You’re standing in line at the grocery store. Your cart is full. The person behind you is sighing loudly because you’re taking too long. You swipe your card, and it’s declined. You try again. Declined. You open the app to see what's up, but the screen just spins and spins. This isn't just a bad dream; for thousands of people during a Capital One banking outage, this is a stressful, public reality. When a major player like Capital One goes dark, it doesn't just mean you can't check your balance. It means the digital plumbing of your life has burst.

The truth is, we’ve become dangerously reliant on these digital interfaces. We assume the "cloud" is this invincible thing, but really, it’s just someone else’s computer that can, and will, break. Most of the time, these outages aren't some massive cyberattack by a shadowy group. They’re usually much more boring. A botched software update. A misconfigured server. A physical fiber optic cable getting cut by a construction crew in Virginia.

Why the Capital One Banking Outage Kept You From Your Cash

When the Capital One banking outage hits, the first thing everyone does is flock to DownDetector. You see those little red spikes on the graph. It starts in the Northeast, then spreads. Usually, the problem is centralized in the API—the "Application Programming Interface"—which is basically the bridge that lets your phone talk to Capital One’s vault. If that bridge collapses, it doesn't matter if you have ten million dollars in the bank. You can't reach it.

During recent disruptions, users reported that while their physical cards might work at a gas station, the mobile app was a total ghost town. This creates a weird "partial outage" scenario. Some people can pay for dinner, while others can't even see if their paycheck hit. It’s inconsistent. It’s frustrating. It makes you want to keep a wad of twenties under your mattress.

Capital One actually has a pretty sophisticated tech stack. They were one of the first major banks to go "all-in" on the cloud, specifically AWS (Amazon Web Services). While this makes them faster at rolling out new features, it also means if there’s a regional hiccup with Amazon’s servers, Capital One feels the heat immediately. It’s the trade-off for modernization. You get a slick app, but you also get the vulnerabilities of a hyper-connected system.

The Real Impact on Your Credit Score

Many people worry that if they can't log in to pay a bill during a Capital One banking outage, their credit score will take a nosedive. Honestly? Probably not. Banks usually have a grace period for these things. If the lights go out on their end, they aren't going to penalize you for not being able to flip the switch. However, you have to be proactive. If you’re late because of their glitch, you better believe you need to call them the second the systems are back up.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

Realistically, the bigger risk is the "domino effect." If your auto-pay for your mortgage was supposed to trigger from your Capital One 360 account and the system was down, your mortgage lender doesn't care whose fault it was. They just see a missed payment. This is why having a backup bank—even if it just has a few hundred bucks in it—is basically a necessity in 2026.

Sorting Out the Myths: Was it a Hack?

Every time the app goes down, Twitter (or X, whatever we're calling it today) explodes with rumors of a Russian hack or a North Korean data heist. Stop. Take a breath. While Capital One did have a massive, well-documented data breach back in 2019—affecting over 100 million people—most day-to-day outages are purely technical debt.

Tech debt is basically the "clutter" in a company's code. Banks are old. Even the "digital-forward" ones are often running new software on top of ancient systems from the 80s. Sometimes, those two layers just stop talking to each other. When you see a Capital One banking outage, it's usually a developer somewhere sweating over a line of code that worked yesterday but decided to quit today.

What to do when the app says "Connection Error"

- Don't keep spamming the login. You might actually get your account locked for "suspicious activity" if you try to force it.

- Check the debit card separately. Often, the payment processing network (Visa/Mastercard) is still working even if the Capital One app is down.

- Use the phone. I know, nobody likes calling customer service. But the automated touch-tone system often uses a different "pipe" than the mobile app. You might be able to check your balance there.

- Take screenshots. If you’re trying to move money to avoid an overdraft fee and the system fails, document it. That’s your evidence for getting fees waived later.

The Infrastructure Problem Nobody Talks About

We talk about "The Bank" like it's one big building with a vault. It's not. It's a sprawling web of vendors. There’s a vendor for the app UI, a vendor for the credit scoring, a vendor for the Zelle integration, and a vendor for the actual core banking ledger.

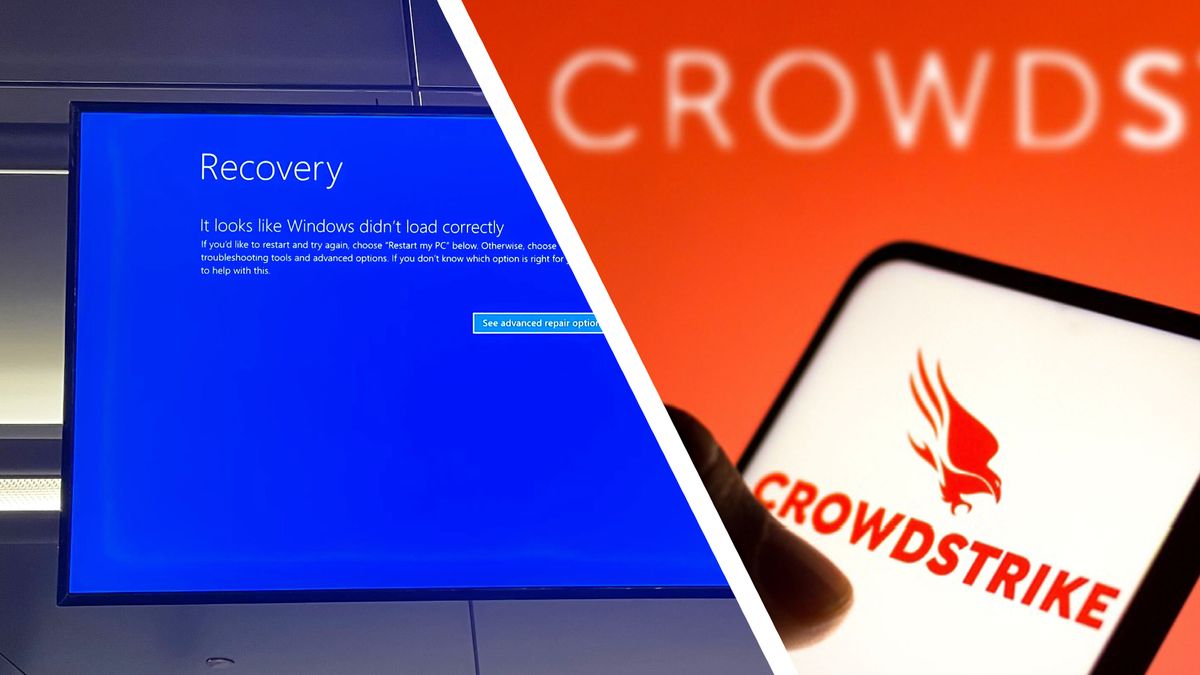

If any one of those vendors has a bad day, you experience a Capital One banking outage. It’s a systemic vulnerability. The industry calls this "third-party risk." In 2024 and 2025, we saw several instances where a single point of failure—like a CrowdStrike update or an AWS regional outage—took down dozens of banks at once. Capital One, despite its massive size, is part of that ecosystem. They aren't an island.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Is your money actually safe?

Yes. Your money is FDIC insured. An outage doesn't mean your money evaporated into the ether. It just means the "viewing window" to your money is temporarily painted black. Even if Capital One's entire digital presence stayed dark for a week, your balance is recorded in multiple redundant backups across the country.

The real danger isn't losing the money; it’s the "opportunity cost." It’s missing that investment window or being unable to pay a deposit on a new apartment. That’s where the damage happens. And unfortunately, banks are very rarely liable for your "inconvenience" or "lost opportunities" caused by an outage. Read the fine print in your account agreement. They basically promise to try their best, but they don't promise 100% uptime.

Practical Steps to Outage-Proof Your Life

Waiting for a Capital One banking outage to happen before you prepare is a losing game. You've gotta be "financially redundant." It sounds fancy, but it's just common sense.

Keep at least one credit card from a completely different bank. If you have a Capital One Venture card, maybe get a Chase Freedom or an Amex. They use different processing networks. If one goes down, the other is likely fine. It's the simplest way to ensure you're never stuck at a gas station pump at 2 AM with no way to pay.

Also, keep a "disaster fund" in a local credit union. Why a credit union? Because they often operate on different software than the big "megabanks." Plus, if the digital world goes to hell, you can actually walk into a physical building and talk to a human named Brenda who knows where the ledger is.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

Finally, set up "Low Balance" alerts that go to your email, not just app push notifications. Emails are often archived and can be accessed even if the app won't load. It gives you a "last known state" of your finances.

When things go south, stay calm. The engineers are likely working in a "war room" with way too much caffeine trying to fix the mess. Your money is still there. You just have to wait for the bridge to be rebuilt.

The next time you see "System Maintenance" or "Temporary Outage," don't just roll your eyes. Take it as a signal to move a little "emergency cash" into your wallet or your backup account. Digital banking is a miracle until it isn't.

Actionable Checklist for the Next Outage

- Download your statements monthly. If the system goes down for an extended period, you’ll want a record of your balance that isn't dependent on their servers.

- Diversify your digital wallets. Keep your Capital One card in Apple Pay, but also keep a backup card from a different issuer there.

- Follow official "Status" pages. Instead of trusting rumors on social media, look for the official Capital One Help handles. They are usually the first to acknowledge if the problem is widespread or just "you."

- Establish a "Cash Stash." It sounds old-school, but $100 in small bills in your glove box solves 90% of the problems caused by a banking outage.

Everything eventually breaks. The goal isn't to find a bank that never goes down—because that bank doesn't exist. The goal is to be the person who isn't sweating when it happens because you saw it coming.