You’re staring at your phone at 8:00 p.m. on a Tuesday, watching a ticker move, and you wonder: is anyone actually "at work" right now? It’s a fair question. Most folks think the New York Stock Exchange (NYSE) and Nasdaq are like a local bank—9 to 5, lights out, doors locked. Honestly, that's not even close. In 2026, the old "opening bell" is more of a ceremonial suggestion than a hard start.

The short answer? The stock market is open for regular trading from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays.

But if you stop there, you’re missing the weird, wild world of pre-market and after-hours trading that basically keeps the global economy humming while you're sleeping. Plus, big changes are currently hitting the tape. Nasdaq recently pushed for 23-hour-a-day trading, and the SEC has been looking at how to make the U.S. markets feel more like the 24/7 crypto world.

The Core Hours: When the Real Money Moves

The 9:30 a.m. to 4:00 p.m. ET window is what we call the "core trading session." This is when the big institutions—the BlackRocks and the Vanguards of the world—do their heavy lifting. It's the period of highest liquidity. Basically, if you want to sell a thousand shares of Apple and not get a terrible price, you do it during these hours.

Why these specific times? Tradition, mostly. It gives traders time to grab coffee and digest the morning news before the "Opening Cross," and lets them finish up before dinner. But keep in mind, these hours are strictly Monday through Friday. On weekends, the physical floors and the primary electronic matchers are largely quiet.

Pre-Market and After-Hours: The Wild West

Here is where it gets interesting. You don't actually have to wait for 9:30 a.m. to trade. Most major brokerages, like Schwab or Fidelity, allow pre-market trading starting as early as 4:00 a.m. ET.

Wait, 4:00 a.m.? Yeah. It sounds crazy, but if a company drops an earnings report at 4:05 a.m., the price starts moving instantly. If you’re waiting until the 9:30 a.m. bell to react, you’re already five hours late to the party.

Then you’ve got the after-hours session, which runs from 4:00 p.m. to 8:00 p.m. ET. This is where the drama happens. A CEO resigns at 4:15 p.m.? The stock might tank 10% before the sun even sets.

- Pre-Market: 4:00 a.m. – 9:30 a.m. ET

- Regular Session: 9:30 a.m. – 4:00 p.m. ET

- After-Hours: 4:00 p.m. – 8:00 p.m. ET

Just a heads up: trading during these "extended hours" is risky. The volume is thin. That means if you try to sell, there might not be many buyers, leading to "slippage"—where you end up getting a much lower price than you expected. You've gotta use limit orders here; otherwise, you're asking for trouble.

2026 Holidays and Early Closures

The market doesn't care about your personal vacation, but it does care about federal holidays. For 2026, there are a few dates you need to circle on your calendar so you don't try to trade while the servers are down.

The NYSE and Nasdaq are closed on these days in 2026:

- New Year’s Day: Thursday, Jan. 1

- Martin Luther King, Jr. Day: Monday, Jan. 19

- Presidents' Day: Monday, Feb. 16

- Good Friday: Friday, April 3

- Memorial Day: Monday, May 25

- Juneteenth: Friday, June 19

- Independence Day (Observed): Friday, July 3

- Labor Day: Monday, Sept. 7

- Thanksgiving Day: Thursday, Nov. 26

- Christmas Day: Friday, Dec. 25

Wait, there’s a catch. The market doesn't always just shut down entirely; sometimes it just leaves work early. In 2026, we have "early close" days where the market shuts down at 1:00 p.m. ET. These usually happen around Thanksgiving and Christmas. For instance, Friday, November 27 (the day after Thanksgiving) and Thursday, December 24 (Christmas Eve) are both 1:00 p.m. finishes. If you're planning a trade at 3:00 p.m. on those days, you're going to be looking at a blank screen.

Does the Stock Market Ever Open 24/7?

We are getting closer. As of 2026, the push for "23/5" trading is the biggest story in market infrastructure. Nasdaq filed paperwork to extend its sessions so that global investors in places like Singapore or London don't have to stay up until midnight just to buy American stocks.

Some platforms, like Robinhood or Interactive Brokers, already offer "Overnight Trading" for a selection of the most popular stocks and ETFs. They basically match buyers and sellers internally or through dark pools. It's not the "official" exchange, but for the average person, it looks and feels the same.

Global Markets: If You’re Trading Overseas

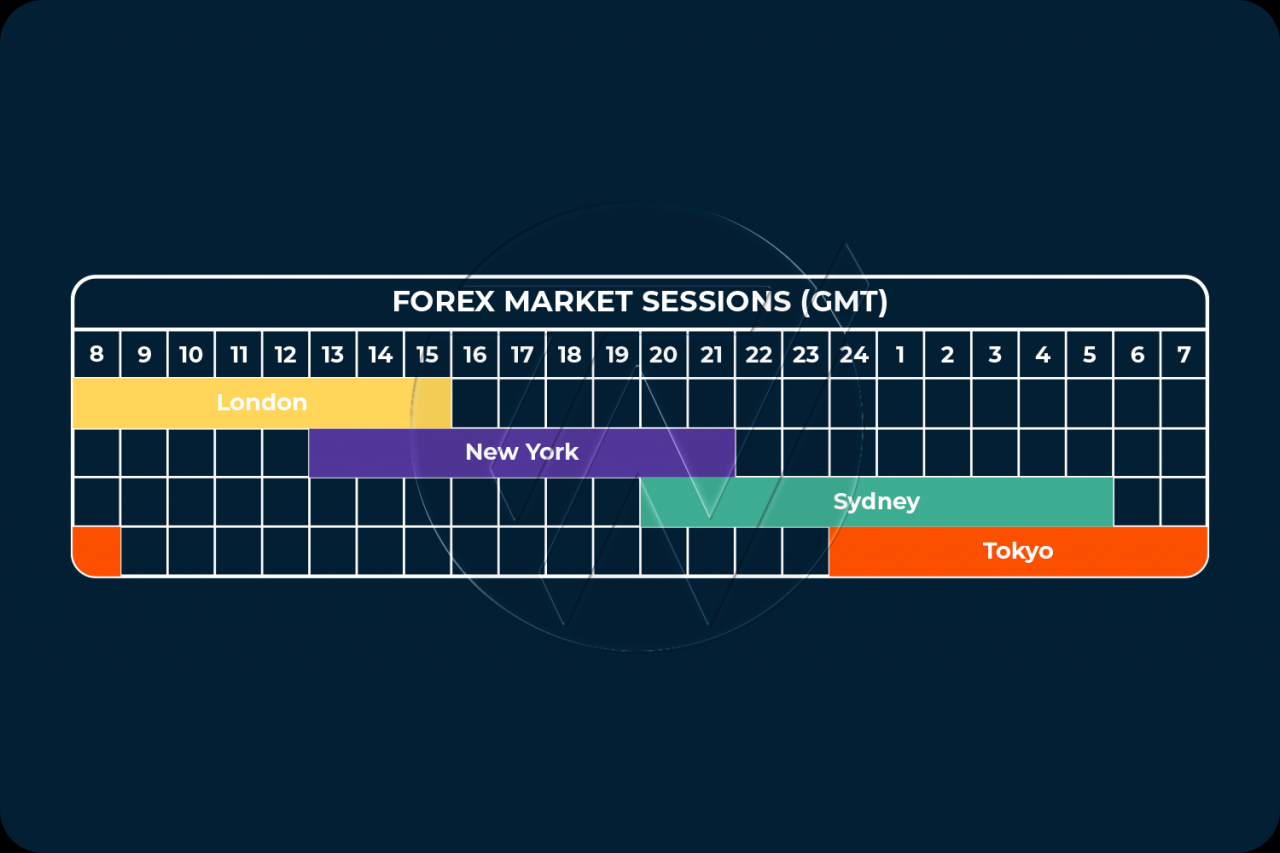

If you’re looking at the FTSE in London or the Nikkei in Tokyo, the clock resets.

The London Stock Exchange (LSE) is open from 8:00 a.m. to 4:30 p.m. local time. Because of the time difference, that’s roughly 3:00 a.m. to 11:30 a.m. ET. Many U.S. traders use the London open as a "preview" for what might happen in New York a few hours later.

In Asia, things are even more different. The Tokyo Stock Exchange (TSE) actually takes a lunch break! They’re open from 9:00 a.m. to 11:30 a.m., then everyone goes to eat, and they come back from 12:30 p.m. to 3:00 p.m. local time. It's a bit more civilized than the non-stop American grind, honestly.

💡 You might also like: Today Stock Market Performance: Why Everyone Is Freaking Out Over Rates (Again)

What Most People Get Wrong

The biggest misconception? That the closing price at 4:00 p.m. is "set in stone."

It’s not. If you look at a stock price on Google or Yahoo Finance at 6:00 p.m., it might be totally different from the 4:00 p.m. close. This is because of the after-hours trading we talked about. This is why "gaps" happen—when a stock closes at $100 on Monday but opens at $110 on Tuesday morning. The "work" happened while the regular market was closed.

Also, don't forget about the "Bond Market." It operates on a slightly different schedule, usually 8:00 a.m. to 5:00 p.m. ET, and it has its own set of holidays (like Columbus Day/Veterans Day) where stocks might be open but bonds are closed. It's confusing, I know.

Actionable Next Steps for You

Now that you know what times are the stock market open, you can actually use this to your advantage. Most retail investors lose money because they panic during the low-liquidity hours.

- Check your broker’s settings. See if you have "Extended Hours" trading enabled. Even if you don't use it, you should see the live prices.

- Use Limit Orders. Never, ever use a "Market Order" during pre-market or after-hours. The price swings are too violent.

- Watch the 9:30 a.m. "Reversal." Often, the trend that happens in the pre-market (4 a.m. to 9 a.m.) completely flips once the regular session opens and the "big money" enters the room.

- Sync your calendar. Add those 2026 early-close dates (Nov 27 and Dec 24) to your phone now so you don't get caught in a liquidity trap.

The stock market in 2026 is a 24-hour beast disguised as a 9-to-5 job. Understanding the clock is just as important as understanding the companies you're buying.