Making money is easy to talk about but remarkably hard to do at scale. If you look at the Fortune 500 or the latest 2026 IBISWorld data, you'll see massive numbers. We're talking trillions. But for most of us, "what businesses make the most money" isn't just a trivia question—it's a roadmap. Honestly, the answer depends on whether you're looking for raw revenue (the big checks) or high profit margins (the money you actually keep).

Some industries are basically "money printers" because they have low overhead. Others, like grocery stores, move billions of dollars but only keep a tiny sliver. It's a weird paradox. You can run a $10 million company and be broke, or a $1 million company and be rich.

The High-Margin Kings: Why Software and Finance Win

If you want to know what businesses make the most money in terms of keeping what they earn, look at Software as a Service (SaaS). It’s almost unfair. Once a developer writes the code for a platform, selling it to the 10,000th customer costs almost nothing. Companies like Microsoft and Adobe have historically maintained net profit margins north of 30%. In 2025, Microsoft's net profit margin sat around 35.7%, a staggering figure for a company of that size.

Finance is the other heavyweight.

Banks and investment firms don't "make" products; they move money. JPMorgan Chase and Goldman Sachs thrive on fees and interest. According to recent 2025-2026 reports, the commercial banking sector in the U.S. is projected to hit over $1.5 trillion in revenue. When interest rates are elevated, these guys basically get a raise without doing extra work.

👉 See also: How Much Do Chick fil A Operators Make: What Most People Get Wrong

But it’s not just the giants. Small-scale "Professional Employer Organizations" (PEOs) and niche consulting firms are currently seeing profit margins as high as 90% in some specific 2026 market segments. Why? Because they sell expertise. Expertise doesn't require a factory or a fleet of trucks.

The Revenue Giants: Volume Over Everything

Then there's the other side of the coin. Total revenue.

Walmart is the perennial king here. They brought in over $680 billion in 2025. It’s a number so large it’s hard to wrap your head around. But their profit margin? It’s usually a razor-thin 2% or 3%. They make money because they sell a billion tubes of toothpaste, not because they make a lot on each one.

✨ Don't miss: ROST Stock Price History: What Most People Get Wrong

Retail and hospitals are the heavy lifters of the economy. UnitedHealth Group and CVS Health are massive revenue engines. In 2026, the health and medical insurance industry is expected to generate upwards of $1.5 trillion. People need healthcare. It’s a non-negotiable expense, which makes these businesses incredibly stable, even if their operations are nightmare-level complex.

The 2026 AI Gold Rush

We have to talk about NVIDIA.

In the last two years, they’ve become the poster child for "what businesses make the most money." Their net profit margin recently hit an insane 53.7%. That is unheard of for a hardware company. They aren't just selling chips; they are selling the "shovels" for the AI gold mine. When every company on earth is trying to build a chatbot or an automation tool, NVIDIA is the one getting paid first.

Real-World Profitable Businesses for Small Operators

Most of us aren't starting the next Google. So, what works for the rest of us?

🔗 Read more: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

- Specialized Consulting: If you know how to integrate AI into a supply chain, you can charge $300+ an hour. The overhead is just your laptop and your brain.

- Real Estate Leasing: Specifically land leasing and industrial storage. IBISWorld lists land leasing as one of the highest-margin sectors in 2026, often exceeding 80% profit because the "product" (the land) doesn't depreciate or require much maintenance.

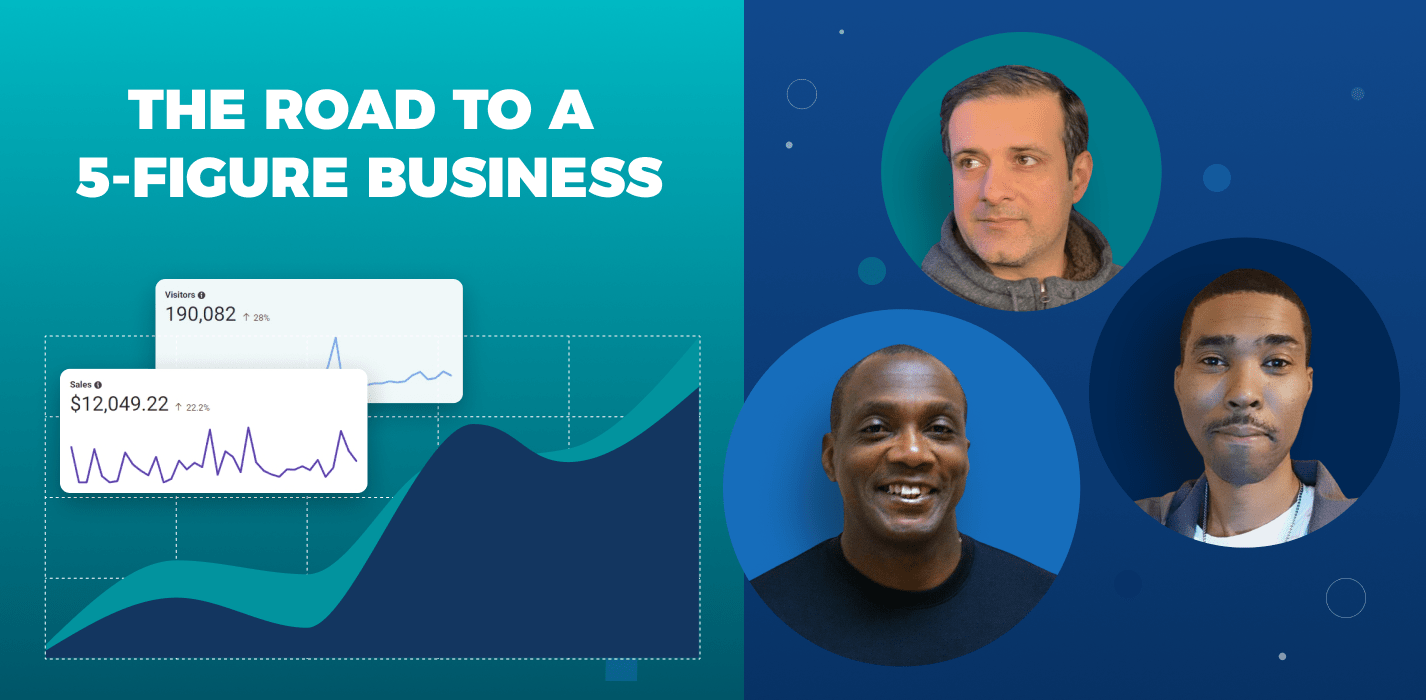

- Niche SaaS (Micro-SaaS): Instead of trying to be the next Salesforce, many entrepreneurs are building tiny tools that solve one specific problem—like a Shopify plugin for eco-friendly packaging—and pulling in $20k a month with zero employees.

- Health Staffing: With an aging population, agencies that find and place nurses are seeing margins over 90% right now. The demand is so high that the "middleman" takes a massive cut.

The Misconception of "Passivity"

A lot of people think the businesses that make the most money are "passive."

That’s a lie.

Real estate requires management. High-margin software requires constant security updates. Even a "cash cow" like a car wash (which can have 40% margins) needs someone to fix the sensors at 2 AM when a pipe bursts.

The most profitable businesses are usually those that solve a "painful" problem. If a business saves another company $1 million, they can easily charge $100,000 for it. That’s value-based pricing, and it’s the secret sauce behind almost every high-margin success story.

Actionable Steps for Choosing a Profitable Path

If you're looking to enter a high-income field, stop looking at "what's cool" and start looking at the math.

- Audit the Margin: Don't just look at revenue. Ask: "After I pay for the product, the marketing, and the staff, how much is left?" If it's less than 10%, you're in a volume game. You'll need to be huge to be rich.

- Focus on B2B: Businesses have larger budgets than consumers. Selling a $5,000 software seat to a law firm is much easier than selling 5,000 $1 apps to teenagers.

- Check the Scalability: Can you double your sales without doubling your staff? If yes, you have a winner. If no, you’ve just bought yourself a very high-paying job.

- Target "Inelastic" Demand: Look at sectors like healthcare, cybersecurity, or essential infrastructure. People pay for these even during a recession.

The landscape is shifting fast. In 2026, the winners are the ones who use technology to stay lean while solving problems that the "big guys" are too slow to touch.