You’ve seen the TikToks. People living in $800,000 homes in Texas complaining that they are "struggling" to get by. Then you’ve got the families in Manhattan pulling in $300,000 a year who feel like they’re just one expensive dental bill away from a crisis. It’s weird. We have these rigid economic brackets on paper, but the reality of what is considered upper middle class is incredibly slippery. It changes based on where you pump your gas and whether you bought your house in 2012 or 2024.

Middle class used to be the dream. Upper middle class was the upgrade. It meant the "good" life. We're talking two late-model SUVs in the driveway, a 529 plan for the kids that’s actually funded, and the ability to fly to Mexico for a week without checking your bank balance every three hours. But honestly, the definition is breaking.

According to Pew Research Center, the middle class is technically anyone earning between two-thirds and double the median household income. If we look at recent U.S. Census data, that puts the "middle" roughly between $50k and $150k for a family of three. So, logically, the upper middle class starts where that ends. But try telling a family of four in San Francisco that they are "upper" anything on $155,000 a year. They’ll laugh you out of the room. They’re basically renting a two-bedroom apartment and hoping the car doesn't make that clicking sound again.

The Income Thresholds That Actually Matter

If you want the hard data, the Brookings Institution and various Pew studies usually peg the upper middle class as the top 15% to 20% of earners. In 2026, looking at the trajectory of inflation and wage growth, you’re looking at a household income starting around $150,000 to $200,000 nationally.

But it’s not just about the paycheck.

It’s about what economists call "discretionary power." Being upper middle class means you aren't just surviving; you’re accumulating. You have the "extra." You have a portfolio. Maybe it’s not a massive brokerage account, but you definitely have a 401(k) that you’re maxing out, or at least hitting the employer match without thinking twice.

Income is a snapshot. Wealth is the movie.

A surgeon fresh out of residency making $350,000 might have a negative net worth because of $400,000 in student loans. Are they upper middle class? On paper, yes. In their daily life? They might be living more frugally than a plumber in Ohio making $90,000 who inherited a house and has zero debt. This is where the standard definitions of what is considered upper middle class start to fail us. It’s why the "vibes" of the class often matter more than the W-2.

Education and the "Professional-Managerial Class"

In the 1970s, Barbara and John Ehrenreich coined the term "Professional-Managerial Class" (PMC). This is the heartbeat of the upper middle class. It’s less about the money and more about the degree on the wall.

👉 See also: Finding MAC Cool Toned Lipsticks That Don’t Turn Orange on You

- You usually have at least a Bachelor’s, often a Master’s or a JD/MD.

- Your job involves "knowledge work"—spreadsheets, coding, managing people, or legal briefs.

- You have a high degree of autonomy. No one is timing your bathroom breaks.

This group manages the systems that keep society running. If you work in a job where you can work from a laptop at a coffee shop and nobody cares as long as the work gets done, you’re likely in this bracket. It’s a shift from the old blue-collar middle class where you were paid for your time. Here, you’re paid for your expertise.

But there’s a catch.

The "mass-affluent" lifestyle—another term used by firms like Merrill Lynch—is becoming harder to maintain. We’re seeing a "bifurcation." There’s a group of people making $200k who feel rich, and a group making $200k who feel like they’re running on a treadmill that’s set just a little too fast.

The Geography Tax: Why $250k is the New $100k

Location is the ultimate "upper middle class" gatekeeper.

In a city like Indianapolis or St. Louis, a $175,000 household income is phenomenal. You are the king of the cul-de-sac. You’ve got the finished basement, the designer kitchen, and you’re probably a donor to the local arts center. You are firmly, undeniably upper middle class.

Now, move that same income to Brooklyn or Seattle.

Suddenly, you’re looking at $4,500 a month for a decent apartment. Childcare for two kids might run you another $4,000. After taxes—which are higher in these states—and retirement contributions, that $175,000 vanishes. You’re shopping at Trader Joe’s, sure, but you’re checking prices on the organic chicken.

The "Upper Middle Class" in Tier 1 cities is often defined by "the struggle for the basics." We’re talking about the fight for a spot in a good public school or the ability to own a home with a yard. This is why many families are "downshifting." They move to Tier 2 cities—think Charlotte, Raleigh, or Phoenix—to actually feel like the class they belong to on paper.

✨ Don't miss: Finding Another Word for Calamity: Why Precision Matters When Everything Goes Wrong

The Lifestyle Markers: How to Spot the Bracket

Forget the fancy cars. In 2026, a brand-new Ford F-150 can cost $80,000. Everyone has a nice car; they just have 84-month loans. The real markers of what is considered upper middle class are more subtle now.

- Outsourced Labor: If you pay someone to mow your lawn, clean your house, or deliver your groceries, you’re buying back time. This is the hallmark of the upper middle class.

- Health as a Status Symbol: It’s the $200-a-month gym membership, the wearable tech that tracks sleep, and the ability to buy "clean" food without looking at the receipt.

- Educational Enrichment: It’s not just school. It’s the private soccer coach, the violin lessons, and the summer "enrichment" camps.

- The "Buffer": Having $20,000 in a high-yield savings account that you don't touch. That’s the real luxury.

It's about security. The middle class worries about a $1,000 emergency. The upper middle class has the insurance, the savings, and the credit lines to make that emergency a mere "annoyance."

The "Henry" Problem

There's a specific subset of people called HENRYs—High Earners, Not Rich Yet.

These are the people who make $250,000 to $500,000 but have very little in the way of net worth. They’re usually young professionals. They have the income to be upper middle class, but their lifestyle or debt load keeps them from feeling it. They are the ones driving the luxury market, buying the $3,000 couches and the designer bags, but they are often one layoff away from a total lifestyle collapse.

True upper middle class status usually requires a level of stability that HENRYs haven't reached. It’s the difference between earning the money and having the money.

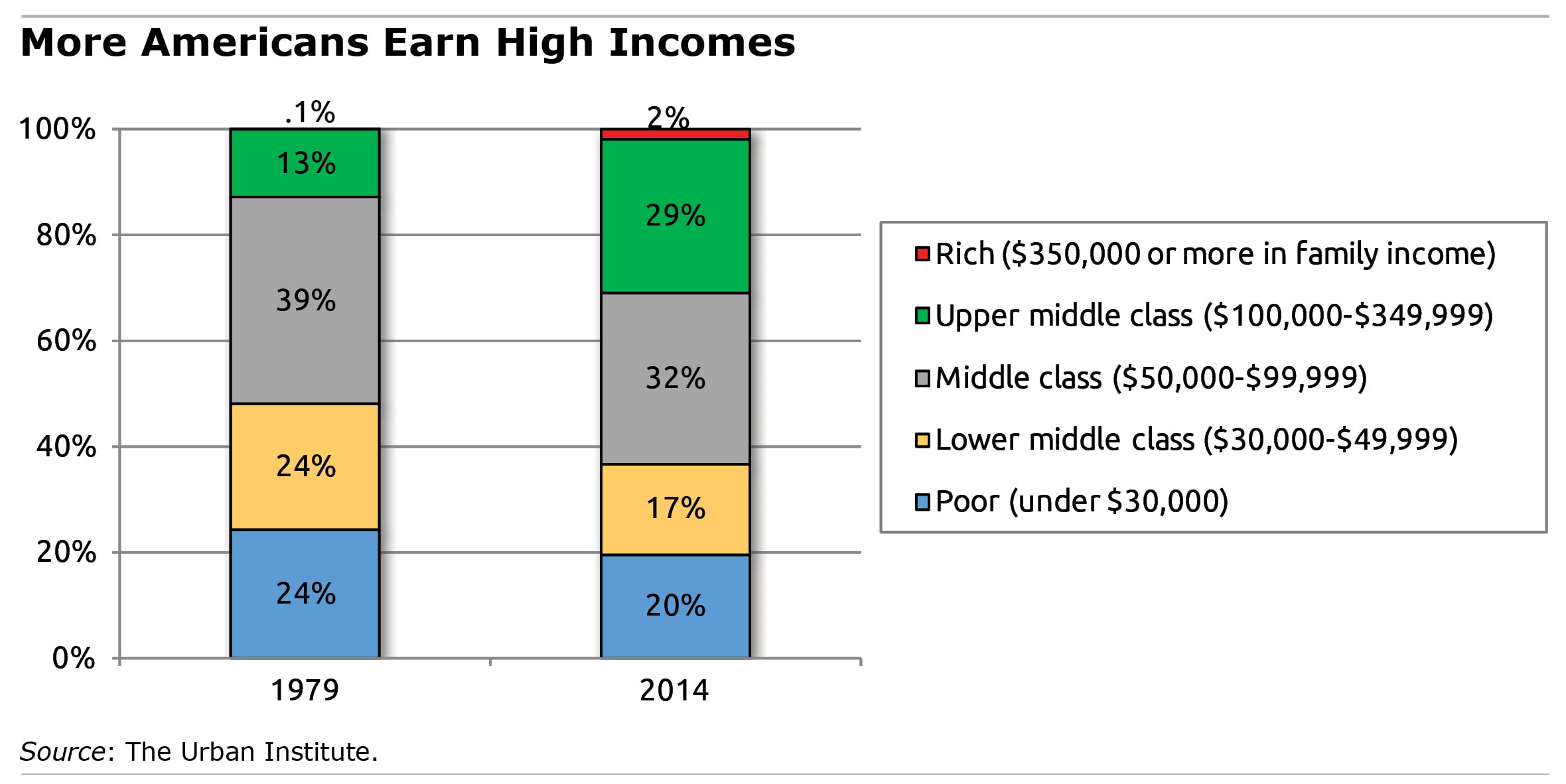

The Shrinking Middle and the "Class Ceiling"

Is it getting harder to stay here? Honestly, yeah.

The cost of the "Upper Middle Class Starter Pack"—housing, healthcare, and higher education—has outpaced wage growth for decades. This has created a "class ceiling." If your parents weren't upper middle class, it’s significantly harder for you to get there, even with a good degree.

Sociologist Richard Reeves, in his book Dream Hoarders, argues that the upper middle class has gotten really good at "opportunity hoarding." They live in the best school districts, they have the professional networks to get their kids internships, and they pass down "soft skills" that the corporate world rewards.

🔗 Read more: False eyelashes before and after: Why your DIY sets never look like the professional photos

This isn't just about being "rich." It's about a structural advantage.

When we talk about what is considered upper middle class, we have to acknowledge that it’s becoming a hereditary caste. If you start there, you’re likely to stay there. If you don't, the ladder is getting steeper. The rungs are further apart.

Actionable Steps to Evaluate Your Standing

If you're trying to figure out where you sit or how to move up, stop looking at the gross income on your tax return. That number is a lie. Instead, look at these three things.

Calculate Your Post-Fixed-Cost Ratio

Subtract your "survival" costs—mortgage/rent, utilities, basic groceries, insurance, and minimum debt payments—from your take-home pay. If more than 30% of your income is left over for saving, investing, and "fun," you are effectively living an upper middle class lifestyle, regardless of the raw dollar amount.

Check Your Debt-to-Asset Trajectory

Are your assets (house equity, 401(k), brokerage) growing faster than your liabilities? Upper middle class status is defined by the transition from "working for money" to "money working for you." If your net worth isn't increasing by at least 10% of your gross income annually, you might be a high earner, but you aren't building class stability.

Audit Your "Safety Nets"

True class status is about what happens when things go wrong. Do you have disability insurance? Life insurance? An emergency fund that covers six months of actual lifestyle costs, not just "beans and rice" costs? If you can lose your job tomorrow and not change your kids' school or your zip code for six months, you've made it.

The reality of the American class system in 2026 is that the "middle" is hollowing out. You’re either drifting toward the top 20% or sliding toward the bottom 60%. Understanding where you land is less about bragging rights and more about knowing how much "padding" you have against a volatile global economy. Stop comparing your life to the people on your Instagram feed; half of them are "HENRYs" drowning in lease payments. Focus on the gap between your income and your expenses. That gap is where the "upper" part of the class actually lives.