You're standing at the counter or sitting at your desk, pen in hand. It’s a simple piece of paper, right? But one wrong squiggle or a missing digit in the corner can turn a routine payment into a massive headache. Honestly, most of us haven't written a paper check in months, maybe years, so it's easy to forget the anatomy of the thing. If you're wondering what should a check look like before you hand it over, you aren't alone. Banks are getting stricter, and fraud is, frankly, getting way more sophisticated.

Standardization is the only thing keeping the financial world from descending into absolute chaos. Every check follows a specific blueprint laid out by the American National Standards Institute (ANSI). If your check doesn't have these specific landmarks, it’s basically just a colorful scrap of paper that your bank's scanner will spit right back out.

👉 See also: GDP Growth Rate: What Most People Get Wrong About the Numbers

The Visual Anatomy of a Valid Check

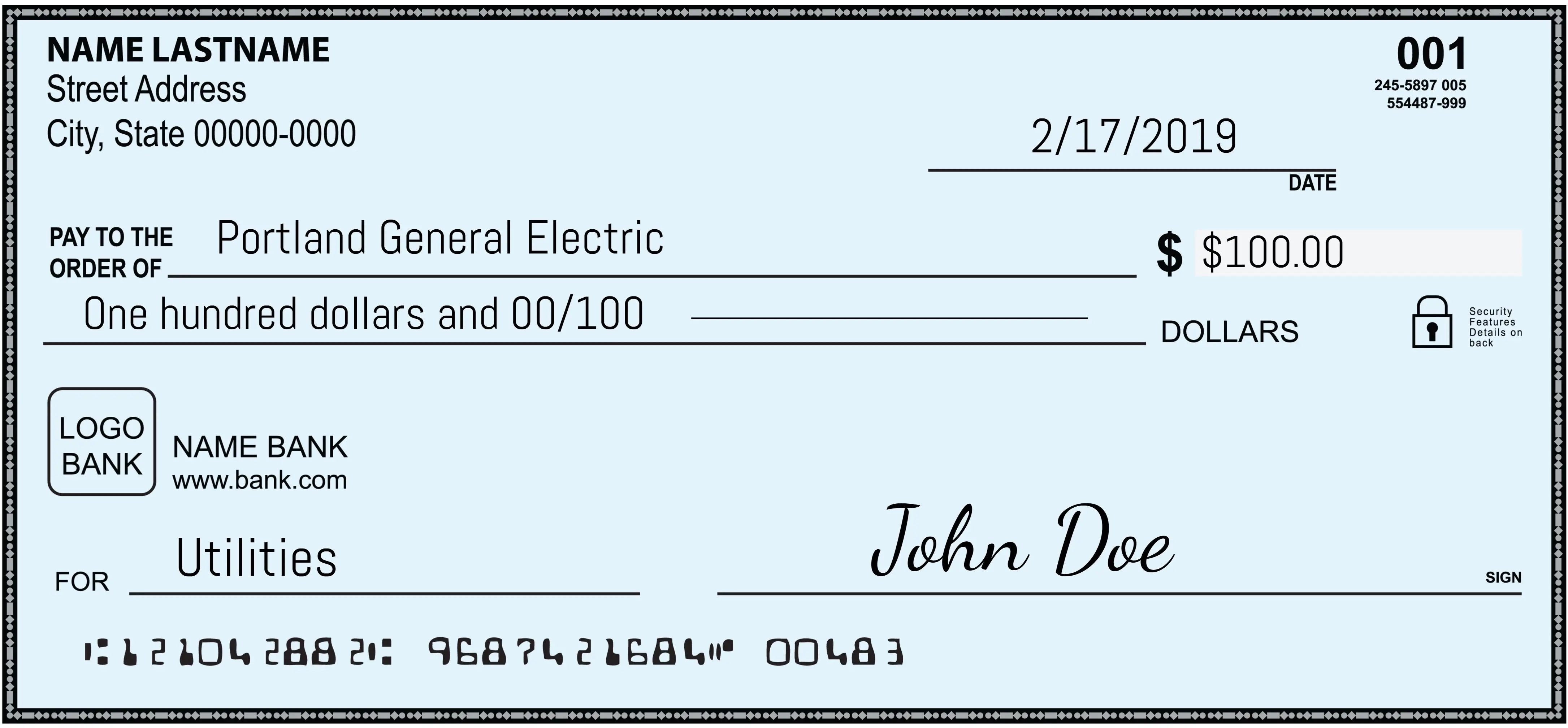

Let’s look at the top left corner first. This is where your personal information lives. It should have your name and your address. Sometimes people include their phone numbers, but security experts usually advise against that nowadays. Why give a stranger more data than they need? Underneath that, you’ll see the date line. This is actually more important than people realize. If you "post-date" a check, writing a future date, you're basically asking the recipient to wait, but here’s a reality check: most banks don't actually have to honor that. They can often cash it the moment they see it.

Then there’s the "Pay to the Order of" line. It's pretty straightforward. You write the name of the person or business getting the money.

The Magic Numbers at the Bottom

Have you ever noticed those weird, blocky numbers at the bottom? That’s the MICR line. It stands for Magnetic Ink Character Recognition. Computers read this using magnetic sensors, which is why you can’t just print a "real" check on a standard home inkjet printer and expect it to work every time.

✨ Don't miss: Converting 10 francs to US dollars: Why it depends on the country and the year

The first nine digits on the left are your routing number. This identifies your specific bank. It’s like a GPS coordinate for your money. The next set of numbers is your account number, and the final short string of digits is the check number, which should match the number in the top right corner. If these aren't there, or if they look blurry or altered, that is a massive red flag.

The Two Versions of the Amount

This is where people usually mess up. There are two places to write the value: the small box on the right and the long line underneath the recipient's name. The box is for the numerical amount (e.g., $150.25). The line is where you write it out in words (One hundred fifty and 25/100).

What happens if they don’t match? Legally, the words carry more weight than the numbers. According to the Uniform Commercial Code (UCC), specifically Section 3-114, if there is a discrepancy, the written words are the "controlling" amount. If you write "$100" in the box but "Two hundred dollars" on the line, the bank is technically supposed to pay out two hundred. In the real world, though? A teller will probably just reject it to avoid the liability.

It’s also smart to draw a line through any empty space after you write the amount. This prevents someone from adding an extra "thousand" or a few extra zeros. It sounds like something out of an old movie, but check washing—where criminals use chemicals to erase ink—is a billion-dollar problem.

Security Features You Probably Never Noticed

A real check shouldn't just look like a printed document. It should feel and react like a secure instrument. High-quality checks usually have a "padlock" icon on the back. This isn't just for show. It usually points to a list of security features present on the paper.

- Microprinting: Look at the signature line or the border of the check through a magnifying glass. On a real check, that line isn't a solid stroke. It’s actually tiny words, like "AUTHORIZEDSIGNATURE," printed so small they look like a line to the naked eye. Photocopiers can't replicate this; they just turn it into a blurry mess.

- Chemically Sensitive Paper: If someone tries to use bleach or acetone to change the name on the check, the paper will often change color or a "VOID" pattern will appear.

- Watermarks: Hold the check up to the light. Many business checks have an embedded image that you can only see from an angle.

Business vs. Personal: Do They Look Different?

Basically, yes and no. A business check is usually larger—often 8.25 inches wide compared to the standard 6 inches for personal checks. They also tend to have "vouchers" or stubs attached. These stubs are for record-keeping, listing what the payment is for, like an invoice number or payroll taxes.

If you're looking at a business check, it should look professional. If it's flimsy or looks like it was cut with scissors, be careful. Businesses also use "Positive Pay" systems where they send a list of issued checks to the bank. If the check in your hand doesn't match the bank's digital list, it won't clear.

👉 See also: Crude Oil: What Most People Get Wrong About the World's Most Important Fluid

What a Check Should Not Look Like

Fraud is the biggest reason to know what a check should look like. Scammers love using fake checks because they take a few days to "bounce." You deposit a check, the bank makes the funds available as a gesture of "good faith," you spend the money, and then three days later, the bank realizes the check was a total fake. Now, you owe the bank that money back.

Watch out for these signs of a fake:

- No Bank Logo: Every legitimate check has the logo or name of the financial institution. If it’s just a generic font, walk away.

- Missing Address: If the bank's address is missing or is just a P.O. Box, that's sketchy.

- Smooth Bottom Edge: Real checks are usually torn from a book, meaning at least one edge should be perforated or rough. If all four edges are perfectly smooth, it might have been printed on a standard sheet of paper.

- Incorrect Routing Number: You can actually Google a bank's routing number. If the check says "Chase" but the routing number belongs to a small credit union in another state, it's a scam.

The Modern Alternative: The E-Check

Sometimes, what a check looks like isn't paper at all. An "e-check" or ACH transfer uses the same information—routing and account numbers—but moves it digitally. When you pay a utility bill online using your checking account, you're essentially creating a digital version of that paper slip. It’s faster, safer, and leaves a much better digital trail.

Actionable Steps for Handling Checks

To keep your money safe, don't just glance at a check. Really look at it. If you’re writing one, use a gel pen (like a Uni-ball Signo 207). Gel ink contains pigments that trap themselves in the fibers of the paper, making it nearly impossible to "wash" off compared to standard ballpoint ink.

Always verify the MICR line. If you're receiving a check for a large amount from someone you don't know well, call the issuing bank. Don't use the phone number printed on the check—look the bank up independently. Ask them to verify if the account is active and if the check number exists.

Lastly, keep your checkbook locked up. It sounds old-school, but a stolen checkbook is a skeleton key to your entire savings. If you stop using checks, don't just throw the old ones in the trash. Shred them. Every single one.

Next Steps for You:

Check your current checkbook for the padlock icon on the back to see which security features your bank uses. If you haven't updated your checks in over five years, consider ordering a new set with updated microprinting and chemical-reactive paper to better protect against modern fraud techniques.