If you’re checking the volkswagen stock price today, you’re probably seeing a bit of red on your screen. As of January 17, 2026, the market is still digesting the closing numbers from Friday’s session. It wasn't exactly a victory lap for the German automotive giant. On the Xetra exchange, Volkswagen’s preference shares (VOW3) finished the week at €101.40, down about 1.74%.

It’s a weird time for VW.

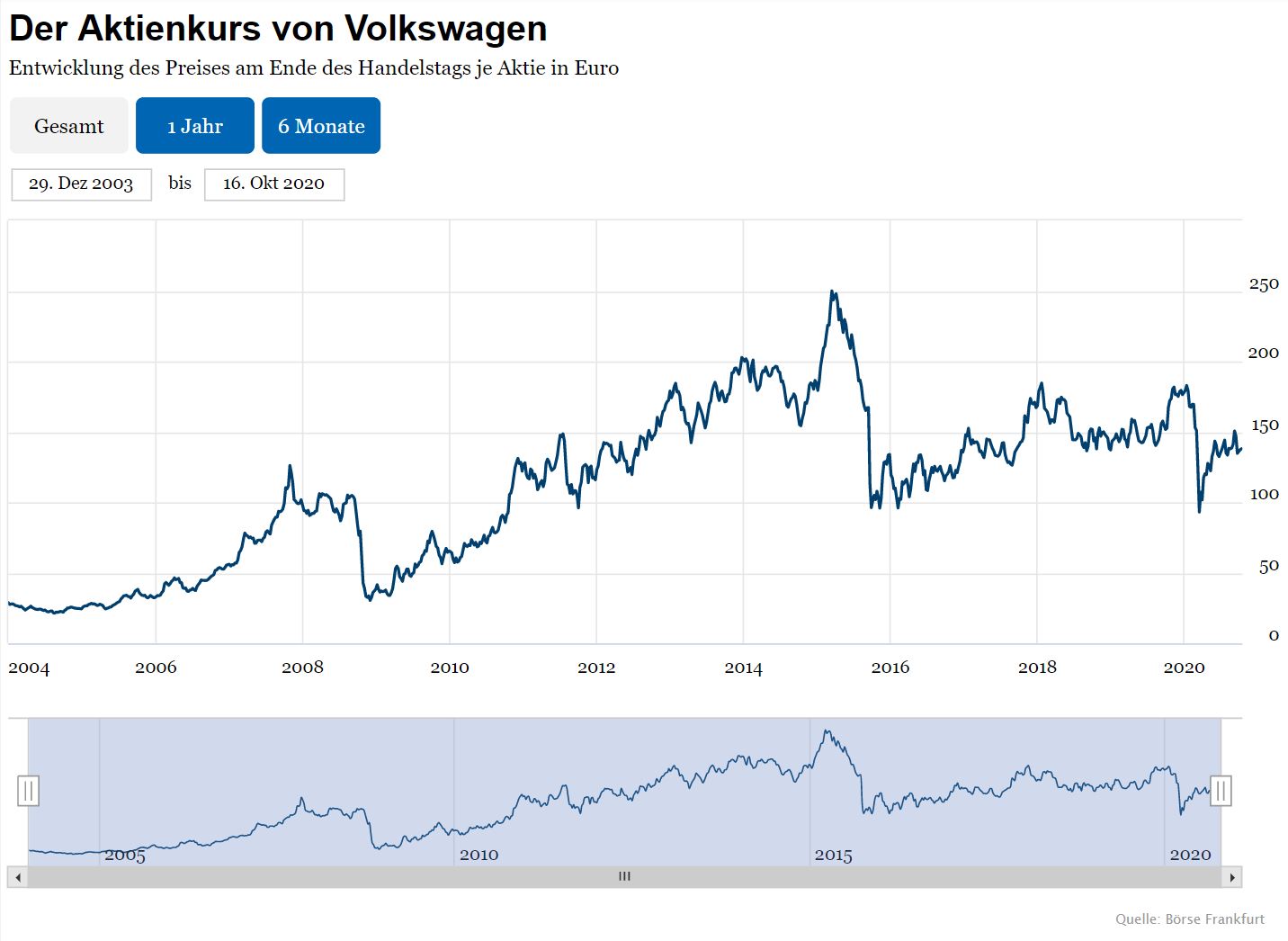

The stock has been bouncing around between €100 and €104 for the last couple of weeks like a pinball. Honestly, if you look at the 52-week range—which stretches from a low of roughly €82 to a high near €117—we’re sitting right in the messy middle. Investors seem stuck in a "wait and see" mode.

Are they a tech company yet? Or just a legacy carmaker with a lot of expensive batteries?

Why the Volkswagen Stock Price Today is Twitchy

The drop we saw heading into this weekend didn't happen in a vacuum. There's a lot of "macro" noise, but for VW specifically, the pressure is coming from two very different directions: China and software.

Earlier this week, the company confirmed that its EV deliveries for the past year stayed pretty much flat. That’s not what you want to hear when you're trying to outrun Tesla and a dozen Chinese startups. While Europe showed some life, the Chinese market—VW’s traditional piggy bank—is becoming a battleground. Local brands like BYD are eating everyone’s lunch with cheaper, tech-heavy cars.

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

The $29,000 Gamble

One thing keeping the volkswagen stock price today from sliding further is the hype around the "ID. Polo." At least, that's what everyone is calling it. It's a budget-friendly EV priced around €25,000 ($29,155) meant to launch this year.

If they nail it, they win back the masses.

If they miss the mark or delay it, the stock is going to feel it.

The Software Pivot (Finally?)

You've probably heard about the CARIAD drama over the years. It’s been the Achilles' heel of the group. However, news out of CES 2026 suggests they are finally getting their act together. They just signed a major deal with Qualcomm for "Snapdragon Digital Chassis" solutions. Basically, they're outsourcing the brains of the car to people who actually know how to build brains.

The market liked the news, but investors are cynical. They’ve heard "the software is fixed" before.

Breaking Down the Numbers (The Nerdy Stuff)

Let’s talk value. VW is currently trading at a P/E ratio of about 7.6. In the car world, that’s... fine. It’s not great, but it’s not "distressed" territory either.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

- Market Cap: Holding steady around €55 billion.

- Dividend Yield: This is the part that keeps income investors around. It’s currently hovering around 6.1%. That’s a beefy check just for holding the stock, though dividends are never a sure thing if earnings take a hit.

- Analyst Consensus: Most of the big banks have a "Buy" rating on this, with an average price target of €114.93. That suggests about a 13% upside from where we are today.

What Most People Get Wrong About VW Stock

People tend to think of Volkswagen as just the "VW" brand. That’s a mistake. When you buy this stock, you’re buying a massive conglomerate that includes Audi, Lamborghini, Bentley, and Porsche (mostly).

Audi and Porsche are the ones keeping the lights on. The "Brand Group Core"—VW, SEAT/Cupra, and Skoda—actually saw a 5% revenue bump in the first half of last year, which was a surprise to many. They've been cutting costs like crazy. Ludwig Fazel, the new Head of Group Strategy who took over in December, is reportedly obsessed with "lean structures."

The China Problem Isn't Going Away

You can't talk about the volkswagen stock price today without talking about Hefei. VW just finished a massive Test Center there. They are now "In China, for China." This means they are developing cars specifically for Chinese tastes right on the ground, rather than trying to sell German-designed cars to a market that wants something different.

It’s a risky move. If geopolitical tensions rise or US import tariffs get even nastier (which they did last year), VW is caught in the middle.

Is This a Buying Opportunity?

So, is it a steal at €101?

👉 See also: ROST Stock Price History: What Most People Get Wrong

Kinda. It depends on your stomach for volatility.

If you’re a long-term bull, you’re looking at that 6% dividend and the fact that the stock is trading at a fraction of its book value. If you’re a bear, you’re looking at the slowing EV growth and the massive capital they need to build battery factories like the new Salzgitter gigafactory.

Honestly, the volkswagen stock price today reflects a company in the middle of a massive, expensive identity crisis. They are trying to go from a hardware company to a software-defined vehicle company while fighting a price war in their biggest market.

Actionable Insights for Investors

If you are looking to trade or hold VW stock right now, here is the playbook:

- Watch the ID. Polo Launch: This is the litmus test for their EV strategy. If the reviews are good and the price stays under €25k, the stock could break out of its current range.

- Monitor the Euro-Yuan Exchange: Because of their massive exposure in China, currency fluctuations can hit their reported earnings harder than actual car sales.

- Check the 200-Day Moving Average: The stock is currently trading about 8% above its 200-day average. This is usually a sign of healthy momentum, but if it dips below €98, the technicals get ugly.

- Diversify Across Tickers: Remember that in the US, you're likely looking at VWAGY (the ADR), which trades in dollars and represents a 1/10th share. It closed Friday at $11.69.

Keep an eye on the next quarterly report. That's when we'll see if the cost-cutting measures Ludwig Fazel is implementing are actually hitting the bottom line or just moving numbers around.