West Red Lake Gold Mines (TSXV: WRLG, OTCQX: WRLGF) is having a moment. Honestly, it's about time. After years of the "Madsen curse" hanging over the Red Lake district in Ontario, things are finally looking different. As of mid-January 2026, the west red lake gold stock price has been on a tear, recently hitting around CA$1.25 on the TSX Venture.

It’s a massive jump from where things were a year ago.

The company just officially declared commercial production at the Madsen Mine on January 1, 2026. This isn't just another corporate press release. It's a signal that Shane Williams and his team might have actually cracked the code on an asset that buried its previous owners. If you’ve followed the "Pure Gold" saga of the early 2020s, you know how rare this is. Back then, the mine was a disaster of cost overruns. Today, WRLG is pulling high-grade ore from the South Austin zone and actually making it work.

Breaking Down the West Red Lake Gold Stock Price Movement

Why is the market suddenly so bullish? Basically, they're hitting their numbers.

In December 2025, the mill averaged 689 tonnes per day. That’s about 86% of its permitted capacity. For a junior miner, hitting 94.6% recovery rates is pretty stellar. When the company announced these results on January 12, 2026, the stock price jumped over 6% in a single session.

Check out the recent price action:

On January 2, 2026, the stock was sitting around CA$1.03. By January 16, it was hitting CA$1.25. That’s a 20% gain in a couple of weeks. Investors are finally starting to believe that this isn't just a "re-run" of the old failures.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

The company ended 2025 with about CA$46 million in cash and gold receivables. That’s a decent cushion. They also generated US$73 million in revenue throughout 2025 during the ramp-up phase. Selling gold at an average price of US$3,650 per ounce certainly helped. With gold prices now flirting with even higher levels in 2026—some analysts at J.P. Morgan are eyeing $5,000 gold by year-end—the leverage here is intense.

The Madsen Mine Turnaround: What Changed?

The biggest difference between now and 2022 is the geology. Or rather, the understanding of the geology.

WRLG’s management didn’t just flip a switch. They did 90,000 meters of infill drilling. They shrunk the drill spacing from 20 meters down to about 7 meters. In plain English? They actually know where the gold is now. They aren't "chasing ghosts" like the previous operators did.

- The 4447 Zone: This is the "jewelry box." It’s a high-grade area in South Austin.

- Grade Reconciliation: Their bulk sample reconciled within 1% on grade. That is unheard of in complex narrow-vein mining.

- Shaft Integration: The shaft is nearing full operation, which should drop hauling costs significantly.

The west red lake gold stock price reflects this operational de-risking. Analysts at Alpha Spread and Fintel have been moving their price targets higher, with some 1-year forecasts reaching as high as CA$2.63. Of course, that assumes gold stays hot and the mill doesn't hit any major mechanical snags.

What Most People Get Wrong About WRLG

Kinda funny how people think this is just a one-trick pony with the Madsen Mine. It isn't.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

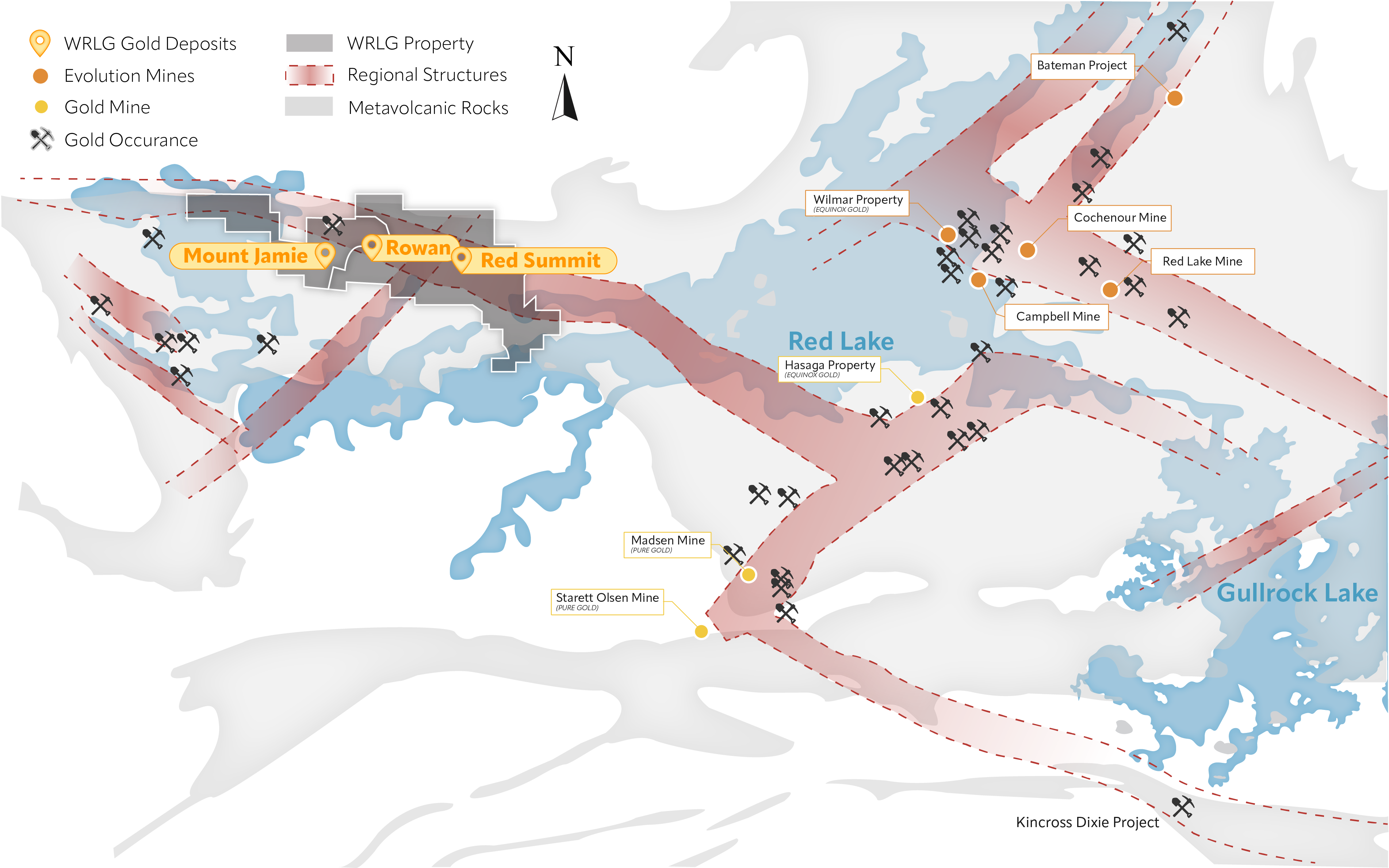

While everyone is staring at the mill throughput at Madsen, the company is quietly drilling at the Rowan Property. Rowan has some of the highest-grade intercepts in the district. We’re talking 26.16 g/t Au over 11 meters. They’re planning a joint Madsen-Rowan pre-feasibility study (PFS) for Q3 2026.

The goal? A 100,000-ounce-per-year production hub.

If they pull that off, the current market cap of around CA$490 million starts to look a bit small. Most mid-tier producers with that kind of output trade at much higher valuations. But—and there's always a "but" in mining—they still have to prove they can sustain it. The market is littered with miners who had a great first quarter and then hit a "bad patch" of geology in the second.

Analyst Sentiment and Risk Factors

Wall Street (and Bay Street) seems to be in a "wait and see" mode that is slowly turning into "FOMO."

- Buy Signals: Moving averages are currently giving a strong "buy" signal. The short-term average is well above the long-term trend.

- Support Levels: If there’s a pullback, traders are looking for support around CA$1.05 or $0.81 (on the OTCQX).

- The "Gold" Tailwinds: You can't talk about the west red lake gold stock price without talking about the macro environment. With central banks continuing to hoard gold, the floor for the metal feels very solid.

There is still risk, obviously. Shareholders have been diluted over the past year to fund the restart. If the company needs another big capital raise before reaching free cash flow, that could cap the upside. Also, the mining industry in Ontario is facing the same labor and inflation pressures as everyone else.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

Actionable Insights for 2026

If you're looking at West Red Lake Gold, don't just watch the daily ticker.

Watch the Q1 2026 guidance. The company is expected to release its official production targets any day now. If they guide for a significant ramp-up toward mid-2026, the stock might not stay at $1.25 for long.

Keep an eye on the "904 Complex." Management has mentioned this is a new high-grade area that looks similar to the 4447 zone. If they can replicate the success of 4447 in other parts of the mine, the "life of mine" (LOM) estimates will likely get a massive upgrade.

For those trading the U.S. ticker (WRLGF), the graduation to the OTCQX in late 2025 has improved liquidity. It's much easier for institutional players to jump in now than it was six months ago.

Next Steps for Investors:

- Monitor the Q1 Guidance: This will be the "make or break" document for the 2026 fiscal year.

- Watch the Gold Price: Junior miners are basically high-beta versions of the gold price. If gold drops, WRLG will drop harder. If gold flies, expect WRLG to outperform.

- Check Grade Reconciliation Reports: The company has been very transparent about how the actual mined grade compares to their models. If this stays within 5%, the management team is doing their job.

The west red lake gold stock price is finally reflecting a company that has transitioned from a "developer with a dream" to a "producer with a plan." It’s a rare turnaround story in a district known for breaking hearts.