Honestly, if you’ve been watching the exchange rate lately, you know it’s been a wild ride. Everyone in Accra and the diaspora is constantly refreshing their phones to see the latest USD to Ghana cedis numbers. For years, it felt like the cedi was on a one-way trip downward, but things are getting way more nuanced as we head deeper into 2026.

The market is currently hovering around 10.85 GH₵ for every 1 US Dollar.

Compare that to the chaos of 2022 or even early 2024, and it’s almost unrecognizable. Back then, people were panicking, hoarding dollars, and watching prices at Melcom jump every single week. Now? We are seeing a stabilization that some experts—and definitely my uncle at the forex bureau—never saw coming.

The Reality Behind the USD to Ghana Cedis Numbers

Why is this happening? It’s not just luck.

Basically, the Bank of Ghana (BoG) has been playing a very aggressive game. They’ve managed to get inflation down to roughly 5.4% as of late 2025, which is a massive drop from the 50%+ nightmare we lived through a few years ago. When inflation stays low, the cedi doesn't lose its "purchasing power" quite as fast.

👉 See also: Why Every Custom Canopy Tent With Logo Isn't Built The Same

But there’s a bigger, shinier reason. Gold.

Ghana is currently one of the world's top gold producers, and with global gold prices hitting records—averaging around $3,700 per ounce in some projections for 2026—the country is finally sitting on a decent cushion of foreign reserves. The "Gold-for-Reserves" program and the newer GoldBod initiatives have funneled actual bullion into the central bank's vaults. This gives the BoG the "firepower" to step into the market and stop the cedi from spiraling when demand for dollars gets too high.

What the Experts are Watching

A lot of the current stability is tied to the IMF program. We are technically in a "post-debt-restructuring" era.

- Debt Relief: Ghana has been saving about $3 to $4 billion a year because it doesn't have to service old external debts right now.

- The Big Push: The government is dumping billions into infrastructure, which usually helps growth but can sometimes put pressure on the currency if they have to import too much equipment.

- Interest Rates: The BoG recently slashed its policy rate to 18%. That’s a huge signal. It means they aren't as afraid of a currency collapse as they used to be.

Where to Actually Exchange Your Money

If you’re sending money home or trying to buy dollars for a trip, the "official" rate and the "forex bureau" rate are still two different animals. They’ve gotten closer, but they aren't twins.

- Commercial Banks: Places like Ecobank or GCB are usually the safest but might have slightly lower rates for you if you're selling dollars.

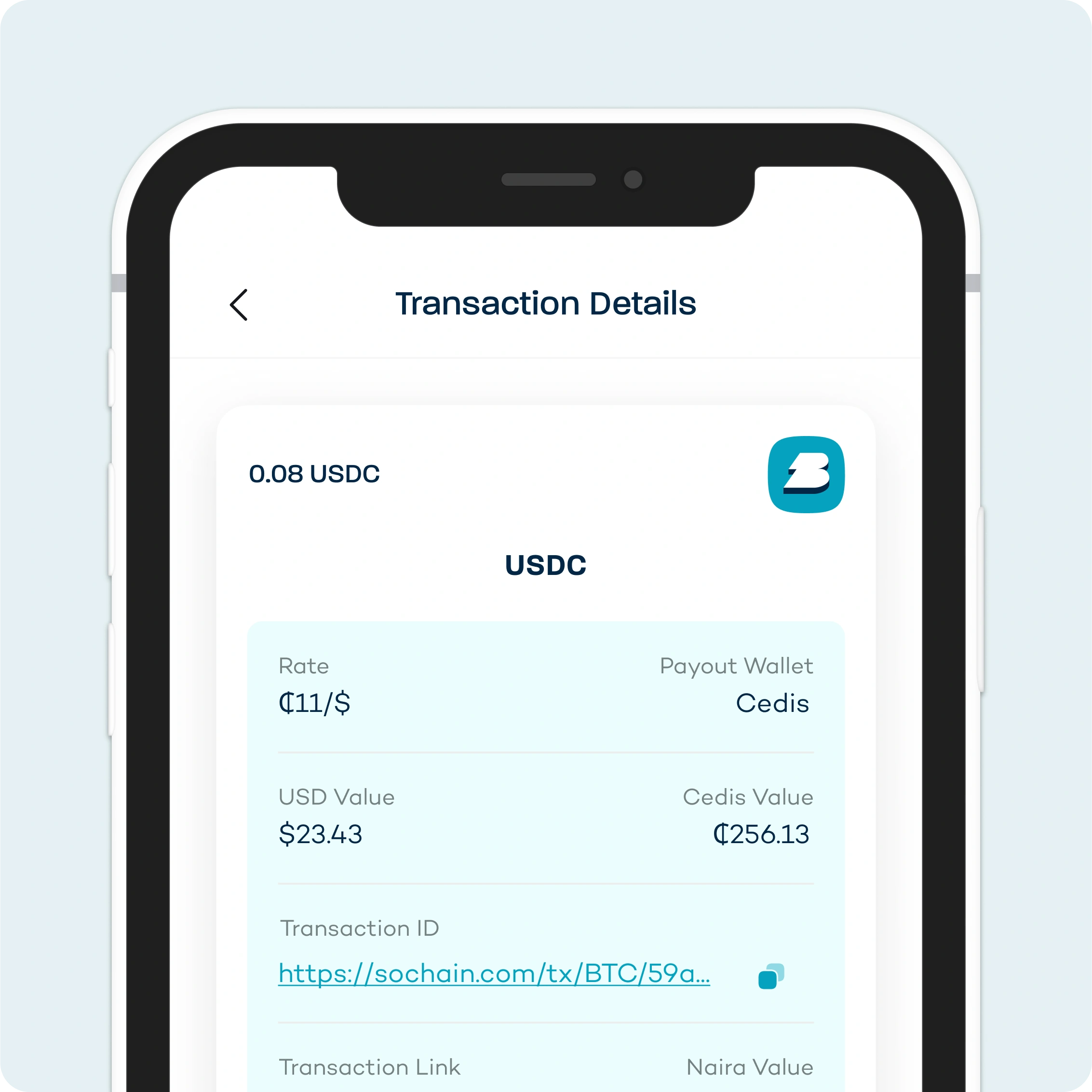

- Digital Apps: Sendwave, Remitly, and Taptap Send are the kings of the diaspora. They often bake their profit into the rate, so the "mid-market" rate you see on Google isn't what you'll actually get in your Momo wallet.

- Licensed Forex Bureaus: Still the best for raw cash. Just make sure they are licensed by the BoG. The black market (cowries) is tempting when the spread is wide, but in 2026, the risks of counterfeit notes or legal trouble are way higher than they used to be.

Why Most People Get the Cedi Forecast Wrong

People always expect the cedi to crash during election cycles or holiday seasons. While demand for the dollar does go up in December because importers are restocking for Christmas, the structural changes in Ghana's economy are starting to blunt that impact.

💡 You might also like: Is David Ellison a Republican? The Truth About the New Face of Paramount

We’re seeing a shift toward "Gold-backed" stability.

Does this mean the cedi will ever go back to 1:1? No. That ship has sailed, hit an iceberg, and sunk to the bottom of the Atlantic. But the days of seeing the USD to Ghana cedis rate jump by 20% in a single month seem to be over for now.

Fitch Solutions and the IMF are both cautiously optimistic, projecting growth of around 4.8% to 5% for the year. That’s solid. It means the economy is producing more, which theoretically supports a stronger currency. However, keep an eye on those US interest rates. If the Fed in Washington decides to keep their rates high, the dollar stays strong globally, and the cedi has to work twice as hard to keep up.

Actionable Steps for 2026

If you’re dealing with foreign exchange, don't just wing it.

✨ Don't miss: Why the Coca-Cola Stock Ticker KO Still Dominates Portfolios Today

First, diversify your holdings. If you have a large amount of cedis, consider putting some into the new "Ghana Gold Coins" or high-yield Treasury bills, which are still paying out decent interest despite the rate cuts.

Second, time your transfers. Don't wait until the last week of December to send money for a building project. The "December rush" still causes minor spikes in the rate.

Third, use a comparison tool. Don't just stick to one app. Spend five minutes checking the rates across three different platforms. Over a few thousand dollars, the difference can literally buy you a flight from Kumasi to Accra.

The bottom line is that the cedi is finally breathing again. It’s not a sprint, but the marathon looks a lot less exhausting than it did two years ago. Stay informed, watch the gold prices, and don't panic-buy dollars based on WhatsApp rumors.