Hollywood hasn't seen a knife fight this messy in decades. For months, the Warner Bros. Paramount merger rumors have dominated every headline from Burbank to Wall Street, but the situation just took a sharp, litigious turn. Honestly, if you thought this was going to be a simple corporate handshake, you haven't been paying attention to the chaos of 2026.

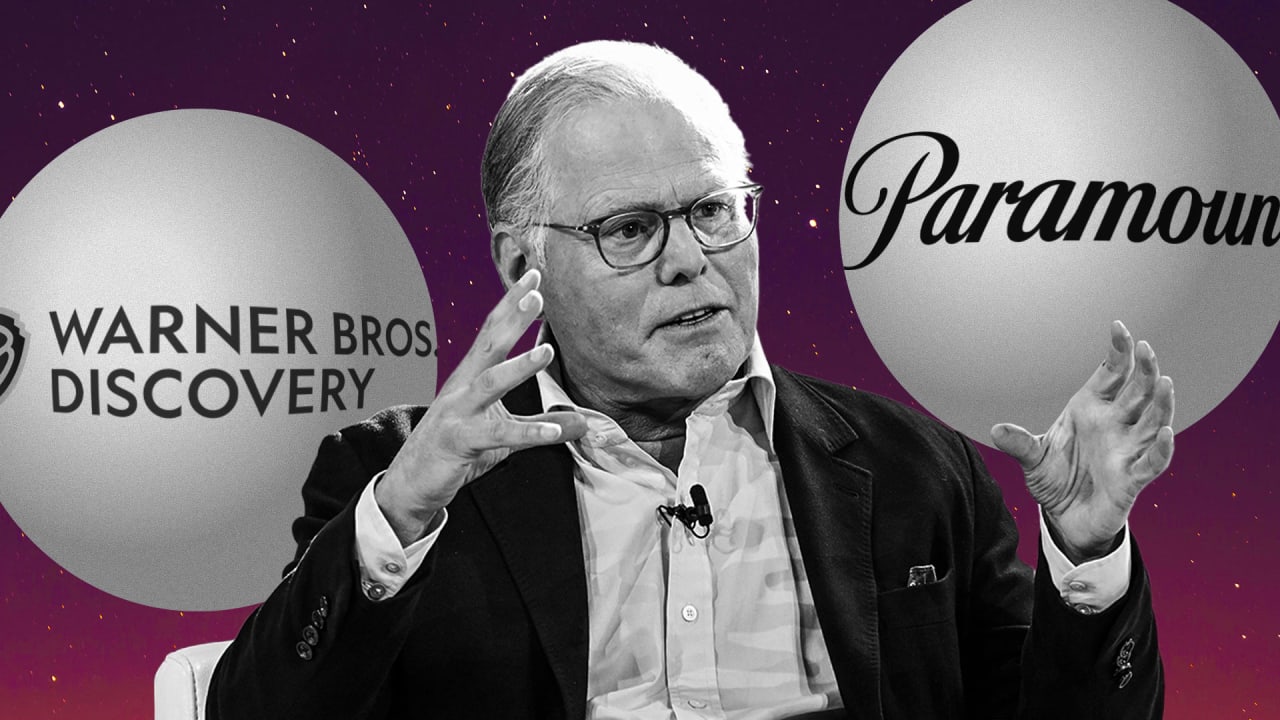

Basically, we are looking at a three-way tug-of-war. In one corner, you have David Ellison’s Paramount Skydance (PSKY) throwing massive piles of cash around. In the other, Netflix is trying to swallow the "prestige" parts of Warner Bros. Discovery (WBD) like HBO and the film studios. And stuck in the middle is David Zaslav and the WBD board, who seem to want literally anything except what Paramount is offering.

🔗 Read more: Why Use a Currency Converter HKD to US When the Rate Never Changes?

Why the Warner Bros. Paramount merger rumors refuse to die

Most people get this wrong: they think it's just about two studios becoming one. It's actually a battle over the "linear stub." That's corporate-speak for the old-school TV channels like CNN, TNT, and Discovery. Netflix doesn't want them. They want the shiny stuff—the DC Universe, Harry Potter, and the HBO library.

David Ellison, however, wants the whole thing.

On January 12, 2026, Paramount Skydance officially filed a lawsuit in the Delaware Chancery Court against WBD. They aren't just rumors anymore; it’s a full-blown legal war. Ellison is accusing the WBD board of hiding the truth from shareholders. He claims the Netflix deal, which WBD is currently favoring, is actually a worse deal for the people who own the stock.

The $30 per share bombshell

Let’s look at the numbers because they are wild. Paramount is offering $30.00 per share in all cash. That values the whole of WBD at roughly $108.4 billion. Compare that to the Netflix offer, which is a mix of cash and stock valued somewhere around $27.42 per share depending on how the market feels that day.

- Paramount's Bid: All cash, $30/share, takes the whole company (including the "dying" cable networks).

- Netflix's Bid: Roughly $23.25 in cash + some Netflix stock + a piece of a new spinoff called "Discovery Global."

- The Larry Ellison Factor: David Ellison’s dad, Oracle founder Larry Ellison, has personally guaranteed $40.4 billion in equity to make this happen.

Why would WBD say no to more cash? The board, led by Samuel Di Piazza Jr., says the Paramount deal is too risky. They called it an "extraordinary amount of debt." They’re worried that if the deal fails, WBD will be left in a pile of rubble.

🔗 Read more: Sam's Club Business Membership Benefits: What Most Small Business Owners Get Wrong

The Netflix pivot and the "Discovery Global" problem

The reason these Warner Bros. Paramount merger rumors are so persistent is that the Netflix deal feels... complicated. To make the Netflix merger work, WBD has to spin off its cable networks into a separate company called Discovery Global.

But here’s the kicker: Paramount released an analysis on January 8, 2026, claiming that Discovery Global is essentially worth zero dollars. They pointed at Versant Media—a similar recent spinoff—which saw its stock tank by 18% immediately after its debut.

If those cable networks are worthless, then the Netflix deal looks a lot less attractive to a regular investor.

Hostile takeovers and proxy fights

Since the WBD board keeps saying "no thanks," David Ellison has moved to Plan B. He’s going directly to the shareholders. This is what we call a hostile bid.

🔗 Read more: The West Coast Cure Story: How a Black Market Kingpin Went Legal (Mostly)

Paramount has announced they will nominate their own slate of directors for the WBD 2026 Annual Meeting. They want to fire the current board and put in people who will say "yes" to the merger. It’s a bold move. It’s also incredibly expensive.

What this means for your favorite shows

If Paramount wins, you basically see the birth of a new "Mega-Studio." Think Paramount+ and Max merging into one giant app. You’d have Star Trek and Batman under the same roof.

If Netflix wins, it’s a bit different. Netflix would own the Warner Bros. studio and HBO, but they’d likely stay away from the news and sports side. CNN and TNT would be left to fend for themselves in that "Discovery Global" spinoff.

The antitrust headache

Regulators are already circling. Senators like Elizabeth Warren and Bernie Sanders have voiced concerns that either deal will lead to higher prices for you and me. Whether it's Paramount or Netflix, the Department of Justice is going to spend all of 2026 looking at this through a magnifying glass.

Actionable insights for the coming months

If you’re following this saga, don't just look at the stock price. Watch these specific markers:

- The January 21 Deadline: This is when Paramount’s current tender offer expires. They’ll likely extend it, but the language they use will tell us how aggressive they plan to be.

- Delaware Court Rulings: If the judge forces WBD to reveal the "hidden" math behind the Netflix deal, it could tip the scales for shareholders.

- The "All-Cash" Netflix Rumor: On January 14, reports surfaced that Netflix might pivot to an all-cash offer to match Paramount. If that happens, Ellison might have to dig even deeper into his dad’s pockets.

The Warner Bros. Paramount merger rumors have evolved into a case study on the death of traditional media. Whether it’s a tech giant like Netflix or a legacy-meets-tech hybrid like Skydance-Paramount, the old Hollywood is being carved up. Keep an eye on the "Discovery Global" valuation—that's the real canary in the coal mine for this entire deal.

The next big date to circle is the opening of the WBD director nomination window in early February. That is when the proxy war officially begins.

Source References: * Paramount Press Release (Jan 8, 2026) - Reaffirming $30/share offer.

- WBD Board Statement (Jan 7, 2026) - Rejecting Paramount tender offer.

- Delaware Chancery Court Filing (Jan 12, 2026) - Paramount vs. Warner Bros. Discovery.

- Bloomberg Intelligence analysis on the "Discovery Global" spinoff valuation (Jan 2026).