So, you’re thinking about the money situation in the Big Apple. Maybe you’re planning a move, or maybe you just saw a $28 sandwich in Midtown and wondered how anyone actually survives here. Honestly, trying to pin down the average income in New York City is like trying to catch a G train on a Sunday—it’s complicated, and the answer depends entirely on where you’re standing.

If we look at the raw numbers from 2024 and 2025, the median household income in New York City is roughly $81,228.

That sounds decent until you realize it’s barely enough to rent a shoebox in some neighborhoods. But here’s the kicker: "Average" is a dangerous word in a city that houses both billionaires on Billionaires' Row and families in the Bronx struggling to make ends meet. The wealth gap isn't just a talking point; it's the defining feature of the city's economy in 2026.

Breaking down the average income in New York City by borough

NYC isn't a monolith. It’s five different worlds. When people ask about the average income in New York City, they usually think of Manhattan, but Manhattan is the outlier.

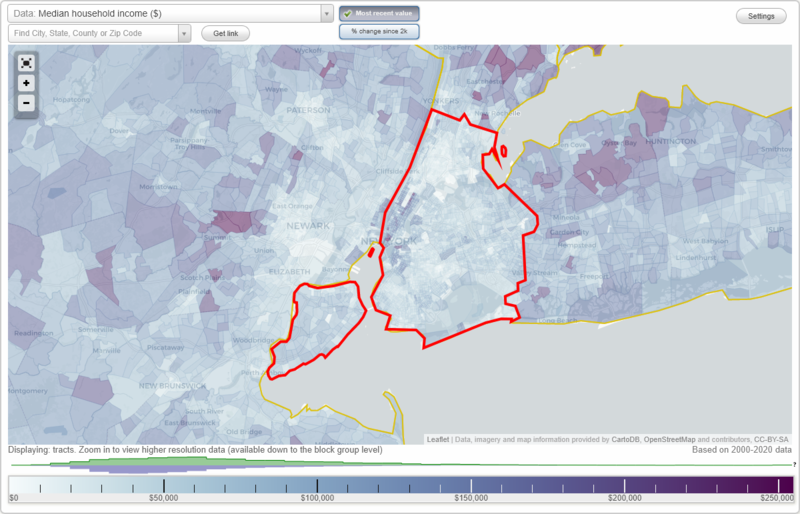

In Manhattan, the median household income pushes toward $100,000, with some zip codes like 10007 (Tribeca) boasting medians over $250,000. It's the highest nominal income county in the country. But then you look at the Bronx. The median there is closer to **$47,000**. That's a massive gulf.

Brooklyn and Queens sit in that middle-ish ground. Brooklyn’s median is around $75,000, though if you’re in Williamsburg, that number feels much higher than if you’re in Brownsville. Queens follows closely at about $82,000, bolstered by a massive, diverse middle class. Staten Island actually holds its own with a median near $96,000, mostly because it has a high concentration of multi-income households and civil servants.

Why the "Average" doesn't tell the whole story

Numbers lie. Or at least, they hide the truth.

👉 See also: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

The "average" is skewed by the top 3% of earners. Recent data from the Center for New York City Affairs shows that while the average New Yorker’s wages grew a bit, the top 3%—folks making over $312,000—saw their pay jump by 9% in a single year.

Meanwhile, if you’re a middle-income earner, your wage growth probably lagged behind the cost of a gallon of milk. In 2026, the "average" person is actually feeling a bit of a squeeze.

The "Good Salary" vs. The Average

What’s a "good" salary? Ask a local. Most will tell you that for a single person to live comfortably—meaning you aren't eating ramen every night and you can actually afford a drink at a rooftop bar—you need to be making between $70,000 and $100,000.

If you have kids? Double it. Triple it. The 2025 Area Median Income (AMI) for a family of three is set at $145,800. If you're below that, you might actually qualify for "affordable" housing, which tells you everything you need to know about the cost of living here.

Living on the average income in New York City: The reality check

Let’s talk about the 2026 cost of living. It’s roughly 27% to 131% higher than the national average, depending on which index you trust and how much you like to shop at Whole Foods.

Housing is the monster under the bed. The average rent for a one-bedroom in Manhattan has hovered around $4,000 to $5,000 recently. Even in "cheaper" boroughs, you’re looking at $2,500 for something that doesn't have a bathtub in the kitchen.

✨ Don't miss: Is The Housing Market About To Crash? What Most People Get Wrong

- Food: Costs rose nearly 60% over the last decade.

- Utilities: Expect to pay about $200-$300 a month just to keep the lights on and the AC humming in July.

- Transportation: A subway swipe is a fixed cost, but if you're ride-sharing, those $40 trips from LaGuardia add up fast.

Basically, if you make the "average" income of $81,228, you’re bringing home roughly **$5,000 a month** after taxes. If half of that goes to rent, you’re left with $2,500 for everything else. In NYC, $2,500 disappears faster than a tourist’s dignity in Times Square.

High-paying industries vs. the rest

Where is the money coming from? It’s no surprise that finance and tech lead the pack.

Software engineers in the city are averaging between $100,000 and $150,000. If you're a VP in finance, you’re looking at $175,000 as a baseline. On the flip side, the city relies on a massive workforce of service and retail workers who often make the minimum wage (currently $16/hour in NYC).

This disparity creates two different New Yorks. One where people spend $200 on "omakase" dinners and another where people are working two jobs just to cover the ConEd bill.

Actionable steps for navigating NYC's economy

If you're looking at these numbers and sweating, don't panic. You just need a strategy. The average income in New York City is a benchmark, not a destiny.

1. Calculate your "True NYC" budget

Don't use a generic calculator. Use the 40x rule: landlords usually require your annual salary to be 40 times the monthly rent. If you want a $3,000 apartment, you need to make $120,000. If you don't make that, look for roommates. It’s the NYC rite of passage.

🔗 Read more: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

2. Look at the "Outer-Outer" boroughs

Manhattan is a playground; the other boroughs are where people actually live. Look into neighborhoods in Eastern Queens or Southern Brooklyn. The commute is longer, but your "average" income will actually buy you a bedroom with a window.

3. Negotiate for the "NYC Premium"

If a company is hiring you in New York, they know the cost of living. Never accept a "national average" salary for a job based in NYC. You should be asking for at least a 20-30% premium just to offset the local taxes and rent.

4. Leverage city programs

If your income is near or below the median, check the NYC Housing Connect portal. The "lottery" for affordable housing is competitive, but it’s the only way many middle-class New Yorkers stay in the city.

The average income in New York City tells a story of a city that is becoming more expensive and more divided. Whether you're above or below that $81k mark, surviving here is about being "New York smart"—knowing where the deals are and never paying full price for a Broadway ticket.

To get a real sense of your standing, look up the specific AMI for your family size on the official NYC Housing Preservation and Development (HPD) website. This will give you a clear picture of where you sit in the city's complex financial hierarchy and whether you qualify for rent-stabilized opportunities. Be sure to track your expenses for a month using a local-specific app to see exactly how much the "NYC tax" is eating into your take-home pay.