Honestly, trying to track the exchange rate from the US to Zimbabwe currency feels a bit like chasing a ghost in a gold mine. You think you've got the number pinned down, and then you realize the street is playing by a totally different set of rules.

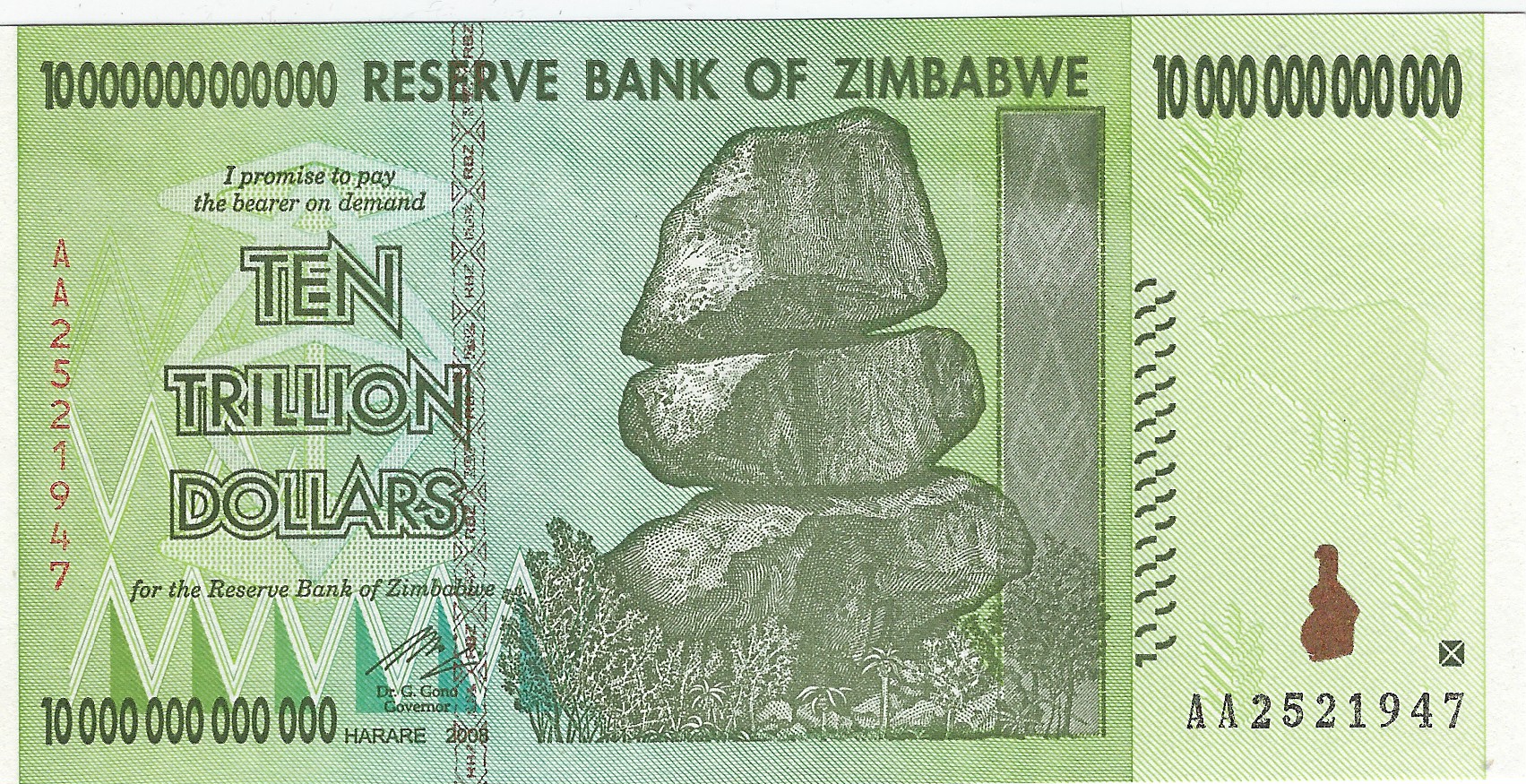

If you’re looking at your screen right now seeing something like 25.62, you’re looking at the ZiG. That stands for Zimbabwe Gold. It’s the latest attempt—the sixth in about fifteen years—to fix a money system that has been, frankly, a mess. But here is the thing: what the bank says and what the guy selling tomatoes in Harare says are rarely the same.

The Reality of the ZiG

Zimbabwe launched this gold-backed currency in April 2024. The idea was simple. Back the money with actual physical gold and foreign reserves so people would finally trust it. By early 2026, the Reserve Bank of Zimbabwe (RBZ) has managed to grow those reserves to over $1.1 billion.

That sounds impressive. It is. But trust isn't built overnight, especially when the previous currency, the Zimbabwean Dollar (ZWL), ended its life trading at over 30,000 to one US dollar.

Today, the official rate hovers around 25 to 26 ZiG per 1 USD.

But don't get too comfortable with that number. In the "informal" or parallel market—which is basically where most of the country actually breathes—the rate is often much higher. We’ve seen it slide toward 40 or 50 in the past when things got shaky. If you're heading there or sending money, you've got to know which rate you're actually dealing with.

📖 Related: Which States Do Not Have State Income Taxes: What Most People Get Wrong

Why the US Dollar is Still King

Walk into any shop in Bulawayo or Victoria Falls. You'll see prices in ZiG, sure. But you’ll also see everyone reaching for greenbacks.

The US dollar accounts for a massive chunk of transactions in Zimbabwe. At one point, it was 85%. Even with the government pushing the ZiG, the USD is still the "safe" money. People use ZiG for small things—change, bus fare, bread. For the big stuff? Cars, rent, school fees? It’s almost always USD.

The government wants to phase out the dollar by mid-2026. They want the ZiG to be the only legal tender. Whether that actually happens depends on if the inflation stays low. Right now, annual inflation is sitting around 15%, which is a miracle compared to the triple-digit nightmares of the past, but it’s still high enough to make people nervous.

How to Handle Money if You’re Visiting or Sending

If you are trying to navigate the US to Zimbabwe currency exchange, stop thinking like you're in London or New York. It's different here.

- Cash is literally everything. Do not rely on your international Visa or Mastercard for everything. While they work in big hotels and some supermarkets, many smaller vendors only want cash.

- Bring small bills. If you bring $100 bills, you are going to have a hard time getting change. Bring $1s, $5s, and $10s. The "change" you get back might be in ZiG, or even in "scrip" or pieces of paper in some rural areas.

- Check the RBZ website. The Reserve Bank of Zimbabwe updates the official rate daily. Use it as a baseline, but assume you’ll pay a bit more in the real world.

- Use official Bureau de Change. It might be tempting to use a guy on a street corner promising a better rate, but the government has been cracking down hard on "illegal" trading. It’s not worth the risk of getting caught or getting fake notes.

The Gold Factor

What makes this version of the currency different? Gold.

👉 See also: Average US Single Income: Why the Numbers Feel So Different Than Your Reality

The RBZ has been aggressive about buying bullion. They’re holding tons of it in their vaults. In late 2025, gold prices hit record highs, crossing $4,500 per ounce. This actually helped the ZiG stay somewhat stable because the "backing" of the currency was literally becoming more valuable every day.

But there's a catch. Zimbabwe has a lot of external debt—about $21 billion. When you owe that much to the world, it’s hard to keep your local currency strong. The IMF (International Monetary Fund) is watching closely. They’ve said the ZiG shows "relative stability," but they’re still cautious. You should be too.

What's Next?

The next six months are the real test. As the government moves closer to that mid-2026 goal of a "ZiG-only" economy, expect some friction.

📖 Related: Chase Bank Hours: What Most People Get Wrong About When They're Open

If you're an investor or just someone sending money home to family, the best move is to stay liquid. Don't hold huge amounts of ZiG if you don't have to. Use it for your daily expenses, but keep your savings in a more stable asset—whether that's USD, actual gold, or property.

The exchange rate between the US to Zimbabwe currency is finally looking more like a normal economic indicator and less like a random number generator. But in Zim, "normal" is a relative term.

Your Action Plan:

- Monitor the official RBZ interbank rate daily to understand the floor of the market.

- Keep a "Dual-Wallet" system if you are on the ground: USD for value preservation and ZiG for small, daily transactions.

- Watch the gold price. Since the ZiG is "structured" around gold, a massive drop in global gold prices could lead to a sudden devaluation of the local currency.

- Prioritize digital transfers (like EcoCash or InnBucks) for local payments, as physical ZiG notes can sometimes be in short supply.

The transition is happening, but the US dollar isn't going away without a fight. Stay informed, keep your cash small, and never trust a "too good to be true" rate on the sidewalk.