You've probably seen the headlines lately about the US trade deficit with Canada. It sounds like a disaster, right? Like we're "losing" or being "taken for a ride" by our neighbors to the north. Honestly, if you just look at the raw numbers from the U.S. Census Bureau, it’s easy to get that impression. In 2024, the United States ran a goods trade deficit of about $62 billion with Canada. By the time we hit late 2025, that gap was still staring us in the face, sitting at nearly $39 billion for the first ten months of the year alone.

But here’s the thing. Most people get this totally wrong.

A trade deficit isn't like a credit card balance where you're just bleeding money. It’s more like a grocery bill. You have a "trade deficit" with your local supermarket because you buy food from them, but they don’t buy anything from you. Does that mean the supermarket is winning? Sorta, in a literal sense. But you’re the one with the full fridge.

The Oil Elephant in the Room

If you want to understand the US trade deficit with Canada, you have to talk about energy. Basically, Canada is America's gas station.

We import millions of barrels of crude oil every single day—about 4.3 million barrels per day at last count. In 2023, the value of that crude oil alone was roughly $93 billion. When you add in natural gas and electricity, the energy bill is massive.

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

Here is the "secret" that economists like those at TD Economics have been shouting into the void: if you take energy out of the equation, the United States actually has a trade surplus with Canada. That's right. When it comes to cars, machinery, and iPads, they're buying more from us than we're buying from them.

We choose to buy Canadian oil because it’s there, it’s reliable, and our refineries in the Midwest and Gulf Coast are literally built to process the heavy crude that comes out of the Alberta oil sands. If we stopped importing it to "fix" the deficit, your gas prices would skyrocket overnight. Not exactly a win.

The 2025 Tariff Rollercoaster

The last year has been a wild ride for trade relations. We saw a flurry of 25% to 35% tariff threats (and some actual implementations) under the International Emergency Economic Powers Act (IEEPA). The justification? Issues ranging from border security to fentanyl.

But have you noticed the "USMCA loophole"?

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

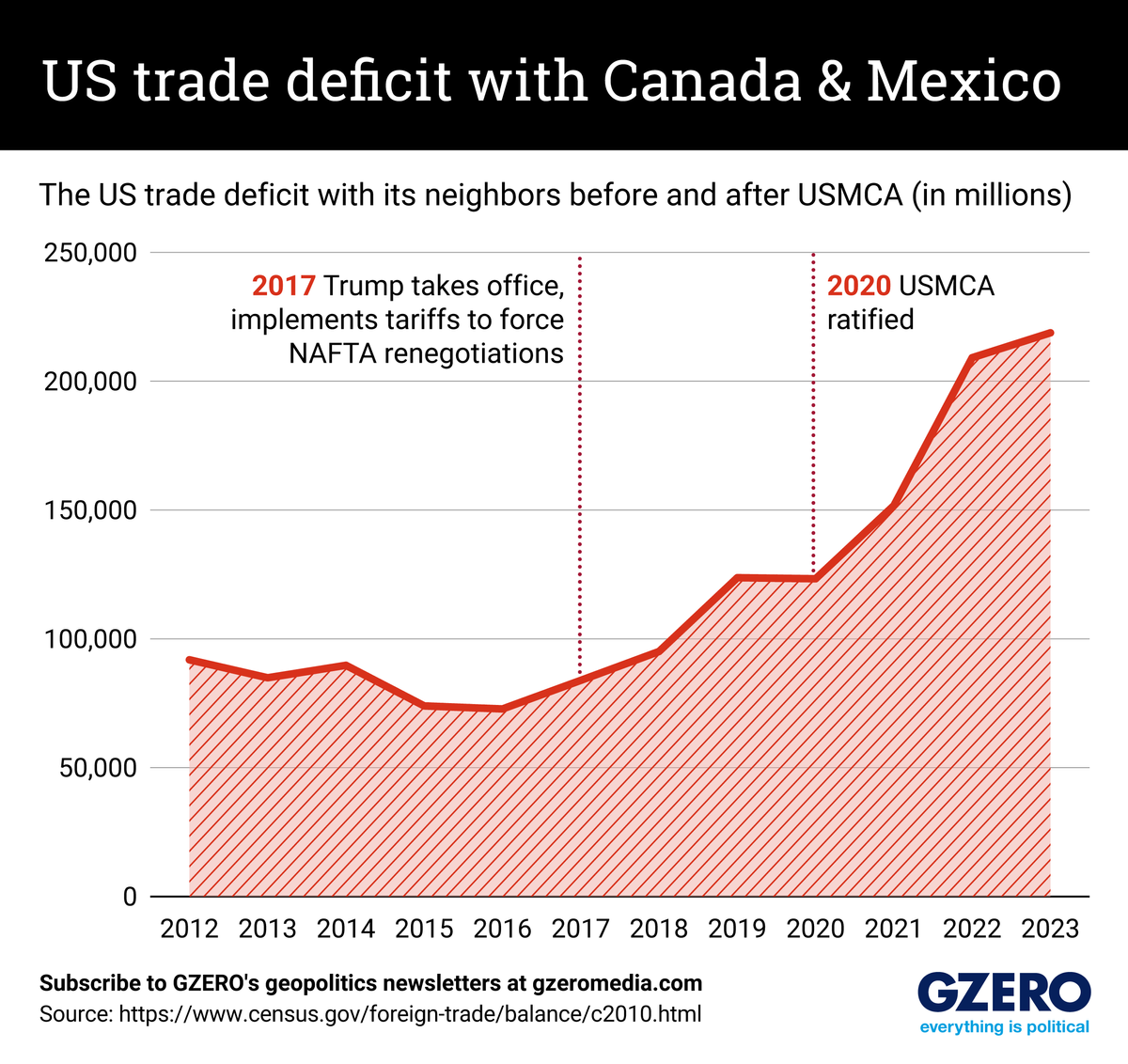

Under the United States-Mexico-Canada Agreement (the sequel to NAFTA), most goods that actually meet the "rules of origin" requirements are exempt from these crazy tariffs. This created a weird two-tier economy in 2025. Products moving under the treaty stayed relatively stable, while "non-compliant" goods got hammered.

The effective tariff rate on Canadian goods actually stayed surprisingly low—around 3% to 6%—because the two economies are so tightly fused together. You can't just slap a tax on a Canadian car part without hurting a Detroit assembly line. It’s like trying to perform surgery on a pair of Siamese twins with a chainsaw.

What We're Actually Buying and Selling

It's not just oil and maple syrup. The trade flow is incredibly complex.

- Vehicles: We ship billions of dollars in cars and parts back and forth. A truck might cross the border six times before it's even finished.

- The "Services" Secret: While the "goods" deficit gets all the press, the US has a massive surplus in services. We sell them software, financial advice, and Hollywood movies to the tune of a $33 billion surplus in 2024.

- Softwood Lumber: This is the zombie of trade disputes. It never dies. The US claims Canada subsidizes its timber, Canada says "nuh-uh," and we've been fighting about it since the 1980s.

- Agriculture: Think about those tomatoes or cucumbers you buy in February. Chances are, they came from a Canadian greenhouse because it's too cold to grow them in most of the US during winter.

Why the Deficit Might Shrink (or Not) in 2026

We're standing at a bit of a crossroads right now. The USMCA is up for a mandatory review in 2026. This isn't just a "check-in"; it’s a full-blown renegotiation opportunity.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

Expect some fireworks.

The US is pushing for even tighter "rules of origin," especially to keep Chinese components out of the North American supply chain. Meanwhile, Canada is playing the "energy card." Ontario Premier Doug Ford and other leaders have already hinted that if the US gets too aggressive with tariffs, Canada could rethink how much electricity or critical minerals (like the lithium and nickel needed for EVs) they send south.

Also, keep an eye on the Trans Mountain Pipeline expansion. For decades, Canada was "captured"—they had to sell to the US because there were no pipelines to the coast. Now, they can ship oil to Asia. If more Canadian oil starts heading to China or India, the US trade deficit with Canada might actually "improve" (shrink), but we'll be paying more for oil from elsewhere. Careful what you wish for.

Actionable Insights: What This Means for You

If you're a business owner or just someone worried about their 401(k), here is the "so what" of the situation:

- Watch the 2026 USMCA Review: This is the biggest event on the calendar. If the "sunset clause" gets triggered or negotiations stall, expect massive volatility in the stocks of auto manufacturers and transport companies.

- Verify Your Supply Chain: If you import from Canada, make sure your paperwork proves the goods are "USMCA compliant." In the current political climate, "Made in North America" is your best protection against surprise 25% tariffs.

- Don't Fear the Deficit: Ignore the political rhetoric that treats the deficit as a "loss." Focus on the volume of trade. High volume means a healthy, integrated economy; low volume (even with a surplus) usually means everyone is getting poorer.

- Energy Transition is Key: As the US moves toward more domestic renewables and EVs, our dependency on Canadian oil should drop, which will naturally balance the trade numbers over the next decade.

The trade relationship between the US and Canada is the largest and most complex in human history. It's messy, it's loud, and the numbers are eye-watering. But at the end of the day, a $60 billion deficit is a small price to pay for a neighbor that provides your heat, your electricity, and a massive market for your own products.

Keep an eye on the official Bureau of Economic Analysis (BEA) releases every month. They usually drop around the first week of the month and give you the real, un-spun data before the politicians get their hands on it. Understanding the difference between the "goods" deficit and the "services" surplus is the first step to seeing the real picture of North American prosperity.