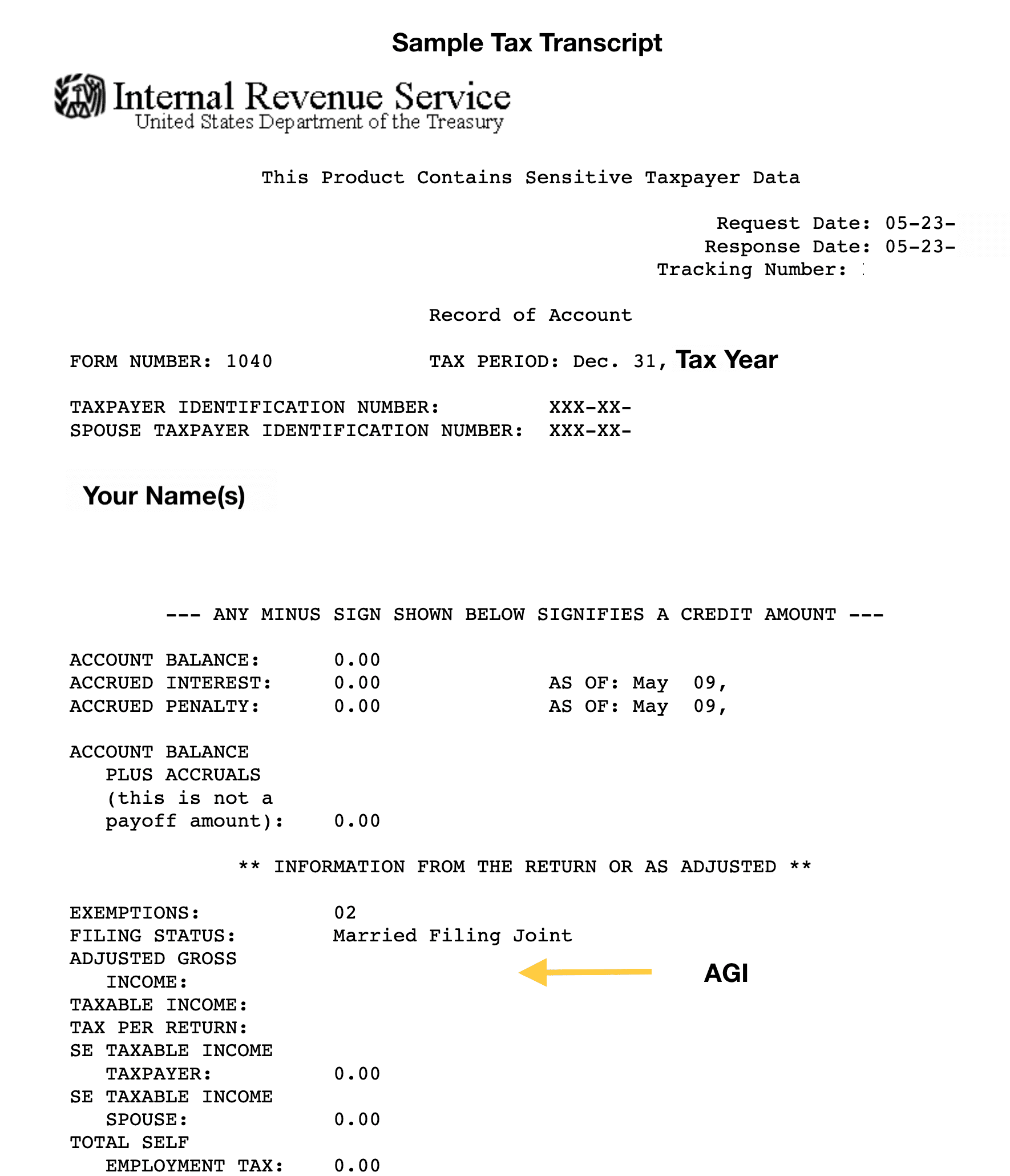

3. Watch the Transcripts. If "Where's My Refund" is being vague, look at your IRS Tax Transcript. You can pull this online at the IRS website. Look for "Code 846." That code represents "Refund Issued." If you see that code, the money is officially on its way, even if the main tracker hasn't updated yet.

4. Adjust for Next Year. If your refund is massive—like $5,000 or more—you're basically giving the government an interest-free loan all year. That’s your money you could have had in your paycheck every month. Consider adjusting your W-4 with your employer so you get more cash in your pocket throughout the year instead of waiting for a lump sum in April.

The reality of when do you get the tax return comes down to your specific tax situation. If you’re a simple W-2 filer with direct deposit, expect 10 to 21 days. If you’re a complex filer with credits, business income, or paper forms, buckle up for a long wait. Keep your records organized, stay away from "refund anticipation loans" (which are just high-interest traps), and keep a close eye on your official IRS portal.