Honestly, walking into a Walmart in 2026 feels a bit different than it did a few years ago. You’ve probably noticed the digital shelf labels flashing updated prices or the way the app somehow knows exactly which aisle you’re standing in. It’s not just a grocery store anymore.

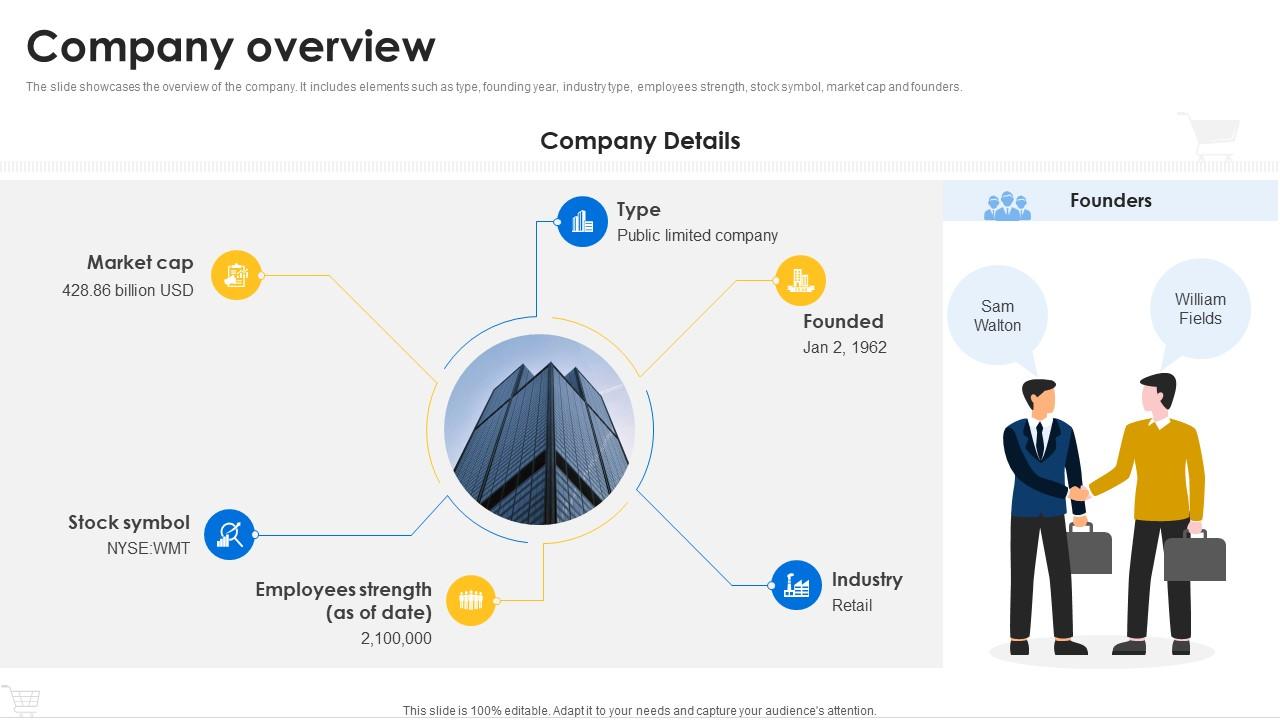

Walmart is currently undergoing its biggest transformation since Sam Walton opened that first store in Rogers, Arkansas, back in 1962.

We’re talking about a company that now manages over 10,800 stores across 19 countries. But the real story isn't just the physical buildings. It’s how they’ve turned into a tech company that happens to sell milk and socks. In the third quarter of fiscal year 2026, their global e-commerce sales shot up by 27%. That’s massive for a company of this size.

The Big Leadership Shakeup

There is a major changing of the guard happening right now. Doug McMillon, who has been the face of the company as CEO since 2014, is officially retiring on January 31, 2026.

John Furner is taking the wheel.

If you follow retail, you know Furner. He’s been running Walmart U.S. for years and is basically the architect behind their "Store of the Future" concept. Greg Penner, the Chairman of the Board, has been pretty vocal about Furner being the right guy to handle the "digital acceleration" phase.

It’s a handoff that feels stable, yet high-stakes.

They also just added Shishir Mehrotra, the CEO of Superhuman, to their Board of Directors this January. Bringing in a heavy hitter from the software world tells you exactly where their head is at: they want to out-tech Amazon.

What Most People Get Wrong About the Business Model

Most people think Walmart makes all its money by selling cheap groceries.

💡 You might also like: Panama Refining Co. v. Ryan: Why the Hot Oil Case Still Matters Today

Kinda, but not really.

The "Old Walmart" relied on thin margins and high volume. The "New Walmart" is leaning into high-margin services. Think about this: their global advertising business, Walmart Connect, grew 53% recently. They are becoming an advertising powerhouse because they know exactly what 255 million weekly customers are buying.

The Profit Engines

- Membership Fees: Sam’s Club and Walmart+ income is growing way faster than actual product sales. These fees are pure profit compared to selling a head of lettuce.

- The Marketplace: They now have over 500 million sellers on their third-party marketplace. Walmart doesn't have to own the inventory; they just take a cut of the sale and often charge for shipping through Walmart Fulfillment Services (WFS).

- Data and AI: Roughly 40% of their software now uses AI to optimize inventory. If a store in Florida is running low on water before a storm, the system usually knows before the manager does.

The Global Footprint in 2026

Walmart isn't just an American thing. They’ve narrowed their focus to specific international "pillars" that are actually working.

Mexico is huge for them. Walmex is a beast, especially with events like "El Fin Irresistible" (their version of Black Friday). Then you have Sam’s Club China, where digital sales now make up about half of their total revenue.

And don't forget Flipkart in India. During their "Big Billion Days" sale, they were processing 87 orders every single second.

👉 See also: NC Stimulus Check 2025: Why You Might Be Waiting for a Refund That Isn’t a Stimulus

Total revenue is hovering around $179.5 billion per quarter. To put that in perspective, that’s more than the annual GDP of some small countries.

Why Walmart Still Matters for the Average Shopper

For you, the changes are more practical. They are currently rolling out those digital shelf labels to 2,300 stores. No more paper tags. This allows them to change prices in real-time to stay competitive.

They are also cleaning up their ingredients.

John Furner mentioned that customers want simpler stuff. So, they’re working on pulling synthetic food dyes and artificial ingredients out of their private-label products. It’s a move to grab the "wellness" crowd that usually shops at Target or Whole Foods.

Practical Numbers to Know

- Employees: They still employ about 2.1 million "associates" globally.

- Stores: In the U.S. alone, there are 4,606 Walmart stores and about 600 Sam’s Clubs.

- Delivery: Roughly 93% of U.S. households are now within the reach of their same-day delivery network.

The Road Ahead

Is it all perfect? Definitely not.

They are dealing with serious supply chain volatility and the massive cost of integrating AI into every single warehouse. Plus, they’ve committed to "responsible recruitment" by 2026, aiming to eliminate forced labor and unethical fees in their global supply chain. That’s a massive undertaking that requires auditing tens of thousands of suppliers.

💡 You might also like: Dolar hoy en BanCoppel: Why the Price You See Online Isn’t Always What You Get

They are also navigating a world where "Value-Based Pricing" is king. If they lose their reputation for being the cheapest, the whole house of cards could get shaky.

If you want to keep an eye on where they're going, watch their e-commerce profitability. For the first time recently, their digital side actually started making real money instead of just burning cash to compete with Amazon. That’s the real win for them.

Actionable Next Steps:

- Monitor the Leadership Transition: Watch for John Furner’s first 100 days starting in February to see if he pivots away from McMillon’s "tech-first" strategy or doubles down.

- Audit Your Marketplace Strategy: If you're a seller, prioritize Walmart Fulfillment Services (WFS). The algorithm in 2026 is heavily favoring items that can be delivered in under three hours.

- Track Digital Labels: If you're a consumer, use the Walmart app in-store to scan items; the digital labels and app-based pricing are becoming increasingly personalized.