Money feels like a constant, doesn't it? You swipe a card or glance at a banking app and the numbers are just... there. But the system governing those numbers hasn't actually been around that long in the grand scheme of American history. If you're asking what year was the federal reserve created, the short answer is 1913. Specifically, President Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913.

It was a cold Tuesday. Most of Congress had already left Washington for the Christmas holidays.

Before that moment, the United States was basically the Wild West of finance. We didn't have a central bank. We had "panics." That’s what they called them back then—bank runs where people would sprint to the teller window to get their cash before the vault went dry. If one big bank in New York failed, the whole country felt the tremors. It was a mess, honestly.

The Secret Meeting That Started It All

You can’t really talk about the year the Fed was born without mentioning 1910. Three years before the official pen hit the paper, a group of incredibly powerful men gathered at a private club on Jekyll Island, Georgia. They went in secret. They used fake names. They told people they were going on a duck hunting trip.

Senator Nelson Aldrich was there. So were representatives from the Rockefeller and Morgan families. These guys weren't exactly "men of the people," and they knew it. They realized the U.S. economy was too volatile. The Panic of 1907 had nearly destroyed the system, and it was only saved because J.P. Morgan—the man, not just the bank—personally stepped in to shore up the markets.

That’s a terrifying way to run a country. You can't rely on one rich guy to save the world every time the market dips.

The Jekyll Island group drafted a plan for a central banking system. They wanted something that could provide "liquidity." Basically, they wanted a way to print money when things got tight so banks wouldn't collapse. But Americans hated the idea of a "Central Bank." It sounded too European, too elitist, too much like the British system we’d fought a revolution to escape.

1913: The Year the Fight Ended

By the time 1913 rolled around, the political winds had shifted. The Democrats were in power, and they weren't huge fans of the "Aldrich Plan" because it looked like a handout to Wall Street.

🔗 Read more: US Stock Futures Now: Why the Market is Ignoring the Noise

However, they knew they needed something.

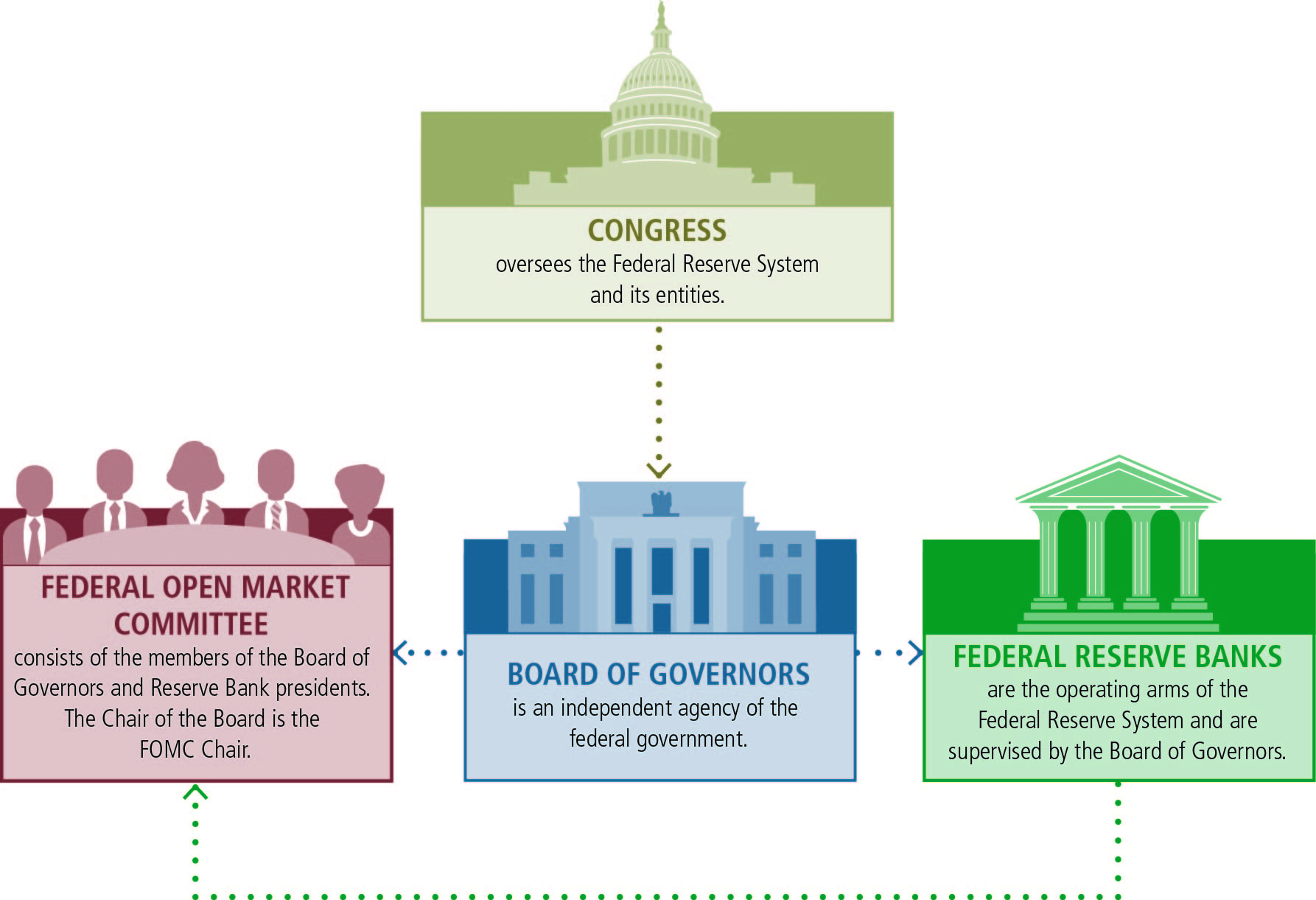

Congressman Carter Glass and Senator Robert Owen took the bones of the Jekyll Island plan and massaged it. They added more public oversight. They created a structure where the power wasn't just in New York, but spread across 12 regional banks. This was the "decentralized central bank" compromise.

Why the Date Matters

When Woodrow Wilson signed the Act in December 1913, he wasn't just creating a building or a committee. He was fundamentally changing what it meant to be an American citizen. Before 1913, if a bank failed, your life savings might just vanish. Poof. After 1913, the "Lender of Last Resort" existed.

It didn't work perfectly right away. Not even close.

The Fed's early years were rocky. They arguably made the Great Depression worse by tightening credit when they should have loosened it. It took decades of trial and error—and a lot of economic pain—to figure out how to actually balance inflation and employment.

The Three Main Jobs of the Fed Today

The Federal Reserve has evolved significantly since that 1913 start date. Today, they have what's called a "dual mandate."

- Maximum Employment: They want as many people working as possible without the economy overheating.

- Stable Prices: This is the fancy way of saying "keep inflation at 2%."

- Moderate Long-Term Interest Rates: They try to keep the gears of the economy greased so people can buy houses and businesses can expand.

When you hear news about "The Fed raising rates," that's the 1913 machinery in action. They are literally making it more expensive to borrow money to slow things down, or cheaper to borrow money to speed things up.

💡 You might also like: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Misconceptions About 1913

A lot of people think the Fed is a government agency. It’s actually a bit weirder than that. It’s an independent entity that is "within the government" but not "of the government." The Board of Governors is appointed by the President and confirmed by the Senate, but the 12 regional banks are set up like private corporations.

This hybrid structure is why conspiracy theorists love talking about 1913.

Some folks argue that the creation of the Fed was the day America lost its sovereignty to "international bankers." While that's a bit dramatic, it is true that the Fed has an incredible amount of power for an unelected body. They control the money supply. If they decide to print more money (quantitative easing), your dollars in your savings account technically lose a bit of value.

How the Federal Reserve Affects You Right Now

You might wonder why a law signed over a century ago matters to your grocery bill today.

Basically, everything is connected to the "Federal Funds Rate." This is the interest rate banks charge each other for overnight loans. Because the Fed was created to be the "bank for banks," they set this floor.

- Your Mortgage: If the Fed raises rates, your 30-year fixed quote goes up.

- Your Savings: Higher Fed rates mean your "High Yield Savings Account" actually starts yielding something.

- Your Job: If the Fed over-tightens to fight inflation, companies stop hiring.

It’s a balancing act that started in 1913 and has never really stopped. We are currently living through one of the most aggressive "tightening" cycles in history as the Fed tries to kill the inflation that spiked after 2020.

Lessons From the 1913 Creation

If we look at the history, the creation of the Federal Reserve was a response to chaos. The U.S. had suffered through the Panic of 1873, the Panic of 1893, and the Panic of 1907. The people were tired of losing their shirts every decade.

📖 Related: Starting Pay for Target: What Most People Get Wrong

Was the 1913 solution perfect? No. But it replaced a system that was essentially "every man for himself."

The nuance here is that the Fed isn't a magic wand. It can't prevent every recession. It can't make everyone rich. What it can do—and what it was designed to do in that winter of 1913—is provide a backstop. It ensures that the plumbing of the financial world keeps moving, even when the house is on fire.

Key Takeaways for Navigating Today's Economy

Understanding the Fed's origin helps you realize that the economy isn't just "natural." It’s managed. Here is how you can use that knowledge:

Watch the FOMC Meetings

The Federal Open Market Committee meets eight times a year. These are the people who decide the fate of interest rates. You don't need to be an economist to read the "summary of economic projections." If they say they are worried about inflation, expect your borrowing costs to stay high.

Don't Fight the Fed

There’s an old saying on Wall Street: "Don't fight the Fed." If the Fed is pumping money into the system (lowering rates), markets usually go up. If they are pulling money out (raising rates), markets usually struggle. Align your investment risk with the Fed's current stance rather than trying to outguess them.

Understand the "Lender of Last Resort"

In 2023, when Silicon Valley Bank collapsed, people panicked. But the Fed stepped in with "emergency lending facilities." Because they have the power given to them in 1913, they can essentially create money to prevent a systemic meltdown. Knowing this can help you stay calm when the headlines start screaming about a banking crisis.

Follow Inflation Data (CPI)

Since the Fed is obsessed with that 2% inflation target, you should be too. If the Consumer Price Index (CPI) comes in high, the Fed will likely keep interest rates high. This affects your ability to refinance a home or get a car loan.

The year 1913 changed the trajectory of the American dollar forever. It moved us away from a gold-backed, rigid system toward a "flexible" currency managed by humans. It's a system built on trust and data, and while it's far from flawless, it’s the engine that powers the global economy today.

Keep an eye on the Fed's dot plot—a chart showing where each official thinks rates will be in the future—as it is the best roadmap we have for where the economy is headed in the next 24 months.