The year is 2026, and the world is finally witnessing what many thought was impossible: a Berkshire Hathaway without Warren Buffett at the day-to-day controls. It’s a weird feeling. On January 1st, Greg Abel officially took over as CEO, ending a 55-year run that basically redefined how we think about wealth.

But here’s the thing. Most people looking at warren buffett berkshire stock right now are asking the wrong questions. They're obsessed with the "Oracle" leaving, but they're missing the massive, $380 billion elephant in the room.

The Cash Hoard Is a Warning, Not Just a Safety Net

Honestly, the biggest mistake you can make is assuming Berkshire is just a collection of companies like Geico or See’s Candies. It's not. It's a capital allocation machine. Right now, that machine is sitting on a cash pile so big—roughly $381.7 billion as of the most recent filings—that it could literally buy several Fortune 500 companies in cash.

Why hasn't he spent it?

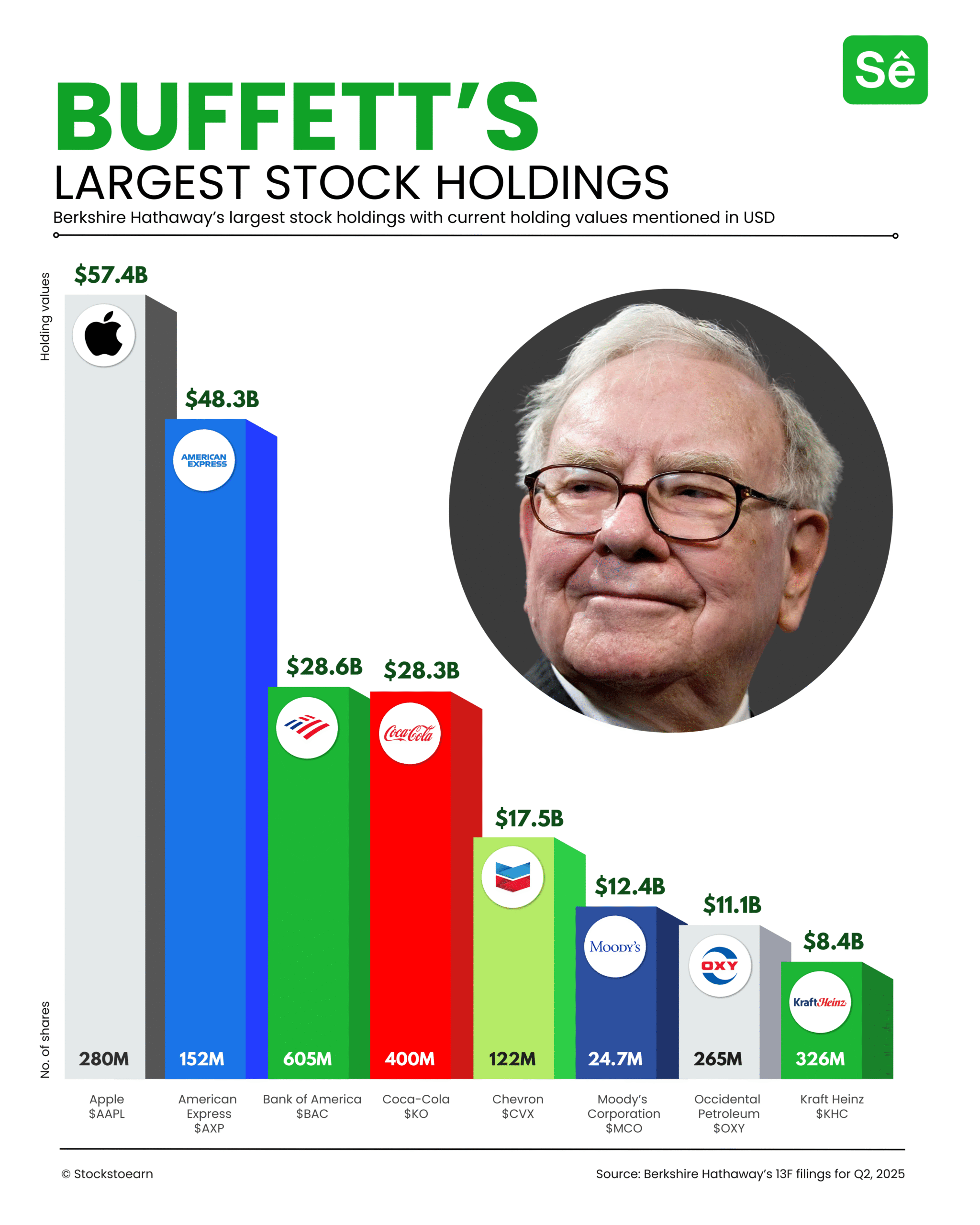

Buffett spent his final year as CEO being a net seller of stocks. He slashed the Apple position from nearly $200 billion down to around $60 billion. He trimmed Bank of America. He stayed away from the AI frenzy.

📖 Related: Inside 2050 N Stemmons Fwy Dallas TX 75207: The World Trade Center Dallas Explained

When the S&P 500 Shiller CAPE ratio—a metric Buffett watches like a hawk—hits 39, he doesn't see a "new era." He sees a bubble. Most retail investors are chasing the "Magnificent Seven," but the smartest guy in the room spent 2025 building a fortress. This isn't just "playing it safe." It's a silent alarm.

He's waiting for a crash. Or at least a correction.

What Most People Get Wrong About Greg Abel

There's this persistent myth that once Buffett steps back, Berkshire will suddenly start acting like a "normal" company. People expect a dividend. They expect aggressive tech buys.

You’ve gotta be kidding.

Greg Abel has been in the Berkshire orbit for 26 years. He’s not a "new guy." He’s the guy who built the energy division into a powerhouse. While he's getting a much bigger paycheck than Buffett's famous $100,000 salary—Abel is pulling in about $25 million—the culture isn't shifting as much as the headlines suggest.

- The Decentralized Model: Berkshire’s 30+ subsidiary CEOs will still have near-total autonomy.

- The "Oxy" Strategy: Look at the OxyChem deal. Berkshire just finished a $9.7 billion acquisition of Occidental's chemical unit in early January 2026. This is the Abel playbook: boring, cash-generative, industrial.

- The Philosophy: Buffett is still Chairman. He's the spiritual lead. Abel isn't going to go rogue and buy a pre-revenue AI startup just to look modern.

The "Dexter Shoe" Lesson Still Matters

Whenever people talk about warren buffett berkshire stock, they forget the mistakes. Buffett actually loves talking about them. He calls the 1993 purchase of Dexter Shoe his "most gruesome" error.

Why? Because he paid with Berkshire stock.

The shoemaker went to zero, but the shares he gave away would be worth over $18 billion today. This is why you see Berkshire sitting on cash now. They learned that their own stock is the most valuable currency they have. They don't want to "waste" it on overpriced acquisitions in a hot market.

If you’re holding BRK.B shares right now, you aren't just betting on a portfolio of stocks. You're betting on the optionality of that cash. When the market finally breaks—and it always does—Abel will have the only checkbook that doesn't bounce.

Is the Stock Overvalued Right Now?

Let's look at the numbers. BRK.B is trading around $492, which is just below its 52-week high of $542.

Morningstar actually thinks it’s slightly undervalued, with a fair value estimate around $510 for the B shares. At roughly 16 times earnings, it’s a bargain compared to the broader market, which is trading at nearly 27x in some sectors.

But there's a catch.

The "Buffett Premium" might be fading. For decades, the stock traded at a premium because people were paying for Warren’s brain. Now, they're paying for Greg’s execution. It’s a different kind of value. The stock underperformed the S&P 500 in 2025—up about 10% vs the index’s 16%.

📖 Related: Mister Green Tea Ice Cream: Why That Shark Tank Pitch Still Matters

That’s fine. Berkshire isn't built to win in a mania. It's built to survive a massacre.

Actionable Insights for Your Portfolio

If you're looking at warren buffett berkshire stock as a long-term play, here is how to actually think about it in 2026:

- Don't Expect a Dividend: It’s not happening. Berkshire still believes it can compound money better than you can. If you need income, look at Coke or American Express—the stocks Berkshire owns, not Berkshire itself.

- Watch the Buybacks: This is the real "Buffett Indicator." If Berkshire starts aggressively buying back its own shares, it means the leadership thinks the stock is cheap. If they stop, like they did for stretches in 2024 and 2025, you should probably be cautious too.

- Silver Might Be the Secret Move: Rumors are swirling about a massive silver position being built in the final days of Buffett's tenure. Keep an eye on the February 13-F filings. If the "Oracle" moved into precious metals on his way out, it’s a massive vote of no-confidence in the dollar or the equity market.

- Patience is the Only Edge: Most investors can't sit on cash for five years. Berkshire can. If you want to invest like them, you have to be okay with underperforming during a "melt-up" so you can be the one buying when everyone else is panicking.

The "post-Buffett" era isn't a crisis. It's a stress test for a system that was designed to outlive its creator. Greg Abel isn't trying to be the next Warren Buffett; he’s trying to be the best steward of the $380 billion war chest ever built.

Own it for the fortress, not the hype.

📖 Related: Other Words for Enticing and Why Your Vocabulary is Killing Your Conversion Rate

Next Steps for Investors:

- Check the Price-to-Book Ratio: Berkshire traditionally bought back shares when the P/B ratio was around 1.2. While they’ve become more flexible, it remains a solid gauge of "fair value."

- Review the 13-F Filings (Due Feb 14): Look specifically for "new" entries. This will be the first look at what Greg Abel and the remaining investment team (like Todd Combs' successors) are prioritizing without Warren's final sign-off.

- Build Your Own "Dry Powder": Follow the lead of the $381 billion hoard. Ensure you have a liquid cash position so you can act if a market correction brings high-quality stocks back to reasonable valuations.