You're staring at a digital form. Maybe it's for a direct deposit from a new job, or perhaps you're trying to send a wire transfer to a friend who finally convinced you to split the cost of a vacation rental. The box is blinking at you, demanding to know: what is the branch name of a bank?

It sounds simple. You might think, "Oh, it's just Chase."

Well, not exactly.

If you just type the name of the banking institution, that form is probably going to get kicked back. Honestly, the branch name isn't just the giant logo on the front of the building. It’s a specific identifier that tells the financial system exactly where your account lives geographically. Most of the time, this refers to the street name or the neighborhood where you physically walked in and signed those stacks of paperwork to open the account.

If you opened your account online—which, let's be real, almost everyone does now—things get a little weirder. You might not even have a "home" branch in the traditional sense.

Understanding the "Why" Behind the Branch Name

Banks are massive, sprawling labyrinths of data. JPMorgan Chase, for example, has thousands of locations. If someone sends money to "Chase," the system has no idea which of those thousands of vaults it’s supposed to land in. The branch name serves as a human-readable tag that matches up with the more technical data, like your routing number.

Think of it like an address. The bank name is the city; the branch name is the specific house.

Generally, the branch name is the name of the local office. If you opened your account at a Bank of America on 42nd Street in Manhattan, the branch name is likely "42nd Street" or "Bryant Park." It's rarely something poetic. It's usually just functional.

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Sometimes, banks use a "Main Office" designation. This is super common with smaller local credit unions. They might have five locations, but all the back-end processing happens at the headquarters. In that case, even if you went to the tiny drive-through branch on the edge of town, your official branch name might still be the "Main Branch" or "HQ."

How to Find Your Branch Name Without Calling Support

Nobody wants to sit on hold for forty minutes listening to elevator music just to ask a basic question. Luckily, you don't have to.

The easiest way to find out what is the branch name of a bank is to look at your checkbook. I know, nobody uses paper checks anymore, but they are a goldmine of information. Look at the top left corner. Usually, right under your name or the bank's logo, there’s a small line of text. That’s your branch. It might say "Highland Village Branch" or "Downtown San Jose."

If you're a millennial or Gen Z and haven't seen a physical check in three years, go to your mobile app.

- Log in.

- Click on your specific account (Checking or Savings).

- Look for "Account Details" or "Statements."

- Download a PDF of your most recent monthly statement.

That PDF is a legal document. It has to be accurate. Somewhere in the header—usually near the routing number or the bank's address—the specific branch name will be listed.

The Online Banking Loophole

What if you use an online-only bank like Ally, Chime, or SoFi? They don't have bricks. They don't have branches.

In these cases, the "branch name" is almost always just the city where the bank is headquartered or where their main digital hub is registered. For many online banks, you’ll see "Direct" or "Digital Branch" listed. For example, if you're looking for the branch name for a major online player, it might default to "Salt Lake City" or "Sioux Falls" because that’s where their charter is held. If a form is forcing you to enter something and "Online" doesn't work, check the bank's "Contact Us" page for their legal headquarters address.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Routing Numbers vs. Branch Names

There is a huge misconception that the routing number and the branch name are the same thing. They aren't. But they are cousins.

The American Bankers Association (ABA) assigns routing numbers. A single bank can have dozens of different routing numbers based on the state where the account was opened and the type of transaction (wire vs. ACH).

When you ask, "what is the branch name of a bank," you're asking for the label. When you provide a routing number, you're providing the GPS coordinates.

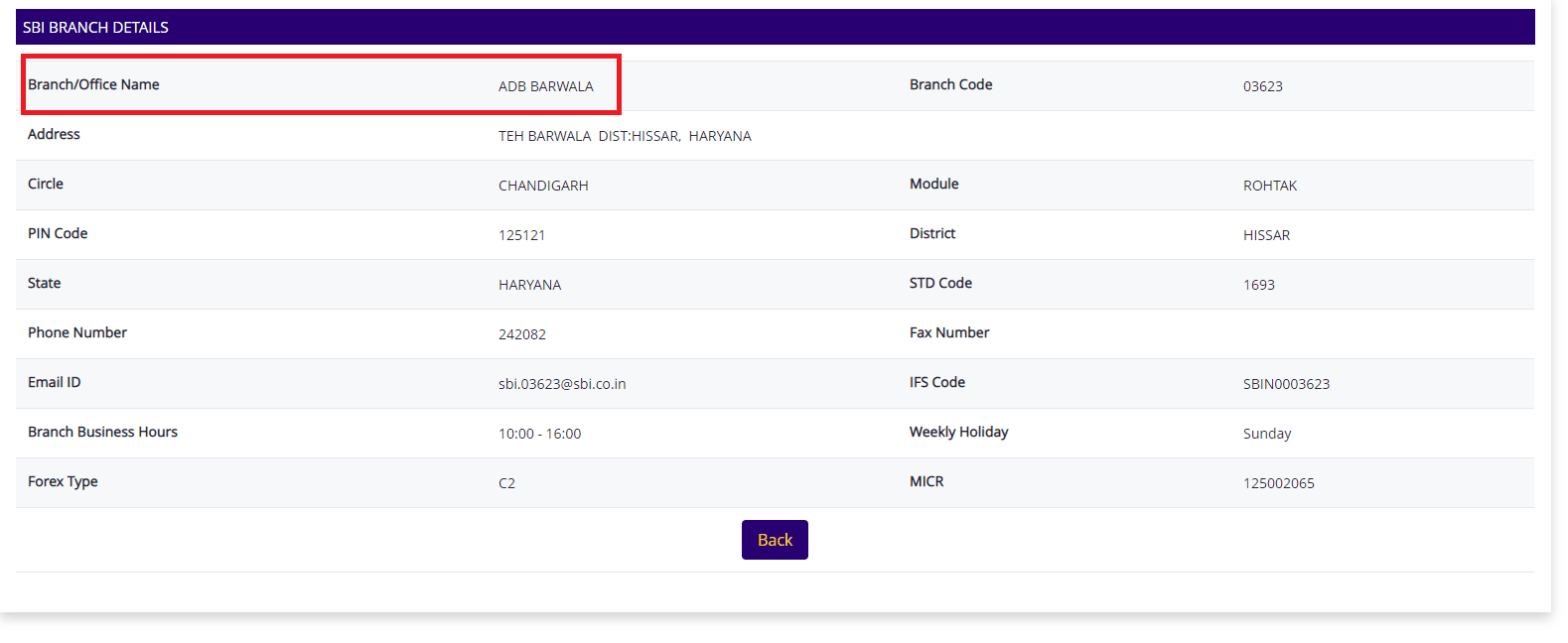

If you have the routing number, you can actually reverse-engineer the branch name. There are various "Routing Number Lookup" tools provided by the ABA or financial sites. You plug in those nine digits, and it will spit out the official legal name of the branch associated with that number.

Keep in mind that bank mergers happen all the time. Your bank might have been "First National" five years ago, but now it’s "PNC." When these mergers happen, the branch names often change to match the new corporate structure, but the old routing numbers sometimes stay active for years to avoid breaking everyone's auto-pay settings.

Common Naming Conventions You’ll Run Into

You might see some strange labels when hunting this down.

"Financial Center" is a big one. Bank of America loves this term. Instead of calling it the "Oak Street Branch," they might call it the "Oak Street Financial Center." If you’re filling out a form, just "Oak Street" is usually fine.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

"Retail Branch" is another. This distinguishes the place where people walk in to deposit checks from the "Commercial" or "Wealth Management" offices that handle the big fish.

Then there’s the "Transit Number." This is mostly a Canadian thing. If you’re doing business with a Canadian bank like TD or RBC, they won't ask for a branch name as much as they'll ask for a five-digit transit number. That number is the branch name in the eyes of their system.

When the Branch Name Actually Matters (and When It Doesn't)

For a standard paycheck deposit, the branch name is honestly a bit of a relic. The routing and account numbers do 99% of the heavy lifting.

However, for international wire transfers—using the SWIFT or BIC system—precision is everything. If you're sending $5,000 to an account in Germany, and you get the branch name wrong, that money might get stuck in "purgatory" for weeks. The receiving bank's "intermediary" system uses the branch name to verify that the person claiming the money is actually registered at that specific location.

It's also vital for legal documents. If you're getting a mortgage or setting up a trust, the "Branch of Account" is a legal term. It dictates which state’s laws might apply to certain disputes.

Real-World Examples of Finding the Info

Let’s look at a few specific banks just to see how much they vary.

- Wells Fargo: They often name branches after the nearest intersection. If the bank is on the corner of Sunset and Vine, guess what? The branch name is "Sunset & Vine."

- Capital One: Since they’ve moved toward the "Cafe" model, many of their newer branches are literally called "Capital One Cafe - [Neighborhood Name]."

- Small Town Banks: If you use "The Bank of Eufaula," and there is only one building in the whole world, the branch name is just "Main Office."

If you are ever in doubt, just look at the back of your debit card. There is a phone number there. Call it and say, "I'm filling out a wire transfer form, what is the official branch name for my account?" The representative will give it to you in seconds. It’s a very standard request.

Actionable Steps to Locate Your Branch Name

Instead of guessing and risking a failed transaction, follow this quick checklist to get the right answer the first time:

- Check your mobile app's "Direct Deposit" tab. Most modern banking apps have a "Set up direct deposit" button that generates a pre-filled form. This form will almost always have the correct branch name and address printed on it.

- Look at the bottom of a canceled check. If you have a checkbook, the branch address is usually printed there. The "name" is simply the primary identifier of that address (e.g., "Northwest Branch").

- Use a Routing Number Search. If you only have your routing number, go to the official website of your bank and search for that number. It will link you to the geographic region or specific branch it represents.

- Search "Bank Name + City + Branch Name" on Google Maps. If you know exactly where you opened the account, the Google Maps listing title is often the official branch name used in the bank's internal database.

- Verify for Online Banks. If you use an online bank with no physical locations, use the bank's headquarters city (found in their "Terms of Service" or "Privacy Policy") as the branch location if the form requires it.

The branch name is essentially the "home base" of your money. Even in a world that’s increasingly digital and borderless, these old-school geographic markers keep the global financial gears turning without grinding to a halt. Finding it takes about two minutes of digging, but it saves hours of headache later on.