It’s an awkward moment. You’re standing at a post office counter or a grocery store service desk, and you need to pay for something—maybe rent or a used car—but they won’t take a personal check. They want a money order. If you’ve never held one, you might be wondering exactly what a money order looks like and if it’s just some glorified piece of paper. Honestly, it kind of is. But it's a piece of paper that acts like cash, which makes it both incredibly useful and a little bit nerve-wracking to handle.

Most people expect something high-tech. In reality, a money order usually looks like a skinny, colorful check. It’s often printed on that thin, slightly grainy paper that feels a bit "official" but also a little flimsy. If you’re looking at one from Western Union, it might have a yellow and blue tint. A MoneyGram usually leans toward red or white. The United States Postal Service (USPS) versions are unmistakable with their distinct green and yellow Benjamin Franklin watermarks.

🔗 Read more: Titan Stock Price: Why Everyone Is Watching the Tata Powerhouse in 2026

The Anatomy of the Paper: Breaking Down the Design

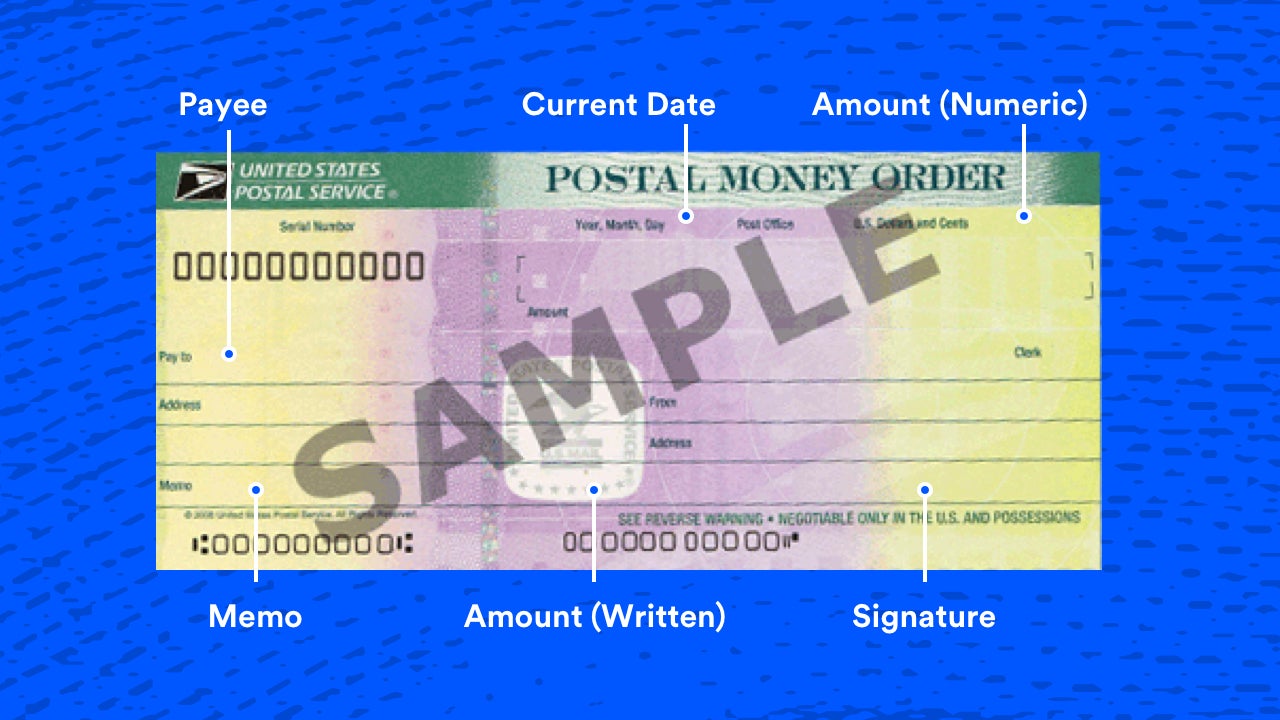

When you finally get one in your hand, don’t just shove it in your pocket. Look at it. At first glance, it’s basically a check. You’ll see a line for the "Pay to the Order Of," which is where you write the name of the person or business you’re paying. This is the most important part. If you leave it blank, it’s as good as a hundred-dollar bill dropped on the sidewalk. Anyone who finds it can write their own name in and cash it.

There is also a space for your signature, usually labeled "Purchaser, Signer, or Drawer." Interestingly, the back looks exactly like a standard check. It has a designated area for endorsement. You don’t sign the back; the person you are giving it to signs the back when they go to the bank.

Why the Graphics Actually Matter

You might notice weird squiggly lines or metallic strips. These aren't just for decoration. Since money orders are "guaranteed funds," they are prime targets for counterfeiters. USPS money orders are especially famous for their security features. If you hold a real USPS money order up to the light, you should see a repeated watermark of Benjamin Franklin. If he’s not there, or if he looks like a blurry cartoon version of a Founding Father, you’re likely holding a fake.

Comparing the Big Three: USPS vs. Western Union vs. MoneyGram

Not all money orders are created equal. Depending on where you go, the aesthetic changes quite a bit.

The USPS Money Order

This is the gold standard. It’s officially called a "Postal Money Order." It’s usually a pale green or yellowish-tan. It feels thicker than a grocery store receipt but thinner than a business card. The "Amount" is typically printed by a machine in a very specific, dot-matrix style font that’s hard to alter without it being obvious. These are limited to $1,000. If you need more, you’re buying two.

The Western Union Version

You’ll find these at pharmacies like Walgreens or Rite Aid. They usually have a more modern look, often with a blue-and-white color scheme and the iconic Western Union logo. They tend to look a bit more like a computerized receipt than a traditional bank check. The security features here include microprinting—tiny words that look like a solid line to the naked eye but reveal text under a magnifying glass.

The MoneyGram Style

Walmart and many grocery chains use MoneyGram. These often have a red or pinkish hue. They are generally smaller than the USPS versions. Because they are printed on-site from a thermal printer, the ink can sometimes look a bit "flat." Be careful with these near heat; the paper can darken if left on a hot car dashboard, making the whole thing unreadable.

👉 See also: Stock Symbol for United Airlines: What Most People Get Wrong

The Part Everyone Forgets: The Receipt

When you buy a money order, the machine doesn't just spit out the payment. It also gives you a stub or a carbon copy. This is your lifeline. If the money order gets lost in the mail or stolen, that little slip of paper is the only way you’re getting your money back. It contains the serial number and the specific office code where it was issued. Without it, you are basically out of luck. Most people just toss it, but you should keep it until you’re 100% sure the person you paid has the cash in their account.

Why Does It Look So Old-School?

It’s 2026. We have instant wire transfers and crypto. Why do we still use these paper relics? Because they bridge the gap for the "unbanked" or for transactions where a stranger doesn't trust your personal check. A personal check can bounce. A money order cannot, because you already paid the cash upfront. It’s a physical manifestation of "I have the money, and here is the proof."

Red Flags: How to Spot a Fake Money Order

Knowing what a money order looks like also means knowing what a fake one looks like. Scammers love using these because people trust them. A fake money order often feels "off." The paper might be too glossy or too thin, like standard printer paper.

Check the edges. Real money orders are perforated. If the edges are perfectly smooth, it might have been cut from a larger sheet of paper on a home printer. Also, look at the numbers. On a legitimate money order, the serial numbers are usually crisp. If the ink looks blurry or the numbers don't align perfectly, walk away.

Another trick: look for the dollar sign. Many high-quality money orders have "security thread" or a "void" pantograph. If someone tries to photocopy a money order, the word "VOID" will often appear across the copy in giant letters, even if it wasn't visible on the original.

Where to Get One and What It Costs

You can’t just print these at home. You have to go to a physical location.

👉 See also: Current BRL to EUR Rate: Why the Brazilian Real is Fighting Back in 2026

- The Post Office: They charge a small fee, usually around $2 to $3, depending on the amount.

- Retailers: Walmart is famously cheap, often under $1.

- Banks: Your own bank will do it, but they might charge you $5 or $10 because they’d rather you use a cashier's check.

- Convenience Stores: 7-Eleven and similar spots often have a Western Union kiosk.

Actionable Next Steps

If you are about to go buy one, here is exactly what you need to do to make sure the process is smooth. First, bring cash or a debit card. Most places will not let you buy a money order with a credit card because it’s a "cash equivalent" transaction.

Second, have the recipient's name spelled correctly. You cannot easily change the name once it’s printed. If you mess up, you usually have to pay another fee to cancel it and get a new one.

Third, fill it out immediately. Do not leave the store until the "Pay to" line is filled. If you walk out and drop it, you've just dropped a stack of cash that anyone can use.

Finally, take a photo of the receipt and the completed money order with your phone. If the physical receipt gets lost, having that serial number in your camera roll can save you weeks of headaches and hundreds of dollars. Money orders might look like a throwback to the 1950s, but they are still one of the most reliable ways to move money when digital options aren't on the table. Keep the stub, check the watermarks, and always use a black ink pen.