You're sitting at your kitchen table, staring at a stack of mail that feels heavier than it actually is. One of those envelopes has the red stagecoach logo on the corner. Your stomach drops. If you're behind on payments or sensing a financial storm on the horizon, the phrase Wells Fargo mortgage loan modification probably sounds like a lifeline and a labyrinth all at once. Honestly, it is both.

People think a modification is just a simple "fix" where the bank waves a magic wand and your payment drops by half. It isn't. It’s a grueling, document-heavy chess match between you and a massive financial institution. But here is the reality: Wells Fargo does not actually want your house. Foreclosure is expensive, messy, and bad for their bottom line. They would much rather have you paying something than paying nothing while they try to sell a vacant property in a volatile market.

The Brutal Truth About Why Your Application Gets Stuck

Most people assume the bank denies modifications because they’re greedy. While banks aren't charities, the real reason for most denials is actually "incomplete documentation." It sounds like a bureaucratic excuse, but it’s the truth. You send 48 pages; they say they only got 47. You send a bank statement from December; they wanted the one that ended on January 5th.

📖 Related: 2050 target date fund: Is it actually enough to retire on?

Wells Fargo uses a specific set of internal engines to determine if you qualify. They’re looking at your Debt-to-Income (DTI) ratio. If your mortgage payment—including taxes and insurance—is significantly higher than 31% of your gross monthly income, you’re in the "sweet spot" for a modification. If it’s already lower than that, they’ll likely tell you that you don't have a "hardship" that qualifies, even if you feel like you're drowning.

Then there is the Net Present Value (NPV) test. This is a cold, hard calculation. The computer compares how much money the bank makes if they modify your loan versus how much they make if they just take the house and sell it tomorrow. If the modification loses them more money than the foreclosure, you’re going to get a rejection letter. It’s not personal. It’s math.

Flex Modification vs. Internal Wells Fargo Programs

There isn't just one "modification." That’s a huge misconception. Depending on who owns your loan—Fannie Mae, Freddie Mac, the FHA, or if Wells Fargo kept it on their own books—the rules change completely.

If you have a conventional loan owned by Fannie or Freddie, you’re likely looking at a Flex Modification. This is a standardized industry program. It usually aims for a 20% payment reduction. They do this by stretching your loan term out to 40 years (480 months) and potentially lowering your interest rate to a "market rate" set by the agencies.

For those with FHA loans, the rules are even more rigid. The FHA Loss Mitigation Waterfall is a step-by-step process. First, they check if you can handle a "Standalone Partial Claim," where the government basically gives you a zero-interest loan to pay off your arrears. If that doesn't work, then they move toward a formal modification.

Wells Fargo also has "proprietary" or internal programs for the loans they own themselves. These are the wild west. Because they aren't bound by federal agency rules for these specific loans, they have more flexibility—or less, depending on the current corporate policy. You have to ask your "Single Point of Contact" (SPOC) specifically which program you are being evaluated for. If they can't tell you, they aren't doing their job.

The Paperwork Nightmare (And How to Survive It)

You need to become a librarian of your own life. Wells Fargo will ask for a "Request for Mortgage Assistance" (RMA) package. This is your bible.

- The Hardship Letter: Don't write a novel. Don't blame the economy or politics. Be clinical but honest. "I was laid off on March 12th, stayed unemployed for four months, and started a new job on July 1st at a 20% lower salary." That is what an underwriter needs to see.

- Income Verification: If you’re self-employed, God help you. You’ll need a Profit and Loss (P&L) statement. Wells Fargo underwriters are notoriously picky about P&Ls. If the math doesn't perfectly match your bank deposits, they will flag it for fraud or inconsistency.

- The 30-Day Rule: Everything has an expiration date. Your paystubs and bank statements are usually "stale" after 30 days. If the bank takes 31 days to review your file, they will ask for the new ones. This creates a loop of doom where you are constantly sending mail. To break it, upload everything digitally through the Wells Fargo online portal and call them 24 hours later to confirm receipt.

Why the Trial Period is a Trap (Sorta)

If you get approved, you'll likely start with a "Trial Period Plan" (TPP). This is usually three months. You pay the new, lower amount. If you miss one payment—even by a day—the whole thing is cancelled.

But here’s the kicker: making trial payments does not mean you are officially modified. You are still technically in default during the trial. The bank is "testing" you to see if you can actually afford the new number. Only after the third payment is made and you sign the final modification documents (which must be notarized) is the deal done. Do not go out and celebrate by buying a new car the moment you get a trial offer. Your credit score is still under a microscope.

The "Zombie" Foreclosure Risk

Sometimes, Wells Fargo will move forward with foreclosure proceedings while simultaneously reviewing your modification application. This is called "Dual Tracking." Federal law (Regulation X under the CFPB) technically prohibits this in many cases, but "technicalities" happen.

If you receive a notice of a sale date while you are in active review, you need to scream. Call your SPOC. If they don't help, file a complaint with the Consumer Financial Protection Bureau (CFPB) immediately. Nothing moves a bank faster than a federal inquiry hitting their compliance desk. It's often the only way to get a human to actually look at a file that has been stuck in the automated system for months.

Practical Steps to Get Your Modification Approved

Don't just wait for the bank to call you. They won't. Or if they do, it'll be a collections agent, not a loan specialist.

- Determine your owner. Go to the Fannie Mae or Freddie Mac "Loan Lookup" tools online. If they don't own it, it’s likely FHA or a Wells Fargo portfolio loan. Knowing this tells you which "waterfall" of rules you have to follow.

- Request a "Single Point of Contact." By law, they have to assign you one. Get their direct extension. If they "leave the company" (which happens a lot), demand a new one immediately.

- Fax and Upload. Never just mail things. Use the online portal and keep the confirmation receipts. If you fax, keep the "Success" transmission report. These are your receipts for when they inevitably say they didn't get your documents.

- Check your DTI. If your income is too high, you won't get a lower payment. If it's too low, they'll say you can't sustain the loan. You need to show that you have enough left over after the mortgage to pay for food, gas, and electricity, but not so much that you look like you're just trying to get a cheaper rate for fun.

- Look into the Homeowner Assistance Fund (HAF). Many states still have "HAF" money left over from federal grants. This money can be sent directly to Wells Fargo to "restate" your loan or pay down the principal before you even start the modification process. It makes the bank's math much easier.

Is it worth the headache?

Usually, yes. A successful Wells Fargo mortgage loan modification can drop an interest rate from 7% down to 4% or 5%, and it can wrap all those missed payments (the "arrears") into the back of the loan so you aren't required to pay $20,000 upfront.

However, be aware of the "balloon." Some modifications don't forgive the money you owe; they just move it to the end of the loan as a non-interest-bearing principal forbearance. This means when you sell the house or finish the 40-year term, you might owe a big lump sum. It's a "future you" problem, but it's better than an "evicted you" problem today.

The key is persistence. This is a war of attrition. The bank wins if you get frustrated and stop sending papers. You win if you stay on the phone, stay organized, and refuse to let your file sit on a desk for more than 48 hours without a check-in. It’s exhausting, but keeping your home usually is.

✨ Don't miss: 1 INR to PKR: Why the Exchange Rate is Doing This Right Now

Next Steps for Homeowners:

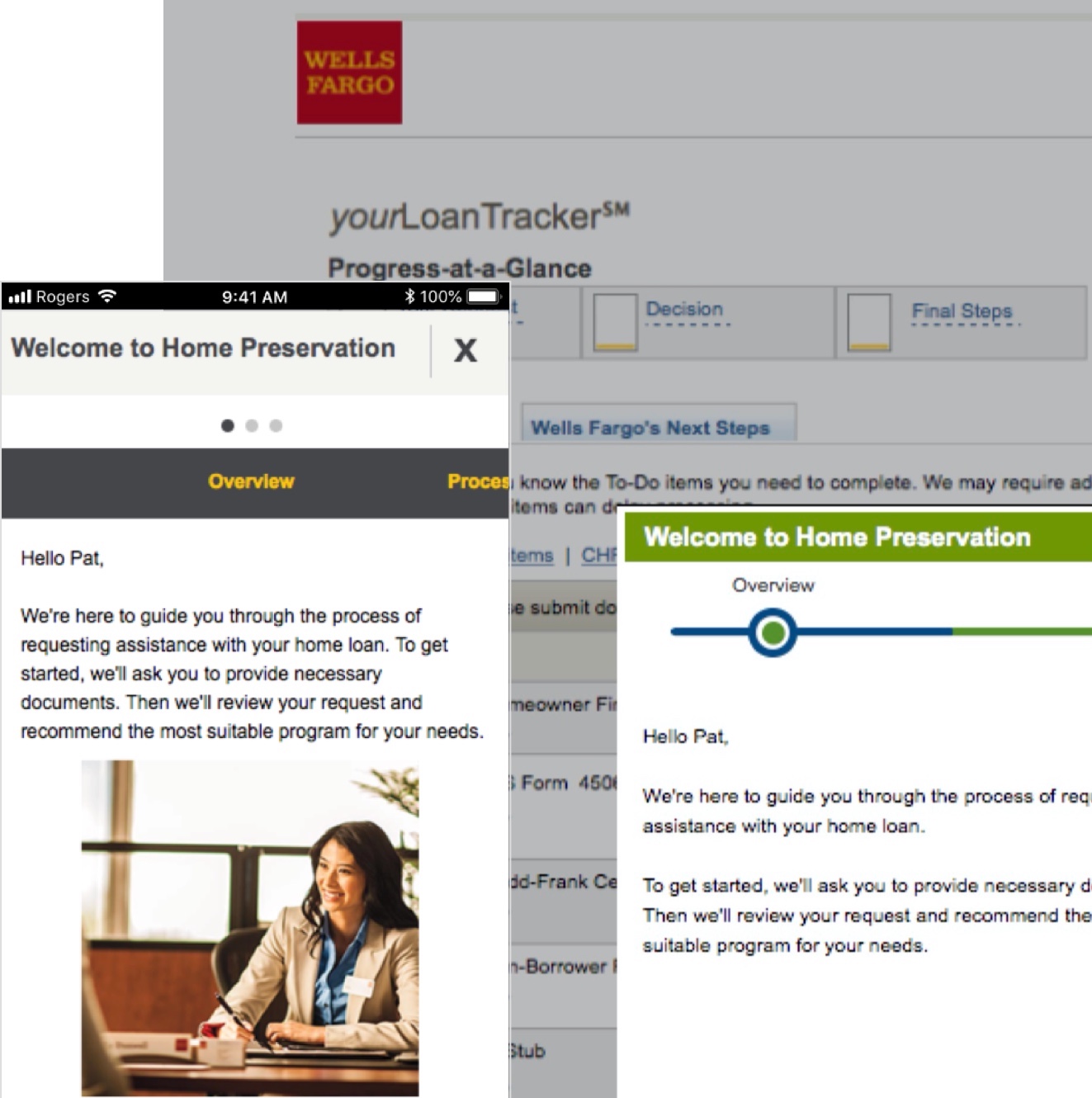

Audit your last three months of bank statements to ensure your "disposable income" aligns with the bank's hardship requirements. Then, log into the Wells Fargo Mortgage portal to see if a "pre-approved" workout plan is already sitting in your documents tab—sometimes the system generates these before you even ask. If not, call the loss mitigation department and specifically ask for an "RMA Starter Kit" to be emailed to you today.