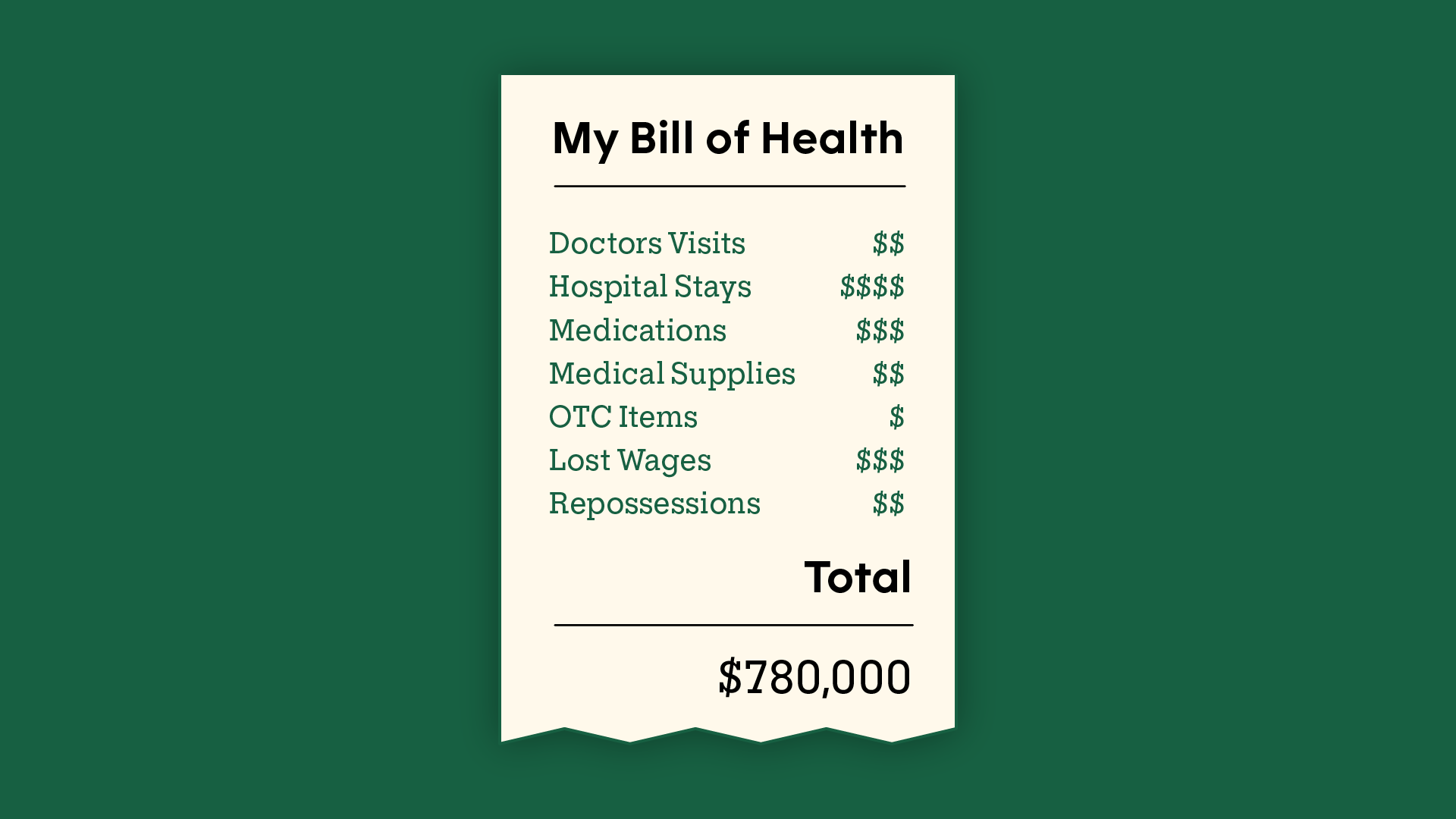

You’re staring at a piece of paper that costs more than your car. It’s a familiar gut-punch. For most of us, opening a medical bill feels less like a financial transaction and more like a threat. You might be tempted to just shove it in a junk drawer and forget it exists. Don't.

Ignoring it won't make it vanish. In fact, what happens if I don't pay a hospital bill is a slow-motion car crash that starts with a few polite letters and ends with a trashed credit score or a process server at your front door. It’s not just about the money; it’s about how the American healthcare system handles "uncompensated care."

The first 90 days: The quiet before the storm

Hospitals aren't usually in a rush to sue you the day after you're discharged. Usually, the first 30 to 90 days are handled by the hospital’s internal billing department. They’ll send you color-coded notices. First, it's white and polite. Then, it might be yellow or pink with "Past Due" stamped in bold.

During this window, you’re still in the "safe zone." The debt hasn't hit your credit report yet. Why? Because the Fair Credit Reporting Act (FCRA) and recent updates from the major credit bureaus (Equifax, Experian, and TransUnion) give you a grace period. As of 2023, medical debt under $500 shouldn't even show up on your credit report anymore. But if you owe more than that, the clock is ticking.

Hospitals often have "Financial Assistance Policies" or FAPs. By law, non-profit hospitals have to provide these. If you're under a certain income threshold—often 200% to 400% of the Federal Poverty Level—they might legally have to wipe the bill or heavily discount it. But they won't tell you that unless you ask. Honestly, they’d rather you just pay the "Chargemaster" price, which is the inflated "sticker price" no insurance company ever actually pays.

When the debt collectors start calling

If 90 to 120 days pass and you haven't sent a dime or set up a plan, the hospital sells your debt. Or they hire a third-party agency to bark at you. This is where things get loud.

👉 See also: Cleveland clinic abu dhabi photos: Why This Hospital Looks More Like a Museum

The phone calls start. Your debt is now being handled by people whose entire job is to be annoying until you pay. You have rights here under the Fair Debt Collection Practices Act (FDCPA). They can't call you at 3:00 AM. They can't tell your boss you’re a deadbeat. But they can—and will—report the delinquency to credit bureaus once the 365-day waiting period expires.

That one-year waiting period is a lifesaver. It was implemented to give people time to work out insurance disputes. Use it. If you’re wondering what happens if I don't pay a hospital bill for over a year, the answer is a massive drop in your credit score. We’re talking 50 to 100 points. That affects your ability to rent an apartment, buy a house, or even get a decent cell phone plan.

The legal "Nuclear Option": Lawsuits and Garnishment

Can a hospital sue you? Yeah. They can.

It depends on the state and the hospital's specific policy. In places like Virginia or New York, some large health systems have historically been aggressive, filing thousands of lawsuits against patients. If they win a judgment against you, they can potentially garnish your wages. This means a chunk of your paycheck is taken before you even see it.

In some states, they can even put a lien on your house. You still own the house, but you can’t sell it or refinance it without paying the hospital first. It’s a heavy-handed tactic, but for a hospital trying to recoup $50,000 for a heart procedure, it’s a standard business move.

✨ Don't miss: Baldwin Building Rochester Minnesota: What Most People Get Wrong

What about "Medical Indigent" status?

Some people think they are "judgment proof." If you have no assets, no job, and no savings, a hospital can sue you, but they can't take blood from a stone. However, judgments can last for years—sometimes a decade—and they can be renewed. So, the moment you do get a job or an inheritance, the debt collector is standing there with their hand out.

The "No Surprises Act" and your rights

You need to know about the No Surprises Act. If you went to an in-network hospital but an out-of-network doctor (like an anesthesiologist you didn't choose) treated you, they can't send you a "balance bill" for the difference. This is a common way people end up in debt without realizing it. If you get a bill that looks like a "balance bill" from an emergency visit, it might actually be illegal.

Specific steps to take right now

If you are staring at a bill you can't pay, do not hide. Movement is your best friend.

1. Ask for an itemized bill.

Hospitals are notorious for "upcoding." This is when they charge you for a high-level ER visit when you only needed a few stitches. Or they charge you $15 for a single Tylenol. When you ask for an itemized list with CPT codes, the billing department often "discovers" errors and the total drops. It happens more than you’d think.

2. Check the Financial Assistance Policy (Charity Care).

Search the hospital’s website for "Financial Assistance" or "Plain Language Summary." If you make $50,000 a year and have a family of four, you might qualify for a 100% write-off at many non-profit hospitals. You have to fill out an application and provide tax returns, but it’s worth the paperwork.

🔗 Read more: How to Use Kegel Balls: What Most People Get Wrong About Pelvic Floor Training

3. Negotiate the "Medicare Rate."

Hospitals usually accept much lower payments from Medicare than they do from individuals. Tell them: "I can't pay the $5,000, but I see the Medicare reimbursement rate for this procedure is $1,200. I can pay that today if we settle the account." Many times, they’ll take the bird in the hand.

4. Use a Patient Advocate.

If the bill is massive—six figures—look into hiring a professional patient advocate. These are experts who know how to navigate the billing bureaucracy and can often slash bills by 50% or more for a fee or a percentage of the savings.

5. Avoid the "Medical Credit Card" trap.

Hospitals will often push "CareCredit" or other medical credit cards. Be extremely careful. These often have 0% interest for a few months, but if you don't pay it off in full, the interest rate jumps to 26% or higher, retroactive to the start date. It’s often better to stay in debt to the hospital than to a high-interest credit card company.

What happens if I don't pay a hospital bill isn't a single event; it's a process of escalating pressure. You have more leverage at the beginning than at the end. Once it goes to a collection agency, you’re dealing with a company that bought your debt for pennies on the dollar. At that point, you can often settle for 20-30% of the original cost, but your credit will have already taken the hit.

Avoid the hit. Fight the bill while it's still sitting on the hospital's desk. Verify every charge, apply for charity care, and never agree to a payment plan that you can't realistically maintain.

Actionable Insights for Managing Medical Debt:

- Audit the codes: Use a site like FairHealthConsumer.org to look up the "fair" price for the CPT codes on your itemized bill.

- The $500 Threshold: Remember that medical debts under $500 will not appear on your credit report under current consumer protection rules.

- Written Records: Never negotiate over the phone without recording the call (if legal in your state) or asking for a follow-up email. Verbal promises from billing clerks mean nothing.

- State Statutes: Look up the "Statute of Limitations" for medical debt in your state. In some places, it’s as short as three years; in others, it’s ten. Once that time passes, they can no longer sue you for the debt.

- Avoid "Co-mingling": Do not put medical debt on a standard credit card. Medical debt has more consumer protections than credit card debt. Once you pay the hospital with a Visa, you’ve turned a "protected" medical debt into an "unprotected" consumer debt.