Honestly, if you're checking your bank account or looking at mortgage rates right now, the numbers probably feel a bit stubborn. As of January 15, 2026, the federal funds rate is sitting in a target range of 3.50% to 3.75%. It’s been there since the Federal Reserve’s last meeting in December, following a series of three consecutive quarter-point cuts that closed out 2025.

But there’s a massive elephant in the room.

Usually, the "Fed rate" is a dry topic for economists in gray suits. Right now? It's the center of a high-stakes legal and political drama that feels more like a Netflix thriller than a financial report. Federal Reserve Chair Jerome Powell recently dropped a bombshell statement on January 11, revealing that the Department of Justice served the Fed with grand jury subpoenas. The subtext isn't hard to read: there is immense pressure from the administration to slash rates faster, and Powell is digging in his heels to keep the Fed independent.

Why the Current Rate Matters for Your Wallet

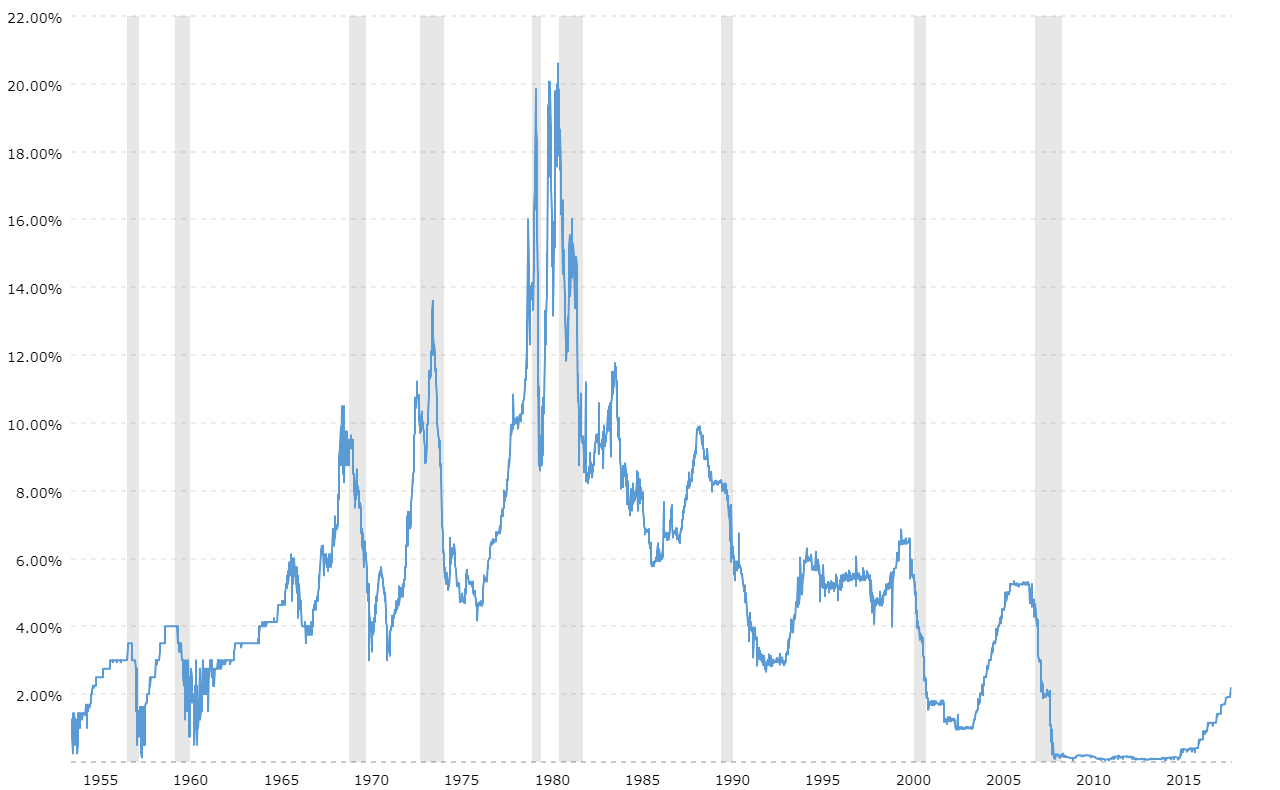

The fed funds rate is basically the "master key" for the entire U.S. economy. When it moves, everything from your credit card APR to the interest on a small business loan follows suit. While the rate has dropped significantly from the 5.25%–5.50% peaks of 2024, it’s still high enough to make borrowing feel "expensive" compared to the "free money" era of the early 2020s.

📖 Related: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

What is fed fund rate today in practical terms? It’s a 3.64% effective rate.

If you are waiting for mortgage rates to plunge back to 3%, you might be waiting a long time. Even with the Fed cutting rates three times recently, the 30-year fixed mortgage is still hovering in the low 6% range. This happens because long-term lenders are nervous. They see the political fighting and the massive fiscal deficits and they’re adding a "risk premium." Basically, they're charging you more because the future looks a little chaotic.

The Great 2026 Divide

Inside the Federal Open Market Committee (FOMC), things are getting tense. The "dot plot"—that famous chart where Fed officials hide their anonymous predictions—shows a group that can't agree on what happens next.

👉 See also: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

Some officials, like Minneapolis Fed President Neel Kashkari, are worried. He’s been vocal this week, warning that cutting rates too aggressively could backfire and send inflation back up. On the flip side, there’s a lone "dot" out there predicting rates could drop as low as 2% by the end of the year.

It's a mess.

- The "Hawks" want to hold steady at 3.50% to 3.75% to make sure inflation is truly dead.

- The "Doves" worry that keeping rates here will eventually break the job market, which has been "moving sideways" lately.

- The Markets are betting on one or two more cuts later this year, likely starting in June.

The Jerome Powell vs. DOJ Situation

You can't talk about interest rates today without mentioning the legal threats. Powell’s term expires in May 2026. The fact that the DOJ is looking into "renovation projects" at Fed buildings is widely seen by market analysts as a pretext. Powell himself said as much, stating that the pressure is really about his refusal to follow the President's preferences for lower rates.

✨ Don't miss: Big Lots in Potsdam NY: What Really Happened to Our Store

This is huge. If investors start to believe the Fed is losing its independence, they might demand even higher interest rates on government bonds to compensate for the uncertainty. That could actually keep your car loan or mortgage rates higher even if the Fed tries to cut.

What You Should Actually Do Now

Stop waiting for a "magic" rate drop. The era of 3% mortgages is effectively over for the foreseeable future. Instead, look at the reality of a 3.50%–3.75% benchmark.

- For Homebuyers: If the math works at 6%, buy. If you wait for a 4% rate that never comes, you might just watch home prices climb higher while you sit on the sidelines.

- For Savers: High-yield savings accounts and CDs are still paying out decent returns, often above 4%. This is the "silver lining" of a higher fed fund rate.

- For Debt Holders: If you have high-interest credit card debt, the Fed's recent cuts haven't provided much relief. Most retail cards are still charging 20%+. Focus on aggressive repayment rather than waiting for a policy shift to save you.

The next big update comes on January 28, when the FOMC wraps up its first meeting of the year. Most experts, including those at Morningstar and UBS, expect them to hold steady at the current range. They want to see more data—and perhaps see how the legal drama plays out—before making the next move.

The smartest move is to plan your 2026 finances around the rates we have today, not the ones you wish we had. Look for the next FOMC statement on January 28 to see if the "sideways" trend in the labor market finally forces their hand.