Saving for retirement feels like a moving target. Just when you think you’ve got your budget dialed in, the IRS goes and changes the rules. Honestly, it’s a lot to keep track of. If you're trying to figure out what is the 401k max for 2024, the short answer is $23,000 for most people.

But "most people" isn't everyone.

There's a massive difference between what you can put in and what the "total" limit is when you count your boss's contributions. Plus, if you’re over a certain age, the math changes completely. Let's break down the real numbers and the weird edge cases that might actually save you a fortune in taxes.

The Basic Number: What is the 401k Max for 2024?

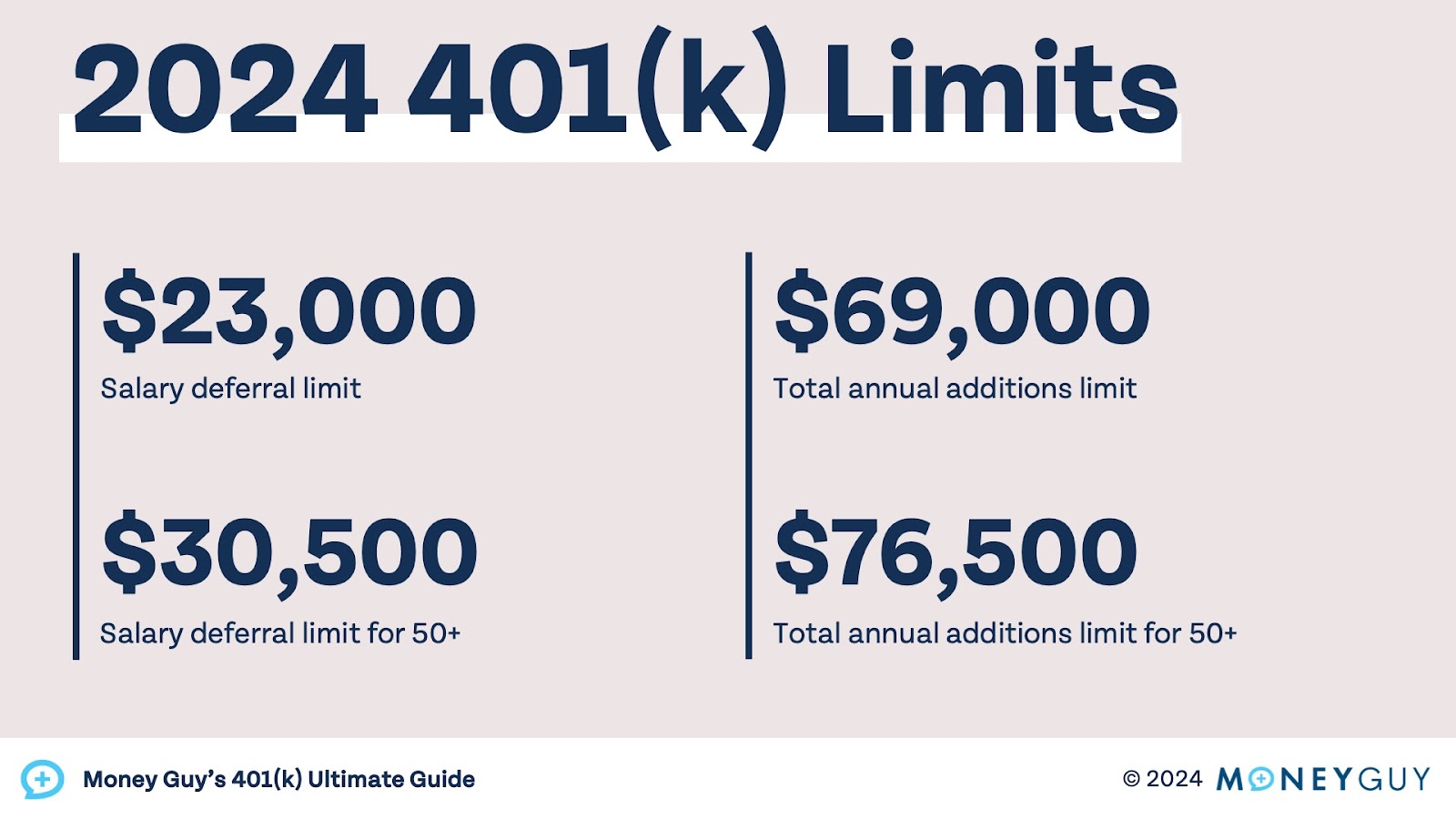

For the 2024 tax year, the IRS bumped the individual contribution limit to $23,000. That’s a $500 increase from 2023. It might not sound like a life-changing jump, but every extra dollar you stuff into a tax-advantaged account is a dollar the government can't touch right now.

This $23,000 limit applies to elective deferrals. Basically, that’s the money you choose to take out of your paycheck before it even hits your bank account. It applies to traditional 401k plans and Roth 401k plans. You can split your money between the two, but the total still can't cross that $23,000 line.

The Age 50 "Bonus"

If you were born in 1974 or earlier, you get a break. The IRS knows some people started saving late, so they allow "catch-up" contributions. For 2024, the catch-up limit stays at $7,500.

💡 You might also like: Current USD to THB Exchange Rate: What Most People Get Wrong

So, if you’re 50 or older, your personal 401k max for 2024 is actually $30,500.

One thing people often miss is that you don't actually have to be 50 the day you make the contribution. As long as you turn 50 at any point during the calendar year, you’re eligible for the full $30,500. It’s a nice little birthday present from the Treasury Department.

The "All-In" Limit: Don't Forget the Match

Here is where it gets interesting—and where most people stop reading. The $23,000 limit is just your portion. Your employer can also put money in, usually through a match or a profit-sharing contribution.

There is a separate "Section 415" limit for the total amount of money that can enter your 401k from all sources.

For 2024, the total 401k limit is $69,000.

🔗 Read more: SIRI Share Price Today: Why This Massive Dividend Yield Might Be a Trap

If you are 50 or older, that total cap jumps to $76,500.

Imagine you’re a high-earner at a company with a very generous profit-sharing plan. You put in your $23,000. Your employer could technically put in another $46,000 on your behalf, provided you have the salary to support it. Most people never hit this ceiling, but if you’re self-employed or have a Solo 401k, this is the number you really care about.

Why the 401k Max for 2024 Matters for High Earners

If you make a lot of money, the IRS watches you a bit more closely. They have this category called "Highly Compensated Employees" or HCEs. For 2024, you’re an HCE if you made more than $155,000 in 2023.

Why does this matter? Nondiscrimination testing.

Basically, the government doesn't want 401k plans to only benefit the bosses. If the lower-level employees at your company aren't saving much, the IRS might actually limit how much you can put in, even if it’s below the $23,000 max. It’s annoying. You might get a check back at the end of the year for "excess contributions," which then becomes taxable income.

SECURE 2.0 and the Roth Catch-Up Confusion

There was a huge panic recently about a new rule saying catch-up contributions for high earners must be Roth (after-tax). The IRS eventually realized that payroll systems across America weren't ready for this. They pushed the requirement back.

For 2024, you can still make your catch-up contributions to a traditional (pre-tax) 401k, regardless of how much you earn. You've got until 2026 before that Roth requirement actually kicks in.

Strategic Moves for 2024

Knowing the numbers is only half the battle. You’ve gotta know how to use them.

- The Mega Backdoor Roth: Some plans allow "after-tax" contributions (different from Roth). If your plan allows this, you can blow past the $23,000 limit and try to hit that $69,000 total limit. You then convert that extra money into a Roth IRA. It’s a complex move, but for someone with extra cash, it’s the ultimate tax hack.

- Front-loading: If you have the cash flow, some people try to hit their max early in the year. Be careful, though. If you hit the $23,000 limit in September, you might miss out on your employer's "match" for October, November, and December—unless your company has a "true-up" provision.

- The Solo 401k: If you have a side hustle, you can open a Solo 401k. You act as both the employee and the employer. This is how freelancers can sometimes stash away nearly $70k a year while only "earning" a mid-six-figure income.

Actionable Next Steps

Don't just nod and forget this.

First, log into your benefits portal right now. Look at your current contribution percentage. If you’re trying to hit the 401k max for 2024, divide $23,000 (or $30,500) by the number of pay periods you have left. Adjust your percentage accordingly.

👉 See also: Average Social Security Check at Age 70: Why Waiting Often Beats the Math

Second, check if your employer offers a Roth 401k option. Many people default to traditional pre-tax contributions because that's "how it's always been done," but if you think tax rates will be higher when you retire, paying the tax now at the $23,000 limit might be a smarter play.

Finally, if you're over 50, make sure your "catch-up" contribution is actually turned on. Sometimes it’s a separate checkbox in the system. Don't leave that $7,500 of tax-advantaged space on the table. It's yours; use it.