If you’ve ever scrolled through those shiny rankings of the world’s wealthiest spots, you’ve probably seen the same names pop up. Luxembourg. Singapore. Ireland. Maybe Qatar or Switzerland. On paper, these places look like they’re literally paved with gold. But honestly, if you actually flew to Dublin or Luxembourg City right now, would you feel like you're standing in the epicenter of the world's greatest fortune? Kinda, but maybe not in the way the numbers suggest.

Most people asking what are the richest country rankings based on usually get hit with a wall of acronyms. GDP. PPP. GNI*. It’s enough to make your eyes glaze over. But here’s the thing: those numbers are often a total illusion.

Take Ireland, for instance. If you look at the 2026 International Monetary Fund (IMF) data, Ireland's GDP per capita is hovering around $135,000. That’s insane. It’s significantly higher than the United States or even Switzerland. But if you talk to a local in Cork or Dublin, they’ll tell you about a massive housing crisis and a cost of living that’s squeezing the life out of the middle class. So, where is all that "wealth" actually going?

The Giant Accounting Trick: Why GDP Lies to You

To understand what are the richest country stats really telling us, we have to look at how we measure "rich." Usually, it's GDP (Gross Domestic Product) per capita. Basically, you take all the money a country makes and divide it by the people who live there.

Simple, right? Not really.

In places like Ireland and Luxembourg, "all the money the country makes" includes the global profits of massive tech and pharma giants that just happened to park their headquarters there for tax reasons. Think Apple, Google, or Meta. When Apple sells an iPhone in Paris, a chunk of that profit might be recorded in an office in Dublin. It inflates the Irish GDP, but that money doesn't stay in the pockets of Irish citizens. It’s what economists call "Leprechaun Economics."

Actually, the Central Statistics Office in Ireland had to invent a whole new metric called *Modified GNI (GNI)** just to figure out how their economy is actually doing without all the multinational noise. In 2023, the gap was over €219 billion. That’s nearly 40% of their GDP that essentially never touches the local economy.

✨ Don't miss: 40 Quid to Dollars: Why You Always Get Less Than the Google Rate

Luxembourg: The Commuter Kingdom

Then you have Luxembourg. It consistently ranks #1 or #2 globally. Why? It's not just the banks (though there are a lot of those—over 150 at last count). It’s a math quirk.

Luxembourg has a tiny resident population, but every single morning, thousands of workers drive in from France, Germany, and Belgium. Their work adds to Luxembourg's GDP, but since they don't live there, they aren't counted in the "per capita" part of the equation. It makes the country look twice as rich as it actually is.

The 2026 Heavy Hitters: Who Actually Wins?

If we ignore the tax havens for a second and look at where the most money is actually flowing, the list shifts. The United States remains the heavyweight champion in terms of total economic size, with a projected GDP of over $31 trillion in 2026.

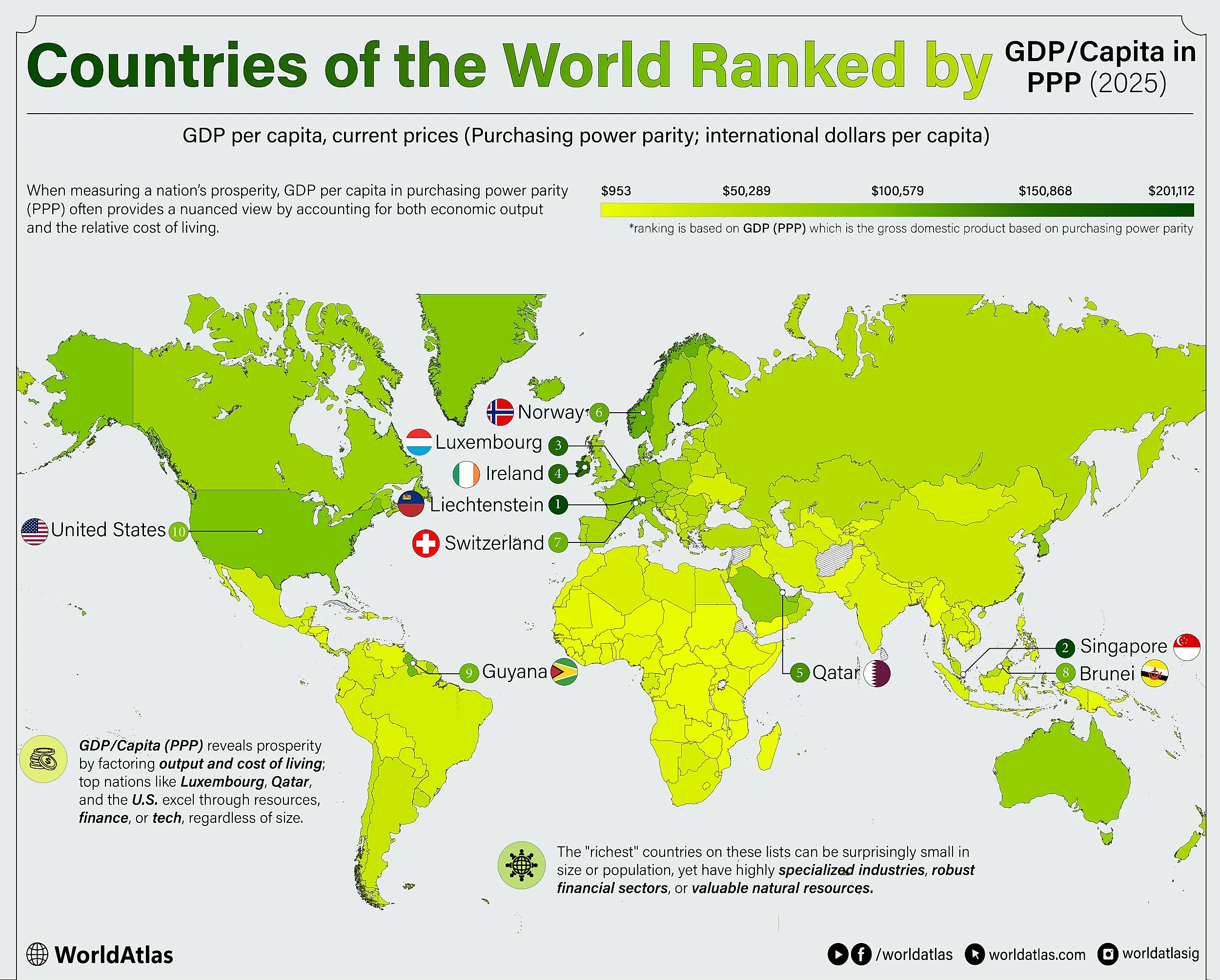

But for regular people, what are the richest country winners often come down to Purchasing Power Parity (PPP). This is basically a "Big Mac Index" on steroids. It adjusts for the fact that a dollar goes much further in, say, Texas than it does in Zurich.

Based on current 2026 projections from the IMF and World Bank, here is how the top of the pile generally looks:

- Luxembourg: Still the king of the "per capita" stats due to its status as a global financial hub and the "commuter effect."

- Singapore: A genuine powerhouse. Unlike the tax havens, Singapore has massive sovereign wealth funds like Temasek and GIC that have stockpiled hundreds of billions. When you land at Changi Airport, you can actually see the wealth in the infrastructure.

- Ireland: Dazzling on paper, but heavily distorted by multinational profit shifting.

- Qatar: Pure resource wealth. With a small population and some of the world's largest natural gas reserves, their per-person yield is through the roof.

- United Arab Emirates: They’ve done a better job than most at diversifying away from oil into tourism, real estate, and tech.

Singapore vs. Everyone Else

Honestly, Singapore is probably the most "real" of the top-tier wealthy small nations. They didn't just invite companies to set up PO boxes; they built a global trading hub. Their GDP per capita PPP for 2026 is estimated around $161,000. Because the government owns so much of the land and invests so heavily in its citizens, the "wealth" feels more tangible there than in the European tax hubs.

🔗 Read more: 25 Pounds in USD: What You’re Actually Paying After the Hidden Fees

The Rise of the New Titans

While the tiny nations fight for the per-capita crown, the global landscape is shifting. India is the one to watch. By 2026, India has officially become a $4.5 trillion economy, overtaking Japan to become the 4th largest in the world.

It’s a weird paradox. India is "rich" as a nation, but because there are 1.4 billion people, the average person is still relatively poor compared to the West. This is why "what are the richest country" is such a tricky question. Are we talking about the power of the government, or the bank account of the average Joe?

- United States: $31.8 trillion (Total GDP)

- China: $20.6 trillion (Total GDP)

- Germany: $5.3 trillion (Total GDP)

- India: $4.5 trillion (Total GDP)

Guyana is another wild story. Thanks to a massive oil boom, they’ve had the fastest-growing GDP in the world recently. In just a few years, they’ve shot up the rankings. It’s a classic example of how "natural resource lottery" can change a country's stats overnight, even if the infrastructure on the ground hasn't caught up yet.

What Most People Get Wrong About Wealth Rankings

You’ve probably seen Switzerland on these lists and thought, "Yeah, that makes sense." And it does. Switzerland is wealthy because of high-value manufacturing—think Rolex, Nestlé, and pharmaceuticals—combined with a world-class banking sector.

But even Switzerland struggles with the "rich country" trap. When your GDP is that high, your prices follow. A coffee in Geneva might cost you $7. A basic lunch? $35. This is why PPP (Purchasing Power Parity) is the only metric that matters for real life. If you make $100k in Luxembourg but your rent is $5k a month, are you actually richer than someone making $60k in a place where rent is $800? Probably not.

The "Hidden" Rich

Some places don't even show up on these lists because they aren't technically independent countries. If you counted Monaco or Bermuda, they’d wipe the floor with Luxembourg. Monaco’s GDP per capita is often estimated over $200,000, but because it’s a tiny principality, it’s frequently left out of the main IMF/World Bank data sets.

💡 You might also like: 156 Canadian to US Dollars: Why the Rate is Shifting Right Now

How to Actually Use This Info

If you’re looking at these rankings because you’re thinking about moving, investing, or just winning a pub quiz, here’s the reality:

First, look at the Gini Coefficient. This tells you how wealth is distributed. A country can be "rich" but have a few billionaires and millions of people in poverty. The UAE and Qatar have massive wealth, but it's not exactly spread evenly among the migrant worker populations.

Second, check the Human Development Index (HDI). This factors in life expectancy and education. A country like Norway might have a lower GDP than a Gulf state, but its citizens often have a much higher quality of life because that money is reinvested into social safety nets.

Actionable Insights for 2026

- For Investors: Look past the headline GDP. Focus on countries with high "Modified GNI" or strong sovereign wealth funds (like Singapore or Norway). These are more stable.

- For Digital Nomads: Look at the gap between Nominal GDP and PPP. You want a country that is "rich" enough to have great Wi-Fi and infrastructure, but where the PPP makes your foreign currency go further.

- For Students of Economics: Keep an eye on the "Leprechaun Economics" debate in the EU. There is a lot of pressure to change how multinational profits are taxed, which could cause the GDP of countries like Ireland to "collapse" on paper overnight, even if the actual economy doesn't change a bit.

Ultimately, the answer to what are the richest country depends entirely on whether you're looking at a map, a spreadsheet, or a bank statement. The numbers on the screen are usually just the tip of a very complicated, very tax-efficient iceberg.

To get a true sense of a nation's prosperity, compare the GDP per capita PPP against the cost of local housing and the quality of public services. A country that ranks 10th but offers free healthcare and low crime is often "richer" for its residents than a 1st-place country where every service is privatized and expensive.