You probably think of a tax return as a thick, intimidating stack of papers that smells like a post office. Honestly, it used to be exactly that. But if you’re asking what does a 1040 look like these days, the answer is surprisingly… small. Since the major overhaul back in 2018, the IRS has been trying to make the form look more like a "postcard," even though most of us still end up attaching ten other pages anyway.

It's a two-page document. That’s the core of it. Two pages that summarize your entire financial life for the year. If you look at a 2024 or 2025 version, you'll see it’s surprisingly airy with a lot of white space. But don't let the simplicity fool you. It’s basically the "cover sheet" for your relationship with the federal government.

The First Page: Who You Are and Where the Money Came From

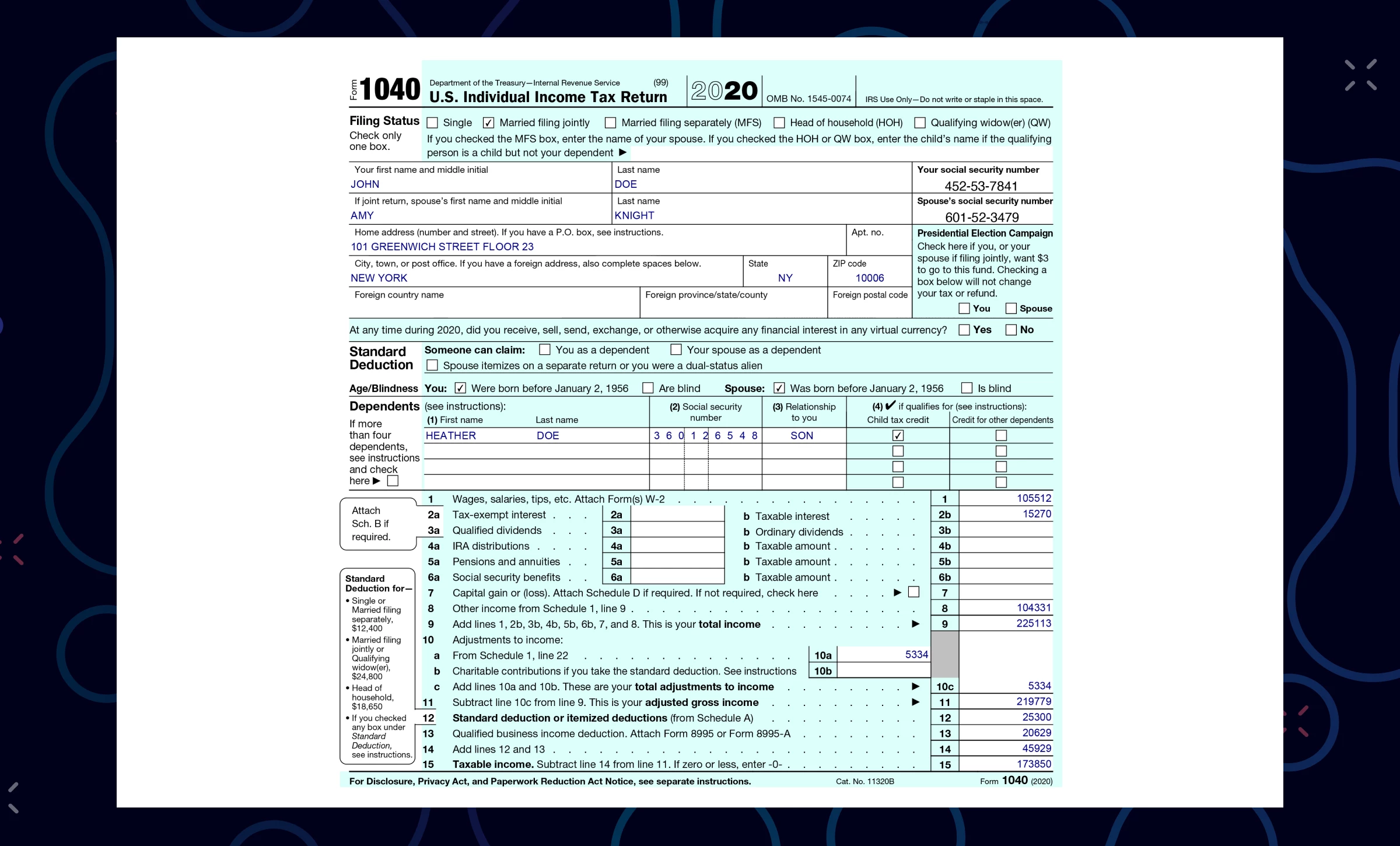

The top half of the first page is pretty standard. It’s your "ID card." You’ve got your name, address, and Social Security number. If you’re filing with a spouse, their info goes there too. Then you’ve got the checkboxes for your filing status—Single, Married Filing Jointly, Head of Household, etc. This part matters more than people think because it dictates your standard deduction.

Right below that is the "Digital Assets" question. This is a big deal now. The IRS wants to know if you received, sold, or exchanged any cryptocurrency. Even if you just bought a few bucks' worth of Bitcoin on a whim, you have to check a box. Ignoring this is a bad move because the IRS is aggressively tracking on-chain data now.

Then we get into the meat: the income lines.

Lines 1 through 9 are where the math starts. Line 1a is usually your W-2 wages. But you’ll also see lines for tax-exempt interest, dividends, and IRA distributions. If you have a side hustle or own a small business, that income doesn't actually show up as a raw number here first; it lives on Schedule C and then migrates over to the 1040. By the time you get to the bottom of page one, you’re looking at your Adjusted Gross Income (AGI). This is the "magic number." It determines if you qualify for credits or if you're too "rich" for certain deductions.

What the Second Page Tells the Government

Turn the page. Now we’re looking at the damage.

The top of page two is where the deductions live. Most Americans take the Standard Deduction. For the 2024 tax year, that was $14,600 for singles and $29,200 for married couples. You subtract that from your AGI, and what’s left is your Taxable Income.

This is where things get a bit messy visually. You'll see a line for "Tax." This isn't just a flat percentage. It’s calculated based on the tax brackets, which are progressive. You might also see numbers from Schedule 2 if you owe "Alternative Minimum Tax" or had to pay back some excess premium tax credits from your health insurance.

Then come the credits. The Child Tax Credit is the big one here. If you have kids under 17, this line is your best friend.

💡 You might also like: Real Estate Agent Stock Photos: Why Your Branding Feels Fake and How to Fix It

Finally, you reach the "Payments" section. This is where you list how much was already taken out of your paycheck throughout the year. If Line 33 (Total Payments) is bigger than Line 24 (Total Tax), congratulations. You’re getting a refund. If not, you’re writing a check.

Why the Design Is Actually Kind of Deceptive

The IRS marketed the "new" 1040 as being simpler. In reality, they just took information that used to be on the main form and shoved it onto "Schedules."

- Schedule 1: For "Additional Income" like gambling winnings or jury duty pay.

- Schedule 2: For additional taxes like Self-Employment tax.

- Schedule 3: For non-refundable credits like the one for child care expenses.

So, while the 1040 looks like a clean two-page document, for anyone with a complex life, it’s just the tip of the iceberg. If you’re a freelancer, your tax return "looks like" a 50-page novella once you include all the supporting documents.

Real-World Example: The "Simple" vs. "Complex" 1040

Let’s look at two people.

Person A: Works a 9-to-5, rents an apartment, has no kids. Their 1040 is pristine. It’s two pages, half-empty, and takes ten minutes to read.

Person B: Works a 9-to-5 but also drives for Uber, has two kids, and sells vintage Pokémon cards on eBay. Their 1040 looks identical to Person A's at first glance. But attached to it is a Schedule C (business profit), a Schedule SE (self-employment tax), and Form 8812 (child tax credit).

When you ask what does a 1040 look like, you have to realize that the "form" is just the summary. The "return" is the whole package.

Common Mistakes People Make When Looking at Form 1040

People often confuse the 1040 with the W-2. Your W-2 is what your boss gives you; the 1040 is what you give the government. Another common trip-up is the signature line. It’s on the bottom of page two. If you’re filing on paper (which, why?), and you forget to sign it, the IRS considers the whole thing invalid. It’s like it never happened.

✨ Don't miss: Queens County NY Property Search: What Most People Get Wrong

Also, watch the "Standard Deduction" boxes. There are tiny checkboxes if you or your spouse are 65 or older or blind. Checking those increases your deduction. It’s free money. People miss it because the font is tiny and it doesn't look like a "money" section.

The Evolution of the Layout

If you found an old 1040 from the 1990s in your attic, you’d barely recognize it. It was dense. No margins. Tiny rows. The current version uses a much larger font and more "human" language. This was a deliberate choice by the IRS to reduce errors. When people can actually read the form, they tend to screw up less.

But even with the better layout, the 1040 is still a legal document. Every line corresponds to a specific part of the Internal Revenue Code. When you sign it, you are swearing under penalty of perjury that every number on those two pages is true.

Actionable Steps for Your Next Filing

Knowing what the form looks like is half the battle. Here is how to handle it without losing your mind.

Grab a copy of last year's return. The IRS rarely changes the line numbers drastically from year to year. If you had a number on Line 8 last year, you probably need one there this year. Comparing the two side-by-side is the fastest way to spot if you’re missing something big, like a dividend statement or a 1099-NEC.

Check the "Refund" section early. Look at Line 34 and 35 on page two. This is where you put your routing and account number. If you want your money fast, double-check these digits. A single typo here means your refund gets mailed as a paper check, which can take weeks or months longer to arrive.

Don't ignore the "Third Party Designee" section. This is a small area near the signature. If you want your CPA or even a knowledgeable family member to be able to talk to the IRS on your behalf about this specific return, you have to name them here. Otherwise, the IRS won't tell them a thing.

Verify your AGI before filing electronically. To "sign" your return digitally, most software will ask for your AGI from the previous year. If you don't have last year's 1040 handy, you might get stuck. Keep a digital PDF of your 1040 saved in a secure spot like a password-protected cloud drive or an encrypted thumb drive.

🔗 Read more: Finding the Uber Office in Bronx: What Drivers Actually Need to Know

The 1040 isn't just a form; it's a map of your financial year. Whether it's the "postcard" version or a beefed-up document with dozens of schedules, it remains the single most important piece of paper you'll deal with every April. Understanding its layout—from the ID section on page one to the refund math on page two—is the best way to stay in the government's good graces and keep as much of your money as possible.