You’re standing at a colorful beach shack in Oistins, the smell of grilled flying fish hitting you, and you reach for your wallet. You see the price: $40. Your heart skips a beat because, for a second, you think that’s 40 US dollars for a plastic plate of fish.

Relax. It’s almost certainly Barbados Dollars (BBD).

Honestly, the relationship between the US dollar and the local "Bajan" buck is one of the most stable things in the financial world. Since 1975, the rate has been pinned down like a tent in a hurricane. But while the math seems easy, tourists and even business travelers constantly trip over the small details that end up costing them extra at the ATM or the register.

The Magic Number: USD to Barbados Dollar at 2:1

Basically, the exchange rate is fixed. For every $1 USD you have, you get $2 BBD. It’s been that way for over 50 years. The Central Bank of Barbados works incredibly hard to keep it that way, primarily because the island imports so much—fuel, food, cars—and having a predictable currency makes life easier for everyone.

But here is the "kinda" annoying part. If you go to a bank or look at a formal exchange ticker today, January 18, 2026, you might see a rate like $1.98 or $2.01. Don’t let that confuse you.

On the street, in the shops, and at the hotels, it is 2 to 1. Period.

If you buy a bikini for $50 BBD, you can hand over $25 USD. Most cashiers won't even blink. They do the math in their head faster than you can pull out a calculator. You'll likely get your change back in Barbados Dollars, though. Think of it like a local souvenir that you actually have to spend.

Why the Rate Occasionally "Wiggles"

While the peg is $2.00, the "official" market rate fluctuates slightly due to bank fees and international settlement costs. For instance, current data shows the absolute value hovering around $2.0165 BBD per $1 USD. This doesn't mean you're getting a better deal at the bank; usually, by the time the bank takes their cut, you're back to that $2.00 mark or slightly less.

Should You Actually Exchange Money?

Most people think they need to rush to a currency kiosk the moment they land at Grantley Adams International Airport (BGI).

Don't.

USD is accepted everywhere on the island. From the fancy restaurants in Holetown to the guy selling coconuts on the side of the road in Bathsheba, "Greenbacks" are king. However, there are a few nuances you’ve got to keep in mind if you want to avoid looking like a total amateur.

- Condition matters: If your US bills are torn, super wrinkled, or look like they’ve been through a washing machine, some local shops might reject them. They can’t easily deposit damaged foreign currency at their banks.

- The "No USD" exception: Every once in a while, you’ll find a small ZR bus (those white minivans with the yellow stripes) or a tiny rural shop that prefers local cash. It’s rare, but it happens.

- The 2% Surprise: If you are a local or someone with a Barbadian bank account buying USD, there is a 2% Foreign Exchange Fee (FXF). As a tourist, you don't pay this to spend your cash, but you might see it reflected in the "spread" if you try to buy BBD at a local bank.

Plastic vs. Cash: The 2026 Reality

We’re in 2026, and Barbados has gone heavily digital. Contactless payments are everywhere. You can tap your phone or your Visa/Mastercard at most places.

Is it better than cash? Sorta.

When you use a US credit card, your bank does the conversion. Usually, they use a rate very close to $1.98 BBD. Plus, unless you have a "no foreign transaction fee" card, you’re going to get hit with a 1% to 3% fee by your own bank back home.

I’ve seen people lose $50 over a week-long trip just in these tiny, invisible fees.

If your card has no foreign fees, use it for the big stuff—hotels, car rentals, fine dining. For the Oistins Fish Fry or buying a round of Deputy beers at a rum shop, stick to cash.

🔗 Read more: Finding Your Way: What a Capital of Cuba Map Actually Reveals About Havana

The ATM Trap

Using an ATM in Barbados is convenient, but the fees are a triple threat:

- The local Barbadian bank fee (often $5–$10 BBD).

- Your home bank’s out-of-network fee.

- The currency conversion markup.

If you must use an ATM, take out a large amount at once ($400 or $500 BBD) rather than making five small trips. It saves you a fortune in flat-rate fees.

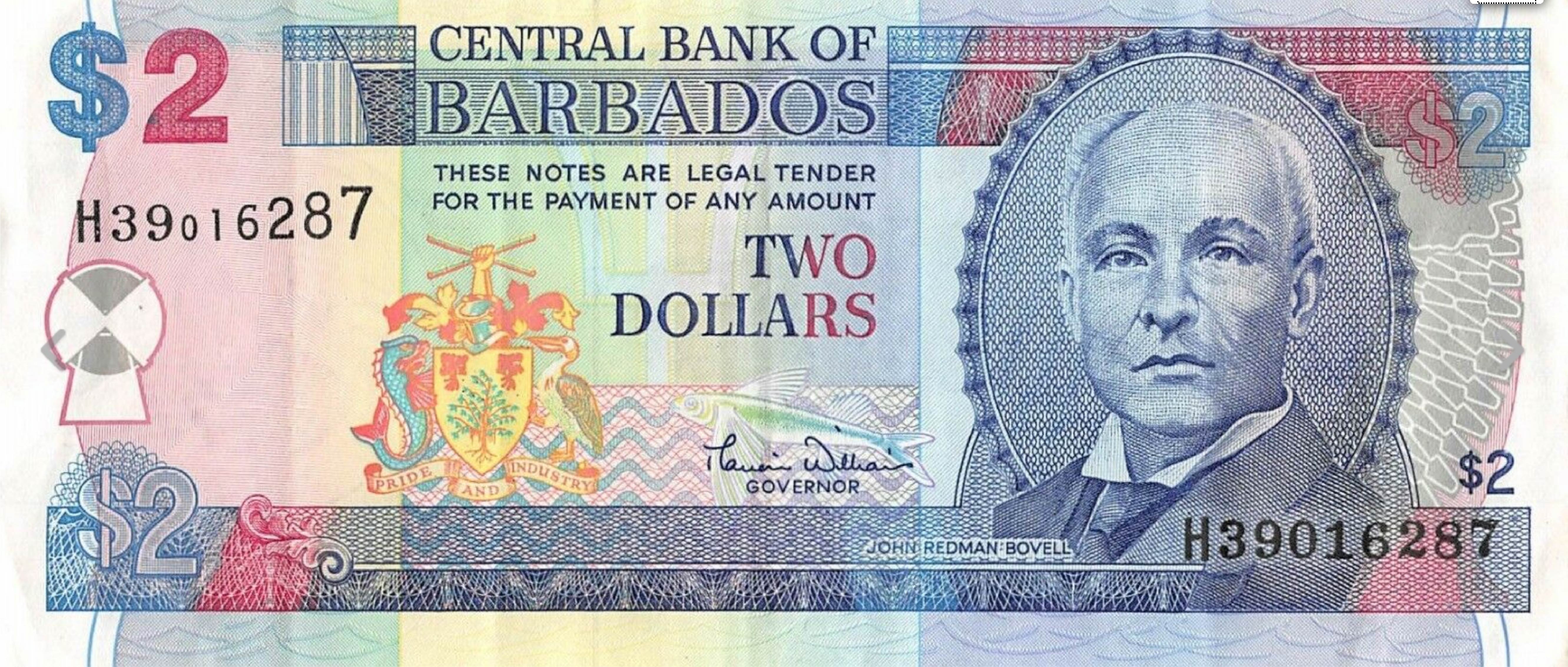

Spotting the Money: Polymer and Portraits

Barbados recently moved to polymer (plastic) banknotes. They feel a bit like thin, smooth plastic and are much harder to counterfeit. They also survive a accidental dip in the ocean much better than the old paper ones.

The colors are bright and easy to tell apart:

- $2 (Blue): Features John Redman Bovell.

- $5 (Green): Sir Frank Worrell.

- $10 (Orange/Brown): Charles Duncan O'Neal.

- $20 (Purple): Samuel Jackman Prescod.

- $50 (Orange): Errol Barrow (the father of independence).

- $100 (Grey/Brown): Sir Grantley Adams.

One quirky thing? The $1 coin is seven-sided. It’s got a flying fish on it. If you have a pocket full of them, remember that retailers aren't actually legally obligated to accept more than $10 in coins for a single purchase. Don't try to pay for a $60 dinner with a bag of shrapnel.

Common Misconceptions About the Peg

People often ask: "Is the Barbados Dollar going to devalue?"

It’s a fair question. Other Caribbean islands have seen their currencies slide. But Barbados treats its 2:1 peg to the USD like a sacred vow. Even during the debt restructuring a few years ago, the government refused to touch the exchange rate.

Why? Because a devaluation would immediately make the cost of living skyrocket for locals.

So, if you hear a rumor at a bar that the rate is changing tomorrow, take it with a massive grain of sea salt. It hasn't changed since the 70s, and the Central Bank has plenty of foreign reserves to keep it that way for the foreseeable future.

Expert Tips for Managing Your Cash

If you're planning a trip or doing business, here is the "boots on the ground" strategy for the USD to Barbados Dollar transition.

1. Bring $5s, $10s, and $20s USD.

Large $100 bills are a pain. Small shops won't have enough BBD change to break a US hundred. You'll end up stuck or forced to buy way more than you wanted.

2. Check the "Symbol" carefully.

On menus, you’ll see the "$" sign. Usually, this means BBD. However, in high-end duty-free shops (like at Limegrove), they might list prices in USD to appeal to tourists. Always ask "Is this Bajan or US?" if you aren't sure. It’s a $50 difference on a $100 item.

3. Use the "Divide by 2" rule.

Since 1 USD = 2 BBD, just cut every price you see in half to know what it’s costing you in "real" money. That $15 rum punch? It’s $7.50 USD. Not cheap, but not insane.

4. Empty your BBD before you leave.

Outside of Barbados, the BBD is basically a souvenir. You’ll get a terrible rate trying to change it back to USD at your home bank in New York or London. Spend your last few dollars at the airport on some Mount Gay rum or Tortuga rum cake.

Actionable Next Steps

Before you head to the island, check if your credit card charges "Foreign Transaction Fees." If it does, call your bank and ask for a travel-friendly version or consider a digital bank like Wise or Revolut, which often gives you the mid-market rate without the "tourist tax."

Pack about $200 in small US denominations to get you through the first two days. This covers your taxi from the airport (approx. $40–$80 BBD depending on where you're staying) and your first few meals without needing to hunt for an ATM.

Once you’re settled, you can decide if you want to pull more local cash or just keep tapping your way through paradise. Just remember: when in doubt, it's 2 to 1.

Enjoy the sun. The math is the easy part.