Money isn't free. Most of us realize that when we look at a credit card statement or a mortgage offer, but we rarely stop to ask who sets the "base price" for every dollar in the global economy. Honestly, it’s not the Fed—at least not directly. It’s the US treasury rates 10 year yield. This specific percentage is the benchmark of all benchmarks. When it wiggles, trillions of dollars shift.

Think of it as the "risk-free" rate. If the US government—which has the power to print the very currency it owes—promises to pay you a certain percentage for a decade, why would you take a bigger risk elsewhere for less? You wouldn’t. That’s why everything from your neighbor's home loan to the valuation of a tech startup in Silicon Valley is pinned to this number.

It’s been a wild ride lately. After years of hovering near historic lows, we've seen a massive repricing. If you’re trying to make sense of your 401(k) or wondering why houses suddenly cost twice as much per month to finance, you’re really looking for an explanation of the 10-year yield.

The Gravity of the 10-Year Yield

The 10-year Treasury is basically the sun in our financial solar system. Everything orbits it. When the yield goes up, the "gravity" of the financial world increases. It pulls money out of risky assets like stocks and crypto because, suddenly, "boring" government bonds are paying out decent cash.

Investors watch this like hawks because it reflects the market's collective gut feeling about the future. Unlike the Federal Funds Rate, which is set by humans sitting in a room at the Federal Reserve, the 10-year yield is set by the open market. It’s the result of millions of trades happening every second. It’s the world’s most sophisticated betting machine on inflation and growth.

Why It’s Different from the Fed Rate

People get these mixed up all the time. The Fed controls the short-term stuff—overnight lending between banks. But the US treasury rates 10 year is a long-term play. It’s about where the world thinks the economy will be in 2030 or 2035.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Sometimes, they move in opposite directions. This is what's called a curve inversion. It’s a fancy way of saying the market thinks the future looks bleaker than the present. When long-term rates are lower than short-term rates, it’s usually a signal that a recession is hiding around the corner. We’ve seen a lot of that "inverted" talk recently because the market is trying to figure out if the Fed’s fight against inflation will eventually break the economy.

Real World Pain: Mortgages and the 10-Year

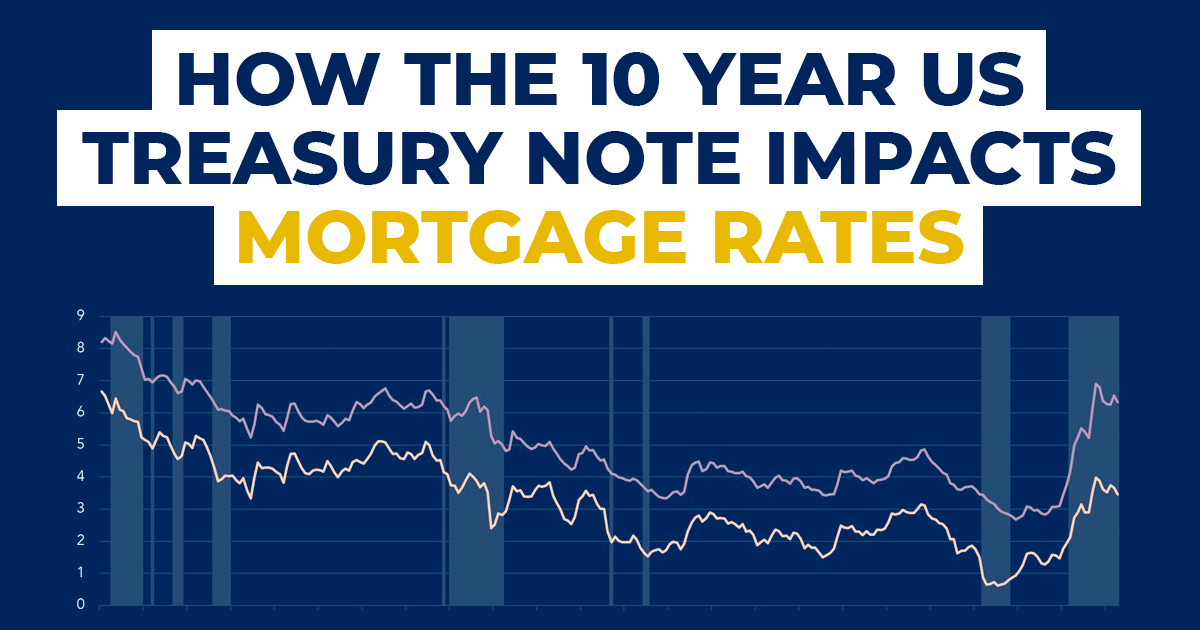

If you want to know what your mortgage rate will be tomorrow, don't look at the news; look at the 10-year Treasury. Banks don't just pick a number out of a hat. They take the current 10-year yield and add a "spread" on top of it—usually about 1.5% to 3%—to cover their own risks and costs.

When the 10-year yield was sitting at 1.5% back in the day, you could get a 30-year fixed mortgage for around 3%. When that yield spiked toward 4.5% or 5%, suddenly those mortgage quotes jumped to 7% or 8%. It’s a direct transmission line.

- Fixed-Rate Mortgages: Closely track the 10-year because the average 30-year loan is actually paid off or refinanced in about 10 years.

- Corporate Debt: Big companies like Apple or Ford issue bonds based on these rates. If the 10-year goes up, it costs them more to build factories.

- Auto Loans: While influenced by shorter-term rates, the general trend of the 10-year sets the tone for all consumer lending.

What’s Actually Driving the Rate Right Now?

Inflation is the big monster under the bed. Bondholders hate inflation. Why? Because if you buy a bond that pays 4%, but inflation is 5%, you’re actually losing 1% of your purchasing power every year. You're paying the government to hold your money. Nobody wants to do that.

So, when inflation expectations rise, investors demand higher US treasury rates 10 year yields to compensate for that loss. If they think the Fed is winning the war on inflation, yields might settle down. If they think the government is spending too much and prices will keep rising, yields go up.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

There's also the supply issue. The US government runs a deficit. To pay for things, it has to sell bonds. If the government issues a mountain of new debt and there aren't enough buyers (like central banks in Japan or China), the "price" of the bond drops. In the bond world, when the price goes down, the yield goes up. It’s an inverse relationship that confuses everyone at first, but it’s just basic supply and demand.

The Term Premium Mystery

Economists talk about the "term premium" a lot. It’s basically the extra "hazard pay" investors want for locking their money away for a decade instead of just rolling it over month-to-month. For a long time, this was actually negative—people were so scared of a market crash they were willing to pay for the safety of Treasuries. Now, that’s changing. People want to be paid for the uncertainty of the next ten years. Politics, climate change, AI—there's a lot that could go sideways.

Misconceptions That Can Cost You

One major myth is that a high 10-year rate is always "bad." That’s not quite right. A rising yield often means the market thinks the economy is getting stronger. It means people are moving money out of "safe" bonds and into "productive" investments because they expect growth.

The problem is the speed.

If rates move too fast, things break. Banks that hold old bonds (which pay lower rates) suddenly see the value of those assets plummet. We saw this with the regional banking stress in 2023. It wasn't that the bonds were "bad"—they were US Treasuries, the safest asset on earth—it was just that their market value dropped because newer bonds were paying so much more.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Another misconception? That the 10-year yield is only for "rich people" or "Wall Street." If you have a pension, a 401(k), or even just a savings account, this number is dictating your life. It determines how much your "safe" portion of your portfolio earns.

Navigating the Future of Rates

So, where is this going? Honestly, nobody has a crystal ball, but we can look at the pressures. We have a massive aging population, huge government debt, and a global shift in how we trade. These are all "inflationary" pressures that suggest the days of 1% or 2% US treasury rates 10 year might be over for a while.

We are likely entering a "higher for longer" era. This means the era of "easy money" where you could borrow for almost nothing is a memory. It changes the math for everything. It means businesses have to actually be profitable instead of just living off cheap debt. It means savers finally get a "yield" on their cash without having to gamble in the stock market.

Actionable Strategy for the Current Rate Environment

Watching the ticker is one thing; making moves is another. Here is how to actually use this information:

- Ladder Your Fixed Income: Don't try to guess the peak. If you're buying bonds or CDs, spread your investment across different maturities (2-year, 5-year, 10-year). If rates go up, you have cash coming due soon to reinvest at higher levels. If they go down, you've locked in today's high rates for the long term.

- Evaluate Your Debt: If you have variable-interest debt, like a HELOC or a credit card, the 10-year yield's upward pressure is your enemy. Prioritize paying these down first. The "spread" banks charge is widening, making this debt more expensive than it looks on paper.

- Stock Market Filter: Look at the companies you own. Can they survive if it costs them 6% to borrow money instead of 2%? High-growth tech companies that don't make profit yet are the most sensitive to the 10-year Treasury. Mature companies with lots of cash (like big pharma or consumer staples) usually handle higher rates much better.

- Real Estate Reality Check: If you're waiting for 3% mortgages to return, you might be waiting a decade. Focus on the "price" of the home rather than just the rate. You can refinance a rate later if the 10-year drops, but you can't change the purchase price you paid.

- Benchmark Your Savings: If the 10-year Treasury is yielding 4.5% and your "High Yield" savings account is only giving you 3%, you're getting ripped off. Use the Treasury rate as your yardstick for what your cash should be earning.

The 10-year Treasury isn't just a line on a chart. It's the heartbeat of the global financial system. By watching it, you aren't just looking at the past—you're looking at what the smartest money in the world thinks about the next ten years of our lives.