Bob Iger is back, but the seats around him are arguably more interesting than the CEO himself.

The Walt Disney board of directors isn't just a group of people in suits making "synergy" happen. Lately, it’s looked more like a high-stakes chess match where the players are constantly checking their own king. If you’ve followed the news over the last couple of years, you know this board has been under a microscope. They’ve faced proxy wars, activist investors, and the messy, public firing of Bob Chapek. It’s been a lot. Honestly, it’s been a chaotic period for a company that usually prides itself on being the most polished brand on Earth.

Let’s be real: people usually don't care about a board of directors. It’s boring corporate governance. But with Disney, the board literally decides what your childhood memories are worth and how much you’re going to pay for a lightsaber. They are the ones who approve the billion-dollar acquisitions like Marvel and Lucasfilm, but they’re also the ones who have to figure out how to make Disney+ actually turn a profit without alienating every parent in America.

Who Actually Runs the Show?

Right now, the board is chaired by Mark Parker. You might recognize the name—he was the long-time CEO of Nike. He stepped into the Chairman role in early 2023, taking over from Susan Arnold. Parker’s presence is a big deal because he’s a "brand guy." When you’re dealing with a company that relies on the emotional connection of its fans, you need someone who understands how to protect a legacy while selling new shoes—or in this case, new streaming subscriptions.

The rest of the roster is a mix of tech giants, financial gurus, and media veterans. You have Mary Barra, the CEO of General Motors. Then there's Safra Catz, the heavy-hitting CEO of Oracle. Having Catz on the board is a clear signal that Disney is obsessed with data and cloud infrastructure. It’s not just about Mickey Mouse anymore; it’s about the backend tech that keeps the parks running and the streaming algorithms humming.

Amy Chang is another one to watch. She’s a veteran from Google and Cisco. Her expertise in tech and consumer platforms is vital as Disney tries to pivot away from traditional cable TV—which is dying a slow, painful death—and into a future where everything is digital.

The Nelson Peltz Factor

We can't talk about the Walt Disney board of directors without mentioning the guy who wasn't on it but desperately wanted to be. Nelson Peltz. His Trian Fund Management launched a massive, multi-million dollar campaign to get him a seat. He argued that the board had lost its way, was overspending, and had failed at succession planning.

He wasn't entirely wrong.

The board's decision to extend Iger’s contract... then hire Chapek... then fire Chapek... then bring Iger back? It looked messy. It looked like a group of people who didn't have a Plan B. While Peltz eventually lost his bid in the 2024 shareholder vote, the pressure he applied forced the board to be way more transparent about their cost-cutting measures and their search for the next CEO.

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

The Succession Headache

The biggest job this board has right now—hands down—is finding the next Bob Iger. Again.

Iger is currently slated to step down at the end of 2026. This isn't his first retirement rodeo, and the board knows they cannot mess it up this time. To handle this, they formed a specific succession committee. It’s led by James Gorman, the Executive Chairman of Morgan Stanley. Gorman is a beast when it comes to succession; he successfully navigated the leadership transition at Morgan Stanley, which is a notoriously difficult thing to do in the banking world.

The board is looking at four main internal candidates:

- Dana Walden (Disney Entertainment Co-Chairman)

- Alan Bergman (Disney Entertainment Co-Chairman)

- Josh D'Amaro (Parks and Experiences Chairman)

- Jimmy Pitaro (ESPN Chairman)

Walden is the creative powerhouse. D'Amaro is the guy the fans love. Pitaro is navigating the tricky world of sports gambling and the move to direct-to-consumer ESPN. The board has to weigh these very different skill sets. Do they want a creative? An operator? A tech visionary? Honestly, it depends on which way the wind blows in the streaming wars over the next eighteen months.

Why Investors are Twitchy

Disney is a weird beast. It’s a theme park company. It’s a movie studio. It’s a tech platform. It’s a cruise line. This complexity makes the Walt Disney board of directors one of the most difficult jobs in the corporate world.

Think about the sheer range of issues they have to vote on. One day they are discussing Florida politics and the Reedy Creek Improvement District (now the Central Florida Tourism Oversight District). The next, they are approving a $60 billion investment in theme parks over the next decade. Then they have to pivot to the ethical implications of using AI in film production or how to handle the declining revenue of ABC and other linear networks.

It's a lot for twelve people to handle.

Critics often point out that the board has been "too cozy" with Iger in the past. There’s a risk of "founder syndrome," even though Iger didn't found the company. He’s been there so long and has been so successful that the board sometimes deferred to him too much. That’s changing. With people like Gorman and Parker in the lead, there’s a sense that the board is finally putting its foot down and demanding a real, sustainable future that doesn't rely on one man’s charisma.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

The Governance Shift

Governance used to be a buzzword. Now, it's a survival tactic.

Disney has had to refresh its board significantly. They added Sir Jeremy Darroch, the former CEO of Sky, which brought a much-needed European media perspective. They also added Carolyn Everson, who has a massive background at Meta and Instacart. These aren't just "names." These are people who understand how to monetize attention in a world where everyone is distracted.

If you look at the board's compensation and structure, you see a shift toward accountability. They are being pushed by institutional investors—the big banks and pension funds—to show that they aren't just rubber-stamping Iger's ideas. They need to prove they can govern through a crisis, not just through the good times when Marvel movies were making $2 billion every summer.

Breaking Down the Current Roster

It’s helpful to see exactly who is sitting at the table. It’s not a secret, but the mix of industries represented tells you where Disney thinks its future lies.

The Strategic Core:

Mark Parker (Chairman) provides the brand stability. Bob Iger is the visionary/CEO. James Gorman is the succession architect. This trio is the "inner circle" of the board right now.

The Tech and Data Power:

Safra Catz (Oracle) and Amy Chang (Cisco/Google) are there to make sure Disney doesn't get left behind in the AI and cloud revolution. If Disney+ fails to innovate its UI or its recommendation engine, these are the people who will be held responsible.

The Consumer Experts:

Mary Barra (GM) and Carolyn Everson (Meta/Instacart) understand the modern consumer. They know how people buy things and how they interact with brands on their phones.

The Media Veterans:

Sir Jeremy Darroch and Maria Elena Lagomasino. They understand the global scale. Disney isn't a domestic company; it's a global superpower. Lagomasino, in particular, brings a wealth of experience in wealth management and international business through her work at WE Family Offices and formerly JPMorgan.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

The Challenges No One Talks About

Everyone talks about streaming, but the board is also sweating over the "Linear Decay."

Linear TV—your standard cable channels like Disney Channel, FX, and Freeform—is where Disney used to make a massive chunk of its cash. That cash is drying up. The board has to decide whether to sell these assets, spin them off, or ride them until the wheels fall off. It’s a brutal calculation.

Then there’s the ESPN dilemma. The board approved the "Venu" sports streaming joint venture with Fox and Warner Bros. Discovery, which has already hit legal roadblocks. They also have to manage the transition of ESPN into a standalone streaming service by 2025. This involves navigating massive rights deals with the NFL, NBA, and MLB. If they overpay for rights, the stock drops. If they lose the rights, the brand dies. It’s a tightrope.

Is the Board Too Big? Too Small?

At 12 members, the Disney board is fairly standard for a Fortune 500 company. Some argue it should be smaller and more agile. Others say it needs even more diversity in terms of industry background—perhaps someone from the gaming industry, given Disney’s recent $1.5 billion investment in Epic Games.

That Epic Games deal is a huge tell. It shows the board knows that Gen Z and Gen Alpha aren't watching movies as much as they are playing Fortnite. By putting money into Epic, the board is essentially admitting that the future of Disney "content" might be an interactive world rather than a 90-minute film.

What You Should Watch For

If you’re an investor or just a fan who cares about the direction of the company, there are three things to watch regarding the Walt Disney board of directors over the next twelve months:

- The CEO Shortlist: Keep an ear out for any leaks or official announcements regarding the narrowing of the field. If James Gorman starts making more public appearances on behalf of the board, it means the search is entering the "final exam" phase.

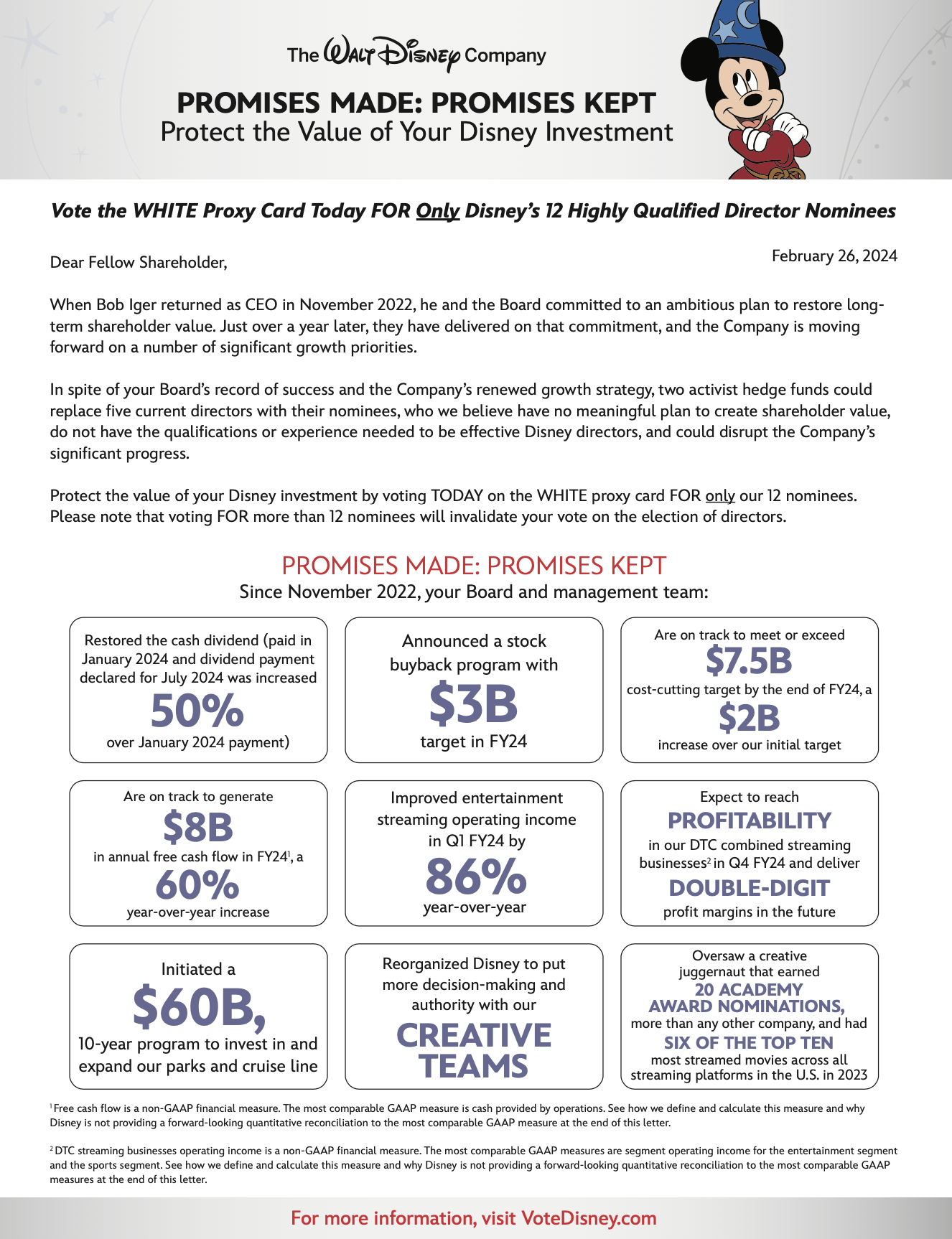

- The Dividend and Buybacks: The board reinstated dividends and share buybacks recently. This was a peace offering to shareholders. If they increase these, it means they are confident. If they cut them, something is wrong in the theme park or streaming numbers.

- New Appointments: If a gaming executive or an AI specialist joins the board, it’s a clear signal of the next 5-year strategy.

The board is essentially the "Brain Trust." For a long time, it felt like Iger was the only one in the room. Now, it feels like there are finally other voices—strong ones—that are willing to challenge the status quo.

Actionable Insights for Shareholders and Observers

Understanding the board's movements can help you predict where Disney's stock and brand are headed. Here is how to keep a pulse on the situation:

- Review the Proxy Statement: Every year, Disney releases a DEF 14A filing. Don't just look at the executive pay. Look at the "Director Skills Matrix." It literally shows you what the board thinks it's missing and what it values.

- Monitor Committee Changes: Pay attention to who is on the Audit Committee versus the Compensation Committee. The Audit Committee (currently including Safra Catz) is where the real financial skeletons are monitored.

- Track the "Institutional" Sentiment: Watch how big firms like BlackRock and Vanguard vote during the annual meetings. If they start voting against board nominees, it means the "smart money" is losing faith in the board's ability to pick a successor.

- Follow the Capital Expenditures: When the board approves a $60 billion expansion for parks, look at where that money is going. Is it going to new lands (growth) or maintenance (treading water)? The board’s appetite for risk is revealed in these budget approvals.

The Walt Disney board of directors is currently in its most "active" phase in decades. The days of quiet meetings and easy votes are over. Every decision they make right now is a brick in the wall of Disney's second century. Whether that wall holds or crumbles depends entirely on whether they’ve learned from the mistakes of the Chapek era. Operating a legacy brand in a digital-first world is hard, but it’s the task they’ve signed up for. Keep your eyes on James Gorman and Mark Parker; they are the ones holding the map right now.