If you’re trying to keep track of what is the tariff on china now, I honestly don't blame you for being confused. The last twelve months have been a total whirlwind of "emergency" taxes, court battles, and sudden "truces" that seem to change every time you check the news.

Basically, we aren't just looking at the old trade war anymore. We are in a completely different era of trade policy.

Right now, as of January 2026, the average U.S. tariff on Chinese imports is sitting around 47.5%, covering pretty much everything that comes across the border. To put that in perspective, back in 2018, that average was only about 3%. It's a massive shift that affects everything from the phone in your pocket to the industrial steel used in Midwest factories.

What’s Actually Happening with Section 301 and the New "Reciprocal" Taxes

The backbone of the current situation is the famous Section 301 tariffs. These were the ones started years ago, but they’ve been beefed up significantly. You’ve probably heard about the "100% tariff" on Chinese electric vehicles. That’s real. It hit in late 2024 and essentially slammed the door on brands like BYD entering the U.S. market at low prices.

But the real story of 2026 is the Reciprocal Tariff and the IEEPA (International Emergency Economic Powers Act) actions.

Early in 2025, the administration pushed for a massive 125% tariff on almost everything from China. It was wild. However, after some high-stakes meetings in Geneva and South Korea, that "nuclear option" was walked back. Instead, we settled into a sort of "managed trade war."

📖 Related: Private Credit News Today: Why the Golden Age is Getting a Reality Check

The "Fentanyl" and "Reciprocal" Truce

Under the deal struck in November 2025—often called the "Trump-Xi Truce"—the U.S. agreed to keep a 10% "reciprocal" tariff in place instead of the higher 125% rate. This is scheduled to stay this way until November 10, 2026.

Here’s the catch: that 10% is on top of the existing Section 301 duties. So, if a product already had a 25% tariff, you’re now looking at 35% minimum.

Breaking Down the Specifics for 2026

Not every product is treated the same. Some sectors are getting hit much harder because the government sees them as "strategic" or linked to national security.

- Electric Vehicles (EVs): These are still at a staggering 100%. The goal here is simple: keep Chinese EVs out to give Ford, GM, and Tesla room to breathe.

- Semiconductors: As of January 2026, many of these are at 50%. Interestingly, there was a brand new 25% "pass-through" tariff just added on high-end AI chips (like those from Nvidia or AMD) that are imported but destined for overseas customers.

- Medical Supplies: This is a big one for 2026. Tariffs on medical gloves just jumped to 100% on January 1. Face masks and syringes are also facing rates between 50% and 100%.

- Critical Minerals: Natural graphite and permanent magnets—things you need for batteries—hit a 25% tariff rate this month.

Why This Matters for Your Wallet

You might think, "I don't buy industrial steel, so why do I care?"

The Tax Policy Center estimated that these 2026 tariff levels will cost the average American household roughly $2,100 this year. It’s basically a consumption tax. When a company like Apple or a tool manufacturer like Milwaukee has to pay 35% more to get parts from China, they don't just eat that cost. They pass it to you.

👉 See also: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

Honestly, it's also why you might see "Made in Vietnam" or "Made in Mexico" on more of your stuff lately. Companies are scrambling to move their factories to avoid these exact numbers.

The China Perspective: Do They Tax Us Back?

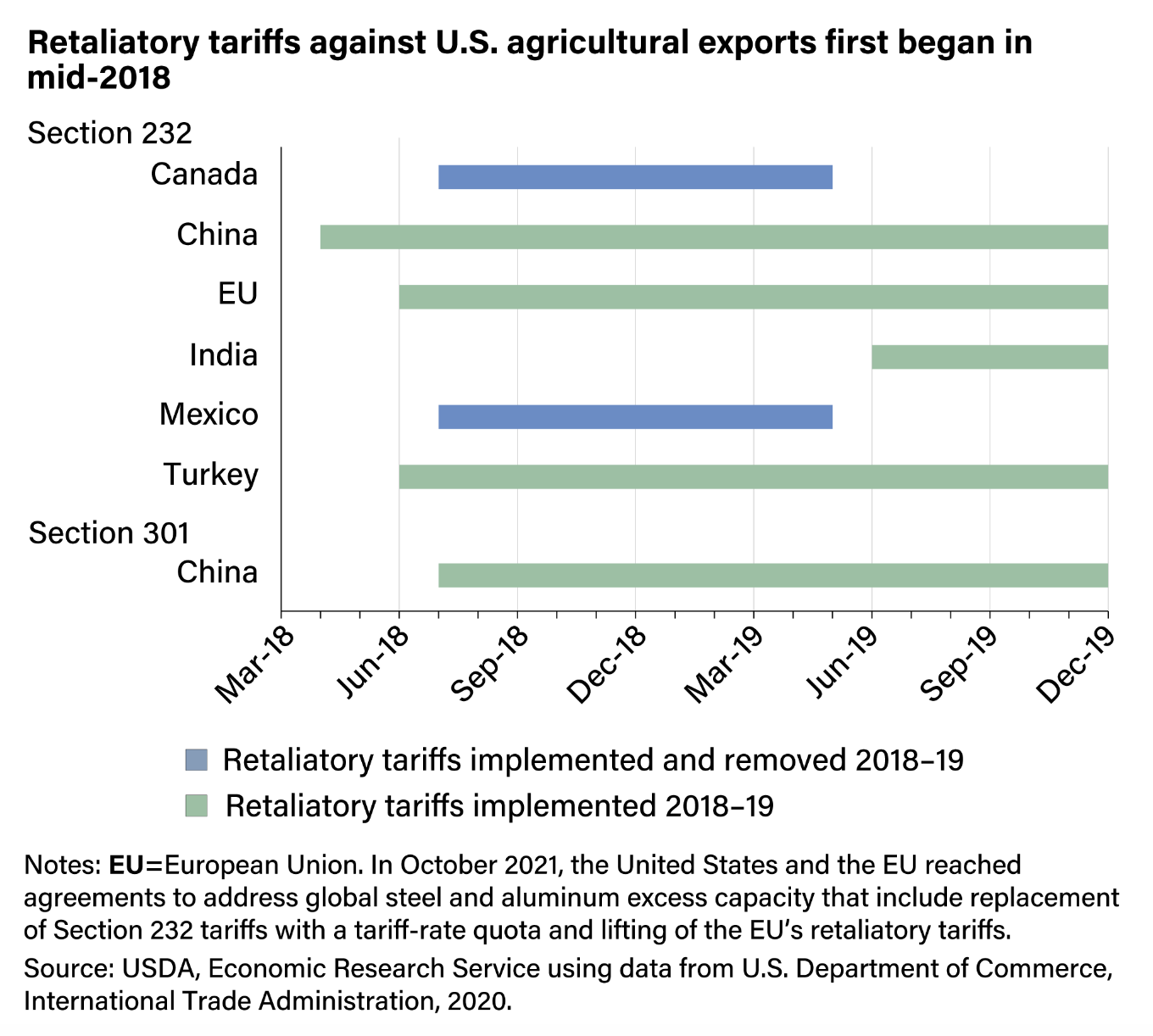

Yes. China isn't just sitting there. Their average tariff on U.S. goods is about 31.9%.

They’ve targeted U.S. farmers specifically. However, as part of the November 2025 deal, China agreed to buy 25 million metric tons of U.S. soybeans annually through 2028. In exchange, they suspended some of their retaliatory taxes on things like pork and corn. It’s a very fragile peace. If the U.S. decides to hike rates again, expect China to stop buying those soybeans immediately.

What Most People Get Wrong About Tariffs

A common misconception is that "China pays the tariff." That’s not how it works.

The U.S. Customs and Border Protection (CBP) collects the money from the U.S. company importing the goods. If a shop in Ohio brings in $10,000 worth of Chinese-made bike frames, they have to write a check to the U.S. Treasury for the duty (let’s say $3,500) before they can even get the frames out of the port.

✨ Don't miss: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

China loses because their products become more expensive and less competitive, but the actual cash comes out of American business accounts first.

Key Dates to Watch in 2026

If you are running a business or planning a large purchase, keep these dates on your radar:

- January 1, 2026: New 100% rates on medical gloves and 25% on certain minerals went live.

- May 31, 2026: Several "machinery exclusions" are set to expire, which could make factory equipment more expensive.

- November 10, 2026: This is the big one. This is when the current "tariff truce" expires. If a new deal isn't reached by then, the rates could theoretically jump back up to those 125% levels we saw discussed in 2025.

Actionable Steps for Navigating 2026

If you’re feeling the squeeze of what is the tariff on china now, you have to be proactive. Waiting for the trade war to "end" isn't a strategy anymore; this is just the new normal.

- Check Your HTS Codes: If you import, ensure your Harmonized Tariff Schedule codes are 100% accurate. Misclassifying goods to "save" on tariffs is a fast track to a massive fine from the CBP.

- Look for "De Minimis" Changes: The government has been cracking down on the $800 duty-free loophole (often used by sites like Temu or Shein). Expect more shipments to be flagged for duties that used to slide through.

- Diversify Suppliers: Look toward "Friend-shoring." Countries like India, Vietnam, and Mexico often have much lower tariff rates (or zero, in Mexico's case, thanks to the USMCA) compared to China’s 47.5% average.

- Apply for Exclusions: There is still a process to ask for a "waiver" if you can prove you literally cannot buy your specific product anywhere else but China. It's a long shot, but for some specialized manufacturing parts, it’s the only way to survive.

The bottom line? Trade with China is getting more expensive, not less. Whether you're a consumer or a CEO, you've got to bake these 30% to 50% "extra" costs into your budget for the foreseeable future.