You've probably been there: standing in a grocery line, wondering if that last-minute Target run actually cleared your account. Or maybe you're sitting on your couch and realize you forgot to mail a check for your kid’s field trip. Honestly, banking used to be a chore involving driving and waiting, but the Wells Fargo mobile app for iPhone basically turns your pocket into a full-service branch. It’s not perfect, but it’s come a long way from the clunky interfaces of the early 2010s.

Let’s get real. Most people just want an app that doesn't crash when they're trying to move money. In early 2026, the landscape for mobile banking is crowded, yet Wells Fargo has managed to keep its iOS experience relatively high-rated, currently sitting at around a 4.9 on the App Store with millions of reviews. That's a lot of opinions.

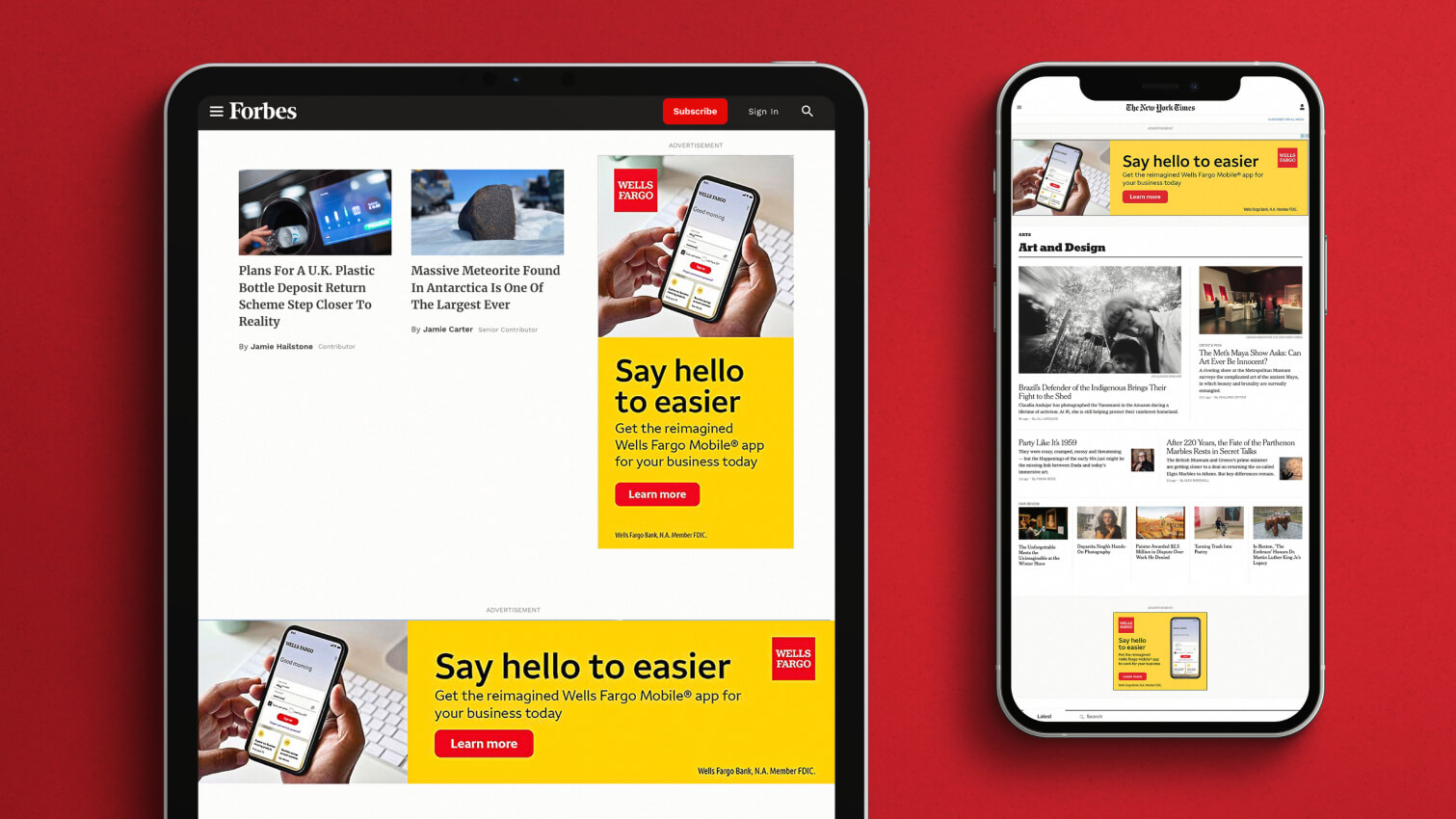

What’s Actually New in the Wells Fargo Mobile App for iPhone?

Banking apps tend to iterate slowly. However, if you haven’t updated your Wells Fargo mobile app for iPhone lately, you might notice the "Fargo" virtual assistant is front and center. It’s not just a basic chatbot; it actually sifts through your transaction history to tell you things like, "Hey, your Netflix subscription went up by two bucks."

The layout recently saw a refresh too. It's cleaner. You’ve got three main tabs now: accounts, pay & transfer, and a dedicated "Security Center." They finally realized that burying the "lock my card" button under five menus was a terrible idea.

🔗 Read more: Finding the Right MacBook Air A1466 Charger Without Fried Logic Boards

The Rise of Fargo

Fargo is their answer to Bank of America’s Erica. It works in English and Spanish. You can literally type "Show my routing number" or "Find my Amazon charges from last month," and it pops up. It's surprisingly decent at understanding conversational language, though it can still get a bit confused if you ask something too complex like "Should I buy this house?" Stick to the basics, and it’s a time-saver.

Dealing With the "Glitch" Reputation

Is the app perfect? Kinda, but no. While many users like BLively55 on the App Store praise it for being "seamless," others have pointed out that the auto-capture for mobile check deposits can be a bit finicky. You have to have the lighting just right, or it simply won't trigger.

There's also the issue of "pending" transactions. Some users have reported that the app takes a while to reflect the true balance after a weekend of heavy spending. This isn't necessarily an app bug—it's how banks process data—but it can be frustrating when you're trying to avoid an overdraft.

Pro Tip: If the app feels sluggish, check if you're running at least iOS 16. The newer builds of the Wells Fargo app are optimized for the latest iPhone hardware, and older operating systems might struggle with the animations.

Security Features That Actually Matter

Security is usually boring until someone steals your identity. Wells Fargo has leaned heavily into the iPhone’s native hardware to prevent that.

- Face ID and Touch ID: You can skip the password entirely. It’s fast.

- The Kill Switch: If you lose your card at a bar, you can "Turn Card Off" instantly in the app. If you find it in your jeans the next morning, you just toggle it back on.

- Mobile Token: For people doing high-value transfers or business banking, the app generates a one-time RSA SecurID code. This replaces those old physical key fobs people used to carry on their keychains.

The iOS Exclusive Perks

There are some things the Wells Fargo mobile app for iPhone does that just feel better than the web version. For example, the iOS-only "Real-time Credit Card Balance" view. You can actually see your balance without even fully logging in if you set up the widget correctly.

Then there’s the Apple Wallet integration. You don't have to manually type in your 16-digit card number. You just go to "Card Settings," tap "Digital Wallet," and it pushes the data to Apple Pay. It takes about thirty seconds.

💡 You might also like: Flex fuel vehicles: What most people get wrong about these engines

Why People Stick With It

Many long-term customers, like Thomas 0120, stay because of the balance between the "home branch" feel and the digital convenience. You can still find a physical location through the app’s GPS map if you need a notary or a cashier's check, but for 99% of your life, you never have to see a teller.

Practical Steps to Master the App

If you're just getting started or want to optimize how you use the Wells Fargo mobile app for iPhone, don't just let it sit there.

- Set up Push Notifications for "Large Purchases." Set the threshold to something like $100. It’s the fastest way to catch fraud before it ruins your week.

- Use the "Total Spending" feature in Fargo. It categorizes your coffee, rent, and gas. It’s an easy way to see where your money is actually leaking.

- Link your Zelle account immediately. It’s built into the "Pay & Transfer" tab. Don't wait until you're trying to split a dinner bill to figure out the setup.

- Check your FICO Score. It’s free in the app and updates monthly. It won't hurt your credit to check it here.

Move your most-used accounts to the top of the home screen by hitting "Edit" in the top corner. This way, you see what matters most the second the Face ID clears. If you're tired of the default look, Wells Fargo even lets you order custom debit cards through the app, which is a nice touch for a bit of personalization.

The app is a tool. It's meant to save you time, not be a destination. Once you've checked your balance and sent that Zelle, close it out and get back to your day. The security session will end automatically, keeping your data locked down until the next time you need it.