Ever feel like the "big banks" are just a monolith of red and green lines? Honestly, if you've been watching Wells Fargo (WFC) lately, you know it's a bit more complicated than that. Most analysts are staring at the same charts, but they’re missing the shift that happened last June when the Federal Reserve finally took the "emergency brake" off.

For years, Wells Fargo was stuck in a regulatory penalty box. That $1.95 trillion asset cap was basically a cage. But we’re in 2026 now, and that cage is open. The wells fargo stock forecast for this year isn't just about interest rates; it’s about a bank that’s finally allowed to grow again for the first time in nearly a decade.

The stock is hovering around $96 right now. Some people think it’s tapped out after a massive run in 2025, but the "smart money" is looking at the $100 to $113 range. Why the gap? Because the market is still trying to figure out if CEO Charlie Scharf can actually turn this into a growth machine or if it’s just a leaner version of the old, scandal-plagued bank.

The Asset Cap Is Gone, But the Homework Isn’t

For those who didn't follow the drama, the Fed's asset cap was a punishment for the 2016 fake-accounts scandal. It meant Wells Fargo couldn't grow its balance sheet. If you can't grow your assets, you can't really grow your profits beyond a certain point.

Last year changed everything. With the cap lifted, Wells Fargo is now aggressively poaching talent from JPMorgan and Morgan Stanley. They aren't just trying to be a mortgage bank anymore. They want to be a top-five global investment bank. They already jumped to ninth in M&A advising globally, helping out on massive deals like the Netflix-Warner Bros. Discovery merger.

It’s kind of a big deal.

🔗 Read more: Philippine Peso to USD Explained: Why the Exchange Rate is Acting So Weird Lately

When you look at the wells fargo stock forecast, you have to factor in this "new" revenue stream. Investment banking fees are volatile, sure, but they offer a much higher ceiling than just collecting interest on car loans. Barclays recently slapped a $113 price target on the stock, which is pretty bold considering where it sat two years ago.

Rates are falling, and that’s a double-edged sword

The Fed has been busy. We’re looking at a Fed funds rate that’s likely to land between 3.00% and 3.25% by the end of 2026. Normally, lower rates hurt banks because they earn less on the spread between what they pay you for your savings and what they charge for a loan (Net Interest Income, or NII).

- The Downside: Wells Fargo is "asset-sensitive." When rates drop, their income from loans usually drops faster than their cost for deposits.

- The Upside: They have a lever that JPMorgan and BofA don't—the ability to grow the size of the pie. Even if the "slice" of profit per dollar is smaller because of lower rates, they can now hold more dollars.

Basically, they’re making up for lower margins with higher volume. It’s a classic pivot.

Why the $100 Level is a Psychological Battleground

If you look at the consensus, the median target is sitting right around $100.50. It’s a big, round number that investors love to get stuck on.

But check this out: The Zacks consensus for Q4 2025 earnings (which they report tomorrow, January 14) is $1.66 per share. That’s a nearly 17% jump from a year ago. If they beat that and give a sunny outlook for 2026, $100 will be in the rearview mirror by February.

💡 You might also like: Average Uber Driver Income: What People Get Wrong About the Numbers

However, Morningstar is still a bit skeptical. They’ve got a 2-star rating on WFC, arguing that the market might be over-extrapolating how much growth is left. They think the "easy money" has been made and that the stock is slightly overvalued compared to its long-term fundamentals. It’s a fair point. You can’t ignore that the stock has outpaced the broader banking ETF (KBE) by a significant margin recently.

The Expense Game

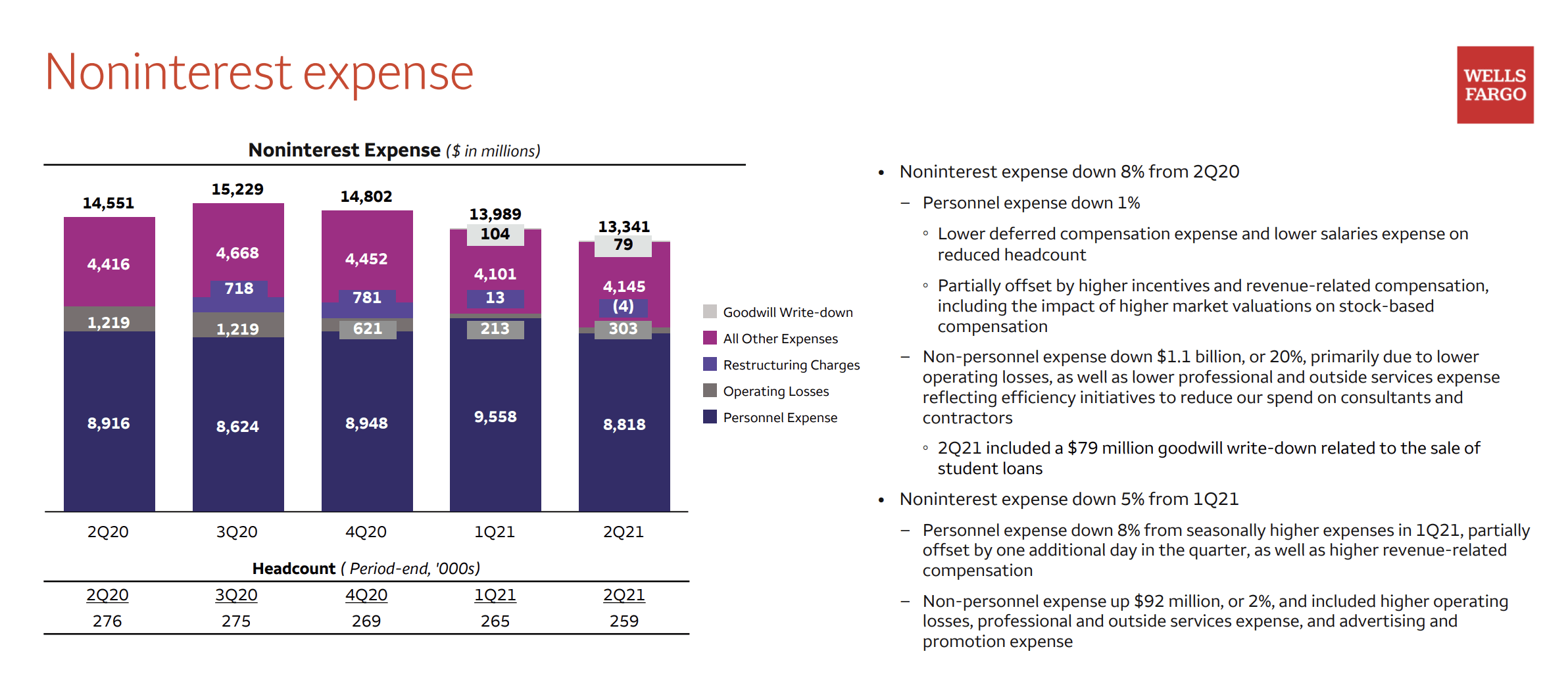

Wells Fargo is obsessed with cutting fat. They are aiming for $15 billion in gross expense savings by the end of this year. They’re closing branches and using AI to automate back-office work that used to take thousands of humans to do.

Efficiency is the name of the game. If they can keep expenses flat while finally growing their assets, the "operating leverage" is going to be a massive tailwind for the stock price.

Real Risks Nobody Wants to Talk About

Let’s be real for a second. It’s not all sunshine and buybacks. There are three big things that could wreck the wells fargo stock forecast for 2026:

- The New Fed Chair: Jerome Powell’s term ends in May. A new leader at the Fed could change the rules of the game entirely, either by slowing down rate cuts or getting tougher on bank capital requirements.

- Consumer Stress: Credit card delinquencies are creeping up. The Zacks estimate for total non-accrual loans is around $8 billion. People are starting to feel the pinch of "higher for longer" inflation, even if interest rates are coming down.

- The "Scandal" Hangover: While the asset cap is gone, the "consent decrees" aren't all finished. If Wells Fargo trips up on a compliance issue again, the regulators will come down on them like a ton of bricks.

What This Means for Your Portfolio

If you're holding WFC or thinking about it, here is the breakdown of what to actually do with this information.

📖 Related: Why People Search How to Leave the Union NYT and What Happens Next

Don't just look at the ticker price. Look at the Return on Tangible Common Equity (ROTCE). Management just bumped their target to 17%-18%. That is a significant jump from their previous 15% goal. If they hit those numbers, the stock isn't just a "hold"—it's a core financial position.

Keep an eye on the January 14th earnings call. Specifically, listen for "NII guidance." If they say Net Interest Income will be flat or growing despite rate cuts, that is your signal that the asset growth is working.

Next Steps for Investors:

- Check the Q4 Earnings Release: Specifically look for the "Non-Interest Expense" line. If it’s above $13.5 billion, the efficiency story might be hitting a wall.

- Monitor the Yield Curve: A "steepening" curve (where long-term rates are much higher than short-term rates) is the best-case scenario for Wells Fargo's profit margins.

- Set a Trailing Stop: Given the volatility expected in the first half of 2026 due to the Fed transition, protecting your 2025 gains is just common sense.

The bottom line? Wells Fargo is finally playing on a level field. It’s no longer a "distressed" asset; it’s a growth stock disguised as a sleepy old bank. Whether it hits $110 or falls back to $85 depends entirely on if they can stay out of their own way while the Fed keeps the liquidity flowing.