So, you’re looking at your bank statement and there it is—that pesky charge. If you’ve noticed a $15 monthly service fee on your Wells Fargo Everyday Checking account, you aren’t alone. Honestly, it’s one of those things that can really sneak up on you if you aren't watching the fine print.

For a long time, this fee was $10. But as of late 2025, Wells Fargo bumped it up. Now, staying "fee-free" requires a bit more intentionality than it used to. Let’s break down exactly what this fee is, why it probably changed for you, and—most importantly—how to make it disappear.

The Reality of the $15 Monthly Service Fee

Basically, the Wells Fargo Everyday Checking fee is the "rent" you pay for the bank to hold your money and give you access to things like checks, the mobile app, and their ATM network. While $15 might not sound like a deal-breaker, it adds up to **$180 a year**. That’s a few nice dinners or a decent chunk of a car payment just for the privilege of having a bank account.

The bank actually rolled out these changes in two phases starting in October 2025. First, they made the requirements to waive the fee harder. Then, in November 2025, they increased the actual dollar amount of the fee.

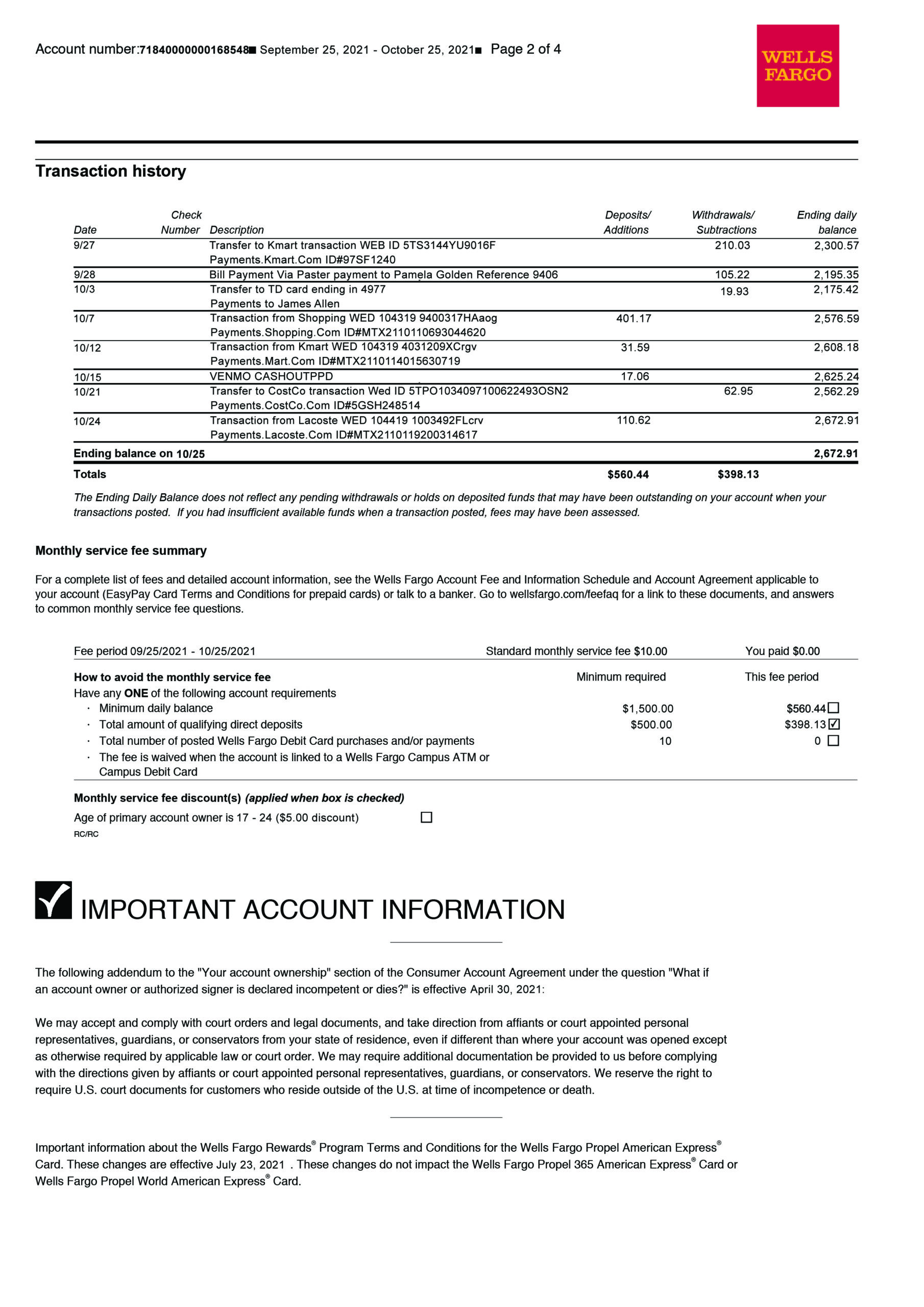

If you're wondering why you suddenly got hit with a charge when you never used to pay one, it’s likely because the minimum daily balance requirement tripled. It went from a manageable $500 to a much steeper **$1,500**.

Five Real Ways to Waive the Fee

The good news? You don't actually have to pay this. Wells Fargo gives you several "out" clauses. If you meet even one of these during your monthly "fee period" (which is basically your statement cycle), they’ll waive that $15 automatically.

1. The Direct Deposit Route

This is usually the easiest way for most people. You need a total of $500 or more in qualifying electronic deposits. This means your paycheck, Social Security, or government benefits.

Kinda important to note: moving money from your Venmo or PayPal usually won't count. It has to be a real ACH transfer or an "Instant Payment" via the RTP network.

2. The $1,500 Daily Balance

If you can keep at least $1,500 in the account at all times, the fee goes away. But be careful here. It’s a minimum daily balance. If your account dips to $1,499 for even one hour on a Tuesday because a bill hit early, you're on the hook for the full $15.

3. The Youth and Student Waiver

Are you between the ages of 17 and 24? If so, you're in luck. The fee is $0 for you. You don’t have to do anything special; the bank just looks at the primary account holder's birthdate. Once you hit 25, though, the standard rules apply, so keep an eye on that birthday.

4. Combined Balances

Maybe you don't keep $1,500 in checking, but you have a savings account or some investments with Wells Fargo Advisors. If your combined balance across all eligible Wells Fargo accounts is **$5,000 or more** on the last business day of the fee period, they’ll waive the fee.

5. Military Benefits

For those in the military, specifically using the Wells Fargo Worldwide Military Banking program, a qualifying non-civilian military direct deposit will also kill the fee.

What Happens if You Overdraw?

The monthly fee isn't the only way Wells Fargo makes money. They also have a $35 overdraft fee.

They do have a feature called "Extra Day Grace Period." It’s actually pretty helpful. If you overdraw your account on a Tuesday, you have until midnight the next business day to get your balance back to $0 (or higher) to avoid the fee. It's not a free pass, but it gives you a tiny bit of breathing room if you accidentally mistimed a transfer.

🔗 Read more: Adobe Systems Stock Price: What Most People Get Wrong About the Creative Giant

Is Everyday Checking Still Worth It?

Honestly, it depends on how you use it. If you need a physical branch to visit and you easily meet the $500 direct deposit requirement, it’s a solid, "old-school" bank account.

But if you’re constantly struggling to stay above that $1,500 balance or you don't have a steady $500 paycheck coming in, you might be better off looking elsewhere. Wells Fargo has another account called Clear Access Banking. It’s a "no-check" account with a lower **$5 fee** that’s even easier to waive—you only need $250 in direct deposits or to be under 24.

Other banks (especially online ones like Ally or Capital One) often have no monthly fees at all. No hoops to jump through, no minimum balances. Just something to think about if you're tired of watching your statement like a hawk.

How to Audit Your Account Right Now

If you want to stop the bleeding, do these three things today:

- Check your statement: Look for the "Monthly Service Fee Summary" section. It literally tells you how close you are to waiving the fee.

- Adjust your direct deposit: If you're getting $450 deposited, see if you can shift another $50 from your paycheck to this account to hit that $500 threshold.

- Set a balance alert: Use the Wells Fargo app to send you a text if your balance drops below $1,550. That $50 buffer is your "safety zone" so you don't accidentally trigger the fee.

Staying on top of your Wells Fargo Everyday Checking fee is really just about knowing which "bucket" you fall into. Once you pick your waiver strategy, it becomes second nature.