If you woke up today expecting a quiet morning in the precious metals market, you're probably staring at your screen in disbelief. Honestly, it’s been a wild ride over the last 24 hours. People keep asking, what is the spot price of silver and gold today, but the answer depends entirely on which minute you check the ticker.

Markets are moving faster than a landslide.

As of mid-day Thursday, January 15, 2026, gold is hovering around $4,592.80 per ounce. It’s down a bit—roughly 0.5%—from the absolute madness we saw yesterday when it hit a lifetime high of $4,650. Meanwhile, silver is doing what silver does best: being total chaos. After nearly touching $94 yesterday, spot silver has pulled back to about **$89.62 per ounce**, a drop of nearly 3% in a single trading session.

Basically, we are seeing a massive "tug-of-war" between record-breaking momentum and some very aggressive profit-taking.

Understanding the chaos: What is the spot price of silver and gold today?

To understand why your bullion is worth a small fortune (or why your buy-in price just got a tiny bit cheaper), you have to look at the headlines. The biggest shock to the system came from the White House. President Trump’s recent decision to skip tariffs on "critical minerals" sent a shockwave through the pits.

Silver and platinum, which many expected to be squeezed by new import taxes, suddenly lost that specific "tariff premium."

✨ Don't miss: Syrian Dinar to Dollar: Why Everyone Gets the Name (and the Rate) Wrong

You've also got the Federal Reserve in a tight spot. Inflation is sticking around like a bad cold, but the labor market is actually looking pretty decent—jobless claims just dropped below 200,000. That’s a weird combo for gold. Usually, gold loves bad news. When the economy looks "too good," traders worry the Fed won't cut interest rates as fast as they hoped.

Current Spot Prices (Live Estimates for Jan 15, 2026)

- Gold Spot Price: $4,592.80 (Down $22.50)

- Silver Spot Price: $89.62 (Down $2.67)

- Platinum Spot Price: $2,344.00 (Down $66.00)

- Palladium Spot Price: $1,738.00 (Down $69.00)

It’s important to remember that these "spot" prices are the wholesale rate for raw metal. If you’re trying to buy a physical 1 oz Silver Eagle or a Gold Buffalo, you’re going to pay a "premium" on top of that. For instance, some dealers are charging nearly $91.42 for a single silver coin today because the physical demand is so high that the paper price on the COMEX can't keep up.

Why silver is the "Meme Investment" of 2026

The surge in silver hasn't just been about jewelry or coins. It’s industrial. Samsung’s new silver-carbon EV battery is reportedly using over two pounds of silver per vehicle to get that 600-mile range. That’s a game-changer.

Investors are piling in because they’re scared of a supply drought. China, which handles about 65% of the world's refined silver, just slapped major restrictions on exports. Only 44 government-approved companies can now ship silver out of the country.

It’s a squeeze. Pure and simple.

🔗 Read more: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

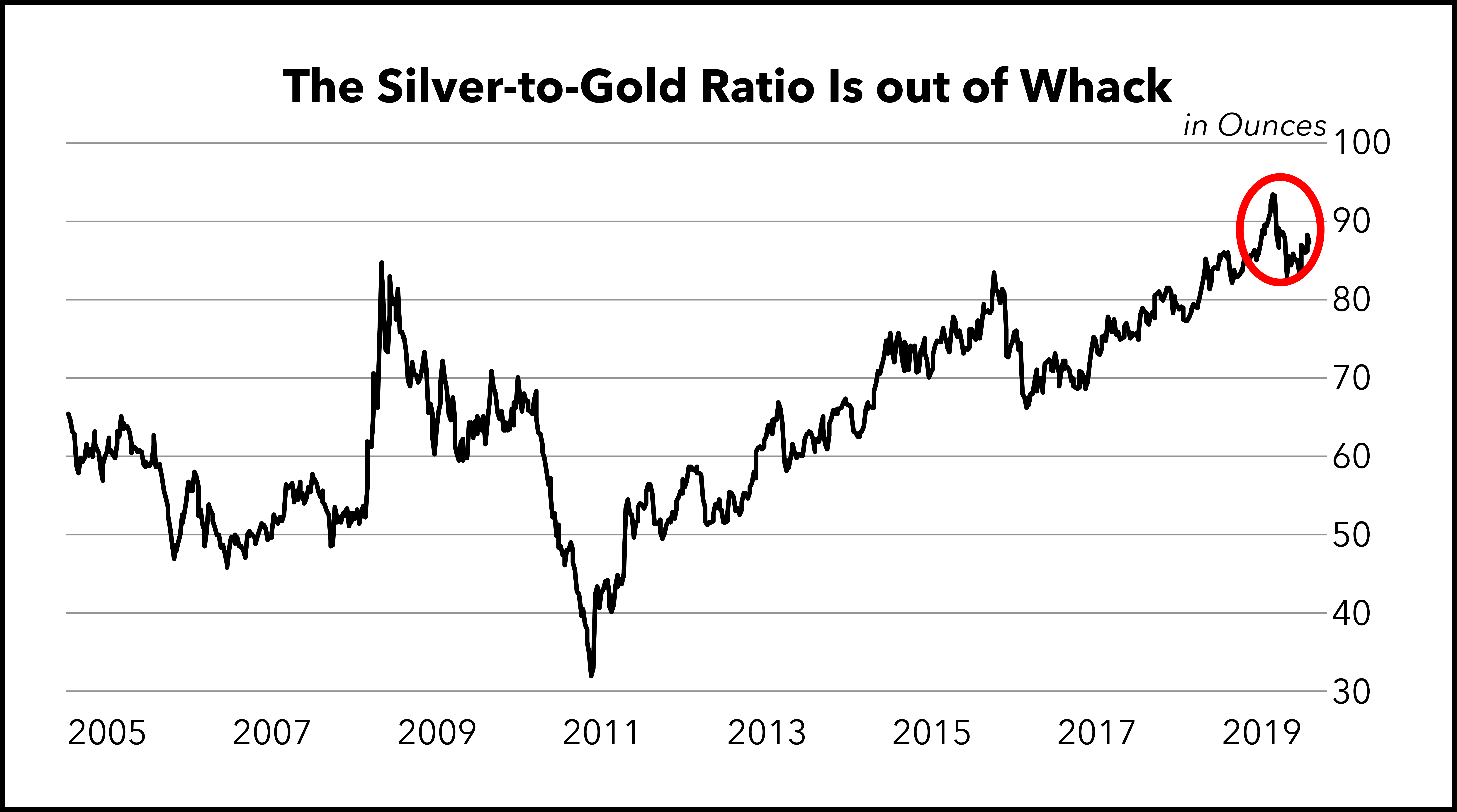

Retail investors are treating silver like the new Bitcoin. We've seen it zoom past $80 and $90 in a matter of months. Some analysts, like Alex Ebkarian from Allegiance Gold, think $100 silver is almost inevitable before the quarter ends. But others, like the folks at BMO Capital, are waving red flags. They think the gold-to-silver ratio—which is currently sitting around 50—is way too low. Historically, that ratio tends to be much higher, meaning silver might be "overextended."

The Gold-to-Silver Ratio: What most people get wrong

Normally, gold is way more expensive than silver. Like, 80 times more expensive. When that ratio drops to 50, it means silver is performing incredibly well relative to gold.

Is it a bubble? Maybe.

But gold isn't exactly sitting still. J.P. Morgan is already forecasting $5,000 gold by the end of the year. Central banks from Brazil to Kazakhstan are dumping US Dollars and buying gold bars as fast as they can melt them. When the "big money" moves like that, the spot price doesn't just go up—it "re-bases" to a new reality.

Practical steps for precious metals investors today

If you're looking at these prices and wondering whether to jump in or run for the hills, here is how the pros are playing it right now.

💡 You might also like: How Much Do Chick fil A Operators Make: What Most People Get Wrong

Watch the $4,603 level for Gold

Technical analysts are obsessed with this number. If gold can close the week above $4,603, the "bulls" are in total control and we likely head toward $4,800. If it fails, we might see a correction back down to $4,300.

Don't ignore the "Premium"

If you are buying physical metal, check the "spread." With silver prices swinging 5% in a day, some dealers are widening their spreads to protect themselves. Don't overpay for "fancy" coins when generic rounds or bars are $5 cheaper per ounce.

Check the "Critical Mineral" list

The US government just proposed a $2.5 billion critical minerals reserve. Silver is on that list. If the government starts "stockpiling" like they do with oil, the "spot price" you see today might look like a bargain in six months.

Monitor the Fed's next move

Keep an eye on the Philadelphia Fed survey and manufacturing indexes. If the US economy shows it can handle higher rates, gold might take a breather. But if the "debasement trade" continues—where people lose faith in the dollar—the ceiling for these metals doesn't really exist.

Actionable insights for your portfolio

Don't panic-buy on the highs. We just saw silver drop from $93 to $89 in hours. That is a massive swing. If you're a long-term holder, these "dips" are usually seen as buying opportunities, but if you're a day trader, you're playing with fire.

The smartest move right now is to dollar-cost average. Instead of throwing your whole savings account at gold at $4,600, buy a little bit every two weeks. This protects you from the "volatility explosion" we are currently witnessing in the London and New York markets.

Keep an eye on the $92 resistance for silver. If it breaks through that again and stays there, $100 is the next logical stop.