Money talks. But honestly, when it comes to the national paycheck, it usually mumbles. You’ve probably seen a dozen different numbers for what is average wage in US workers’ pockets lately. One source says $60k, another says $75k, and your neighbor swears nobody is making more than $20 an hour.

It's confusing.

The truth is, "average" is a tricky word in a country where one person flips burgers and another runs a hedge fund. According to the Bureau of Labor Statistics (BLS) data as we kick off 2026, the average hourly wage for all private nonfarm employees hit $37.02 in December 2025. If you do the math on a 40-hour week, that’s roughly $1,480 a week or about $77,000 a year.

But wait. Before you compare that to your own W-2 and feel great (or terrible), we need to look at the median. The median is the "middle" number—half the country makes more, half makes less. As of the end of 2025, the median weekly earnings for full-time workers sat closer to $1,214. That works out to an annual salary of $63,128.

👉 See also: Why 30 East Street Pontefract is Actually a Big Deal for Local Business

Why the gap? Well, the "average" gets pulled up by the CEOs and tech gurus making millions. The median is usually a much better "vibe check" for what the typical American is actually taking home.

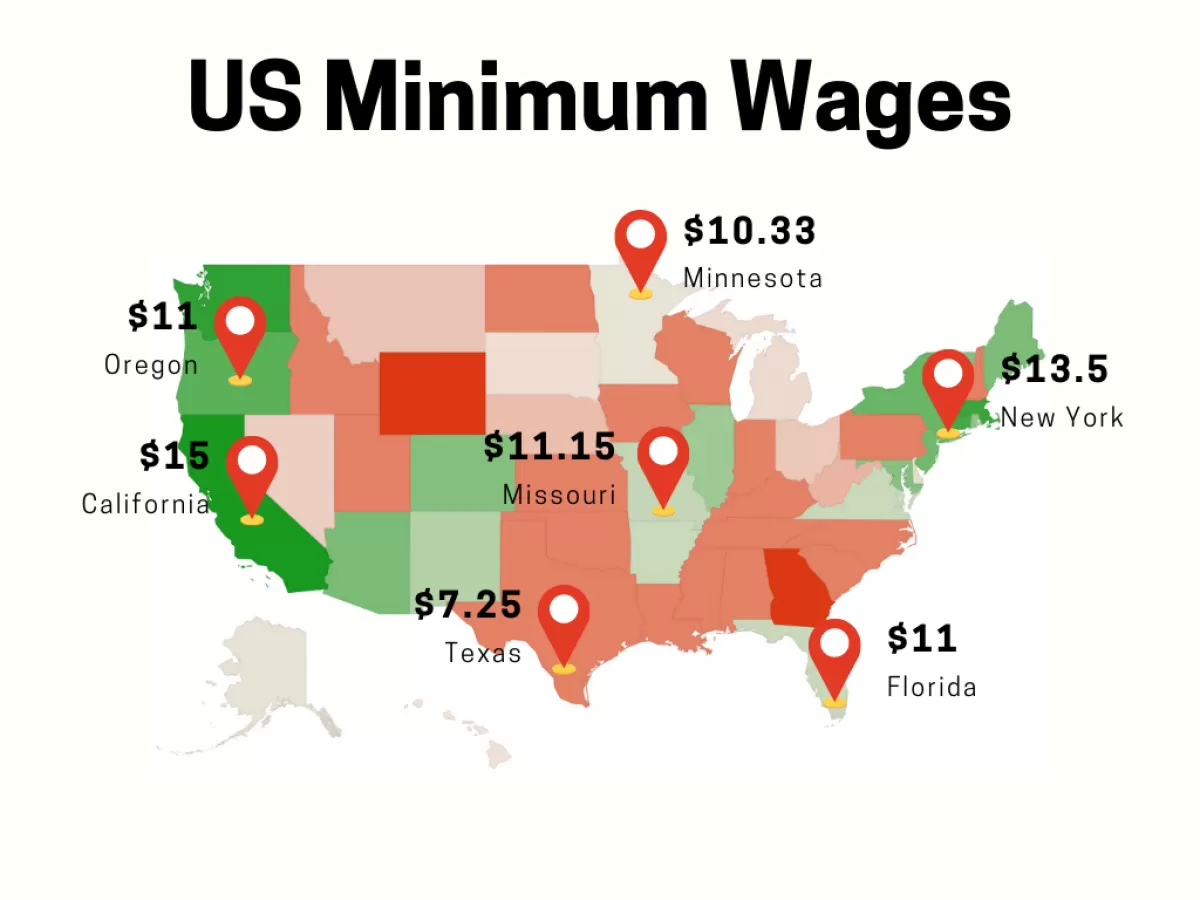

The Great Divide: Industry and Geography

Where you live and what you do matters more than the national average ever will. A barista in Seattle makes more than a bank teller in rural Mississippi, but they also pay five bucks for a gallon of milk.

Take the Information sector—think software devs, data analysts, and media folks. They are currently leading the pack with average weekly earnings of nearly $2,000. On the flip side, people in Leisure and Hospitality are averaging about $600 a week. That is a massive chasm.

High-Paying vs. Low-Paying Sectors (Weekly Averages)

- Utilities: $2,306 (The secret gold mine of the labor market).

- Information: $1,988.

- Financial Activities: $1,810.

- Manufacturing: $1,439.

- Retail Trade: $771.

- Leisure & Hospitality: $595.

Location is just as dramatic. If you're looking for the highest "average" numbers, you look at Massachusetts (around $83,000) or Washington State. Washington is fascinating because it’s not just tech; the state's high minimum wage and strong union presence in aerospace push that number up to about $1,489 a week on average.

Meanwhile, states like Mississippi and West Virginia often hover at the bottom, with average weekly wages closer to $1,000. It sounds low, but if your mortgage is $800, that $1,000 goes further than $2,000 in San Francisco.

What Is Average Wage in US Demographics?

We have to talk about the demographics because the numbers aren't "colorblind" or "gender-neutral." They never have been.

The gender pay gap is still a real thing in 2026. Data shows men’s median weekly earnings are around $1,333, while women are bringing in $1,076. That’s roughly 81 cents on the dollar. It’s been stuck in that neighborhood for a while, though it narrows significantly in younger age groups.

Then there's the race factor. Asian workers continue to have the highest median earnings at $1,620 per week. White workers follow at $1,238. Black workers ($970) and Hispanic workers ($944) still face a significant gap, though Hispanic households saw some of the fastest wage growth—about 5.5%—over the last year.

Education is the other "big one." If you don't have a high school diploma, you're looking at a median of $777 a week. Get that Bachelor’s degree? It jumps to $1,747. Basically, the "diploma tax" is very much in effect.

Inflation: The Silent Pay Cut

You can't talk about wages without talking about what that money actually buys. In late 2025 and early 2026, we've seen "real wages" (wages adjusted for inflation) finally start to tick up.

✨ Don't miss: Current Dow Futures: Why the Market is Rattled by New Tariff Threats

For a long time, even if you got a 3% raise, the price of eggs and gas went up 5%, so you were actually getting poorer. As of the most recent BLS Real Earnings report, real average hourly earnings increased by about 1.1% year-over-year.

It’s progress, but it’s slow. Most people don't feel "richer" yet; they just feel like they're finally stoping the bleeding.

How to Use This Information

Knowing what is average wage in US workers' bank accounts is more than just trivia. It’s leverage.

If you are a mid-level manager in a professional service firm making $60,000 in a high-cost city, you are technically under the national median for your sector. You're being underpaid.

Here is what you should do next:

📖 Related: The Always Day 1 Meme: Why Jeff Bezos’ Obsession Is Now a Corporate Ghost Story

- Check the "OES" data: The BLS has a tool called the Occupational Employment and Wage Statistics (OEWS). Look up your specific job code and your specific metro area. "National average" is for news headlines; "local median for my job title" is for salary negotiations.

- Audit your "Real Wage": Take your 2024 salary and your 2026 salary. If the increase is less than 7% (roughly the cumulative inflation over that span), you’ve taken a technical pay cut. Use that data in your next performance review.

- Watch the sector shifts: We are seeing a "softening" in tech and manufacturing, while Education and Health Services are the only ones consistently adding jobs. If you're looking for stability, the "boring" sectors are currently the safest bets for wage growth.

The numbers are just a benchmark. They don't account for your specific skills, your grit, or your local cost of living. But they do prove one thing: the floor is rising, and if your paycheck isn't rising with it, it's time to have a very uncomfortable conversation with your boss.