You're lying in bed at 11:00 PM on a Sunday, staring at your phone. Most of the world is quiet, but Wall Street's pulse is already racing. You see a headline: "Dow Futures Slide 300 Points." The stock market doesn't even open for another ten hours. How is this happening?

Basically, the "market" never truly sleeps. It just changes form.

Understanding what is dow jones futures starts with realizing that the prices you see on the nightly news aren't just random guesses. They are legally binding contracts. People are betting real money—right now—on where the Dow Jones Industrial Average (DJIA) will be days, weeks, or months from today. It’s a high-stakes game of "what if" that dictates how your 401(k) opens on Monday morning.

The Raw Mechanics of the Dow Future

Forget the fancy suits for a second. At its core, a Dow future is an agreement. You are agreeing to buy or sell the value of the Dow Jones Industrial Average at a specific price on a specific date in the future.

The Dow itself is just a price-weighted index of 30 massive "blue-chip" companies like Apple, Microsoft, and Goldman Sachs. You can’t "buy" the index directly like a gallon of milk. You buy the components, or you trade the idea of the index through futures.

Most of this happens on the Chicago Mercantile Exchange (CME). They offer different flavors of these contracts. The "E-mini" is the big dog. There’s also the "Micro E-mini" for people who don't want to lose their shirt on a single bad trade. The math is surprisingly simple. For an E-mini Dow contract, every "point" the Dow moves is worth $5. If the Dow climbs 100 points, you’ve made $500. If it drops? Well, you're out $500.

It’s leverage that makes this spicy. You don’t need the full $200,000+ value of the contract to trade it. You just need a "margin" deposit. This is why futures traders drink so much coffee. You can control a massive amount of capital with a relatively small amount of cash, which is great until it isn't.

📖 Related: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Why the World Watches Futures at 3 AM

Why does a trader in London care what the Dow futures are doing before New York wakes up? Because of the "crystal ball" effect.

Futures trade nearly 24 hours a day, five days a week. Specifically, they run from Sunday evening to Friday afternoon, with a tiny break in the middle of each day. This means when a factory in China reports bad numbers or a war breaks out in the Middle East at 2:00 AM Eastern Time, the futures market reacts instantly.

Stock prices are "sticky" when the exchange is closed. Futures are fluid.

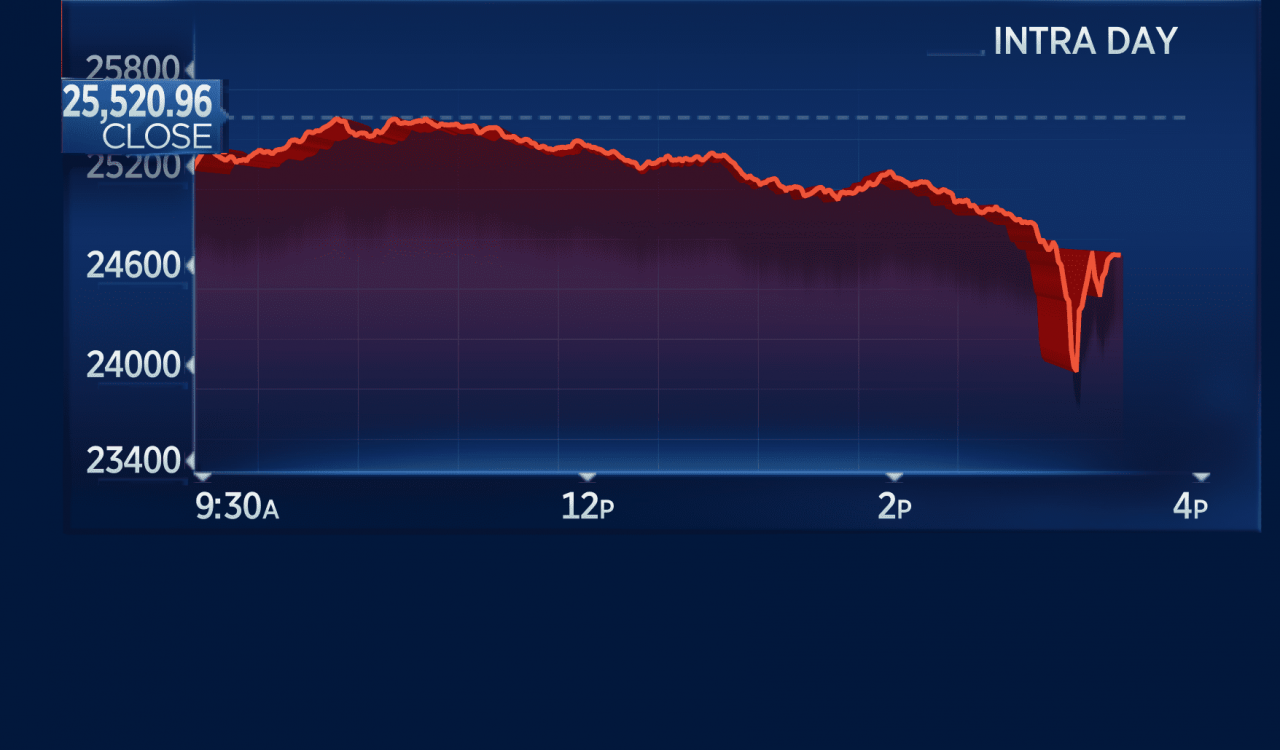

If Dow futures are up 1% before the opening bell, it’s a signal that buyers are hungry. It’s a "pre-game" indicator. But honestly, you have to be careful. Futures can be fake-outs. Sometimes a "limit down" move (where the market drops so fast it hits a circuit breaker) at 4:00 AM turns into a massive rally by noon.

The Major Players: Hedgers vs. Degenerates

Not everyone trading Dow futures is a gambler in a basement. The market relies on two main groups:

- The Hedgers: Imagine you manage a pension fund worth $10 billion. You’re worried the market might crash next month because of an upcoming election. You don't want to sell all your stocks—that's expensive and slow. Instead, you sell Dow futures. If the market crashes, your stocks lose value, but your "short" futures position makes money. It’s insurance.

- The Speculators: These folks are in it for the profit. They have no interest in "hedging" anything. They think the Fed is going to cut rates, so they go "long" on Dow futures to capture the upside.

There's also a third group: the Arbitrageurs. These are usually high-frequency trading (HFT) bots. They look for tiny discrepancies between the price of the futures and the actual price of the 30 stocks in the Dow. They trade in milliseconds to close that gap. It’s basically free money for them, provided their math is right.

👉 See also: Starting Pay for Target: What Most People Get Wrong

Contango, Backwardation, and Other Weird Terms

If you hang around futures traders long enough, they’ll start using words that sound like Latin spells.

Usually, futures prices are higher than the current "spot" price of the Dow. This is because of the "cost of carry"—things like interest rates and the time value of money. This state is called Contango.

But sometimes, things get weird. If investors are terrified about the immediate future, the spot price might be higher than the futures price. This is Backwardation. It’s rare for the Dow, but when it happens, it’s a sign that the market is under extreme stress.

What Most People Get Wrong About "The Open"

You’ll often hear news anchors say, "The Dow is indicated to open 200 points lower."

This is an estimate based on what is dow jones futures at that exact moment. But the "Fair Value" calculation is what really matters. Fair Value is the difference between the futures price and what it would cost to actually hold the underlying stocks (accounting for dividends and interest).

If the futures are trading significantly above "Fair Value," the market will likely open higher. If they are below it, get ready for a sea of red.

✨ Don't miss: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

Don't mistake the futures for the actual market. They are a proxy. They represent sentiment and expectation. On days with huge economic data releases—like the Non-Farm Payrolls report at 8:30 AM—the futures market becomes a chaotic battlefield. Prices will whip-saw hundreds of points in seconds as algorithms digest the data.

Practical Steps for the Average Investor

You don't need to trade futures to benefit from them. In fact, for 99% of people, trading futures is a great way to lose money very fast.

Instead, use them as a weather report.

- Check the "Big Three": Don't just look at Dow futures. Look at S&P 500 (ES) and Nasdaq 100 (NQ) futures too. If the Dow is up but the Nasdaq is down, it means investors are moving money out of tech and into "value" stocks like Boeing or Disney.

- Watch the Volume: If futures are moving on low volume, don't trust the move. It’s likely "noise."

- The 8:30 AM Check: This is the "sweet spot." Most major US economic data drops at 8:30 AM ET. Looking at the futures response at 8:31 AM tells you exactly how the "smart money" interpreted the news.

- Don't Panic: A "red" futures market on Sunday night doesn't mean your portfolio is doomed. Global markets are interconnected. Often, a sell-off in Asia triggers a dip in Dow futures that gets bought up by the time New Yorkers finish their first coffee.

The most important thing to remember is that futures are about probability, not certainty. They tell you what the world expects to happen, but the world is frequently wrong.

If you want to track this in real-time, sites like CNBC, Bloomberg, or the CME Group’s own website provide live candles. Just remember that many free sites have a 10-15 minute delay. In the world of futures, 15 minutes is an eternity. If you're seeing a delay, you're looking at history, not the present.

Next Steps for Your Portfolio

- Monitor the Spread: Start comparing the E-mini Dow futures to the SPY (S&P 500) futures daily. A widening gap usually signals a shift in sector preference (Growth vs. Value).

- Identify Key Levels: Look for "Psychological" levels in the futures, like Dow 40,000. These often act as invisible ceilings or floors where massive amounts of sell/buy orders are parked.

- Check the "VIX": Look at the Volatility Index alongside futures. If futures are falling and the VIX is spiking, the move has "legs" and is driven by genuine fear rather than just a lack of buyers.

Investing isn't about predicting the future perfectly; it's about being prepared for whatever the futures market throws at you when the opening bell finally rings.