You’re standing at the DMV or maybe closing on a house, and suddenly someone asks for a physical check. It feels like a relic from 1995. Most of us live in a world of tapping iPhones and Zelle transfers, so staring at that little rectangular slip of paper can be genuinely intimidating. You don't want to mess it up. If you scribble the wrong thing in the wrong box, the bank rejects it, and suddenly your rent is late or your car registration is in limbo. It’s annoying.

So, what does a filled out check look like when it's done correctly? Honestly, it’s just six specific spots you have to hit. But those six spots are the difference between a valid payment and a piece of scrap paper.

People think checks are dying. They aren't. According to the Federal Reserve’s 2023 Diary of Consumer Payment Choice, while credit cards dominate, we still use checks for high-value transactions like rent, taxes, and contractors. You need to know how to handle them.

💡 You might also like: Other Words for Revoked: Why the Context of Your Legal Disaster Matters

The Anatomy of a Properly Written Check

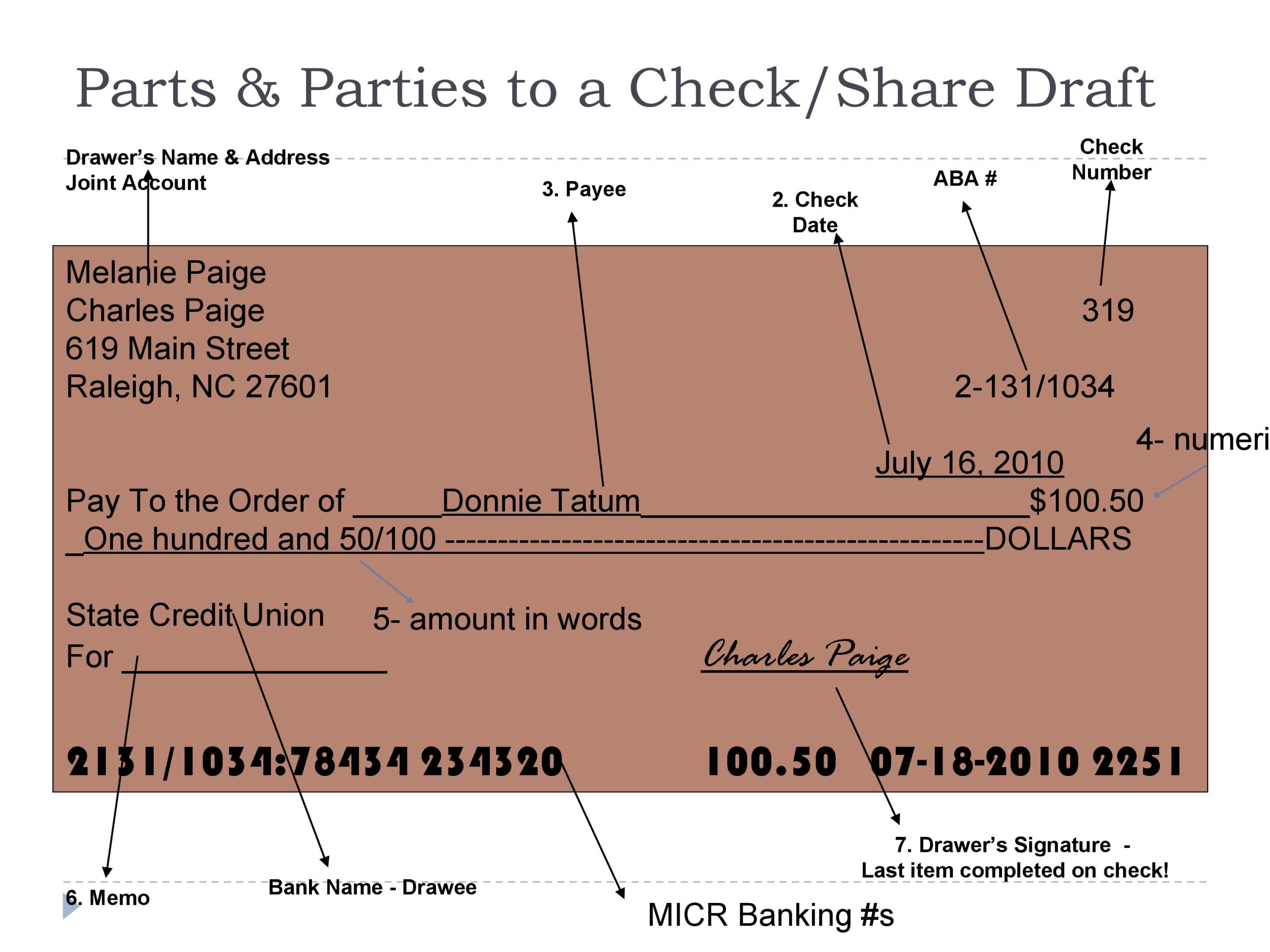

Let's look at the top right corner first. That’s where the date goes. Seems simple, right? Usually, you just put today's date. But here’s a pro tip: "post-dating" a check—putting a future date on it because you don't have the funds yet—is risky. Banks often ignore that date and cash it anyway. If you do that, you're basically gambling with your overdraft fees. Just use the current date unless you’ve got a very specific agreement with the person you’re paying.

Next is the "Pay to the Order of" line. This is where you write the name of the person or business getting the money. Be precise here. If you're paying "John Smith," don't just write "John." If you're paying the "Internal Revenue Service," don't just write "The Tax Guys."

Then there’s the little box with the dollar sign. You write the numerical amount here. Like $1,250.50. Make sure the numbers are clear. If your "7" looks like a "1," you’re inviting a headache.

The Word Line: Where People Usually Mess Up

Directly below the payee line is a long blank space ending with the word "Dollars." This is the most important part of what does a filled out check look like because legally, if the numbers in the box don't match the words on this line, the words win.

You write it out: One thousand two hundred fifty and 50/100.

See that fraction? That’s how you handle cents. You draw a straight line from the end of your words to the printed "Dollars" so nobody can sneakily add extra words like "and ninety-nine" to change the amount. It’s an old-school security trick that still works.

Why Your Signature is Everything

Bottom right. The signature line. Without this, the check is just a piece of paper. It’s the "Go" signal for the bank. You’d be surprised how many people fill out everything perfectly and then just... walk away.

Your signature should ideally match what the bank has on file. If you’ve changed your name or your handwriting has evolved into an illegible scrawl since you opened that account at age sixteen, it might be worth updating your signature card at the branch.

The Memo Line: Your Future Best Friend

On the bottom left, there's a spot labeled "Memo" or "For." This isn't legally required for the check to clear, but it’s a lifesaver for record-keeping. If you’re paying rent, write "February Rent." If it’s for a wedding gift, write "Congrats!"

When you’re looking back at your bank statement six months from now trying to figure out why you gave someone $400, that memo line will tell you exactly what happened.

What About the Numbers at the Bottom?

You’ll notice a string of weird-looking numbers at the very bottom. That’s the MICR line (Magnetic Ink Character Recognition).

The first nine digits are the Routing Number. This identifies which bank you use. It’s like the GPS coordinates for your money. The next set of numbers is your Account Number. Finally, there’s the Check Number, which matches the number in the top right corner.

Don't ever write over these. If you smudge them or write your signature through them, the automated sorters at the bank might spit your check out, requiring manual processing. That delays your payment.

Common Mistakes That Look Suspect

Security is a big deal. If you make a mistake, don't just scribble over it. Banks hate that. It looks like fraud.

If you mess up a name or an amount, the safest thing to do is write VOID in big letters across the front and start over with a fresh check. Most experts, including those at major institutions like Chase or Wells Fargo, suggest keeping a "check register" or a digital log of your voided checks so you can account for every single one in your book.

- Never use pencil. Always use blue or black ink. Pencils can be erased and changed.

- Don't leave blank spaces. Fill the lines.

- Check your balance. It sounds obvious, but "bouncing" a check is expensive.

The Difference Between Personal and Business Checks

If you're looking at a business check, it might look slightly different. It might be larger. It might have three different sections (the check and two stubs). But the core fields—date, payee, amount (numbers), amount (words), and signature—stay exactly the same.

Some business checks require two signatures if the amount is over a certain threshold, like $5,000. If you see two lines at the bottom, check your company policy.

Security Features You Might Not Notice

Ever look really closely at the lines on a check? On many modern checks, the "signature" line isn't actually a line. It’s a "Microprint" line. If you put it under a magnifying glass, it’s actually the words "Authorized Signature" printed over and over again.

There's also usually a "security square" on the back that says "Original Document." If you try to photocopy a check, that square often disappears or reveals a "VOID" watermark. It's pretty high-tech for something that feels so old.

How to Endorse the Back

Once you've filled out the front, the check is ready to go. But what if you are the one receiving it?

You have to sign the back. This is called "endorsing." If you just sign your name, anyone who finds that check can theoretically cash it. That’s a "blank endorsement."

Instead, write "For Deposit Only" followed by your account number and your signature. This restricts the check so it can only go into your specific account. It's a huge safety net if the check gets lost in the mail or dropped on the sidewalk.

Actionable Steps for Success

Writing a check doesn't have to be a stressful event. It's a process.

- Use a permanent pen. No felt tips that bleed or pencils that erase.

- Confirm the payee. Ask, "Who exactly should I make this out to?"

- Match your words and numbers. Read them back to yourself.

- Sign it last. This prevents you from accidentally handing over a signed, blank check.

- Record it. Immediately write the check number and amount in your banking app or a physical ledger.

If you follow these steps, your check will look exactly like it’s supposed to—professional, secure, and ready to be processed without a hitch. Banks see millions of these every day; yours should be the one that gives them zero trouble.