Money is a weird thing. One day, everyone feels like a genius because their house value is climbing and their 401(k) looks like a phone number. Then, seemingly overnight, the vibes shift. People stop spending. Businesses start sweating. We call it a "recession," but that word is basically just a polite way of saying the economic engine started coughing up black smoke.

If you look at the timeline of recessions in US history, you'll notice they aren't just dry data points on a Federal Reserve chart. They are chaotic, messy, and usually caused by people getting a little too excited about things that weren't actually real. Whether it was railroad land in the 1800s or "no-doc" mortgages in 2007, the pattern is usually the same: we trip over our own feet.

👉 See also: The IKEA Store Design Overhaul Explained: Why the Maze is Starting to Disappear

The Great Depression Wasn’t Just One Bad Day

People always talk about the 1929 stock market crash like it was the whole story. It wasn't. Honestly, the crash was just the opening act. The real pain of the Great Depression—the worst of all recessions in US history—came from a series of massive policy blunders and a literal dust storm that ate the middle of the country.

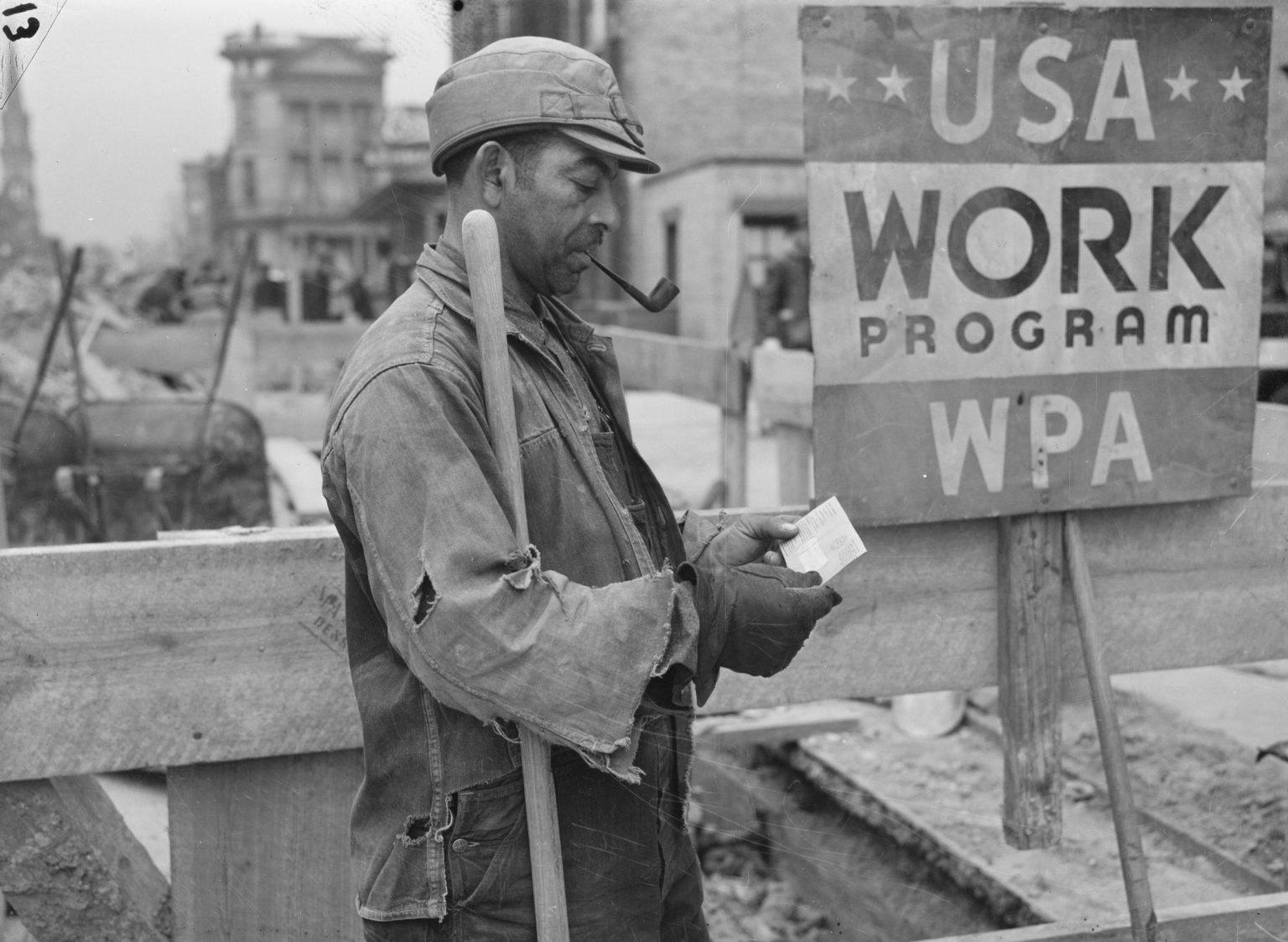

Between 1929 and 1933, the US economy shrank by about 30%. Imagine a third of everything just vanishing. Unemployment hit 25%. You’ve probably seen the photos of men in suits standing in bread lines, looking shell-shocked. That happened because the banking system basically collapsed. Back then, if your bank went bust, your money was just... gone. There was no FDIC to save you.

Milton Friedman, the famous economist, later argued that the Federal Reserve actually made things way worse by tightening the money supply when they should have been loosening it. They watched the house burn down while holding a fire extinguisher they refused to use. It took a massive government spending spree (The New Deal) and, eventually, the industrial demands of World War II to finally kick the engine back into gear.

The 1970s and the "Stagflation" Nightmare

Most recessions follow a simple rule: when the economy slows down, prices stop rising so fast. But the 1970s decided to break the rules. We got hit with "Stagflation"—a gross mix of stagnant growth and sky-high inflation.

It was a total mess.

Oil prices tripled because of the OPEC embargo. Suddenly, filling up your car was a geopolitical event. People were waiting in lines for blocks just to get gas. President Jimmy Carter even went on TV in a cardigan telling everyone to turn down their thermostats. It felt like the country was losing its grip.

🔗 Read more: Afram Jewelers Washington DC: What Most People Get Wrong

The hero (or villain, depending on who you ask) of this era was Paul Volcker. He was the Fed Chair who decided to kill inflation by cranking interest rates up to nearly 20%. It worked, but it triggered a brutal recession in the early 80s. People were literally mailing their car keys to the Fed because they couldn't afford their loans. It was harsh, but it's the reason we had decades of stable prices afterward.

That Time the Internet "Broke"

Remember the late 90s? Everyone thought they were going to get rich off a website that sold pet food or delivered groceries in 30 minutes. The Dot-Com bubble was a classic example of "irrational exuberance."

By March 2000, the Nasdaq peaked and then started a long, painful slide. This recession was relatively mild compared to others, but it wiped out trillions in paper wealth. Companies that had billion-dollar valuations despite never making a single cent in profit suddenly found out that, yeah, cash flow actually matters. It’s a lesson we seem to have to relearn every twenty years.

The 2008 Great Recession: A House of Cards

If the Great Depression was a banking panic, 2008 was a mathematical panic. Wall Street wizards had figured out how to bundle "subprime" mortgages—loans given to people who probably couldn't pay them back—into complex financial products that they labeled as "safe."

It was a lie. Or at least, a very big delusion.

When housing prices stopped going up, the whole thing unraveled. Lehman Brothers collapsed. AIG needed a massive bailout. The "Great Recession" lasted 18 months, making it the longest downturn since WWII. It changed how a whole generation looks at homeownership. Suddenly, a house wasn't a "guaranteed" investment anymore; it was a liability.

We saw the unemployment rate double to 10%. The recovery was agonizingly slow. Even after the "recession" officially ended in June 2009, it felt like a slump for years. This is a nuance people often miss: the NBER (National Bureau of Economic Research) might say a recession is over, but if you’re still looking for a job, it sure doesn’t feel over.

💡 You might also like: International Air Group Share Price: Why Everyone Is Watching IAG Right Now

The COVID Flash-Crash

2020 was the weirdest recession in the book. It wasn't caused by a bubble or bad Fed policy. We just... turned the lights off.

The economy fell off a cliff in March 2020. GDP dropped at an annualized rate of 31% in the second quarter. That is a terrifying number. But because the government pumped trillions of dollars into the system and the Fed dropped rates to zero, the recession was also the shortest in history, lasting only two months. It was a "V-shaped" recovery that left us with the massive inflation hangover we’ve been dealing with lately.

Why Do We Keep Doing This?

You'd think we would have figured it out by now. But recessions are actually a natural, if painful, part of the business cycle.

- Over-extension: People and businesses borrow too much money when times are good.

- The Correction: Something triggers a realization that the debt can't be paid.

- The Flush: The "bad" debt gets wiped out, prices drop, and the system resets.

It's like a forest fire. It looks devastating while it's happening, but it clears out the deadwood so new stuff can grow. That's cold comfort when you're the one losing your job, but that’s the underlying mechanics of how the US system has operated for over 200 years.

How to Actually Prepare for the Next One

Looking back at recessions in US history teaches us that the "unexpected" is actually pretty predictable. It’s going to happen again. We just don't know exactly when or what will trigger it. Maybe it’s AI-driven job displacement, or a massive sovereign debt crisis, or something nobody is even talking about yet.

Stop trying to time the market. You won't. Even the experts at the IMF and the Fed miss the start of recessions more often than they catch them.

Instead, focus on "recession-proofing" your own life. This basically means having a "boring" financial setup. Keep three to six months of expenses in a high-yield savings account—not in stocks, not in crypto, just cash. If you can, keep your fixed costs (rent, car payments, debt) below 50% of your take-home pay. When the next recession hits, the people who survive aren't the ones who made the most money during the boom; they’re the ones who didn't over-leverage themselves.

Real wealth is often made during recessions because that's when everything goes on sale. But you can only buy the dip if you aren't drowning in the deep end yourself. History shows the US economy always bounces back, but the individuals who thrive are the ones who stayed liquid while everyone else was chasing the hype.

Keep your resume updated, even when you love your job. Diversify your skills. In the 1930s, people who knew how to repair things did better than those who only knew how to sell them. The same logic applies today. Being a "generalist" with a solid emergency fund is the best hedge against the inevitable cycle of boom and bust.