You’ve probably seen the headlines about former NFL stars going broke. It’s a tragic, recurring trope in sports: the $50 million contract that vanishes into a cloud of bad investments, custom jewelry, and a fleet of Ferraris. But there’s a flip side to that coin. Some guys in the league treat their paychecks like they’re living on a teacher’s salary, and honestly, the numbers they’ve tucked away are staggering.

If we’re talking about what NFL player saved the most money, we aren't just looking at the guys with the biggest bank accounts. We're looking at the athletes who managed to keep nearly 100% of their actual NFL salary.

The undisputed kings of the "Don't Touch the Principal" club are Marshawn Lynch and Rob Gronkowski. These two didn't just save a chunk of their change; they reportedly didn't spend a single cent of their on-field earnings for years.

The Legend of Marshawn Lynch’s $50 Million Vault

Marshawn Lynch is famous for "Beast Mode," but his financial game is even more aggressive. Throughout his 12-season career with the Bills, Seahawks, and Raiders, Lynch hauled in about $56.7 million in contract money.

Most people would at least buy a house with that, right?

💡 You might also like: Navy Notre Dame Football: Why This Rivalry Still Hits Different

Lynch didn't.

According to reports that surfaced toward the end of his career—and confirmed by NFL Network’s Ian Rapoport—Lynch lived entirely off his endorsement money. Between his deals with Nike, Microsoft, and the iconic Skittles partnership, he was making enough to cover his lifestyle and then some. He treated his NFL salary like it didn't exist. He basically put $50 million into a "do not touch" bucket.

It wasn't just about hoarding cash, though. Lynch has been a quiet master of the "wealth multiplier" effect. He invested in everything from the Seattle Kraken (NHL) to Oakland Roots SC. He even launched his own "Beast Mode" apparel line, which turned into a massive revenue stream. By the time 2026 rolled around, Lynch’s financial blueprint became the gold standard for rookies who don't want to end up as a cautionary tale.

Gronk: The Frugal Party Animal

Then you have Rob Gronkowski. On TV, he’s the guy jumping off boats and spikes footballs. In his bank account, he's a librarian.

📖 Related: LeBron James Without Beard: Why the King Rarely Goes Clean Shaven Anymore

Gronkowski famously revealed in his book It’s Good to Be Gronk that he hadn't touched his NFL salary. Just like Lynch, he survived on endorsement checks from brands like Tide, Dunkin', and Monster Energy. He even admitted recently on a podcast that the only "big" thing he bought early on was a car using a $50,000 bonus from his agent.

Think about that for a second. The man won four Super Bowls and made over $70 million in career earnings. Yet, he was living like a guy on a modest endorsement budget.

Why do this? Gronk was always worried about how long the NFL would last. He was a second-round pick with back issues. He knew the average career is only about three years. By saving every dime of his $72.5 million career salary, he guaranteed that even if his career ended in week two, he’d be set for life.

The Most Impressive Savings Rates in the League

While Lynch and Gronk are the big names, other players have pulled off even more extreme feats of frugality.

👉 See also: When is Georgia's next game: The 2026 Bulldog schedule and what to expect

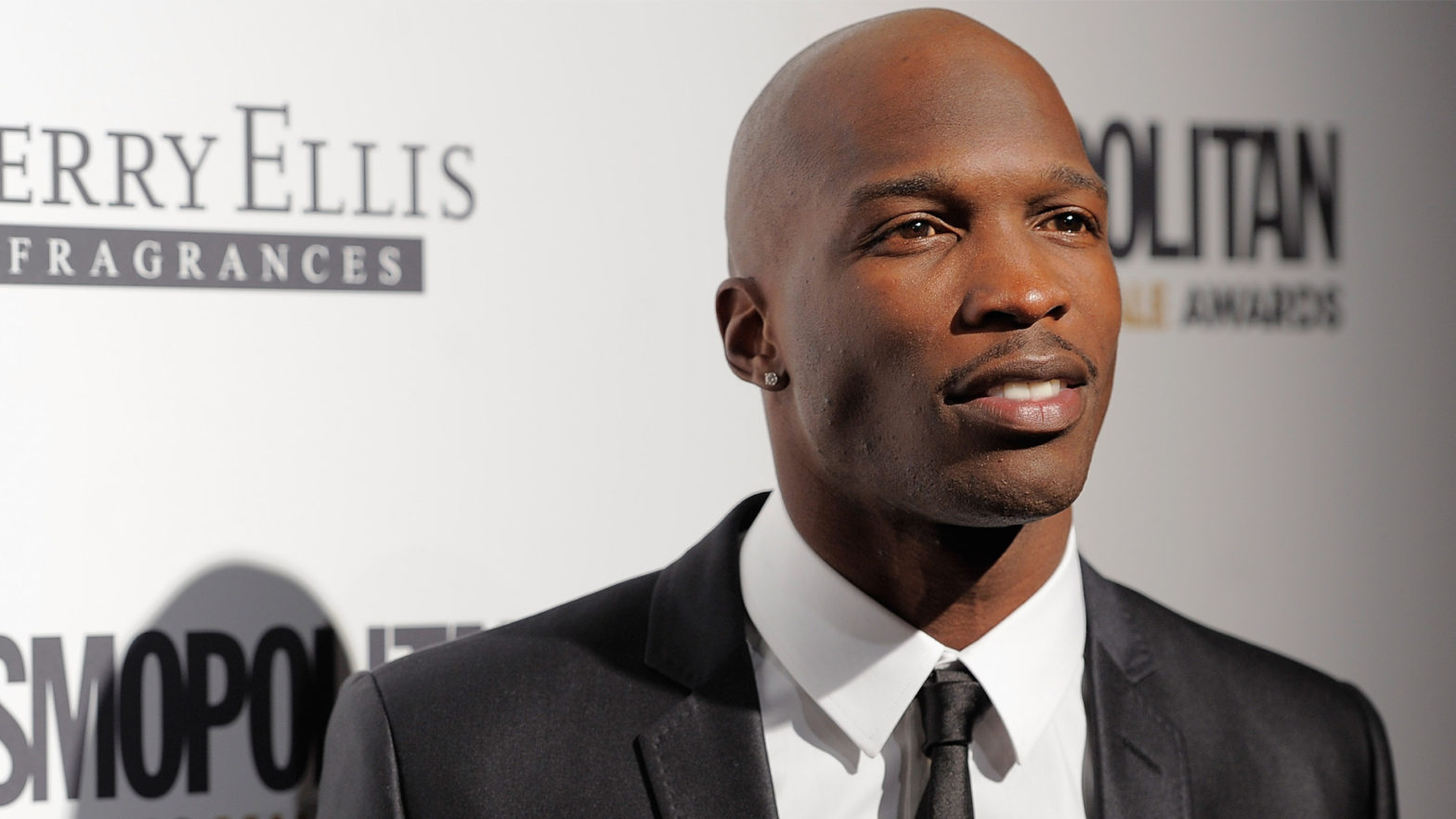

- Chad "Ochocinco" Johnson: He claims he saved 83% of his career earnings. How? By faking the lifestyle. He famously wore fake jewelry from Claire’s and lived in the Bengals’ stadium for two years to avoid paying rent. He made roughly $48 million and kept the vast majority of it by realizing that "image" is a money pit.

- Brandon Copeland: This guy is a literal genius. While playing linebacker, he taught a financial literacy course at Penn (Wharton). Copeland reportedly saved nearly 90% of his income. He didn't just save it; he invested it in real estate and stocks, treating his NFL career as a "venture capital" fund for his future.

- Glover Quin: The former Lions safety lived on a strict "30/70" plan. He and his family lived on only 30% of his salary, while the other 70% went straight into blue-chip stocks.

Why Most Players Fail (And These Guys Succeeded)

The "broke athlete" phenomenon usually happens because of "lifestyle creep." You get a $2 million signing bonus, buy a $1.5 million house, and suddenly the property taxes and maintenance eat your remaining cash.

Carl Nassib once went viral on Hard Knocks for explaining the "Rule of 72" to his teammates. He told them that if they just left their money alone, it would double every seven years. It sounds simple, but in a locker room full of 22-year-olds with newfound millions, it's a revolutionary concept.

The players who saved the most money shared three specific traits:

- Multiple Revenue Streams: They used "side hustles" (endorsements) to pay for their daily bread.

- Delayed Gratification: They drove old cars (Kirk Cousins famously drove a 16-year-old van) while their peers bought fleets.

- Low Overhead: They didn't buy the "starter" mansion that requires a staff of five to maintain.

Actionable Insights for Your Own Finances

You don't need a $10 million signing bonus to use the same logic these guys did.

- Live on the "Base," Save the "Bonus": If you get a raise or a tax refund, don't upgrade your life. Put that extra cash into an investment account.

- Ignore the "Image": Chad Johnson’s fake jewelry is the ultimate lesson. Nobody actually cares what you're wearing; they care what you can afford to do.

- The 70/30 Rule: If you can find a way to live on 70% of your income and save 30%, you're already doing better than most of the NFL.

Saving money in a high-pressure environment is hard. Whether you're in a corporate office or on a football field, the temptation to "look rich" is everywhere. But as Marshawn Lynch and Rob Gronkowski proved, the real "Beast Mode" is having $50 million in the bank that nobody can touch.

If you want to start building a similar safety net, your next step should be to audit your "lifestyle creep" from the last two years. Identify one major recurring expense—like a car payment or a high-end subscription—that you can cut to redirect toward a high-yield savings account or an index fund.