Ever looked at a stock chart and noticed a price just... sitting there? It doesn't crash. It doesn't moon. It just drifts sideways like a boat tied to a dock while the tide goes out. This boring, flat-line behavior is usually exactly what professional traders are looking for. They call it an accumulation phase. Basically, it’s the quiet part of the movie before the hero starts running.

If you’re trying to figure out what is an accumulation, you have to stop thinking about price and start thinking about hands. Specifically, whose hands are holding the asset? In an accumulation phase, big-money players—think institutional investors, hedge funds, or the "smart money"—are quietly buying up shares from retail investors who are bored, tired, or just plain scared. It’s a transfer of ownership.

It's subtle. It's slow. If they bought everything at once, the price would spike, and they’d end up paying way too much. So, they hide.

The Wyckoff Logic: Why Markets Move in Waves

Richard Wyckoff is the name you’ll hear most in these circles. He was a pioneer in technical analysis back in the early 20th century, and his theories still dominate how people trade today. Wyckoff didn't look at indicators like the RSI or MACD as much as he looked at the relationship between supply and demand.

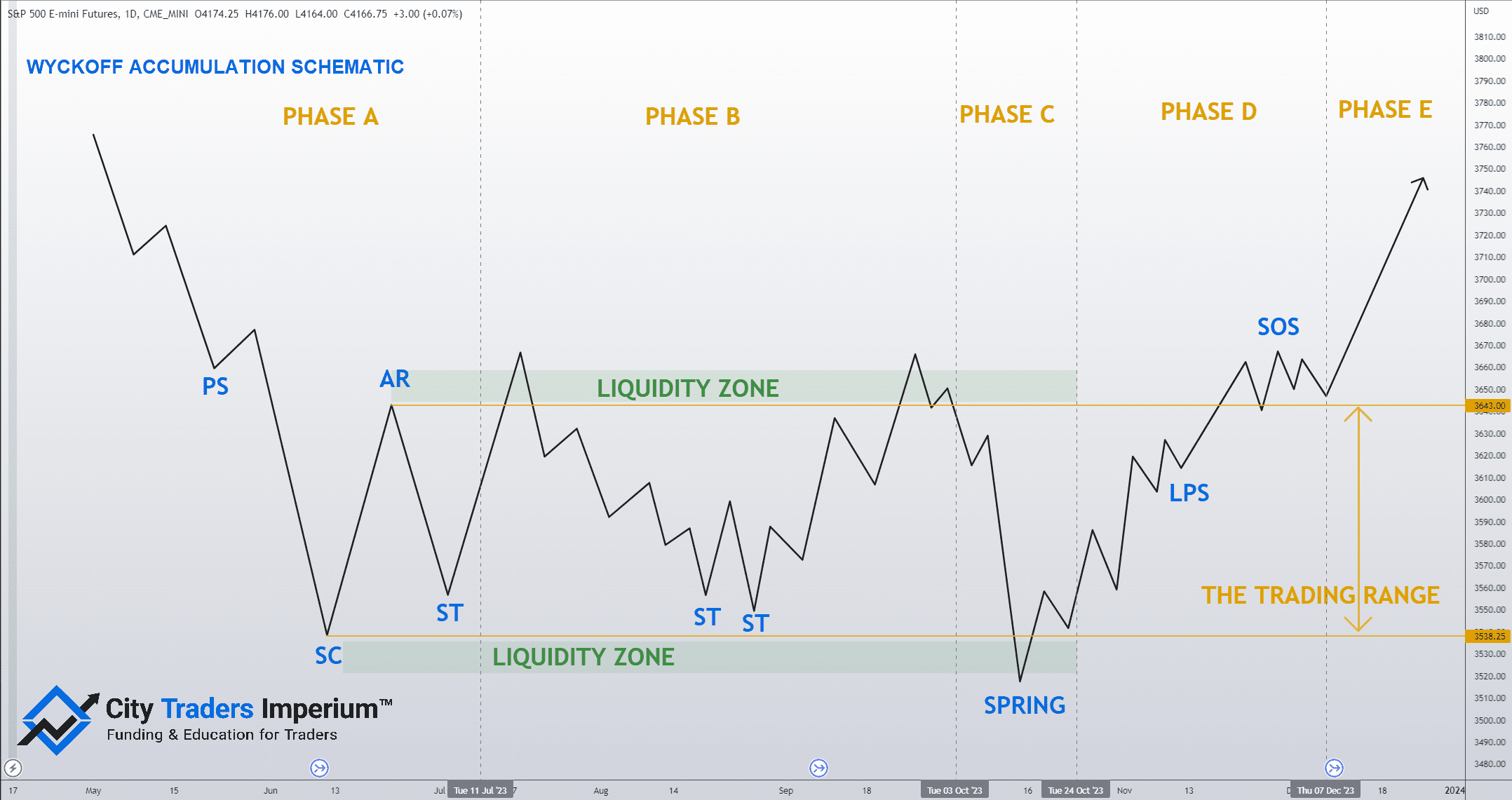

To Wyckoff, accumulation is the first stage of a market cycle. It follows a downtrend. Imagine a stock has been plummeting for months. Everyone is panicking. They’re selling because they can’t take the pain anymore. That’s when the "Composite Man" (Wyckoff’s term for the collective force of institutional players) steps in.

📖 Related: Finding an Authentic Black Guy Stock Image: What Most People Get Wrong

They don't just buy. They absorb.

The price stays in a range. Every time it tries to drop lower, the big players buy the dip. Every time it tries to break out too early, they stop buying, and the price settles back down. This creates a "trading range." It’s a game of patience. They want to fill their pockets without alerting the rest of the market. You've probably seen this on a chart and thought it was a "dead" stock. Honestly, that's exactly what they want you to think.

Spotting the Signs: It’s All About the Volume

You can’t just look at the price candles. You have to look at the volume bars at the bottom of the screen. In a true accumulation, volume often starts to dry up during the dips. This means there isn't much "selling pressure" left. Everyone who was going to sell has already jumped ship.

Then, you'll see small spikes in volume on the days the price moves up within the range. This is the big money stepping in.

One of the most famous patterns in this phase is called a "Spring." It's a nasty little move where the price briefly breaks below the support level. It looks like the stock is about to crash again. Retail traders freak out and hit the sell button, or their stop-losses get triggered. The institutional players then swoop in and buy all those shares at a discount. If the price immediately snaps back into the range after dropping out of it, you’ve likely just witnessed a Spring. It’s a classic trap.

Misconceptions: Accumulation vs. Distribution

People mix these two up all the time, and it’s an expensive mistake to make. Distribution is the polar opposite of accumulation. While accumulation happens at the bottom of a trend, distribution happens at the top.

In distribution, the big players are the ones selling, while the retail public—driven by FOMO (fear of missing out)—is the one buying. Both look sideways on a chart. Both involve a trading range. But the outcome is the total opposite.

👉 See also: Dimon Warns Inflation Up Employment Down: What Most People Get Wrong

How do you tell them apart? Look at the previous trend. If the price just came off a massive 50% run-up and starts going sideways, be careful. That's likely distribution. If the price has been beaten into the dirt for a year and starts moving flat, that’s where you look for accumulation.

Context is everything. Without context, a sideways line is just a line.

The Psychology of the Boredom Phase

Why does it take so long? Sometimes months. Even years in the case of some commodities or "value" stocks.

The goal of accumulation isn't just to buy shares; it's to exhaust the remaining sellers. Institutions want to make sure that when they finally push the price up, there won't be a ton of people waiting to sell and ruin the rally. They wait until the market is completely "washed out."

It's a psychological war. You've likely felt this yourself. You buy a stock, it does nothing for three months while everything else is pumping, and you eventually sell it just to "put your money to work" elsewhere. The second you sell? It takes off. That’s because you were part of the supply that needed to be cleared before the "Mark Up" phase could begin.

📖 Related: The Snowball Alice Schroeder: Why the Definitive Buffett Biography Still Stings

Real World Example: Bitcoin in 2023

Look at the Bitcoin chart from early 2023. After the FTX collapse, the price hovered between $16,000 and $20,000 for what felt like an eternity. The news was terrible. Everyone said crypto was dead. But if you looked at on-chain data, "whales" (large wallet holders) were moving coins off exchanges and into private storage.

That was a textbook accumulation.

The volume on the sell-offs was weakening. The "Spring" happened during various mini-scares, but the price held. Once the supply was sufficiently absorbed, the price broke out, and we entered the Mark Up phase. Those who understood what is an accumulation weren't scared by the sideways movement; they were encouraged by it.

How to Trade an Accumulation Phase

Don't be the first one to the party. Being too early is the same as being wrong in trading. You can sit in a dead asset for a year while inflation eats your capital.

Most professional traders wait for the "Sign of Strength" (SoS). This is a move where the price breaks above the top of the trading range on high volume. It’s the market’s way of saying, "Okay, the big guys are done buying, and we’re ready to move."

Sometimes, the price will come back down to "test" the top of that range. If it hits that old resistance and it now acts as support, that’s often the safest entry point. It’s called a "Back Up to the Edge of the Creek" in Wyckoff terminology.

- Identify a long-term downtrend that has flattened out.

- Look for "volatility contraction"—the price swings get smaller and smaller.

- Watch for a "Spring" or a false breakdown that gets bought up quickly.

- Wait for the breakout with a massive increase in volume.

- Enter on the first successful retest of the range's ceiling.

Trading isn't about predicting the future. It’s about recognizing the footprints of people with more money than you. When you see an accumulation, you’re seeing the footprints of the giants.

Actionable Next Steps

To actually use this information, start by opening a charting tool like TradingView. Pull up a few stocks or assets that have been "boring" lately.

- Check the Weekly Chart: Accumulation is easier to see on higher timeframes. Daily charts have too much noise.

- Add the Volume Indicator: If the price is flat but volume is showing green spikes on up-days, take note.

- Draw Your Lines: Mark the clear "ceiling" (resistance) and "floor" (support) of the current range.

- Set an Alert: Don't stare at the screen. Set an alert for a price break above that ceiling.

Understanding accumulation turns market boredom into a signal. It changes your perspective from "why isn't this moving?" to "who is buying this right now?" Once you see the pattern, you can't unsee it. It’s the fundamental heartbeat of the financial markets. It’s where the real money is made—long before the headlines start screaming about a new bull market. ---