You just landed a job with a $75,000 salary. You do the quick math in your head—that's $6,250 a month. You start eyeing that nicer apartment or finally upgrading your car. Then the first Friday of the month rolls around, you log into your bank app, and you see something like $4,400.

Wait. Where did the other two grand go?

It’s the universal "adulting" jump-scare. That gap between your gross salary and what actually hits your checking account is what we call net income. Understanding what is my take home pay isn't just about being cynical about taxes; it’s about surviving in an economy where every cent is spoken for before you even wake up. Honestly, most people just look at the bottom line of their paystub and sigh, but if you don't know the "why" behind those deductions, you're basically flying blind with your budget.

The Tax Man Always Gets His Cut First

Let's talk about the big elephant in the room: Federal Income Tax. This isn't a flat fee. The United States uses a progressive tax system. Think of it like a set of buckets. Your first chunk of money is taxed at 10%, the next chunk at 12%, then 22%, and so on. As of 2026, those brackets shift slightly every year to keep up with inflation, but the logic remains the same.

Because of this, your "effective" tax rate—the actual percentage of your total income that goes to the IRS—is usually lower than your "marginal" tax rate (the highest bracket you touch). If you're single and making $60,000, you aren't paying 22% on the whole $60,000. You're paying it in slices.

✨ Don't miss: The Meaning of Middle Class: Why Your Bank Account Might Be Lying to You

Then there’s FICA. This is the one that really bites because you can't deduct your way out of it. FICA stands for the Federal Insurance Contributions Act. It covers Social Security and Medicare. Currently, you're looking at 6.2% for Social Security (up to a certain income cap) and 1.45% for Medicare. Your employer matches this, too. If you are a freelancer or a "1099" worker, guess what? You pay both halves. That’s the "Self-Employment Tax," and it's a brutal 15.3% right off the top.

State and Local Nuances That Kill Your Budget

Depending on where you live, your take-home pay can fluctuate wildly.

Move from Miami to New York City and you'll feel like you took a 10% pay cut overnight. Florida has no state income tax. New York City has a state tax and a city tax. It’s expensive to breathe there.

States like Texas, Washington, and Nevada are famous for having $0 state income tax. But don't get too excited—they usually make that money back through higher sales taxes or property taxes. In places like Pennsylvania, you might deal with "Local Earned Income Tax," where your specific township wants 1% or 2% of your check to pave the roads and keep the library open.

The Benefit "Black Hole"

Beyond taxes, your employer-sponsored benefits are usually the next biggest drain. Health insurance is the primary culprit. According to data from the Kaiser Family Foundation, the average worker contribution for family coverage has climbed steadily over the last decade. You might be paying $150 a month, or it could be $600 depending on how generous your company is.

Then you have your 401(k) or 403(b) contributions. This is "good" debt—or rather, "good" deductions. You’re paying your future self. If you contribute 6% of your salary to get a company match, that money disappears before you ever see it. It’s a phantom deduction that builds wealth, but it definitely makes your Friday deposit look smaller.

Don't forget the "invisible" extras:

✨ Don't miss: lululemon owner comments: Why Chip Wilson Still Can’t Stay Quiet

- Flexible Spending Accounts (FSA) for healthcare or childcare.

- Group Life Insurance premiums.

- Short-term and long-term disability insurance.

- Commuter benefits or parking fees.

- Union dues (if applicable).

Calculating the Reality

If you're trying to figure out what is my take home pay for a new job offer, you can't just guess. You need to look at the W-4 form you filled out. That form tells your employer how much to withhold. If you claim "0" or "Single," they take out more to ensure you don't owe the IRS at the end of the year. If you have kids and claim those credits, your paycheck gets bigger, but your potential tax refund gets smaller.

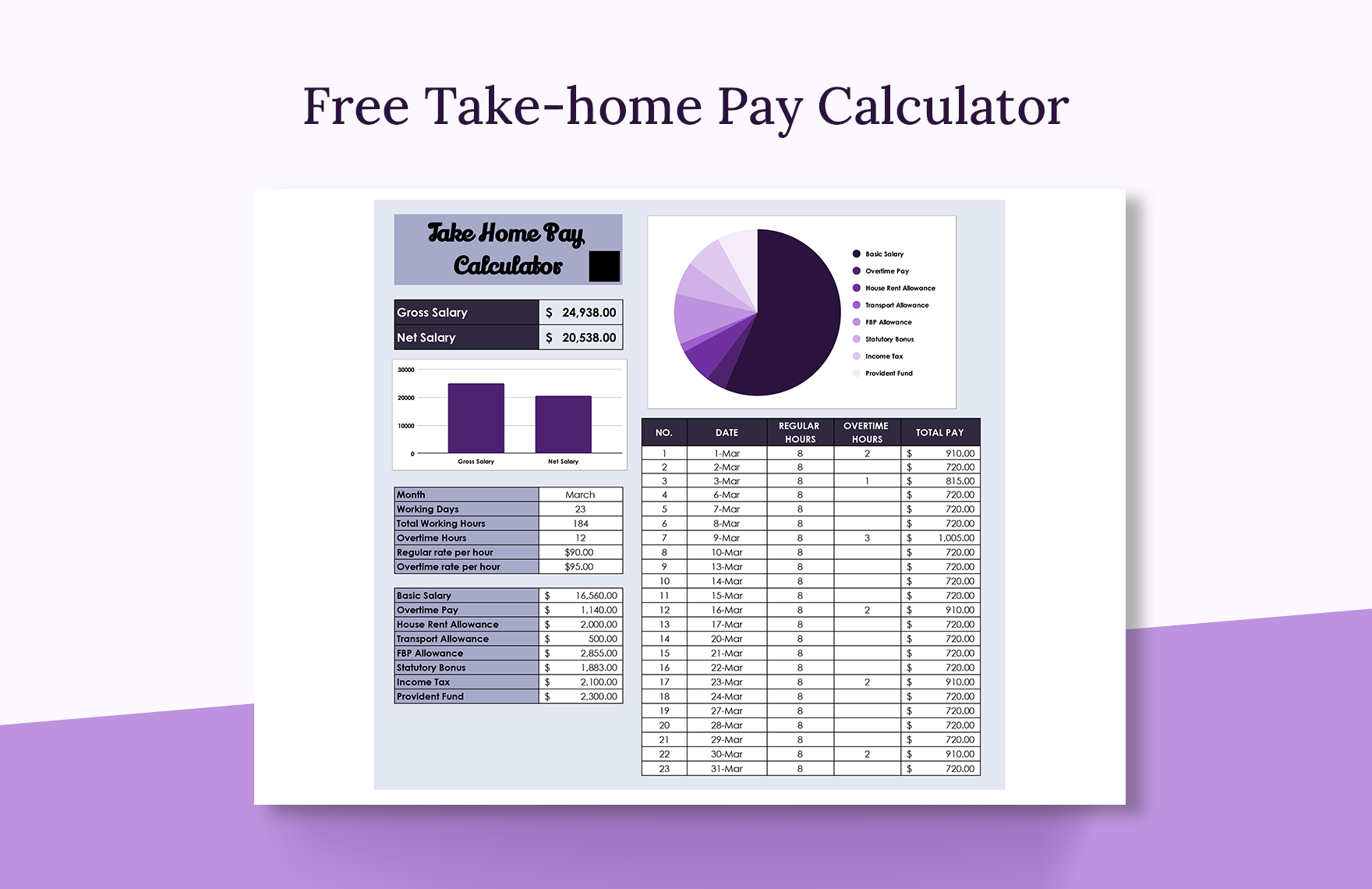

Let's look at an illustrative example.

Imagine Joe. Joe lives in Chicago (Illinois has a flat state tax of 4.95%). He makes $80,000 a year. He puts 5% into his 401(k) and pays $120 a month for his health plan.

Joe's gross monthly: $6,666.

401(k) deduction: -$333.

Health insurance: -$120.

Taxable gross: $6,213.

Now the IRS takes their bite of that $6,213, plus Illinois takes its 4.95%, plus FICA takes 7.65%. By the time everyone is done eating, Joe is likely taking home somewhere around $4,700 to $4,900. He "lost" nearly $1,800 a month to the machinery of the modern workforce.

Why Your Refund Is Actually a Bad Thing

A lot of people celebrate a $3,000 tax refund. Honestly? That's just an interest-free loan you gave the government. If you get a massive refund, it means your take-home pay was lower than it needed to be all year long. You could have had that money in your high-yield savings account earning 4% or 5% interest.

If your take-home pay feels too low, check your withholding. Adjusting your W-4 can put an extra $200 a month in your pocket immediately. It's the fastest "raise" you'll ever get, though you have to be careful not to underpay and end up with a bill in April.

Practical Steps to Master Your Net Income

Stop guessing. Start tracking.

First, pull your last three paystubs. Look for the "YTD" (Year-to-Date) column. This tells the real story of where your money goes. If you see that you've paid $10,000 in taxes and it’s only June, you can start to project your total tax liability.

👉 See also: Is India Share Market Open Today: What Traders Often Forget About Saturdays

Second, use a reputable calculator. Sites like SmartAsset or ADP have payroll calculators that are surprisingly accurate because they factor in local tax laws which change constantly.

Third, evaluate your "voluntary" deductions. Are you paying for a disability insurance policy you don't need because you already have a private one? Is your FSA contribution too high, leaving money on the table at the end of the year?

Finally, align your lifestyle with your net, not your gross. Banks love to tell you that you can afford a mortgage that is 28% of your gross income. That is a trap. Your landlord or mortgage company doesn't care about your gross income; they care about the cash you actually have. Base your rent, car payments, and grocery budget on the number that actually hits your bank account every two weeks.

Understand that your take-home pay is the only number that matters for your daily life. Gross salary is for ego and bank applications. Net income is for buying groceries and building a life.

Actionable Next Steps

- Audit your W-4: Use the IRS Tax Withholding Estimator to see if you are overpaying the government throughout the year.

- Review your insurance premiums: Open enrollment is usually the only time to change these, but knowing the cost now helps you plan for next year's budget.

- Calculate your "Real Hourly Wage": Divide your take-home pay by the total hours you work (including your commute). This often changes how you view "optional" spending.

- Set up a "Tax Buffer": If you are a 1099 worker or have a side hustle, manually divert 25-30% of every check into a separate savings account so you aren't blindsided by quarterly payments.